I asked people on Instagram what they struggle with most when it comes to budgeting and saving money. An overwhelming amount of people said that they struggle NOT with creating a budget, but learning how to stick to one!

How To Stick To A Budget

I know firsthand that self-discipline is easy in theory but can be extremely difficult in real life. I’ve gone on my own debt-free journey. It can take months to change the money habits you’ve had your whole life! So that’s why I’m here to teach you how to stick to a budget with these 6 simple tips.

Even though the days of debt have long passed for us, these are tricks that our family still uses daily to help us stay on track, spend less, and save more!

1. Stay out of the stores.

This one is huge! Go to the store as little as possible, and for goodness sake, don’t go to Target just to look around. Impulse spending is a very real thing for many people. That instant boost of serotonin from quick finds at the store feeds the body. But then you see your credit card statement, and it all comes crashing down!

Impulse spending extends to grocery shopping as well. Try and go to the grocery store once a week. This way, you don’t have multiple opportunities to spend money that you hadn’t planned on spending. You could even consider ordering your groceries online so that you don’t impulse shop while you’re there. Learn more tips about saving money at the grocery store here.

Nowadays, it’s also easy to spend that money right from your phone or laptop. Figure out what triggers you to online shop. If it’s promotional emails, unsubscribe from them. Do Instagram ads have you typing in your credit card info? Try to limit your time on the app every day, and close out ads as you see them. Perhaps you may need to unsubscribe from your Amazon Prime membership.

Overall, you’ll spend less and stick to your budget if you are literally not in a physical place to spend money or eliminate your online shopping triggers. Instead, head to the park and take a walk when you get the urge to window shop. Your wallet will thank you.

2. Check your calendar before you make the budget.

Are there any celebrations, birthdays, school parties, or social outings that you will be attending? Plan in advance by budgeting for them, so you don’t blow your budget!

I cannot tell you how many times I have had something “unexpected” come up, and I felt like my entire month was off track. Then I had the “who cares” attitude and figured I’d try again next month.

If I’m being completely honest, those events were not unexpected at all. Instead, I was just too lazy to set aside time to anticipate events and check my calendar for the next few weeks.

I know that you may not have your entire month already planned out, so be sure to set some money aside for entertainment and gifts. If you don’t end up spending it, you can either roll it over to the next month, use it to make an extra debt payment, or put it into savings for big-spending months such as December for Christmas.

Your budget doesn’t have to be completely thrown off track just because your kids have a birthday party to attend or your friend wants to go out for drinks. And that brings me to the next tip!

3. Revisit your budget often.

Life isn’t perfect, and you cannot anticipate every expense that will arise. That’s why it’s so important to revisit your budget and make changes as needed throughout the month! If you still have two weeks until you get paid, sit down and make a mini-budget. This is one of the best ways to stay on budget as you plan out all the rest of your expenses.

You can rebuild your budget when something unexpected happens. Does it take time? Yes! Is it worth it? You bet! Not only will revisiting your budget help you stay on track, but it might even encourage you to keep spending less than you make.

You get to choose how often you revisit your budget. However, I recommend you do this at least once in between your paychecks! Bi-weekly budgets work best for most individuals for keeping on track. If you’re just beginning, it may be worth the effort to budget weekly while you’re getting used to living within your means.

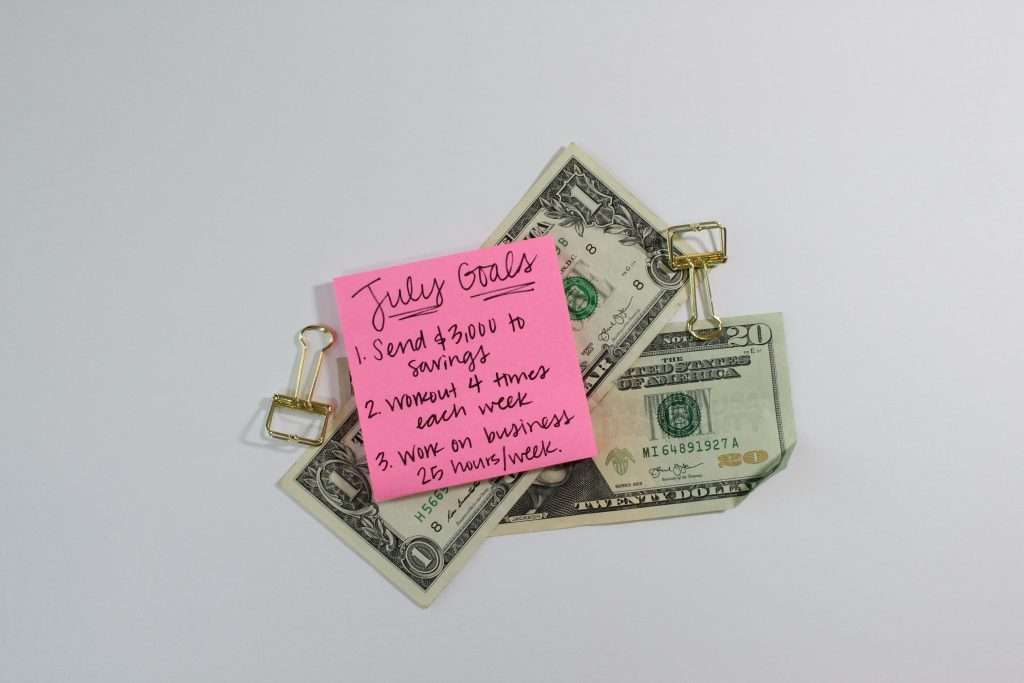

4. Keep your goals visible.

Keep your goals visible and refer back to them often. For example, if you want to be debt-free, make yourself a debt-free thermometer and keep it in a place you pass often. Make a point to think about and talk about your goals as much as possible.

My husband and I kept a thermometer in our closet as a visual for our debt-free journey. We would shade more of it in every few months until we were officially debt-free. It was a physical reminder that we looked at every single day that helped us focus on not only where we were at the moment but where we were going.

You’ll find that you get very excited every time you get to cross something off the list, shade the thermometer, or close an account. That excitement quickly becomes motivation, and you’ll find yourself getting closer and closer to your financial goals.

5. Track your spending every day.

If you want to be extremely knowledgeable about a topic, you’ll make a point to learn more about that topic every day.

For instance, if you want to lose weight, you’ll track your calories or macronutrients daily to help ensure that you are consuming less than you are using. You will make sure that you are setting yourself up for success by eating foods that are healthy and working out several times a week.

When it comes to sticking to a budget, you also have to do some tracking so that you know where your money is going! Tracking your spending every day forces you to face your financial truth and really take a long look at your habits.

It’s hard to learn how to make a budget and stick to it without knowing how much you’re really spending. You may think you only spend a little money on eating out, but when you actually look at it, you may be surprised! There are many apps that can help you automatically track your spending.

Where are you spending the most money? What are you purchasing that you didn’t budget for? Can you add that to your budget next month to help ensure that you stay on track?

We track every single penny that we spend or receive as income. At any moment, my husband and I can look to see how much money we have in our name (even if it includes a bill that will be auto-drafted three days from now). To learn the exact way that we track our money, read How To Easily Track Your Spending.

And just for fun, I highly recommend checking out Our Top 3 Money Mistakes. We made them, so you don’t have to!

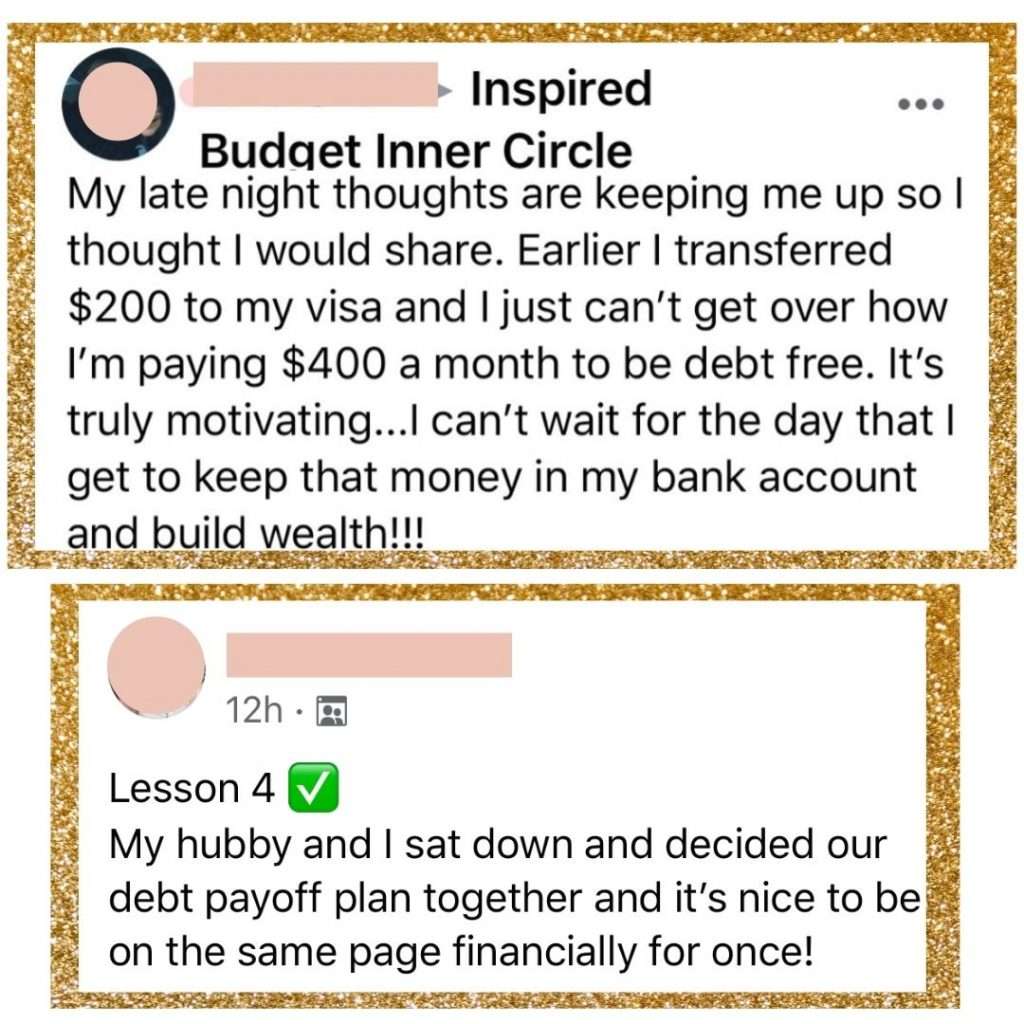

6. Find yourself a budget buddy.

Just like working out, having someone doing it alongside you can make all the difference in reaching your goals. It is so important to have an accountability buddy when you are sticking to a budget for the first (or fifth!) time. Your budget buddy can be a spouse, friend, family member, or even the debt-free community on Instagram!

When you feel like giving up or you need guidance, turn to your budget buddy for help and encouragement! When you want to celebrate that you walked through Target and didn’t make an impulse purchase, call or text your friend and let them know.

If they are also new to budgeting, you can learn how to stick to your budget alongside them. Having someone to walk with on this journey can make saving money and paying off debt so much easier!

If you’re just getting started with budgeting, check out my FREE budgeting and debt payoff sheet that you can use to create a realistic budget. While paying off debt at the same time, you can make a budget that works for your family and still allows you to have that wiggle room. You’re not alone on your debt-free journey!