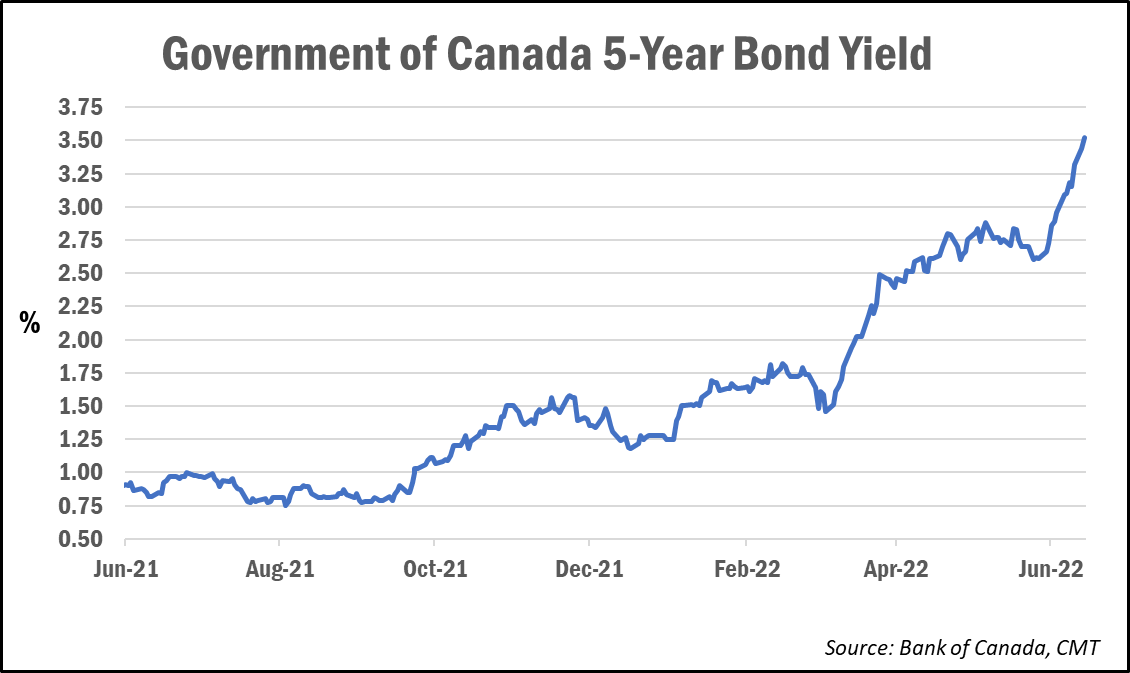

Bond yields surged to a fresh 14-year high this week, driving expectations that fixed rates are likely to continue rising.

As we reported last week, the Government of Canada 5-year bond yield was already on its way up, crossing the 3.20% threshold. Well, on Monday it broke the 3.51% barrier.

This is important because the 5-year bond yield is the best indicator for future moves in 5-year fixed mortgage rates.

Fixed mortgage rates have already been trending higher, with discounted, nationally available rates reaching an average of 4.80% for uninsured mortgages (those requiring a minimum down payment of 20%), while average insured rates have risen to an average of 4.57%, according to data tracked by Rob McLister, rate analyst and editor of MortgageLogic.news.

With bond yields up 20 basis points from Friday, borrowers should expect that 5-year fixed rates “will likely rise again this week,” noted Integrated Mortgage Planners broker Dave Larock, in his latest blog post. “This next round of increases will push five-year fixed rates offered by most lenders above 5% (about double where they were at the start of this year).”

Magenta Capital Corp. suspends new applications

One of the country’s largest private lenders won’t take new loan applications until September, according to a report from the Globe and Mail.

Magenta Capital Corp., a Mortgage Investment Corporation (MIC), reportedly made the announcement in an email to its broker clients, without providing a specific explanation as to why.

The Globe story quoted Magenta CEO Albert Oppenheimer in the company email as saying, “I understand that this is an inconvenience for you and your clients.”

“There will be so many more of these Mortgage Investment Corps suspending lending in the next eight weeks,” predicted Ron Butler, of Butler Mortgage, in a tweet. “When your modelling suddenly shows values dropping 5% a month in some markets, what else can you do?”

Founded in 1994, Magenta is now one of the country’s largest MICs with $430 million in mortgage assets under management.

Fed rate decision preview: 75-bps hike expected

The next big interest-rate decision comes on Tuesday from the Federal Open Market Committee (FOMC) in the U.S.

While a 75-bps rate hike was always in play, odds of such an oversized move have risen significantly following Friday’s fresh 40-year-high inflation reading of 8.6% for May.

“The most likely triggers for a shift to a more aggressive pace of tightening are the upside surprise in the May CPI report and the further rise last Friday in the Michigan consumer survey’s measures of long-term inflation expectations that has likely been driven in large part by further increases in gas prices,” Goldman chief economist Jan Hatzius and others wrote in a note.

Such a move would put further pressure on the Bank of Canada to consider a similar hike on this side of the border to tackle our own 30-year high inflation readings.

“Given the higher odds that the Fed will pick up the size of hikes likely in July with June risk, this makes it significantly more likely that the Bank of Canada will hike by a bigger amount than 50bps at its July meeting and probably 75bps,” wrote Scotiabank economist Derek Holt. “Both central banks are absurdly behind where they should be.”

Housing service costs as bad as 1989: BMO

With interest rates rising at their current levels, mortgage service costs are now as bad as they were in 1989, according to a report from BMO.

“…and that’s with five-year fixed mortgage rates closer to 5% than 12%,” report author Sal Guatieri noted.

He noted that the current housing “frenzy” drove debts to an all-time high.

“About 19% of households owed in excess of 350% of disposable income in 2021, a record,” Guatieri wrote. “The frenzy was due to ‘extrapolative price expectations,” or fear of missing out on future price gains.’” He added that investors largely “led the mania,” accounting for more than 22% of sales in 2021, compared to 19% in 2019.

“They also extracted increasing amounts of equity out of their appreciating investments to, yep, buy more homes,” the report reads. “This group will be the first to pull back, and if they start selling en masse, the price correction could gain steam.”

Majority of Canadians concerned about their ability to afford a home

A majority of Canadians (56%) say they are very (30%) or somewhat (26%) concerned about their ability to buy a home or afford rent. That’s according to Statistics Canada’s latest Portrait of Canadian Society survey released last week.

The level of concern is even more concerning among younger Canadians. Those aged 15 to 29 (53%) and 30 to 39 (39%) were twice as likely as those over the age of 40 (20%) to say they are “very concerned” about their ability to afford housing or rent.

“These concerns have led to changes in behaviour among Canadian youth and younger adults,” StatCan noted. “Over the six months preceding the survey, 39% of those aged 15 to 29 and 38% of those aged 30 to 39 said that they wanted to buy a home or move to a new rental but decided not to because of price concerns, compared with 24% of the overall population.”