Gross domestic product is the most commonly accepted measure of the economy’s performance. For the previous two quarters, it showed that the economy contracted. So recession, right? Wrong.

Before getting into why I don’t think the economy was in a recession during the first half of the year, it’s worth mentioning that things are very weird right now. Contradictions abound. All of the confusion results from turning the economy off and back on again. 2020 threw a wrench in everything. Everything.

People are upset because they think they’re being lied to. “They’re moving the goalpost.” I get it. Inflation sucks and people are hurting and distrustful, and “this is just another episode of political nonsense.”

Ben and I spoke about the definition of a recession on our podcast, and we sided with The White House on this one. Somebody commented, “Serious question. Why isn’t that controversial? Seems bonkers to me.”

The National Bureau of Economic Research is the official arbiter of where we are in the business cycle. They don’t define a recession as “two consecutive quarters of negative GDP growth,” which is widely accepted as a rule of thumb. Here’s their take:

“The NBER’s traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

In 1987, when the great Jason Zweig first became a financial reporter, he asked this question:

“The financial press often states the definition of a recession as two consecutive quarters of decline in real GDP. How does that relate to the NBER’s recession dates?”

For the full response, click here, but there’s one bit I wanted to isolate:

“We do not identify economic activity solely with real GDP, but consider a range of indicators.”

Let’s talk about those indicators. The Federal Reserve Bank of Dallas posted an article yesterday, “U.S. Likely Didn’t Slip into Recession in Early 2022 Despite Negative GDP Growth.”

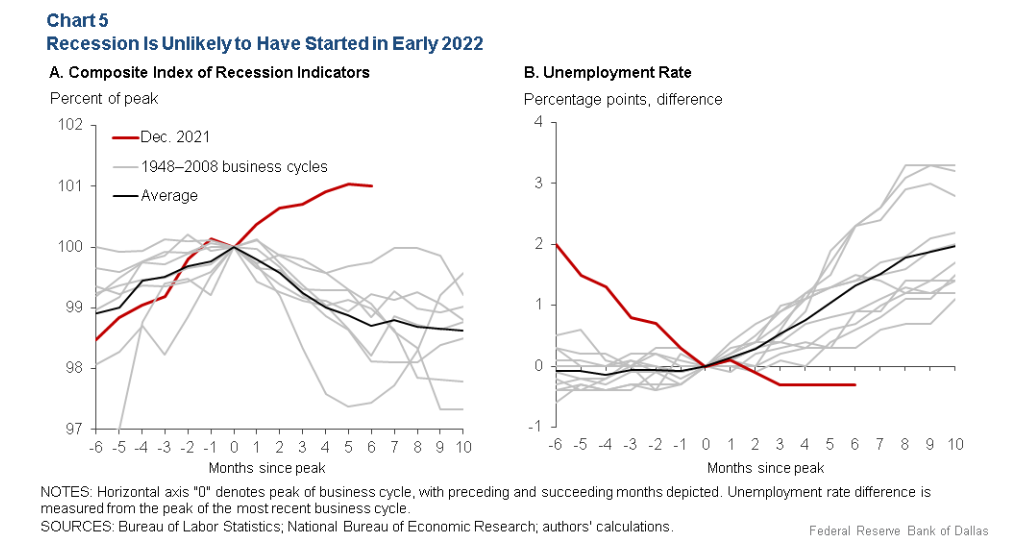

They put forth some compelling evidence that we were not in a recession. They show nonfarm payroll employment and industrial production in the year’s first half compared with previous recessions.

“The gray lines in Chart 1 show the movements of nonfarm payrolls and industrial production in each previous business cycle relative to the peak of that cycle (month 0 = 100); the average across all previous cycles is the black line…The red line is the indicator’s movement between June 2021 and June 2022 relative to the level in December 2021.”

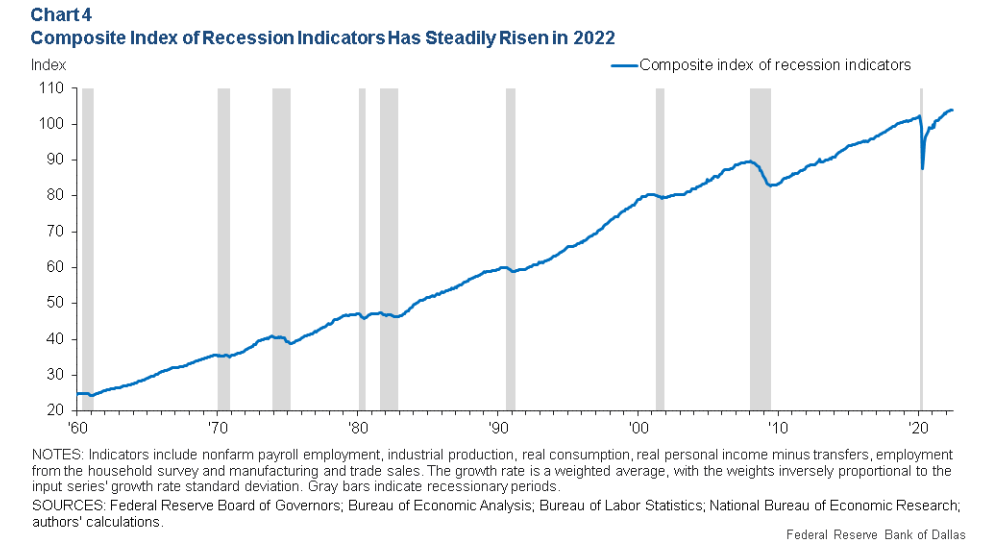

They go a step further and put together a composite index of recession indicators to get a broad-based look at the economy.

Does this look like a recession to you?

Okay, so what? Maybe we aren’t in a recession, but there’s certainly a lot of pain out there. And a lot of pessimism. If everyone feels like we’re in a recession, why does it matter what the data says? First of all, not everyone feels like we’re in a recession. People on the internet might have convinced you of that, but Twitter is not the real world. Durable goods orders don’t hit all-time highs in a recession. Travel companies don’t beat estimates and raise guidance during recessions. And the biggest company in the world doesn’t have its best June quarter ever during a recession.

I’m not pointing fingers, I myself have been more pessimistic than I normally am about the economy. I was proven wrong.

There is still a chance that the economy will contract. Maybe inflation has taken longer to hit the consumer due to the influx of cash they received during the pandemic and their desire to spend after being locked down. Maybe the fed pushes it too far. Maybe the feeling of an incoming recession causes companies to pull back to the point that getting a job becomes more difficult.

Maybe one or more of these things happen during the second half of the year. But I don’t know how you can look at the data and say it happened during the first half.