Stuart Kirk of HSBC (head of worldwide responsible investing!) gave an eloquent short speech on climate financial risk. Youtube link in case the above embed doesn’t work.

Most of the points are familiar to readers of this blog, but they are so artfully put and in such a high visibility place, that you should watch anyway.

Why the catastrophism?

“I completely get that at the end of your central bank career there are many many years to fill in. You’ve got to say something, you’ve got to fly around the world to conferences. You’ve got to out-hyperboae the next guy [or gal]”

A fun bit of hypocrisy:

“Sharon said, `we are not going to survive’..[ but] no-one ran from the room. In fact most of you barely looked up from your mobile phones at the prospect of non-survival.”

Regulatory bother

“what bothers me about this one is the amount of work these people make me do”

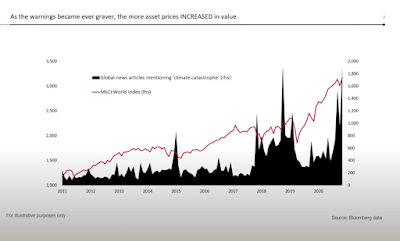

A good point: Markets are not pricing in end of the world.

“Markets agree with me. Despite the hyperbolae, the more people say the world is going to end… the more the word “climate catastrophe” is used around the world, the higher and higher risk assets go. “

Even the worst-case scenarios of 5% of GDP in 2100 are a flyspeck compared to economic growth. Just think back to 1922. “The world is going to be between 500 and 1000 percent richer” Nobody will notice 5% less. “Europe has a GDP per capita 40% less than the US. It’s ok” [Well, it’s not, but it’s a good comparison. The climate “catastrophe” is one eighth the eurosclerosis catastrophe.]

Floods and fires?

“Anything where you put a denominator on those statistics tend to look like that. Human beings have been fantastic at adapting to change.. and we will continue to do so. Who cares if Miami is 6 meters [actually 1 meter] under water in 100 years. Amsterdam has been 6 meters [ actually 6 feet, 2 meters] underwater for ages and that’s a really nice place.”

California’s fire budget is 1% of their state budget and 0.1% of their GDP.

“One of the tragedies of this whole debate, and one we obsess about at HSBC is, we spend way too much on mitigation financing [high speed train to save carbon] and not enough on adaption financing [fire prevention] and I’m sure most of you agree [I’m sure most of the audience did not agree!] “

A good point: Declining size of fossil fuels does not mean loss of profits or financial losses to investors.

“The confusion between volume and value. Anyone who has run money or anyone who has been an analyst knows this very well, but the climate community doesn’t. There is a big difference between falling volumes and a falling price…. what happens to prices at the end of this process is completely divorced from the transition winners and losers”

As we transition, investment in coal oil etc. stops. The existing companies make money off their “stranded” assets as they slowly become smaller and smaller and solar cells and windmills take over.

“The longest bank loans at HSBC are 6 years out. What happens in year 7 is actually irrelevant. “

Central banks

“Central banks are particularly annoying because they haven’t spend enough time worrying about inflation and why it’s going out of control and instead they’ve been spending too much time on climate risk. “

What about policy risk? We kind of agree that the weather won’t cause a financial calamity, so discussion has shifted to “transition risk” to the financial system. What if regulators kill the economy in the name of climate? Kirk caught the Dutch Central Bank completely fudging their climate stress test on this issue. First, they assume that a large carbon tax would dramatically lower GDP for several years, a questionable assumption to start with especially if the proceeds lower more distorting taxes. Most of all, by assuming that there would be a large interest rate rise at the same time which of course hurts banks.

“All the Bank of England and central bank scenarios on climate risk to get a nasty number , they have given the financial sector a whopping great interest rate shock…very easy to make a bank look sick if you destroy their fixed income portfolio. …Even with a carbon tax, even hitting growth, they couldn’t make climate risk move the needle, so they had to get their clever little wonks in the back room to put a gigantic interest rate shock through their models in order to make headlines.”

He does not add, if there is 5 years of strong negative GDP impact, conventional views of monetary policy say interest rates would fall, not rise. A second fudge.

And, projections of climate damage from 1920 would miss the greatest rise in human prosperity ever.

“The markets are crashing around our ears..having nothing to do with climate… Let’s get back to making money out of the transition because we have thousands of opportunities. I agree with the just transition , I agree with teh opportunities that exist with all these facets of technology

*****

What was his reward for pointing out the emperor has no clothes, and that everyone who can’t look up from their cellphone when someone says the world is about to end secretly agrees? Does his employer reward the brave analyst who thinks for himself and can avoid the herd into overpriced securities?

No. He was instantly suspended, though having cleared his presentation ahead of time. FT coverage, Daily Mail or just google it. This emperor and his minions and his consultants does not like his lack of clothing to be pointed out.

Why did HSBC cave so quickly? Fear of woke investors or fear of regulatory retaliation? Just how quickly this evidently clear out of the box thinker, willing to buck the trend and go with fundamentals, finds another job will be a good test of whether there is any competition left in the big bank financial arena.