Post Views:

2,166

In my multiple conversations with investors during the bull-run since 2014, there was no one who said that I will not take advantage of investing in equity when the market will crash. In good times i.e. when the market valuations are usually very high, everyone agrees to the logic of buying low and selling high. But interestingly, very few implement this strategy. Instead, the majority tend to invest when markets are going higher and higher, getting expensive and creates a potential for significant downside risk. They follow the herd, take decisions based on emotions and throw logic out of the window by succumbing to the psychological pressure of witnessing rising market levels and from the actions taken by their peers.

Investing is simple but not easy. Some of the major errors which people commit in an overvalued market are:

1. Investing without understanding the market cycle. Click here to read our blog on market cycles

2. Not knowing how to value assets. You can read about Price vs. Value by clicking here. Buying the best of businesses at wrong prices could turn out to be a bad investment.

3. Not understanding the role & importance of tactical asset allocation (overweight debt in euphoric times and overweight equity in a time of acute pessimism) in creating superior returns over the long term.

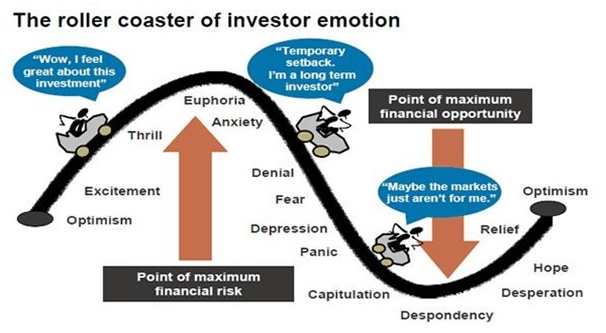

I am a student of the market cycles. One thing is very clear to me. Like we experience good days and bad days in our lives, markets also experience good times and bad times. Market price movements are the apt manifestation of collective human emotions. I would like to reproduce one of my favourite diagrams – market sentiment cycle.

There had been many market cycles of boom and bust in the past and many will follow in the future. Every time the reasons for the turn in market cycles are different and are unexpected but follow the same behavioral template. These cycles are inevitable and no mortal on earth has the power to permanently stop it from occurring. Although, that can be delayed as it was done by the Global Central banks by pumping in the huge amount of money whenever markets appeared to be at the brink of correction. People in power could delay the bigger balance sheet problem by flooding the market with cheap money but didn’t know that the unseen micro enemy will attack the income statement by paralyzing the economic activities. Despite thinking that everything is under our control, time and again we are jolted by such events that remind us that we are just fallible humans and weak in front of the will of nature. It is nature’s way of humbling us down.

Now some of you may say that nobody predicted that a virus named Covid-19 will create havoc all around the world, so it was not possible to be prepared for such a risk. Exactly my point – the real risk is something that we cannot foresee much in advance, all the known risks get already discounted and provisioned for. That’s why the margin of safety principle should never be forgotten. It simply states that the future is uncertain and unknown, therefore, the investments should be made at the prices equal to or lower than the long term fair valuations. This principle, which is at the heart of value investing, ensures that any unforeseen risk that could trigger a meltdown will not result in a significant downside to the portfolio. Those who had followed the principle of the margin of safety, like us, are sitting pretty on cash and equivalents. Having short-sightedness while investing or playing the momentum game could turn out to be a very dangerous proposition.

Google Search trends for the Coronavirus. Nobody saw it coming in a big way till January-February 2020:

We are, however, fortunate to have clients who understood our value investing approach, kept their trust in our strategy, understood the virtue of patience and stick to us when we remained conservative while the markets were showing signs of euphoria. We had been maintaining 0-35% large-cap equity allocation (depending on risk appetite and time of investment) in all the portfolios under our management over the last two years due to our assessment of being in the late stage of the market cycle that was also reflected in the expensive equity prices. We successfully avoided the carnage in mid & small cap in 2018-19 by exiting from all such schemes at the beginning of 2018 and also got benefitted from taking decent exposure in gold a year ago when it was trading at INR 32,000-34,000 unit prices. While benchmark Sensex is down by more than 25% in the last one year, our portfolios returns are in the range of 0% to 5%.

After a sharp fall, the margin of safety has significantly gone up i.e. downside risk potential has drastically reduced. Benchmark PE ratios have also come closer to their long term averages. Now is the time to use the provision created in debt mutual funds to gradually shift to equity. The maximum downside in the market due to Corona and the expected impact on the economy could be as much as 25%-30% from the current levels. Please note, it is the maximum downside in our assessment and not very certain to happen. Since, nobody can catch the bottom, we need to gradually and strategically take higher equity exposure, within a limit of maximum tactical allocation based on our respective risk profile, as the market goes through a downward (sentimental) cyclical trend. This will ensure that our average buying is at cheaper prices (with a high margin of safety). So when the market cycle will inevitably turn up again, which could take a few months to a few years, we would have set a strong foundation for superb returns in the future.

By mere memorizing what Warren Buffet said, “Be greedy when others are fearful and be fearful when others are greedy” won’t make you wealthier unless you implement this saying in spirit. In times (and opportunities) like these which come once in a decade, it takes courage, sanity of mind and patience to generate superb returns in the long term.

Please take all necessary precautions to stay safe and healthy. We as a human race have come out of the difficult times caused by world wars, global pandemics and major financial crises in the past and have only progressed in the long term. This unfortunate time upon us shall pass too.

Truemind Capital Services is a SEBI Registered Investment

Management & Personal Finance Advisory platform. You can write to us at connect@truemindcapital.com or call us on 9999505324.