“Former Tory

cabinet minister David Davis said on Saturday that if the

Conservatives were to become known as the party of high taxes, the

damage

to their economic reputation would be as deep and lasting as that

inflicted on John Major’s government by the disaster of Black

Wednesday in September 1992.” according

to the Guardian. Is he right to be worried? As I

pointed

out after Sunak’s Spring Statement, for the average

worker most of the fall in real wages after tax over the next two

years is down to higher taxes. By next financial year compared to

last year, the

average pre-tax wage is expected to fall by 1%, but by 3% after tax

as Sunak’s tax rises take hold.

The

reason is partly higher national insurance contributions, but also

Sunak’s decision last Autumn to freeze income tax allowances over a

number of years, which at a time of high inflation brings in a lot of

money because it takes a lot of money off taxpayers. We can see the

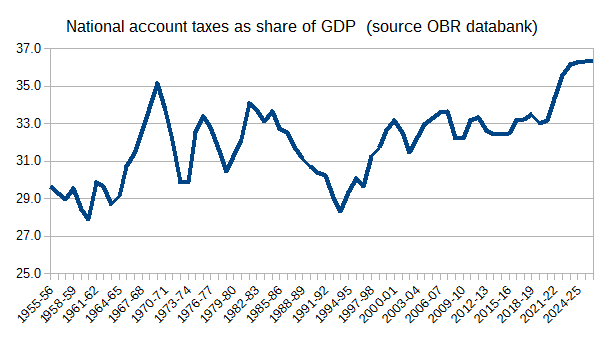

impact that both of these tax increases have on the government’s

overall tax take by looking at the OBR’s series for national

account taxes.

As

many have pointed out, the share of total taxes in GDP is now

expected to be higher than

at any time since WWII.

It

was partly Conservative MPs’ unhappiness with this prospect that

led Sunak to focus on tax cutting in his Spring Statement rather than

helping the poor cope with rising prices. Unfortunately, because of these numbers from the OBR, cutting taxes a bit after you

had raised them a lot just six months earlier

didn’t really cut it with public opinion. Partly as a result, Sunak

is reported

to be furious

with the OBR, making the OBR yet another part of the UK’s pluralist

democracy (after the courts and the civil service) that Tory

ministers are furious with. (In Hungary, whose government is so

admired by some on the right, the independent fiscal institution was

the first to go.)

Sunak’s

political failure of a few weeks ago will not stop him trying the

same trick again, shortly before the next general election. He has

already pledged to cut the basic rate of income tax by 1 percentage

cent point, and if things go to plan he has scope to do more than

that yet still claim debt as a share of GDP is falling. However,

unless he is very lucky, the share of taxes in GDP will remain higher

than it has ever been.

So

how did Sunak find himself raising taxes as Chancellor for a

political party that likes to see itself as the tax cutting party? As

I have argued on a number of occasions, it is not because either the

Chancellor or Prime Minister is more left wing than earlier

Conservative holders of that office. Instead it is the result of two

factors: health spending and austerity.

The

reality that is outlined in all the OBR’s long term fiscal

projections is that, as the UK population grows older and for other

reasons, the share of spending in GDP on health and social care is

bound to rise over time, just as it has since WWII (see the third

chart here,

for example). As health

care is

provided by the state in the UK, that means that taxes must rise (or

borrowing must increase by more and more each year).

That

is why there is an underlying upward trend in the share of taxes in

national income, which is clear from the Chart above. The one

sustained exception to this inevitability of higher taxes was over

the Thatcher period, but that was both short-lived (reversed while

the Conservatives were still in power) and the result of two one-off

factors: North Sea Oil (see here)

and privatisation. Of course good macroeconomics implies that neither

should have been used to cut taxes, but that is another issue.

This

upward trend in taxes would be even more evident if it wasn’t for

two other things: falling defence spending after the end of the cold

war (the ‘peace dividend’) and 2010 austerity. The former is over

(and there is no obvious candidate to take its place), and the latter

cannot be repeated because most areas of public spending have been

cut back to levels that risk political costs for those in power. This

includes the NHS, where waiting lists are now

longer

than at any other time.

On

NHS spending the Chancellor in particular, and this government more

generally, have made two big mistakes which will mean the extra

spending they have provided for the NHS and social care will do

little to improve health services. The first mistake was to declare

the pandemic over before

it was,

which intensified the pressure of Covid on the NHS and is likely to

mean waiting lists will continue to rise for some time. The second

was not to treat any ‘catching up’ from operations delayed by the

pandemic as a cost to be paid for by higher borrowing (like the

furlough scheme) rather than by higher taxes. Sunak was too quick to

try and demonstrate his deficit cutting prowess, rather than

accepting that the pandemic would have fiscal costs even after it had

actually ended.

Another

potential mistake may be to allow higher inflation to raise taxes,

but to leave short term nominal spending plans unchanged. The

immediate difficulty this will cause is to squeeze even further

(relative to the private sector) public sector pay. Public sector

workers will of course try and avoid this squeeze, and it’s unclear

whether any disruption that follows will be more politically costly

to the government or opposition. The longer term difficulty is that this represents a further squeeze to real levels of public spending, which austerity had already cut to the bone.

As

2010-17 austerity has squeezed the public sector as far as politics

will allow, and pressure from an ageing population means that public

spending is bound to rise over time, that means that any Chancellor,

of whatever colour, is likely to have to raise taxes as a share of

GDP over their period of office, unless that period is very short. A

Conservative Chancellor may raise taxes and public spending by less

than a Labour Chancellor, but ‘raising taxes by less’ does not

have the same electoral appeal as ‘tax cutting’ for Conservative

MPs.

Is

there any way out of this arithmetic for Conservative MPs? Ending the

NHS, and replacing it by some kind of insurance scheme, is an

alternative that has attracted some ministers in the past, but it

faces a political obstacle that will be very hard to avoid. Beside

the goodwill most voters have for the NHS, any insurance scheme will

be particularly expensive for older voters, who of course tend to

vote heavily Conservative.

Privatisation,

which is ongoing, is not immediately costly in political terms

(because it is hidden from most voters), but it is likely to make the

NHS more rather than less expensive and therefore will increase the

pressure to raise taxation. This is because the NHS, even though it

is heavily under-resourced, is pretty efficient. Thus if it remains

free at the point of use, provision in private hands will end up

being more costly for the government to pay for, because private

provision, even if it is equally efficient, needs to divert some

profit to shareholders. So NHS privatisation, while it may be pursued

for other reasons, does not get the Conservatives out of their need

to raise taxes.

So

Conservative MPs who think their party can once again become one that

reduces the overall tax burden are living a fantasy. Of course the

party and its Chancellor can, and will, raise taxes to cut them by

less later and hope some people do not notice the trick being played.

In addition the party and its Chancellor can, and will, raise some

taxes so that others can be cut and hope some people do not notice

the trick being played. But the wish to be a tax cutting party will

mean that most public services including the NHS will, under a

Conservative government, be permanently and chronically underfunded

because the party, and its Chancellor, still has the dream of cutting

taxes.