Where do you park your warchest cash while waiting for potential market opportunities? For investors looking for relatively low risk options but with fast (or almost instant) liquidity, moomoo Cash Plus is worth checking out. Here’s a quick review on how it works and why you might want to consider if it is suitable for you.

What are cash management funds?

If this is your first time seeing this term, you should know that cash management funds are a type of low-risk wealth management product. They are also otherwise known as money market funds (aka MMFs) and typically come with the following features:

- Short-term / no lock-up period

- Low minimum capital

- (usually) higher returns than bank interest rates or fixed deposits

These tend to be more suitable for people who seek a temporary place to park their idle cash in, while waiting for an opportunity to act or deploy their monies.

Cash management funds mainly invest in short-term government treasury bills, institutional bonds and other relatively safer assets. This makes them relatively lower in risk compared to stock funds or even various bond funds.

And unlike bonds or fixed deposits, there is usually no minimum capital and redemption is almost instant (or within the next working day). This can be powerful because it gives you the ability to liquidate almost immediately and deploy your funds into any beaten down market opportunities that you’ve spotted, with no waiting time in between.

moomoo Cash Plus – is it safe?

You may have already seen the enticing Cash Plus options if you’re an existing user on the app like me.

But for new users, moomoo SG is offering a daily S$2 cashback* for 30 days maximum if you deposit at least S$100 into Cash Plus within the month of August!

This works out to be S$60 in total, which technically means your returns on a S$100 capital gets boosted to 60.13%* within a single month!

*based on July’s returns, as shown below. August’s returns may or may not be higher, given the current climate of rising interest rates.

But before you do anything, you need to first understand how the returns are generated and decide if it is a suitable finance instrument for your needs.

Specifically for moomoo Cash Plus:

- Instant deposit and withdrawals – simply use the funds in your moomoo SG account to buy, and redeem it for instant use on stock trading or IPO subscriptions when you need to.

This is the biggest benefit of buying cash management funds via your brokerage platform – you get to withdraw and use the redeemed funds almost instantaneously for your stock trades without incurring any margin interest.

- Zero additional fees – the management fees for such cash management funds are deducted from the fund assets, so you do not need to pay any additional fees when you subscribe and/or redeem.

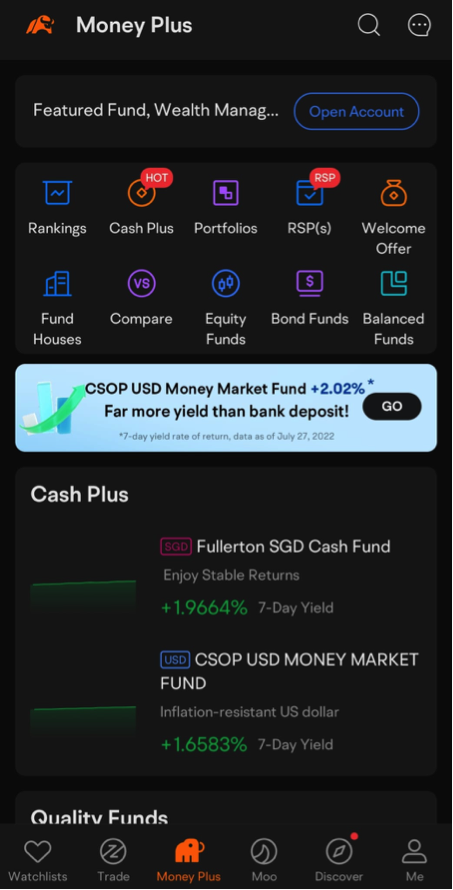

To learn more, simply tap on the “Money Plus” icon in your menu navigation bar where you can then browse through the different funds available on moomoo.

For Cash Plus, investors can choose from 2 Money Market Funds on moomoo i.e. the SGD or USD version.

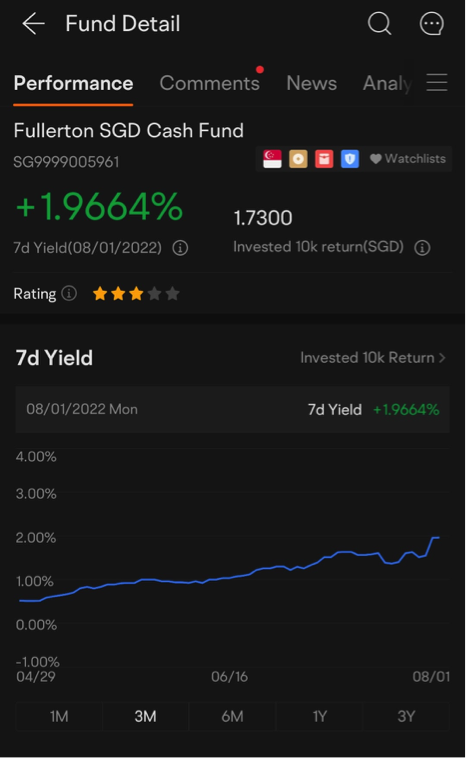

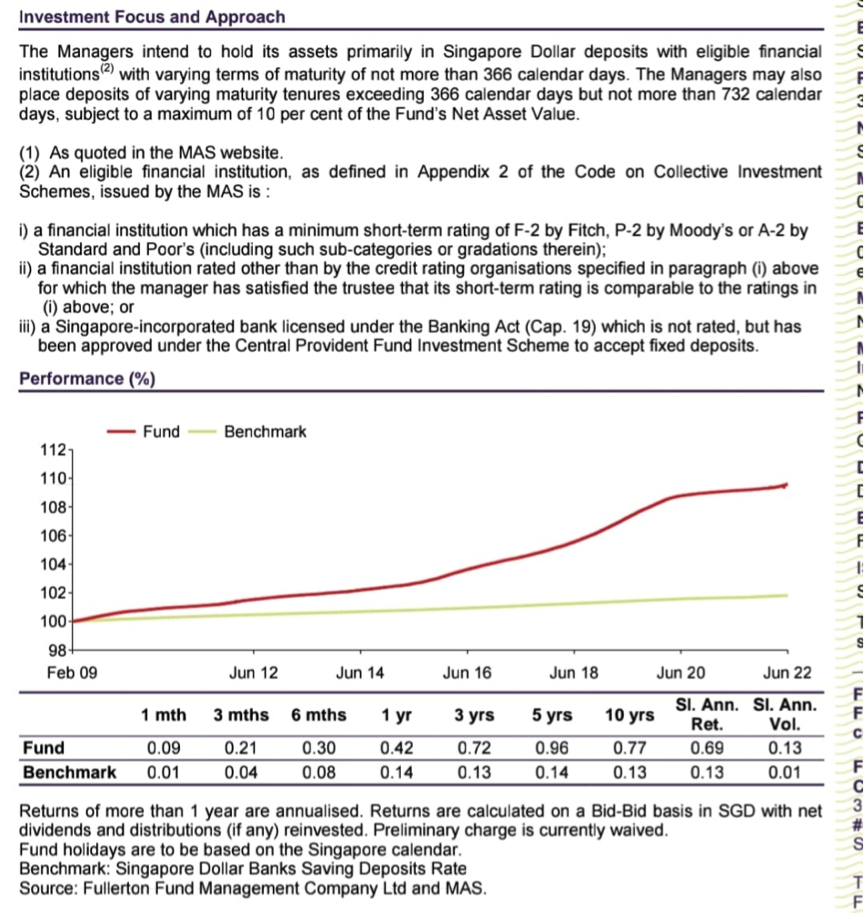

As there’s more data on the historical returns for the SGD MMF managed by Fullerton, I’ve opted to use this as an example instead.

The yield on the Fullerton SGD Cash Fund has been steadily increasing ever since the start of the year. From 0.03% in January, last month’s yield came in at 0.13% (almost 4 times higher). This might help explain why the fund assets have almost doubled vs. earlier this year.

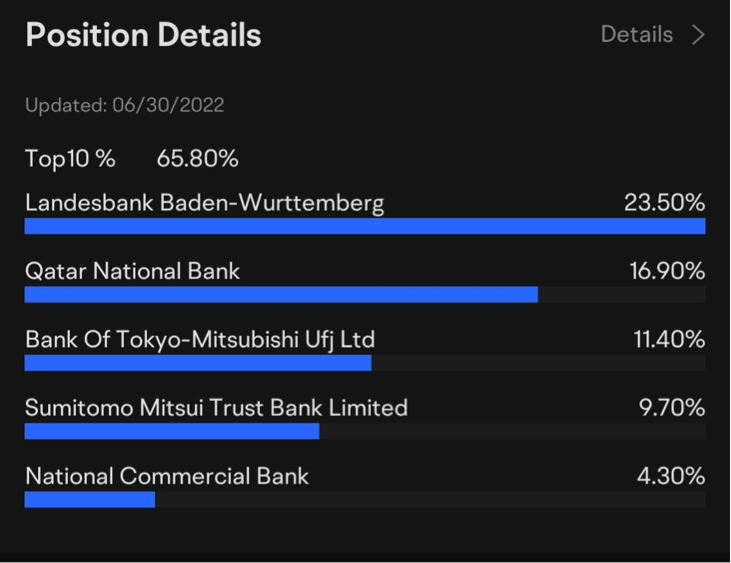

Of course, these yields are neither guaranteed nor should we expect them to rise forever. Instead, you can tap to see what the fund invests into, so you have a better idea of where your money is going.

In this case, we can see that the funds are mainly with major financial institutions SGD deposits. This means that the major risk investors are subject to would be the risk of defaults by these financial institutions, which should be a fairly unlikely event unless there’s major collapse in the global financial system.

Strictly speaking, there is always the chance that the fund may post a negative return on a single day in some extreme cases or scenarios. But specifically for the Fullerton SGD Cash Fund, you can track their performance where it has not had a negative monthly return in all the years since its inception date of 3 February 2009.

You can also tap on “Summary” to view the Fund Prospectus in full, as well as other fund-related documents within your moomoo app itself.

Who is moomoo Cash Plus suitable for?

In general, investors looking to preserve the principal value of their funds + maintain high liquidity + get returns while waiting can consider this as an option.

If you have most of your warchest cash in USD and prefer to avoid FX conversion, there’s also a USD Money Market Fund (offered by CSOP) that you can check out.

Who is NOT suitable for moomoo Cash Plus?

- If what you seek is a capital-guaranteed instrument, then this will not be suitable for you.

You might then be better off with fixed deposits or the Singapore Savings Bonds (provided that you’re successful in getting your desired allocation) instead.

- If you want returns higher than single-digits, then cash management funds are unlikely to get you there.

What can I get if I invest in moomoo Cash Plus?

As mentioned above, moomoo SG is currently running a promotion for the month of August 2022 where you can get S$2 cashback daily (up to a maximum of S$60 cashback for the month) when you invest a minimum of S$100 into Cash Plus.

You can read the full terms and conditions here – the main thing I’ll call out is the criteria to qualify as a “new user” i.e. your first deposit must be after midnight of 1st August.

Futu’s global assets management scale exceeds S$3.6 billion, and this is just the start of what they’re opening up to Singapore investors.

Why trade with moomoo? Read my review here.

Disclosure: I’m a current user and am trading on their platform using my own funds.

Message from our Sponsor Start investing in funds from S$0.01, with the flexibility to withdraw anytime you want to. With $0 commission, no fees for fund subscription and redemption and $0 platform fees, choose moomoo to help you start your fund investments easily today!

The moomoo app is an award-winning trading platform offered by Moomoo Technologies Inc., a subsidiary of Futu Holdings Limited (NASDAQ:FUTU) and backed by Tencent. moomoo SG is regulated by the Monetary Authority of Singapore and is the first online brokerage to have received approvals for all SGX memberships. Disclosure: This post is brought to you in conjunction with moomoo SG. All opinions are that of my own, based on my trading experience with moomoo. Please feel free to click on my affiliate links if you’ll like to sign up for an account! This advertisement has not been reviewed by the Monetary Authority of Singapore.