Post Views:

2,417

“There

are decades where nothing happens; and there

are weeks where decades happen” – Vladimir Ilyich Lenin.

The first Roman empire rule began in 27 BC and helmed by the emperor Caesar Augustus. Roman Empire at its peak conquered a huge part of Europe and significant part of the African continent. The empire built 50,000 miles of roads, amphitheaters, bridges and infrastructures that are still in use today. Even today many of western countries’ alphabet, calendar, languages, literature, and architecture is inspired much from the Romans. How could such a mighty empire collapse?

Trade was important to the Roman economy and it generated

vast wealth for the citizens of Rome. The major currency used in first 220

years in the Roman empire was Denarius. During the early days of the empire,

Denarius was of high purity, holding about 4.5 grams of pure silver. The coin was

worth a day’s wage for a craftsman or a skilled labourer.

However, due to the finite supply of silver and gold, the spending was limited by the number of Denarii that could be minted. But the greed for higher growth and power was then also. So, what should the emperors do to increase their spending on wars, pet projects and other purchases? Officials found a creative way to work around this problem – reduce the silver content in the coin. Thus, by debasement of the currency, they were able to make more coins which led to higher spending by the Government. This idea resulted in further dropping of the silver content in the coins over the years.

Low worth of currency started showing its effect over some period of time. Adding more coins in circulation did not increase prosperity but resulted in inflation as more coins were needed for purchase of goods and services. By the time silver content was reduced to less than 5%, the prices skyrocketed by 1000%.

With rising costs and finite supply of precious metals, the

Roman Govt. levied higher taxes on people to generate revenue for expenditure.

Rome’s trade by severely hit by triangular problems of hyperinflation, high

taxes and worthless currency. The economy was in shambles and trade was majorly

localized and was done using barter methods. Roman empire was in free-fall.

Trade networks perished. Barbarian invasions from different directions plundered

the livelihood further. Within a century, more than 50 emperors were murdered

or killed in battle.

Hyperinflation caused by debasement of currency helped lead

to the demise of western Roman Empire which would cease to exist by 476 AD.

Can you draw any parallels from the story with the present

times?

Much of the developed world used to follow gold standards where

a country’s currency or paper money has a value directly linked to gold. With

the gold standard, a fixed amount of gold was given in exchange of paper

money.

Fast forward to the present times, the gold standard is not

used by any government now. Britain abolished the gold standard in 1931. US

stopped following the gold standard in 1933 and abandoned the remnants of the

system in 1973. The gold standard was completely replaced by fiat money

like US Dollar. Interestingly, the term fiat is derived from the Latin word

fieri which means an arbitrary act or decree.

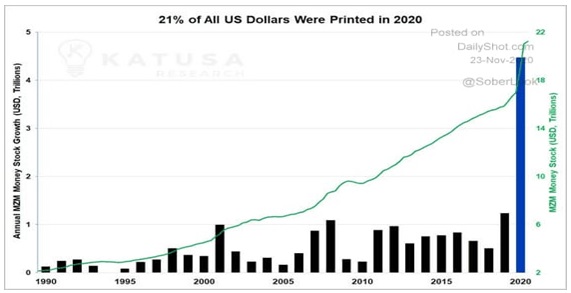

Over the last few years, the pace of printing the fiat money has risen sharply.

US Fed’s balance sheet is expanding by 2.5 times in FY21 over FY20 i.e. from ~4 trillion USD to ~10 trillion USD.

Money is available cheap and in abundance. After the rapid decline in Federal reserve key interest rate, it is now available at 0.25%.

Bonds worth 17 trillion USD are trading at negative yield. More than 80% of the bonds in the world in terms of value are trading at yields less than 2%.

Significant debasement of money has happened and will

continue to happen as per the promises made by the Central banks all around the

world.

This creates a significant risk of rising inflation in

future as soon as the pandemic is curbed or even before that. There is no price

for guessing that gold as an asset class can protect against the risk created

by the actions of our policy makers. That’s why we have been adding at least

10% of Gold exposure in our client’s portfolio since 2018.

Flood of cheap money is finding its way to the stock markets

around the world. In India, foreign institutional investors have been franticly

buying into equities whereas domestic institutional investors like mutual

funds, insurance, etc. are net sellers of equity over the past few months.

Abundance of liquidity backed by the Central banks promise of doing whatever it takes has been encouraging speculative behaviour by market participants. This has resulted in skyrocketing valuations of the stock markets. Nifty currently is trading at a multi-year’s high valuation.

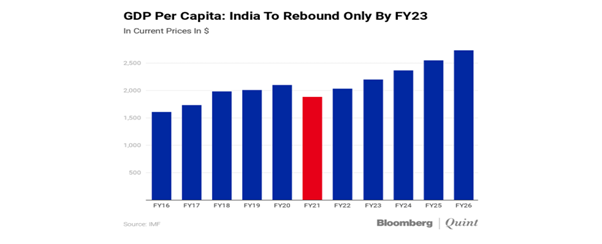

Whereas, the complete economic recovery is still far away and uncertain in terms of its timing and structure. K-shape recovery?

Rising number of cases in Europe has been affecting the economic recovery.

Although, stock markets are exhibiting the emotions of

euphoria, we are still not out of the woods and certainly have lost a few years

of progress made by humanity.

Liquidity has inflated asset prices not just in equity but of long-term bond also (bond price has an inverse relationship with interest rates), which are common asset classes in any investor’s portfolio. Whenever such situation has arisen in the past, the future returns have not been good for a traditional portfolio composition of 60:40 Equity/Debt portfolio.

Investing at very high PE ratios have delivered poor returns even over the next 10 years of investment period. In the chart below, black circles represent periods of Sensex PE ratios much above the long-term average of 20x. The corresponding 10 years returns as reflected by white line has been very poor, even falling below 5% in few cases. On the contrary investing in yellow circles – low PE ratio have delivered decent returns over the next 10 years. Currently Sensex is trading at a PE ratio of around 30x on normalized earnings per share.

Investment Strategy

We remain underweight on equity due to valuation concerns;

overweight on short term debt due to risk of rising interest rates and maintaining

some exposure to gold to hedge the portfolio against global uncertainties due

to risk arising from possible mistakes made by policy makers over the next 5-10

years.

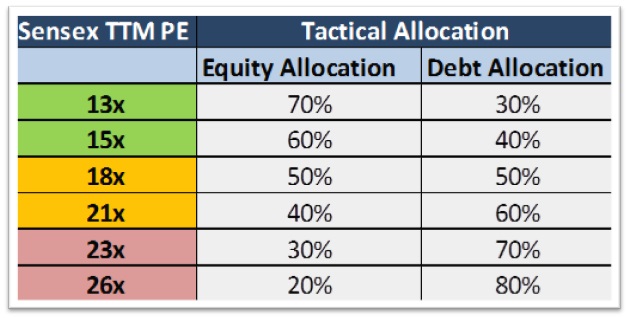

Amid high uncertainty of economic recovery and sky-high valuations of various asset classes, the only reliable investment strategy (after studying various strategies over the long period of time) to our mind is tactical asset allocation. A sample tactical allocation for a moderate risk profile investor can be something like this:

The above image is for illustration purpose only. Every investor has a unique asset allocation plan based on their risk profile, investment horizon and liquidity requirements.

If you have a tactical asset allocation plan in place and have discipline to execute the same by removing emotions out of your investment decision making, you would do much better than others by minimizing the downside risk while enhancing the upside potential of your portfolio.

Truemind Capital Services is a SEBI Registered Investment Management & Personal Finance Advisory platform. You can write to us at connect@truemindcapital.com or call us on 9999505324.