In recent times, we have received a lot of queries on Sectoral and Thematic Funds. The growing interest in the category is also reflected in its net inflows. Sectoral/Thematic category received net inflows of over Rs. 25,000 crores in 2021 (three-fold increase from Rs. 8,000 crores in 2020).

In addition, there are a lot of narratives floating around on various themes and how they can deliver huge returns within a short span.

Given all this excitement surrounding the category, it is easy to get carried away and invest without a second thought. However, this may prove to be a costly mistake, as investing in sector/thematic funds involves a number of nuances.

We have boiled these nuances down into six questions that you need to ask yourself before investing in these funds.

But before that, here’s a quick introduction to Sectoral & Thematic Funds

Sectoral & Thematic Funds offer you an option to take a concentrated exposure to a specific sector/theme.

Sectoral Funds predominantly invest in companies pertaining to a particular sector. Eg: Auto, Banking, Pharmaceutical, FMCG etc.

Thematic Funds, on the other hand, predominantly invest in companies belonging to a specific theme. The difference is that the themes are more broad-based and can be spread across sectors. Eg: Consumption, Infrastructure, Manufacturing, Rural etc.

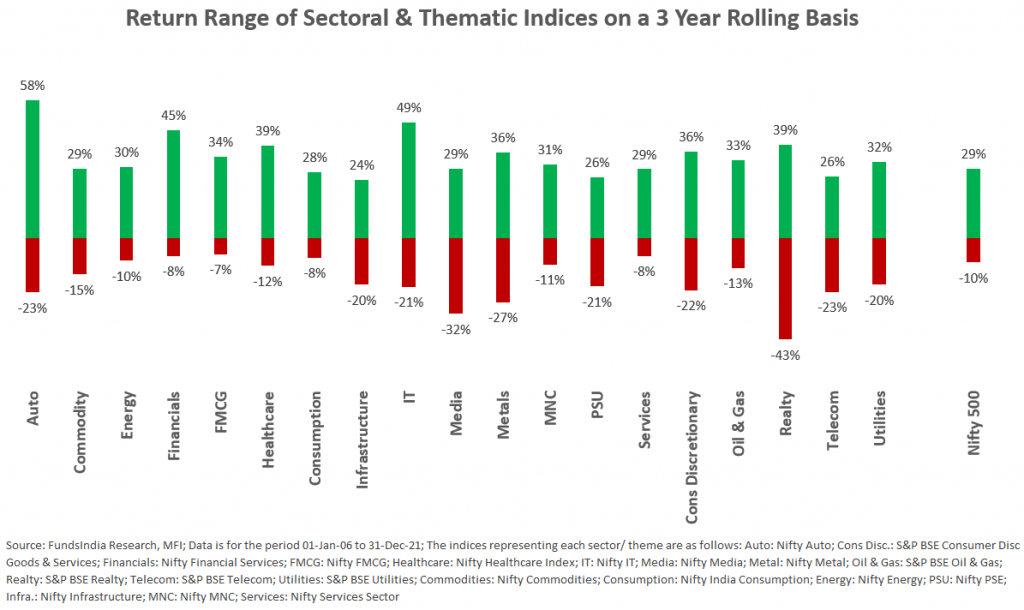

Sector and Thematic Funds, given their concentrated portfolio (read as low diversification), tend to have a high risk-high return profile. This can be noted in the below chart that shows the 3-year return range of the various sectoral and thematic indices over the past 16 years.

Now, let us jump right away into the questions…

Question 1: Have you identified a potential winning theme/sector?

First, you need to ask yourself whether you have identified the potential winning sector/theme for the future. This has to be guided by a strong rationale formed by thorough analysis of that theme.

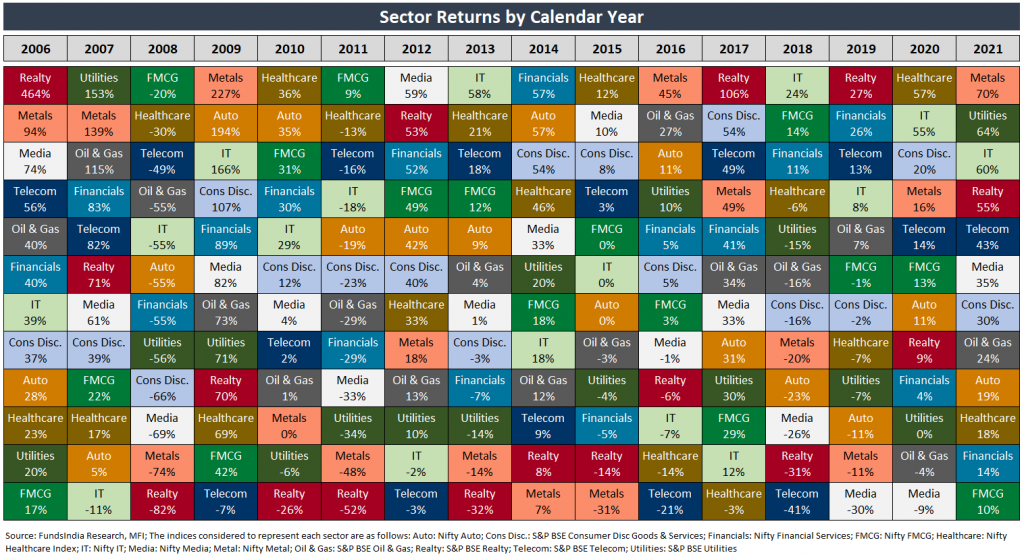

More often than not, we take the easy way out and put our money into themes that have done extraordinarily well in the last few years. But this can lead to underwhelming results, as historically different themes have done well at different times. The sectors/themes that had a great run in the past few years may not do well in the next few years and vice versa.

Infact, over the last 16 years, none of the top performing sectors in a given year have retained their top position the following year. Sectors that ranked at the top (such as Realty, FMCG, Metal, Healthcare, Media & IT) in one year also ranked at the bottom in another year.

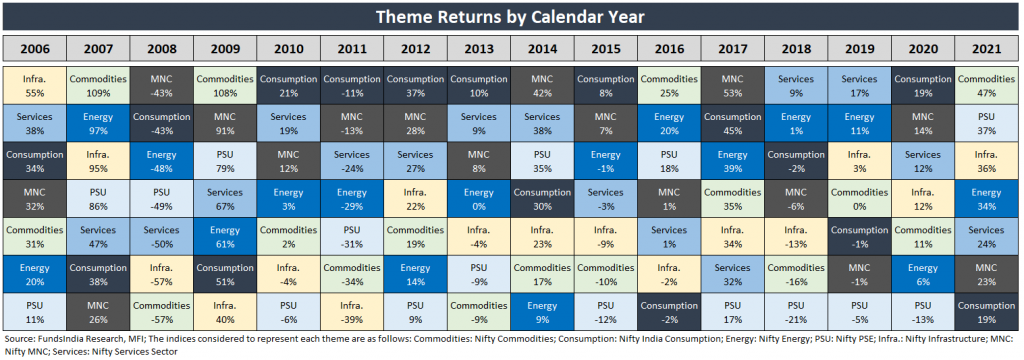

As with sectors, the best performing themes have also largely rotated year after year.

This makes it harder to zero in on a particular theme that could deliver good returns in the next few years.

Question 2: What is your current level of exposure to this theme/sector?

Here, you need to figure out how much exposure you already have to the chosen theme in your existing portfolio.

If your portfolio already has a significant allocation to the theme, then taking additional exposure to the same theme can be avoided. For example, the Banking and Financial Services sector is already adequately represented in most Indian diversified equity funds. If your portfolio has a large-cap bias, then you are likely to have around 30% to 40% exposure to financials.

Question 3: Will you be able to enter and exit the theme/sector at the right time?

Timing matters a lot when it comes to investing in themes/sectors – and depending on which, the returns can be exceptionally good or extremely bad!

Historically, most sector & theme based indices have gone through long stretches of underperformance when compared to other diversified indices. This happens because most sectors are cyclical and are sensitive to the changes in the business and economic cycle. Ideally, you have to enter into the theme before the cycle starts playing out and exit at the peak of the cycle.

But timing the entry and exit is easier said than done.

It is extremely hard to predict when cycles begin and how long they will last. Moreover, different sectors and themes react differently to the economic and business cycles.

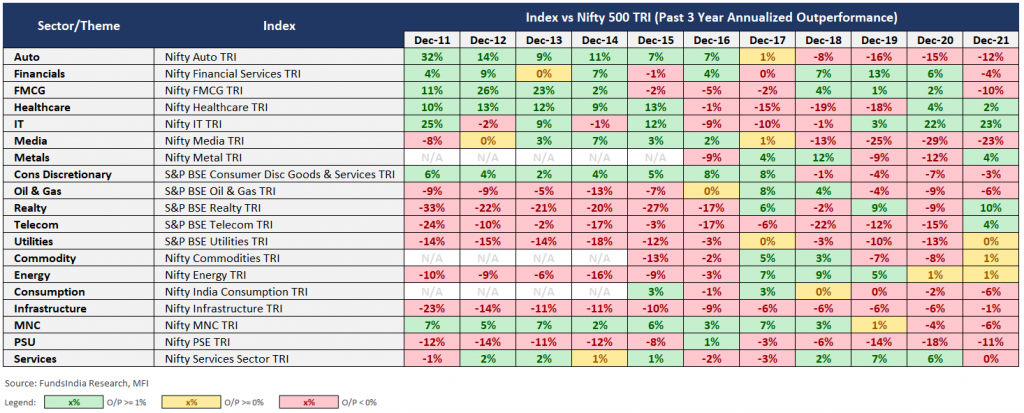

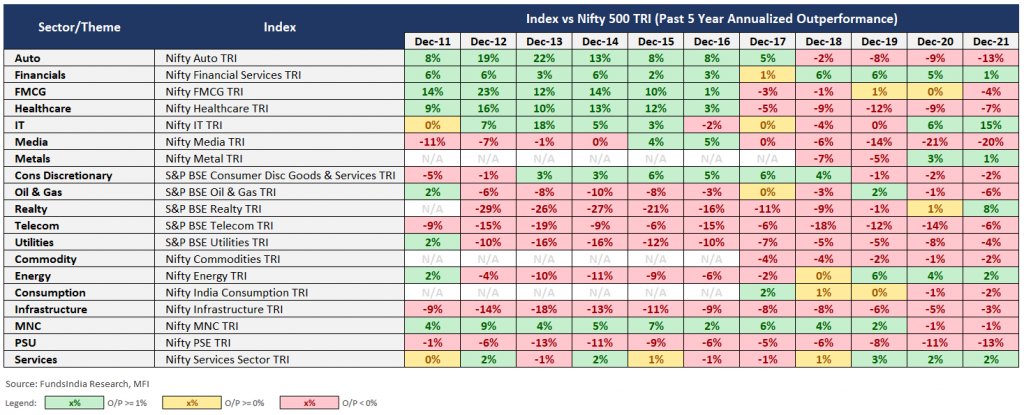

In the past decade, almost all the sectors/themes have gone through extended periods of underperformance from a 3 or 5 year point of view. Even a non-cyclical defensive sector like FMCG has continuously underperformed for over 3 years (2015 to 2017).

The same trend is seen even if we evaluate over a longer time frame of five years.

While there is a potential of higher returns, sector and theme based funds need to be timed correctly both in terms of entry and exit. If the timing goes wrong, these funds might end up disappointing you with dismal returns.

Timing is one of the key reasons why we prefer diversified funds. In a diversified fund, the sector/theme calls are taken by the fund manager and hence you don’t need to worry about timing. However, in sectoral & thematic funds, there is no such flexibility. The fund has to continue with the same mandate even if the sector/theme is not in favour.

Question 4: Will you be able to handle the volatility of the theme/sector?

Though Sectoral & Thematic Funds offer the scope to earn high returns, they also exhibit higher volatility by design. The underperformance in sector and thematic funds (when it occurs) tends to be higher and could persist for extended periods. As shown in the 5-year outperformance table above, the underperformance versus Nifty 500 TRI continued for more than a decade in sectors/themes such as Telecom, Utilities, Infrastructure & PSUs.

The sectoral and thematic indices have historically traded at discount for longer periods of time. For example, Nifty Infrastructure Index was down at least 20% from peak levels in 85% of the days since 2006 (versus 26% of the days for Nifty 500).

Question 5: Have the Valuations already priced in the theme/sector’s potential?

The next challenge is to check whether the valuations of underlying companies have already factored in the expected growth.

Stock prices are a function of the expected performance of a company. Your chances of earning outsized returns are slim if the market has priced in very high expectations and stock prices have run up considerably.

Question 6: Have you selected the fund that is best positioned to play the theme/sector?

Finally, you have to pick the right fund to play the chosen theme. Not all companies/funds pertaining to the theme do well even when the underlying theme is in favour.

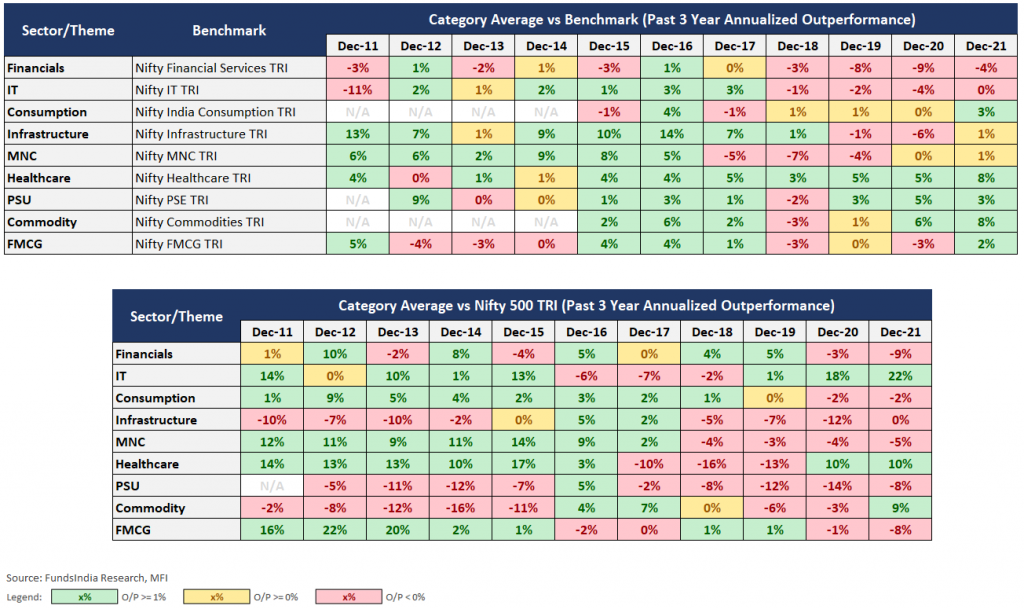

Historically, the performance of the Sectoral & Thematic funds has been very patchy. The category on average has shown patches of underperformance versus both the sector/theme based benchmark as well as the diversified Nifty 500 TRI.

Given this, you need to pick a fund/fund manager with a proven track record of capturing the underlying theme’s performance.

Summing it up

Investing in thematic/sector funds requires four things going right –

- Identifying a winning theme/sector

- Ability to enter and exit the theme/sector at the right time

- Valuations which haven’t already priced in the theme/sector’s potential

- Selecting a fund that is best-positioned to play the theme/sector

Getting all four right on a consistent basis is extremely difficult.

Investors have often piled into these funds at precisely the wrong time, only to be disappointed. The performance figures for majority of sectoral and thematic funds over the long run have largely been underwhelming thus far.

Given their non-diversified exposure, higher risk profile and the need to time both entry and exit, Sectoral/Thematic Funds should not form part of your core portfolio.

Investors with higher risk tolerance who are looking for a specific exposure to a particular theme/sector can consider these funds as part of ‘Extra Risk-Return’ Bucket. This bucket as a whole should not exceed 10-15% of your overall portfolio.

Other articles you may like

Post Views:

4,679