The post Net Worth Report #17 “Dancing Queen” (Down $35,583) 👎 appeared first on Budgets Are Sexy.

Happy Friday, money nerds!

I was chatting with a friend the other day about publishing net worth reports online each month… He was like, ”Dude! That’s a dumb idea because what if the stock market crashes and you lose a whole bunch of money publicly? Wouldn’t you be really embarrassed?“…

I can understand why he thinks this way – after all, the main mission of this blog is to help people grow more money, not lose it…

BUT… the lesser-known (yet equally important) mission of this blog is actually to help people be happy and live the best life they can, regardless of how many dollars they have.

In January, my wife and I lost a whopping $35k in net worth. On the surface, that looks very sad and embarrassing… BUT, the reality is our happiness hasn’t really changed, nor has our lifestyle…

- We still make and enjoy delicious meals together

- We hang and laugh with our friends, same as always

- Our hobbies are the same

- Our family loves us just the same

- We go to work, exercise, do our chores, and relax on the couch together before bed every night, the same as usual

So there’s nothing really to be sad about, even with so much red in our ledger.

I’m not sure if you are feeling crap looking at your net worth this past month… But I encourage you to focus on your day-to-day life and the small things that provide you daily joy. You’ll realize that life is still quite good.  The stock market (out of your control) doesn’t dictate your happiness.

The stock market (out of your control) doesn’t dictate your happiness.

Anyway, here’s how we took a $35k loss last month…

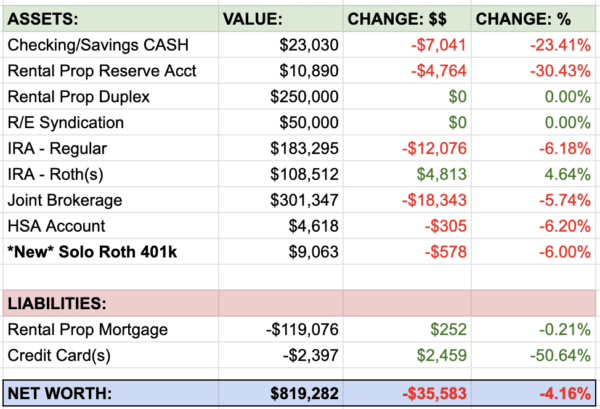

Net Worth as of Feb 1, 2022: $819,282

Summary of our assets and liabilities:

The broad U.S. stock market had the worst monthly drop since March 2020. This is the main reason our assets dropped in value.

Before we get to the individual account breakdowns, here are a few other money-related things that happened in January.

January Money Moves…

Irregular expenses:

- We paid our annual property tax bill for our rental property. This took $5,321.44 from our property float account.

- Our cell phones are on a group family plan, and we pay a family member in 6-month installments… So this cost us $540 in January $90 total per month for our 2 cell plans)

- We spent $496 on “home improvement” (a.k.a. furniture, rugs, and kiddy stuff in anticipation of a child living with us soon – more deets to come on that soon

)

)

Extra income and savings:

- We didn’t really drive much in January, so we only spent $39 in gas for the car! (and right now the tank is still about ¾ full).

- I hustled my butt off and made $2,625 for extra contract work for my employer last month (and it looks like there’s some extra opportunity in February too!)

- We made some big moves with our Venture X credit card… Booked a FREE hotel night for a wedding in June ($300 value) and also got awarded about $1000 in travel credit for hitting our minimum spend.

Detailed Account Breakdowns

Cash Accounts (-$7,041): The major decrease here was funding our Roth accounts for 2022. We still have more than $20k in cash reserves, some of which will be invested this coming month. 🙂

Rental Property + Reserve Account (-$4,764): Apart from our ~5k+ property bill, this rental was actually cashflow positive last month. Here are the rental income and expenses…

$1,975 — Incoming rent from units

(-$138) — Property management fees

(-$617) — Garbage disposal fixes, bath/shower plumbing issues & other maintenance

(-$661) — Mortgage principal + interest

$559 — Total rental gain this month

**Note: I don’t track the monthly ups and downs in property value for this rental. Sources like Zillow and Redfin are too unreliable for my property type, so I only do a value update once a year with a full CMA from my real estate agent.**

Real Estate Syndication (no change in value): We received a $880 dividend in January, which doesn’t change the value of our ownership share. But it does count to our overall investment return. Since we’re coming up on the 1 year mark for this syndication, I’ll have to write a longer post about how this is all performing. So far, it’s crushing initial expectations.

IRA – Regular: (-$12,076): We took about a -6% hit on this account due to stock market volatility. It would have been worse, but the last couple trading days in January were quite nice for the overall stock market.

IRA – Roths: (+$4,813): In early January, we contributed $12,000 to our Roth accounts. The reason we max out both our Roth accounts early each year is because we believe lump sum investing beats dollar cost averaging *most of the time.* Investing at market peaks is scary, but it beats trying to time the market (which I suck at!!)

Joint Brokerage Account: (-$18,343): It stings to see this account with such a massive dip, especially after I just invested $35k in December after the sale of our 3rd rental property. Oh well, we still have a balance over $300k and a long investment horizon.

*NEW* Solo Roth 401(k): ($-578): This is my new Solo 401k with TD Ameritrade (which also has a Roth component). My plan is to max this out in 2022, but the sucky thing is contributions have to be done via wire transfer or mailing in a physical check.

HSA: $4,743 (-$305): No contributions of withdrawals from this HSA. All of the funds are invested in VTI (total stock market index) which is why we took a 6% hit this month.

Breakdown of Liabilities

Rental Property Mortgage: (+$252): Little by little, month by month, our mortgage is being paid off by our tenants. Principal paydown is an often overlooked benefit to owning a rental property, but it’s one of my favorite consistent additions to our wealth each month.

Credit Card Balances: (+$2,459): Since my wife and I pay off our credit card balances each month before the due date, I’m thinking of removing this line item from our tracking sheet going forward. Although it’s technically a “liability,” I can just minus our CC debt from our checking account balance because that’s where it’s paid from anyway. Thinking of slimming down these NW reports in the future for a more simple read!

Other than that, my wife and I have no other debts at this time!

That’s all for now. Cheers to a *hopefully* profitable February for everyone!!

Onwards and upwards!

– Joel

The post Net Worth Report #17 “Dancing Queen” (Down $35,583) 👎 appeared first on Budgets Are Sexy.