One of my tennis buddies told me a funny story about borrowing money from his parents. He was 28 at the time and asked for a $30,000 loan to buy a condominium. Since his parents had the spare cash and weren’t making much from interest, they figured lending money to him was a win-win situation.

All was going well until one day, his mother came over to his newly purchased condominium. It had been a while since they moved in and his mother wanted to have a talk about the lent money.

The mother said, “Paul, your father and I are disappointed in you. It’s been three months since you borrowed our money to buy your condominium and you haven’t paid us anything back. What is going on?”

My tennis buddy replied, “Mom, I had no idea you wanted to get paid back so soon. We’ve been busy furnishing the place and stuff. I guess we should have written down some parameters regarding how you would get paid back!”

Then his mom replied, “Yes, you should have been more considerate about paying us back something every month. We worked very hard for this money and it was supposed to be for our retirement. However, your dad and I talked about it and we’ve decided to forgive the $30,000 loan as a wedding present.”

This is when my friend said he almost burst a capillary in his forehead, “No mom! After the guilt you just gave me, there’s no way I’m accepting your money!”

He then stormed to his room, made some calculations, and gave her a check that paid back some interest and principal. There was no way he would let his mother lord over him like that. He was pissed.

Borrowing and Lending Money From And to Friends And Family Is Tricky

I’m not a fan of borrowing money from friends and family. Money can often make for some weird power dynamics. It can also create resentment, distrust, and unhappiness.

Most of the time, I’d rather just work more and wait longer than borrow money from friends. Meanwhile, I want my parents to enjoy as much of their wealth as possible during their golden years. They are frugal and need to start decumulating more assets.

The more you value your friendship, the more careful you should be with borrowing money from your close friends. You don’t want to lose them!

However, if your friendship is truly great, then borrowing money might be absolutely fine. Your best friend might be more than happy to lend you money because they want the best for you. If they can earn a higher interest rate, then everybody wins.

I know that if a great friend needed to borrow money from me, I would lend it in a heartbeat. Depending on the amount he wanted to borrow and what he wanted to borrow the money for, I might even just write it off as a gift.

I feel like I’ve won the life lottery, so I’ve tried to make it my mission to help out as many friends and family by spreading my lottery winnings. Whether it’s by regularly sending my in-laws money or by giving my parents my Uber Eats account to use as often as they want, spreading the wealth feels great! It’s like creating multiple lottery winners!

It’s much easier to financially help people you know rather than people or organizations you don’t. But that’s my next goal in giving as I enter my decumulation phase.

When Borrowing Or Lending Money From Or To Friends Is OK

I realized something interesting about when borrowing or lending money from or to friends is OK. The determination is based on the amount of money borrowed or lent as a percentage of the lender’s net worth.

If a friend asks to borrow $10, you’d probably have no problem lending the money. The lunch truck only accepts cash because their Square payments machine is broken. You’re probably happy to just buy them lunch.

However, if your friend asked to borrow $10,000, you might start asking questions, like what the hell for?! $10,000 is a weird amount of money to borrow because it’s not enough to buy a car or a house. But it is enough to buy a lot of things you don’t need, such as a fancy watch or a family vacation to Hawaii at a nice resort.

Now imagine if your friend asked to borrow $1 million to buy a house. He needs a bridge loan because he found his dream home and his liquidity is currently trapped in his existing home. He eventually plans to sell the home to pay you back, but it will take time.

Would you lend him $1 million? Most would probably say no.

But what if you had a net worth of $50 million and you have $20 million sitting in cash earning 0.1% interest. You’ve clearly got a top 1% net worth.

Lending $1 million is only 2% of your net worth and 5% of your overall cash reserve. Your friend is also willing to pay you an interest rate equal to the 10-year bond yield, a rate hundreds of times higher than your current interest rate. He would set up an automatic monthly electronic transfer and make it simple.

Given he’s your best friend and you are confident he will pay you back, maybe you might just do it. You earn more interest and your friend gets what he wants, a win-win.

The Benefits To Borrowing Money From A Friend Or Family Member

Let’s quickly discuss the benefits of borrowing money from a friend or family member. They are:

- Usually a lower interest rate than what a bank would charge. You could get a personal loan from a lending marketplace such as Credible. The rate will be much lower than what you would pay to a credit card company. However, it will be much higher than if you borrowed from your friend.

- Easier to get a loan because you don’t have to go through a bank’s underwriting process. It can take 30-60 days on average to get a loan from a bank.

- Access to the money more quickly.

- Potentially access to a greater amount of capital than what a bank would lend.

Now let’s move on to the lender’s point of view to determine how much money to lend to a friend or family member. The benefits of the lender are earning a higher interest rate and helping a friend or family member out.

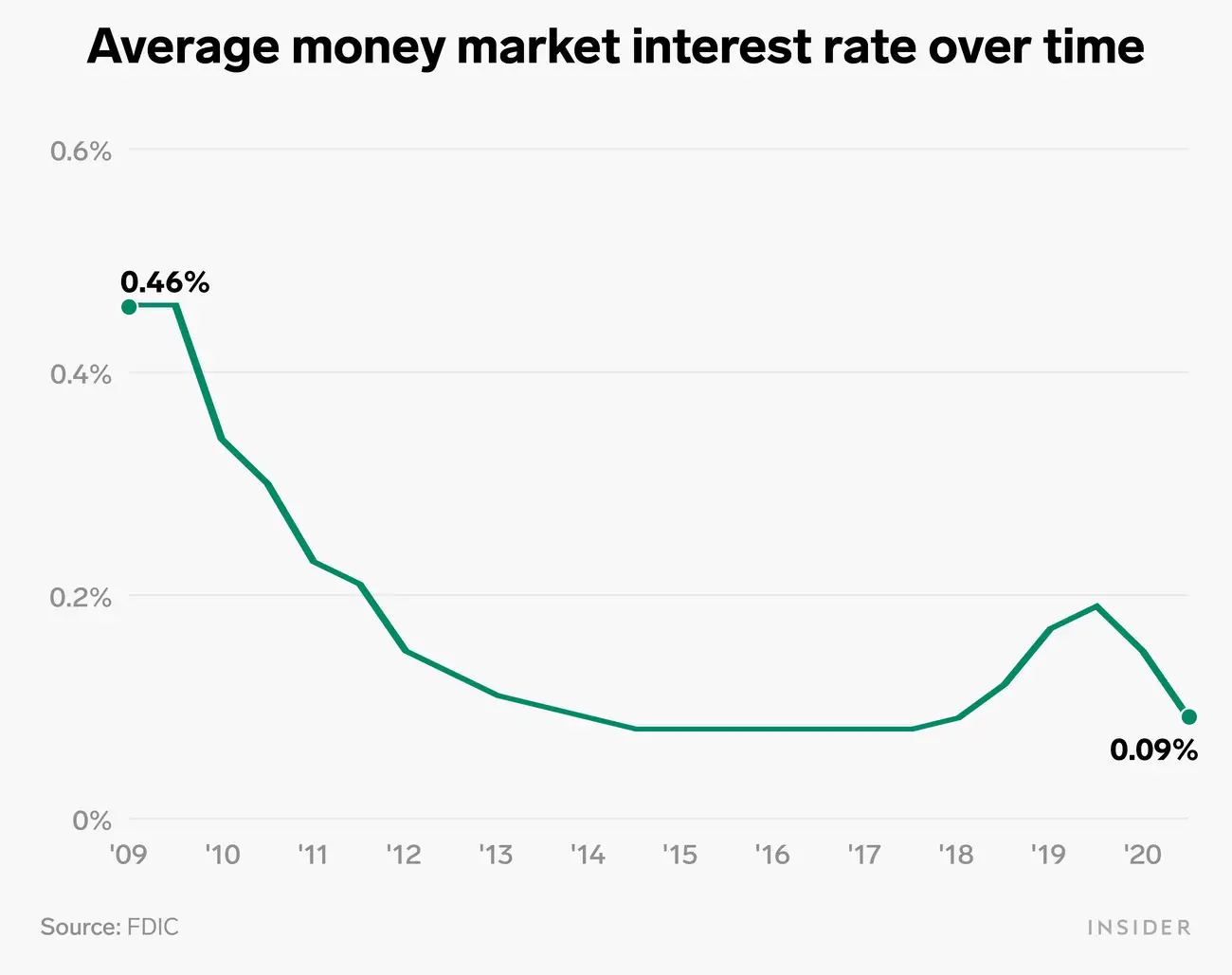

Goodness knows the average money market interest rate is pathetic.

How Much Money To Lend Based On Net Worth

The lower the percentage a loan makes up of your net worth, the higher the propensity you have to lend to your friends and family. I’m also assuming that you would never provide a hard money loan to a non-friend or non-family member. Instead, you would just invest your money in a traditional channel to try and make a return.

The question is, what should the loan’s limit be as a percentage of your net worth? As a lender, you must always assume a certain level of default risk. Further, if your friend or family member fails to pay back the money, you must decide what is the most amount of money you’d be willing to lose while keeping your relationship intact.

Let’s talk through the percentages of loan-to-net worth to figure out how much to lend to friends or family members.

10% Or Greater Loan-To-Net Worth

When it comes to investing in speculative assets, such as cryptocurrency, NFTs, or penny stocks, I recommend limiting your investments to at most 10% of your investable assets. This way, if your speculative investments go to zero, you still have 90% of your investable assets left. However, if your speculative investments become 10 baggers, they will move the needle on your returns.

Since most people don’t have 100% of their net worth in investable assets, lending out 10% or greater of your net worth is very aggressive. Further, the returns likely won’t be massive since you’re limited by the interest rate you can charge to a friend or family member.

The most you could charge would probably be 1-2% above what a bank would charge for a personal loan, business loan, or mortgage. However, most of the time, you would probably lend at a lower rate than what your friend or family member could get elsewhere so they could benefit. Otherwise, it would seem like you’re taking advantage of them.

Meanwhile, you are also benefiting since you are getting a higher rate than you would get from a typical money market account or even a CD.

Lending out 10% or greater of your net worth to a friend or family member is much too much. Therefore, I don’t recommend doing it.

5% Loan-To-Net Worth

Lending out 5% of your net worth feels like the upper limit of how much you should ever lend to a friend or family member.

Let’s say you are worth $1 million. $600,000 is tied up in your home, $300,000 is stocks and $100,000 is in cash. Lending out $50,000 sounds like the maximum amount of money to lend. With this amount, the interest income isn’t significant. But it does feel good to optimize your cash.

Even if you were more liquid with $400,000 in cash and no investments, it’s probably best to limit your loan to 5% of your total net worth. You’ll survive losing $50,000 if your friend doesn’t pay you back.

Losing 5% of your net worth in a stock market correction is par for the course. In a bear market, you could easily lose 35% of the value of your investments. But if you do lose 5% of your net worth to your friend or family member, you are going to feel some resentment.

Therefore, I don’t advise lending up to 5% of your net worth to friends and family either.

1% Loan-to-Net Worth: The Safe Lending Amount

If you’re lending out 1% of your net worth or less to a friend or family, you’re fine no matter what happens. Nothing in your life will change if you lose 1% of your net worth. If your friend doesn’t pay you back or takes a much longer time than agreed upon to pay you back, no big deal.

Let’s say you have a $10 million net worth, $6 million is tied up in real estate and $4 million is in liquid investments like stocks, bond funds, and cash. Lending $100,000 to your best friend for even the most unnecessary reason, like buying a Porsche 911, isn’t a big deal. You could probably have fun driving it too!

Although, if he starts showing off his new car online and completely ignores the covenants of his loan, then you might get pissed off. If you are to borrow money, keep it low key.

If your friend needed to borrow $100,000 to pay for a medical emergency, of course you would lend that amount in a heartbeat and probably much more. The purpose of the loan is an important determinant.

Don’t Lend More Than 2% Of Your Net Worth To Friends And Family

There’s a lot of gray area between lending 1% to 10% of your net worth to friends and family. I say have a hard limit of lending no more than 2% of your net worth to friends and family.

The 1% to 2% spread will take into account:

- How close you are to that friend or family member (the closer you are, the closer to 2%)

- The probability that friend or family member will pay you back (the higher the probability, the closer to 2%)

- The interest rate your friend or family member is willing to pay (the higher the rate, usually the closer to 2%)

- How liquid your net worth is (the more liquid your net worth, the closer to 2%)

- The urgency of using your cash for some other purpose (the less urgent and fewer ideas you have for using your cash, the closer to 2%)

The 1% to 2% loan amount to net worth spread works as your net worth grows.

Of course, if you are a billionaire, you can afford to lend an even greater percentage of your net worth and you’ll still be fine. But who is really going to borrow $10 – $20+ million?

Average Interest Rates For Savings, Money Market, CDs

Below are the average deposit rates for savings, interest checking, money market, and certificates of deposit according to the FDIC. The rates are always changing.

As you can see below, the average deposit rates are pretty low, even after rates have risen aggressively since 2021. Therefore, as a hard money lender, you could do much better.

Set Up Clear Loan Covenants For Lending Money

If you plan on lending out money or borrowing money, clear and strict loan covenants should be made. The contract should have:

- The interest rate and when the interest rate will change (fixed or variable based on an index)

- Whether the loan is amortizing over the course of the loan or an interest-only loan with a bullet payment at the end

- Penalties for late payment or missed payments

- How the loan gets paid (physical check, electronic, in cash, in stocks, etc)

Thanks to technology, it’s easy to receive payments from anybody. It’s simple to send money through Paypal, Zelle, Venmo, or wire transfer.

As a landlord since 2003, the evolution has gone from receiving physical checks to receiving mostly automatic online payments at the beginning of each month. In fact, my new tenants sent me their deposit and first month’s rent from the East Coast.

Lending money can be a tricky situation. However, if you are a charitable person with a large enough net worth, lending money can work out just fine.

Just make sure to follow the guidelines and write out a clear contract that both parties agree upon. The last thing you want to do is ruin a good relationship.

Questions And Action

Readers, what do you think about lending money to friends or family? What is the maximum amount of money you’d lend to a friend or family? How would you come up with the interest rate and other loan covenants? Do you have any examples where lending money turned out great or poorly?

If you’re interested in properly tackling other big financial and life dilemmas, pick up a copy of my new book, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. I go through the logic to help you make optimal decisions for a better life.