Post Views:

1,987

When the booze is overflowing non-stop in a party riding on

high octane, very few drinkers really think about the consequent hangover when

the party stops. In such a high adrenaline atmosphere, many grossly overestimate

their capacity to drink, encouraged by behaviour of their friends & crowd around

them.

The world markets are going through a similar party. The

booze (easy money) is supplied by central bankers all over the world in high

quantity and they promise they won’t stop anytime sooner.

The heady cocktail of easy money has been keeping the party

going on for a long time. Emboldened by the recent successes in the equity

markets where liquidity has lifted all the boats, many investors are doubling

down on their bets by overestimating their ability to absorb losses. Many

believe that the possibility of losses is very minimal since the central banks

are on their side.

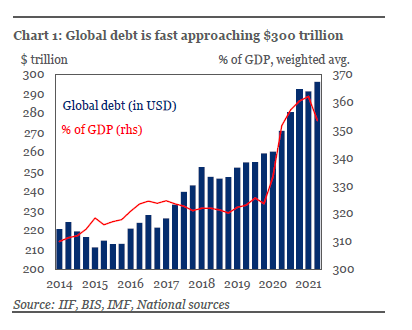

To quantify, the Central bank of the USA – Fed printed more than 20% of total US dollars ever printed in the last year.

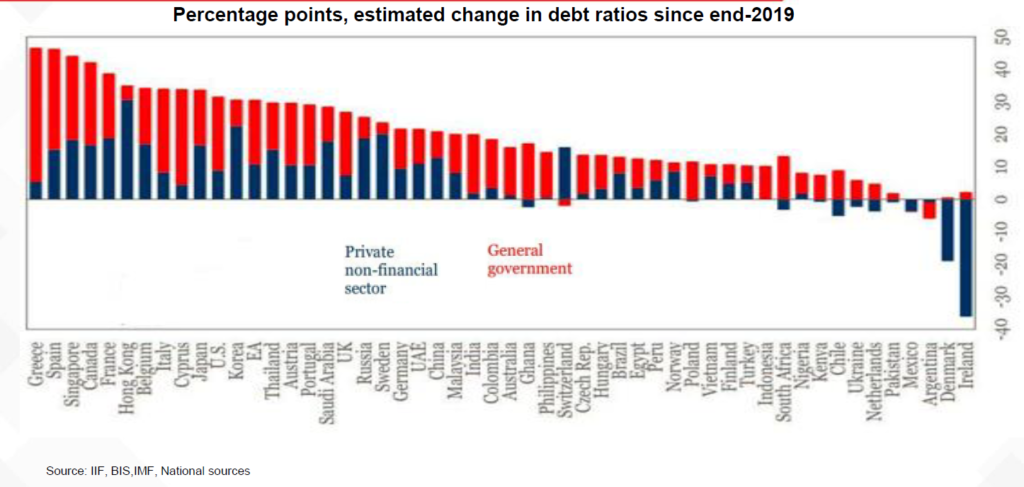

Super loose monetary policy also encouraged many countries & companies to go on a debt binge. The debt as a percentage of overall GDP has risen sharply.

Low interest rates have also played a major role to push people towards speculative asset classes. And so far, the majority have seen the value of their investment going up only in a very short span of time without much downside volatility. Investments in cryptos, equity, and other speculative plays are seen as get-rich-quick schemes and so far, no one is complaining. World markets in some manners resemble casinos.

The rapid money printing and low-interest rates have made

many people rich and consequently happy. Why then central banks never did such

a thing earlier which can make so many people wealthy. The newly minted wealthy

and consequently happy population will obviously love the Govt policies and

will continue to vote for the same set of politicians. Isn’t it the simplest

and brilliant idea for politicians to forever stay in power? They didn’t do it

for a simple reason – Inflation.

Why you should worry about inflation if you are investing in the equity or debt market? How inflation can end the equity market dream run? To understand this, one needs to go not very far in the past. The economic scenario during the 1970-80s serves as a good reference point.

The world monetary system was linked to Gold for a very long time. This means the amount of money printed should be backed by gold. In 1971, the link of money printing to gold was completely broken and the era of fiat currency began. This gave central banks the power to print as much money as they like without any restriction.

The US

followed an ultra-loose monetary policy by keeping interest rates low and by

printing money. That resulted in temporary low unemployment and higher economic

growth. Buoyed by the success of new monetary policy thinking, people

re-elected their president – Richard Nixon in 1972.

Within a few months after the elections, inflation more than doubled to 8-9%, thanks to the easy monetary policy and support from a sharp rise in oil prices. Later in the decade, it would go to 12%. By 1980, inflation was at 14%. To curb inflation, interest rates were raised to close to 20%. Equity market index – S&P 500 which went up until 1972, enthused by the new monetary policy, crashed by 50% over the next two years. The next 10 years annualized returns on the index were negative 9% (Index Value: Oct 1972/Aug1982 – 761/301). Unemployment shot up to 10%. Rising interest rates caused a calamity for interest-sensitive industries, such as housing and cars. Naturally, millions of Americans were angry with the Government by the late 1970s.

Here is the simple economic logic – if the rate of money printing is higher than the rate of production of goods and services in an economy, the prices will increase. In simple terms, if you have x amount of money today and it becomes 2x tomorrow due to excessive money printing keeping the rate of growth of goods and services at zero, then what you could purchase for x earlier, you will have to eventually spend 2x to purchase the same amount of thing because of the impact of inflation. Higher demand, fuelled by excess money, without similar improvement in the supply side results in a bidding war that takes the prices of goods and services higher. Thus, in reality, even if your money is doubled, your purchasing power remained the same. The value of money has just gone down by 50%, leaving you in the same economic state as earlier.

Poor suffer the most from the impact of inflation since they

have very low exposure to assets whereas food & fuel accounts for a major

part of their household budget. Politicians cannot afford to keep so many

voters unhappy and they try everything to bring down inflation or else they

risk losing the public support.

Learning

from the failure of America’s “path breaking” monetary policy of the early

1970s, the policymakers understood the importance of maintaining the fiscal

discipline to prevent long-lasting inflation and its disastrous effects.

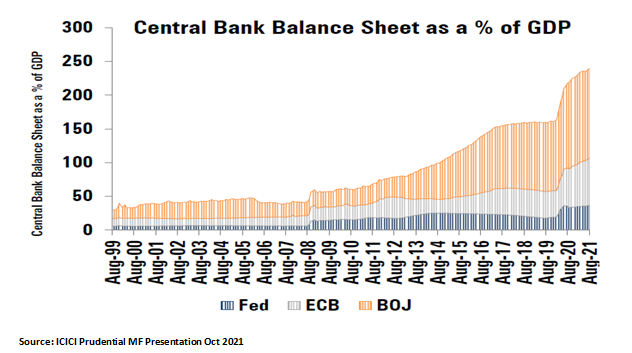

However, this fiscal discipline was thrown out of the window in 2008 after the subprime crisis. Led by US Fed, many central banks printed huge amounts of money, more than doubling their balance sheet size in a few years. They were warned by the economist that this could result in higher inflation. But due to various factors like rising investments in shale gas, global manufacturing shifting to China for their ability to produce goods at low cost, aging demography and productivity gains from technology helped calm the price pressures. Moreover, the money printed was disbursed to the banks and financial institutions that invested the surplus to capital markets.

This gave confidence

to central bankers that money printing will not result in higher inflations.

Before the covid struck, the central banks were trying to reduce their inflated

balance sheet and increase interest rates. However, when the corona-led

economic shutdowns happened, the central banks ran their printing machines at

full capacity. Consequently, the prices of many commodities and services

started rising, due to higher demand and supply-side disruption.

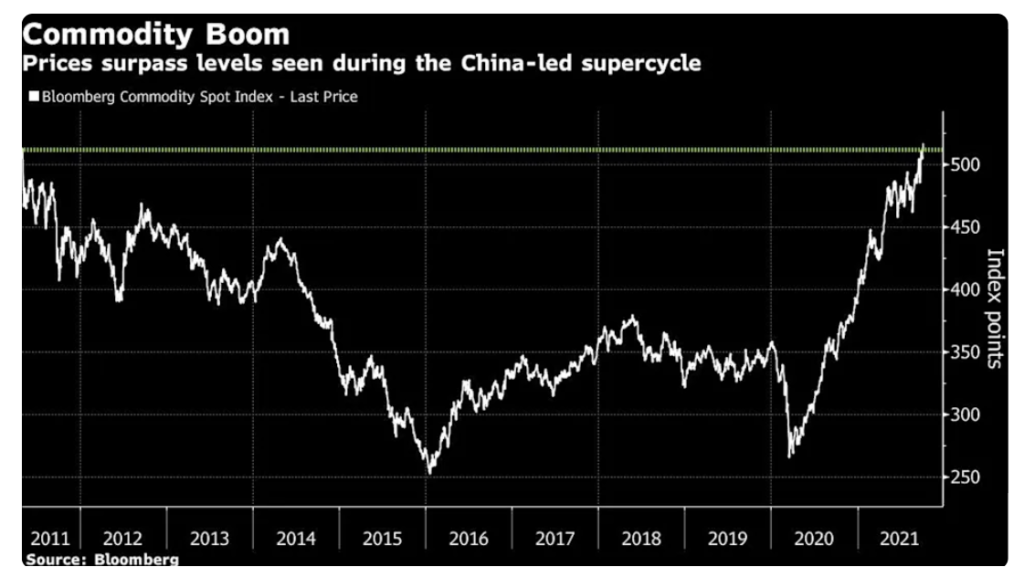

Some of the widely used commodities and their price movements:

Commodities index hits the record as world rebound meets shortages.

All the economies are getting affected by a sharp rise in inflation. In India, commodity inflation has been denting the profitability of consumer companies. Asian paints recently reported 29% YoY profit decline in its Q2 FY22 results. The reason management gave – “unprecedented inflation” like we haven’t seen in the last 30-40 years.

Central banks are

maintaining that the current bout of inflation is transitory. However, it may

not be transitory as earlier thought of due to the following reasons.

– Manufacturers moving out of China for regional diversification lead to increasing costs of production of goods. China is also facing an energy crisis and a shortage of goods. Factory price inflation in China is running in double-digit.

– Compared to the money printing in 2008 which went to the banks, this time many Americans have also got money directly in their bank account

– The pace and quantum of money printing has been excessively high

–

Wages have started rising faster in many decades due to shortage of

labour as compared to the number of vacancies

–

Significant investment shift towards sustainable energy sources resulted

in Greenflation i.e., rising prices for metals and minerals such as

copper, aluminium, and lithium that are essential to solar and wind power,

electric cars, and other renewable technologies.

If inflation continues to rise for a longer time, central banks will be forced to increase the interest rates to curb inflationary expectations. The rise in interest rates will increase the cost of owning equity resulting in a fall in equity prices. Higher interest rates will lead to heavy mark to market losses on long-term debt papers and could lead to contagion in all the asset classes which have been inflated by massive systematic liquidity.

Remember the taper tantrum of 2013? At that time equity markets and debt markets went down sharply due to fear of reversal of loose monetary policy. Now the value of equity and debt is almost 50% higher as a percentage of world GDP as compared to 2013. What will happen to the markets if the central banks decide to begin the end of easy monetary policy?

Now the important question is how to protect our portfolio

from severe decline if inflation doesn’t turn out to be temporary and force the

hands of the Central banks to raise interest rates.

Our

simple advice – maintain equity exposure in your

portfolio to the extent where a 50-60% fall won’t affect your peace of mind.

For debt allocation one can consider short maturity portfolios like ultra-short-term,

low duration, or floating rate funds. Having a 15-20% allocation in Gold could

also help in times of hyperinflation. You can read more about the significance

of gold allocation here and about asset allocation here.

Nobody knows when the music at the stock market party will stop. But we all are certain about this one thing – bigger the party and the cocktail consumption, bigger and worse are the hangover effects.

Truemind Capital Services is a SEBI Registered Investment Management & Personal Finance Advisory platform. You can write to us at connect@truemindcapital.com or call us on 9999505324.