Executive Summary

Welcome to the June 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the big news that TIFIN has raised a new $109M Series D round at an eye-popping $842M valuation, with a vision that embedding investment recommendations and solutions directly into advisor technology can lead advisors to make purchases through TIFIN’s various applications, allowing TIFIN to get paid by asset managers for those asset flows.

Yet as was seen by the rise – and subsequent fall – of various robo-advisor-for-advisors solutions that attempted to offer similar kinds of model marketplaces for advisors, technology is not an “if you build it, they will come” solution in a world where the typical advisor changes a core system less than once per decade. Which means even if TIFIN is right about the long-term vision of “embedded finance”, it’s unclear whether their barely 3,000 current advisor users will even be able to gain material traction against Envestnet’s own embedded finance vision… and its 100,000 advisor head start.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Snappy Kraken acquires Advisor Websites to offer an even more unified advisor marketing solution that packages together the advisor’s website and the marketing funnels attached to it

- Lumiant launches a new financial planning software solution that aims to supplement existing tools by providing a more engaging client portal specifically to better engage the non-financial spouse

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Vanilla raises a $30M Series B round to power not just estate planning software for advisors but what appears to be a tech-enabled estate planning service that will help advisors implement advanced estate planning strategies with their ultra-HNW clients

- FP Alpha launches a new ‘Estate Snapshot’ that, similar to Holistiplan’s Tax Summary, will scan a client’s estate planning documents uploaded by the advisor and provide an instant summary of the key details and potential planning opportunities

In the meantime, we’ve also made several updates to the beta version of our new Kitces AdvisorTech Directory, to make it even easier for financial advisors to look through the available advisor technology options to choose what’s right for them!

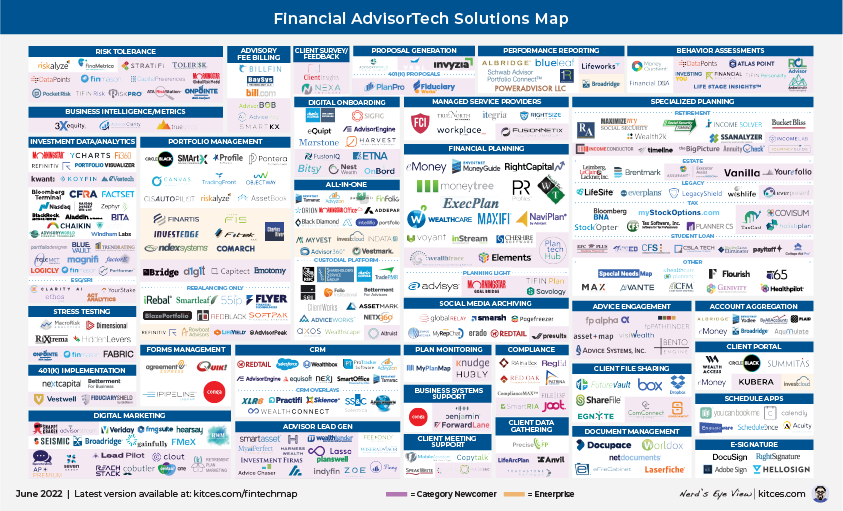

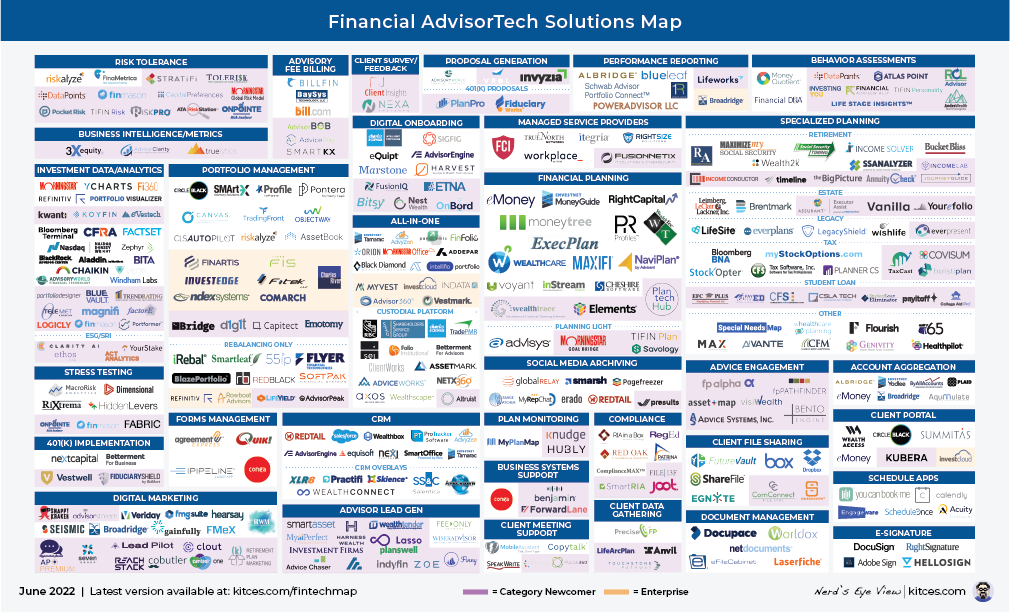

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

While robo-advisors did not exactly replace the world of traditional human advisors, one of their lasting legacies was spurring the realization that good technology experiences can impact investors’ investment choices – from nudges within a technology platform that steer investors towards one investment selection over another, to the fact that ‘good’ technology can become a distribution channel unto itself (gathering assets into whatever asset managers are embedded into the technology solution).

In the years that followed the emergence of robo-advisors, this realization of “technology as a distribution channel” led to both a slew of traditional asset managers acquiring various robo-advisor tools (e.g., Blackrock acquiring FutureAdvisor, Invesco acquiring Jemstep) to embed their funds into the robos’ portfolio solutions, and the rise of ‘model marketplaces’ where asset managers embedded their models (comprised of their own funds) into various rebalancing software platforms (which in turn led to the acquisition of various rebalancing tools by asset managers, including Invesco acquiring Redblack and Portfolio Pathways and Oranj acquiring TradeWarrior which was subsequently rolled up into SEI).

At the same time, the OG of using technology as a distribution channel – Envestnet itself – has also been increasingly making its own big bet on ‘embedded finance’ – which featured very prominently in its recent Envestnet Advisor Summit – most notably by acquiring MoneyGuide and attaching it to the various ‘Exchanges’ (for insurance/annuity products, and credit/loan products, in addition to its existing platform-TAMP investment offerings) so advisors can purchase solutions for their clients from workflows that are embedded directly into the planning software.

And now this month, TIFIN Group announced a stunning $109M Series D round, at an eye-popping $842M valuation, making its own bet that the combination of various tools it has acquired in recent years – from MyFinancialAnswers for financial planning software, to Totum Risk for risk tolerance assessments – can be woven together into a similar advisor interface that will allow TIFIN to capitalize on the embedded finance trend by steering advisors to select investment offerings (and getting paid by those investment providers for the flows).

In fact, as a part of the recent announcement, TIFIN highlighted that it has already signed on 30 investment managers that will compensate TIFIN with ‘virtual shelf space’ payments for over 60 funds that will be embedded into TIFIN’s apps. In addition to TIFIN itself recently acquiring Qualis Capital, an alternative investments platform that would similarly allow TIFIN to monetize advisor flows into featured alts.

Yet while Envestnet and its $3.5B+ market capitalization have arguably validated the market opportunity for embedded finance – especially since Envestnet is still mostly ‘just’ getting paid for investment flows, and hasn’t even fully integrated and ramped up its other insurance/annuity and credit exchanges into material transaction flows – the reality is that AdvisorTech-as-distribution strategies only work when advisors use the software in the first place. As in the end, the majority of robos-turned-model-marketplaces ultimately failed because, in the advisor world, technology is not an “if you build it, they will come” opportunity.

In fact, the recent 2021 Kitces AdvisorTech Research study showed that independent advisors only change any particular piece of their core technology roughly every 12-20+ years (with an intent-to-change rate of only 4% to 8% for most tools). Which means in the aggregate, there may only be a few thousand advisor ‘seats’ in play in any particular year; even Envestnet “only” serves just over 100,000 financial advisors across all of its tools, and it took over 20 years (and the acquisition of major platforms like MoneyGuide for half a billion dollars) to get there.

Which raises the concern that even if TIFIN is right on the long-term bet that embedding insurance and investment solutions into advisor technology will be able to impact and steer advisors towards certain solutions (for which TIFIN gets paid), it’s unclear whether TIFIN can possibly attract enough advisors (from an existing base that is reportedly just approaching 3,000 advisors) to justify its stunning valuation in any foreseeable time frame. Especially since TIFIN has largely acquired AdvisorTech tools that did not yet have any significant traction in the advisor marketplace in the first place – which means TIFIN has not bought existing market share, and at best will still have to figure out how to adapt each of the tools it has acquired in order to find a segment of advisors they can gain traction with, in a hyper-competitive advisor technology marketplace where most major tools already have near-total adoption from the entire addressable market.

In the near term, TIFIN’s significant round likely means even more B2B acquisitions of smaller (and maybe a more sizable?) advisor technology platforms, and more dollars into marketing (expect to see a lot more marketing of TIFIN’s solutions as it makes the push for advisor adoption), while it continues to iterate behind-the-scenes on its various tools to try to find product-market fit. But in the long run, similar to the bubble of robo-advisors and their ultimately unfulfilled valuations at the peak, I suspect we’ll look back on this moment and see that while TIFIN was right that ‘embedded finance’ really is a part of the future, PE investors still grossly overestimated the pace that advisors (and their clients) are willing to change platforms and how hard it is to break into an existing advisor software category and win away market share as a new entrant (much less trying to break into nearly all of them at once).

The T3 (Technology Tools for Today) Conference is the longest standing conference in advisor technology, with a slow and steady growth path that has mirrored the broader growth in advisor technology from a tiny cottage industry of ‘homegrown’ solutions (advisor sees problem, can’t find solution, builds solution for themselves, sells solution to other advisors, now owns a software company on the side) to a robust landscape from niche offerings to large enterprise players, with VC investors fueling new innovation and Private Equity firms powering mergers and strategic acquisitions. And so, given the boom in new investor dollars flowing into advisor technology over the past few years, it is no great surprise that the recent T3 conference – in its first return debut since the pandemic – boasted its largest turnout ever, with nearly 1,000 attendees.

In addition to the strong attendance turnout, though, the flow of dollars into advisor technology was even more evident in the T3 exhibit hall itself, which not only was sold out to capacity (at very-not-inexpensive booth rates!), but featured not the typical advisor technology booth (a table with a logo-embroidered cloth draped over time, and a basic pop-up poster behind) and instead was decked out with multiple double-wide booths with lounge furniture, wood-paneled booths, and high-end LED lighting. In other words, many exhibitors were buying not only $8,000+ booth spaces, but now have the conference budgets to spend that much again in decking out their booths with whatever they could to attract advisors to stop by! (Something that, prior to the recent rise of outside VC, PE, and Strategic investors putting dollars into advisor technology, most companies simply couldn’t afford.)

On the main stage podium, though, the clear and dominant theme of the T3 conference was not necessarily new startups and innovation (in fact, there were remarkably few AdvisorTech companies that made a new debut at this year’s T3 conference), but instead how to weave together the proliferation the providers in the increasingly crowded AdvisorTech landscape, as advisors increasingly struggle with the breadth of solutions that result in a splintering of workflows and the underlying client and advisor data. For which the largest advisor platforms are making the case that they – and their ‘All-In-One’ offering that builds on a single unified data source – are the solution.

For instance, Orion highlighted how their centralized all-in-one solutions can unify an advisor’s data (across their increasingly comprehensive solutions that cover most/all the areas an advisor needs, as Orion highlighted its just-announced Redtail CRM acquisition), as did Envestnet (which doubled down on the theme with the announcement of their new Envestnet Wealth Data Platform at their own Advisor Summit the following week), AdvisorEngine (which debuted new branding, a new look, and sponsored a keynote slot to highlight their new platform) emphasized how data lives at the center of its new unified CRM + portfolio management platform, and Invent.us highlighted how they’re solving the data architecture challenges of larger advisor enterprises, while Reed Colley (previously of Black Diamond) debuted his new Summit Wealth Systems which aims to unify advisor data, while multiple Salesforce overlays highlights how they are unifying data within their CRM system as well.

Notably, though, the latest 2022 T3 Advisor Technology Survey Report – which was also featured at the conference – still shows that ‘all-in-one’ solutions are garnering a small minority market share, up from ‘just’ ~18% market share in 2021 to 21% in 2022, which implies that interest in such solutions is growing but that the overwhelming majority of advisors are not yet sold on the value (or at least, not convinced that the value is worth the hassle of switching costs to consolidate into a new system).

Nonetheless, in a world where the pendulum had swung very far toward all-in-one platforms in the 1990s (where the largest enterprises had the biggest technology budgets to build the best unified platforms), and then back towards the ‘best-of-breed’ solutions in the 2000s and 2010s, the pendulum appears to be swinging back towards unified solutions once again, where the unifying theme is “if the advisor only uses one core system for everything, all their data is in one place and is naturally unified across all of their application”. The question, though, is whether the all-in-one solutions can build – or buy – their way to good enough capabilities in each of the core categories to make advisors willing to let go of their existing best-of-breed solutions?

The financial advisor business has traditionally been an “eat what you kill” kind of business – where new advisors are trained in how to ‘hunt’ for their new business opportunities through cold-calling, cold-knocking, attending business networking events, or if they’re ‘lucky’, reaching out to their existing natural market of friends and family (or former colleagues, for career changers). And those who are successful eventually find that some of their satisfied clients begin to refer others to them as well, slowly shifting the traditional outbound approach to more of an inbound client referral flow.

Notably, in this advisor marketing context, most advisors spend very little at all on marketing in the first place, as we are trained into a more outbound sales-based approach to finding prospects… and in practice, most advisors start their firms with very little in the bank, and don’t have much to spend on marketing, opting instead to spend what they do have a lot of, which is time (since they don’t have many/any clients yet!). Such that the average advisor’s client acquisition cost of $3,119 is 80% based on their time and only 20% based on their hard-dollar spend.

However, in the digital era, the reality is that even consumers who meet an advisor in-person or are referred often still “check them out” online as well – if only to verify that the advisor wasn’t Madoff’s lesser-known partner (or otherwise has some salacious regulatory history that might be unearthed in a quick Google search). And in practice, an advisor’s website and digital presence often serve to ‘affirm’ for the prospect that the advisor is a bona fide professional – which means showing up professionally with their website (and perhaps some related social media channels). At the same time, for advisors that leverage more proactive marketing strategies, the advisor’s website becomes even more important – functionally serving as a ‘digital storefront’ to which prospects are sent when they’re marketed to, in order to check out the advisor’s services and decide whether to reach out.

In that context, it is not surprising that this month, advisor marketing software Snappy Kraken announced the acquisition of Advisor Websites, one of the few remaining independent providers of advisor-specific websites.

The deal has a number of clear synergies out of the gate, from ensuring that advisors using Snappy Kraken for marketing have a strong digital brand and website foundation with Advisor Websites, to applying Snappy Kraken’s SEO consulting services to their own (Advisor-Websites-built) websites, to leveraging Snappy Kraken’s marketing tool to convert visitors to the advisor’s Advisor Websites website, to leveraging Advisors Websites’ calendaring tool to convert Snappy Kraken prospects into actual prospect meetings.

Notably, Snappy Kraken’s acquisition also gains Advisor Websites’ compliance review tools, an essential capability to push into enterprises that have more rigorous compliance review processes for advisor marketing. Which better positions Snappy Kraken to move ‘upmarket’ into advisor enterprises (in particular, independent broker-dealers), where they will compete more directly with the likes of FMG Suite.

Strategically, the decision by Snappy Kraken to acquire and more vertically integrate the marketing funnel makes sense, and mirrors a broader trend of marketing technology tools (not even specific to the advisory industry) that have pursued similar strategies, from MailChimp launching a Website Builder to InfusionSoft/Keap building out its own Landing Page capabilities. Because ultimately, it’s hard to grow a mailing list without a good website to attract them, and it’s hard to turn mailing list readers into clients without a good website to send them (back) to in order to convert. The affinity is natural.

In the end, the only questions will be around Snappy Kraken’s ability to execute, and effectively integrate Advisor Websites’ team and capabilities into a more tightly wound marketing process from website to mailing list to conversion… and then turn it into real results to demonstrate that advisors who spend on marketing really can build more sustainable marketing systems?

Helping clients with their estate planning has long been part of the core offering of a comprehensive financial plan – for the simple reason that for more than half of financial planning’s history, the Federal estate tax exemption was so low (e.g., no more than $600,000 for much of that time) that the ‘typical’ financial planning client had an estate planning ‘problem’, for which the advisor could sell a life insurance policy (typically to be held inside of an Irrevocable Life Insurance Trust, or ILIT) as a solution. In other words, estate planning conversations with clients generated good sales opportunities. However, since the early 2000s, the Federal estate tax exemption began to rise, and the majority of states eliminated their own state estate tax, such that the number of households exposed to Federal estate tax today had plummeted by more than 95%.

The end result of this shift is that “estate planning” today is more about the income tax planning opportunities of passing assets at death (e.g., to maximize step-up in basis), and about ensuring an orderly distribution of estate assets in the first place (which means making sure that clients have their Wills and Trusts in place as necessary, and that the documents reflect the clients’ current wishes).

When it comes to ultra-high-net-worth (ultra-HNW) clientele, though, planning for estate taxes is as relevant as ever. In fact, when clients have 8-figure – or 9-figure, or 10-figure net worths – advisors can arguably add even more financial value to their clients with effective estate planning (that can literally save millions or tens of millions) than ‘just’ trying to add basis points of return to their affluent clients’ portfolios. Which becomes all the more important as advisors seek to expand their value proposition beyond ‘just’ the portfolio to defend and better substantiate their fees.

From the advisor technology perspective, this dynamic is leading to a bifurcation in estate planning software itself. At the ‘low’ end and in the middle market of the mass affluent and ‘mere millionaires’, the primary focus is on modeling the flow of assets (e.g., Yourefolio), and the outright preparation of estate planning documents (with players like Helios-now-EncorEstate and Trust & Will). While for higher net worth clients, Vanilla is competing to support more complex estate planning strategies.

And now this past month, Vanilla has announced a massive $30M Series B round, on the heels of an $11.6M Series A round just last summer, which the company says it was not actively seeking out but accepted in response to inbound interest from VC firms.

At its core, Vanilla supports advisors in the estate planning process, from serving as a repository for gathering existing estate planning documents, to providing estate illustration tools and deliverables to report the client’s current estate plan back to them, and aims to facilitate collaboration between advisors and the estate planning specialists working with their clients. Which Vanilla is now looking to expand even further into an “Ultra” version of their platform for truly ultra-HNW clients, that provides a more detailed analysis of complex estate planning strategies and visualizes their impact (e.g., the tax savings of implementing SLATs or GRATs).

Notably, though, the market for estate planning software is significantly smaller than the market for broader-based financial planning software – where even the largest players (e.g., eMoney, MoneyGuide) measure their revenue in the tens of millions (but not hundreds of millions) – and by Spectrem data, there are barely 2M ultra-HNW households in the US (compared to over 40M mass affluent and millionaire households). Raising the question of how exactly Vanilla will be able to justify the valuation implied by a $30M Series B round.

The answer, in a word: Services. After all, an individual advisor will only pay so much for estate planning software to use with all their clients (where financial planning software typically sells for ~$2,000-$3,000 per year, and separate estate planning software would be an additional cost), but each client the advisor serves may need new or updated estate planning documents themselves. For which the average fee for estate planning documents – especially for ultra-HNW clients – can be $5,000-$15,000 or more, especially when considering the layers of Wills, revocable living trusts, and additional trust strategies from SLATs to GRATs to IDGTs and more.

In other words, the market for providing estate planning services to clients’ advisors – where the estate planning software is both a distribution channel to reach those clients, and a tool to enable the unique B2B2C dynamics of working with advisors and their clients – is much bigger than the opportunity for ‘just’ the software itself. Or viewed more broadly, Vanilla in the long run may be less of an advisor technology company, and more of a tech-enabled (estate planning) service provider… which is arguably a much bigger opportunity?

Financial advisors are not (typically) lawyers, but “estate planning” is a staple of the financial planning process. In practice, this doesn’t mean the advisor will draft or make changes to a client’s actual estate planning documents, but often clients don’t even know or realize what’s in their own documents in the first place. As a result, advisors can and do create value by simply reading through a client’s estate planning documents, to identify the key players (executors, trustees, beneficiaries, etc.), and the flow of assets (either outright to those various beneficiaries, or held in further trusts for their benefit), and then summarizing and reporting it back to clients, to discuss whether their documents (still) align with their actual goals and wishes.

Except the caveat is that estate planning documents themselves are long and dense, which means it takes a significant amount of time for the financial advisor to read through the documents and glean those insights. Presuming the advisor even has the training and experience to read through the documents and know what to look for (and where to find it) in the first place.

To fill this gap, FP Alpha announced this month a new “Estate Snapshot” solution, which will take uploads of the client’s Wills, Trusts, Powers of Attorney, and other key estate planning documents, scan them, and provide a summary report back to the advisor of the key people (e.g., executors and trustees), how the estate assets will transfer, and identify potential planning opportunities. Which can potentially turn what, for some advisors, is a one- or many-hour process of evaluating client documents into just a few minutes to read and review the Estate Snapshot output before beginning the discussion with a client.

FP Alpha’s Estate Snapshot mirrors a similar kind of Tax Summary that Holistiplan produces by scanning and reporting back the details of a client’s tax return – which has quickly turned Holistiplan into one of the fastest-growing AdvisorTech solutions in the latest Kitces AdvisorTech Research – positioning FP Alpha well to grow in a parallel manner in easing the analysis of estate planning documents.

Notably, though, estate planning documents are arguably much more complex to analyze than tax returns – which at least have standardized forms from which the key numbers can be read, while estate planning documents are drafted differently from one attorney (or at least, one attorney’s drafting software) to the next – which means FP Alpha will still have to prove itself in the quality of “readings” it does from potentially complex estate documents, especially since the software is only valuable if advisors can fully rely on its output. (After all, if the advisor has to review the documents after the software to ‘make sure nothing important was missed’, virtually all of the time savings are lost!)

The FP Alpha solution may also face greater challenges in adoption because, unlike Holistiplan – which ‘just’ offers its Tax Return analysis as a core solution – the Estate Snapshot is part of a broader ‘AI-driven comprehensive financial planning solution’, which potentially creates friction for advisors who only wanted the access Estate Snapshot and don’t want to buy (and pay for) the rest of the FP Alpha solution. Raising the question of whether, if it gains traction similar to Holistiplan, FP Alpha will spin off the Estate Snapshot solution as a standalone offering.

Nonetheless, as advisors look to go deeper into their advice relationships with clients – with a particular focus on tax and estate planning, where there can be substantial dollars at stake (which means substantial opportunity to demonstrate value) – there is an inexorable trend towards financial planning and advice engagement tools that don’t necessarily help advisors get through the planning process faster, but instead expedite the initial steps of the planning process so advisors have the time and capacity to go deeper. For which FP Alpha’s Estate Snapshot appears very well positioned to help advisors get through dense estate planning documents more quickly to have better and deeper estate planning conversations with clients.

One of the most often cited industry statistics over the past few years draws from a study by marketing consultancy Iris, which found that a whopping 80% of women leave their financial advisors after losing a spouse. Which casts into stark relief the tendency of typically-male financial advisors to interact primarily with the historically-more-financially-focused male member of a client couple, and either under-nurture the relationship with (or in some cases, outright ignore) the ‘non-financial’ spouse.

On the one hand, this ‘gap’ in the relationship between the financial advisor and the non-financial spouse has led some to call for either better gender diversity amongst financial advisors (in the hopes that women advisors will better relate to the typically-female non-financial spouse), or, more generally, for better communication and relationship training for all financial advisors to more holistically engage both members of the client couple.

On the other hand, some have suggested that if the non-financial spouse is… well, not financially oriented in the first place – that the better approach is to find other non-financial ways to bring them into the relationship, in part through leveraging technology that may engage them more meaningfully.

In this context, this month Australian financial planning software provider Lumiant announced that it is bringing its technology from Australia to advisors in the US, particularly in the hopes that it can become the tool that engages more meaningfully with (and hopefully, prevents the long-term attrition of) the non-financial spouse.

In fact, Lumiant might arguably be called an “Advice Engagement” tool more than traditional financial planning software, given its particular focus on the non-financial aspects of the advisory relationship. As a result, while Lumiant does engage clients in a process to better understand their goals, its intake process also engages in a broader discovery with clients around their values, and features an account-aggregation-based portal that highlights the family’s entire wealth (not just its investment accounts). In addition, Lumiant helps to track the clients’ own tasks and to-dos to help nudge them towards actually following through and completing their planning recommendations.

At the same time, though, Lumiant does also help clients project out whether they’re on track for their “Best Life”, by performing a more ‘traditional’ financial planning projection that allows clients to see multiple planning scenarios and how they fare through various (Monte-Carlo-based) return simulations.

In the interests of being more engaging to the entire family, Lumiant is also structured to facilitate multiple members of the client household to each log in, and is priced accordingly – with a base fee of $3,000/year for up to 80 client logins (with additional logins priced at $10/household down to $1.50/household for bulk purchases of 500+ client logins) to access the advice engagement clients, increased to a base fee of $6,000 to access the financial planning projection engine (and other add-on features, including client vault storage and some estate planning tools to show clients their legacy asset flows after death).

From the broader industry perspective, Lumiant is most interesting for how it is living at the intersection of ‘traditional’ financial planning (projections for whether the client is on track for their financial goals), and the rise of “Advice Engagement” tools that are meant to keep the client engaged in an ongoing manner after the initial plan, with a combination of a client portal with a holistic financial dashboard, Knudge-style task tracking of financial planning action items, and a more values-based lens for understanding clients beyond their financial goals alone.

From the individual advisor perspective, though, it is striking that Lumiant prices at $3,000/advisor – or more, as an advisor with 100+ clients will probably average 150-200+ logins (given spouses and/or other family members who are also engaged), which may bring the pricing to $3,500-$4,000 for the additional logins – which is akin to the cost for the entire financial planning software package from MoneyGuide or eMoney or RightCapital. Especially since ‘traditional’ planning software is still built to go deeper than Lumiant on the core financial planning analysis – which will likely make it hard for planning-centric advisors to ‘give up’ their core planning software, and instead raises the question of whether advisors will really want to pay that much more for a second ‘financial planning’ portal on top of the ones they already receive from their core financial planning software?

In the long run, it seems that Lumiant is building in the right direction for where the broader nature of financial planning is going, with a stronger focus on ongoing advice engagement beyond the initial financial planning process. But at this point, it’s not clear if Lumiant will really be able to win any material market share for advisors who want to buy it on top of the planning software they already own, or if Lumiant’s more appealing/popular features will simply be mimicked by existing financial planning software providers who undercut Lumiant by rolling out similar capabilities with little or no added cost to the advisors already using their existing platforms?

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Can All-In-One platforms build ‘good enough’ solutions in all the key areas for advisors to be willing to let go of their individual systems for one (data-)unified solution? Will advisors increasingly turn to their advisor technology tools to find the ideal insurance and investment products to recommend and implement for their clients? Would FP Alpha’s Estate Snapshot make you more interested in having estate planning conversations if the document review process was faster and easier? Does Lumiant’s portal sound appealing enough to pay for – in addition to existing financial planning software – in the hopes of better engaging a less-engaged spouse? Let us know your thoughts by sharing in the comments below!