ABSLI Fixed Maturity Plan offers you look-and-feel of a bank fixed deposit but disappoints on the returns front. Low guaranteed returns. Club this with the premature exit penalty and this product becomes an easy avoid.

We love Bank fixed deposits. Almost 2/3rd of Indian household wealth is in bank fixed deposits. Thus, it is logical for an insurance company to launch products that give you look-and-feel of a bank fixed deposit. Aditya Birla Sun Life Insurance has launched ABSLI Fixed Maturity plan.

How is ABSLI Fixed Maturity plan similar to a Bank FD?

- Similar nomenclature (There is “Fixed” in the plan name)

- Single Premium (much like your FD investment)

- Guaranteed returns (known upfront)

- Easy calculation of maturity amount

- Not very long maturity (5-10 years)

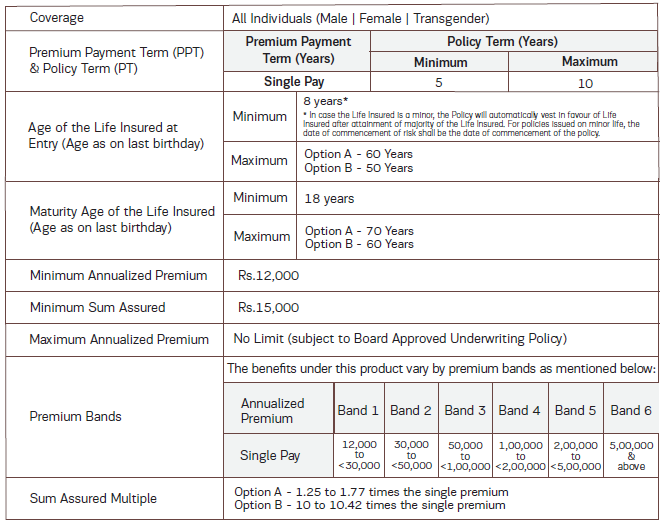

ABSLI Fixed Maturity Plan: Important Features

ABSLI Fixed Maturity plan is a non-participating plan. With non-participating plans, you know upfront how much you will get and when. Guaranteed returns. Therefore, you can use any spreadsheet software to calculate the IRR (returns). Under any non-participating plan, it is the liability of the insurer to pay you the promised amounts.

Single Premium.

2 Variants. Option A and Option B.

Maturity proceeds from Option A will be taxable since the Sum Assured is less than 10 times single premium.

Maturity proceeds from Option B will be exempt from tax.

Policy term of 5 to 10 years. Hence, not a very long maturity product. ABSLI has tried to position this product as an alternative to a long-term FD.

I reproduce the table from the product brochure.

What will be the returns like?

Since it is a non-participating plan, you know upfront what you will get.

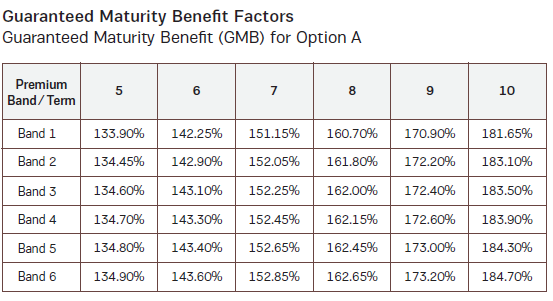

You get guaranteed maturity benefit (GMB). We will first look at returns from Option A and then look at Option B.

With this information, you can easily calculate your returns.

Let’s say you are 45 years old.

Investment: Rs 10 lacs. Including GST, you will pay 10.18 lacs.

Option A.

Maturity: 5 years.

Since the premium is more than Rs 5 lacs, you fall in Band 6.

On completion of 5 years, you will get 134.9% of your investment amount i.e., 13.49 lacs. That’s an IRR of 6.17% p.a.

Had you opted for policy term of 10 years, you would have got 184.7% i.e., 18.47 lacs back. 6.33% p.a.

However, this is Option A. Your returns are taxable.

Let’s try the same combinations with Option B.

Investment: Rs 10 lacs. Including GST, you will pay 10.18 lacs.

Option B.

Maturity: 5 years.

You will get 126.55% back i.e., 12.65 lacs back on completion of 5 years. That’s an IRR of 4.82% p.a.

Change policy term to 10 years.

You will get 168.35% back or 16.83 lacs on completion of 10 years. IRR of 5.35% p.a.

With Option B, your returns are tax-free.

Your entry age will affect your returns

In non-participating plans (or even participating plans and ULIPs), the return depends on your entry age. Everything else being the same, a 35-year-old (at the time of entry) will earn better returns than a 45-year-old.

Why does this happen?

Just check out the GMB numbers for Option B. The GMB goes down with age.

For Option A, since the Sum Assured is only 1.25 to 1.77 times the Single Premium, your age does not affect the returns (that’s the way plan is structured).

However, for Option B, the Sum Assured is 10 times the Single premium. A bigger portion of the premium will go towards providing life insurance cover. And cost of life insurance is higher for older investors. Thus, you can see GMB values go down with entry age for Option B. And that ensures that lower returns for higher entry age.

For the examples considered (45-year-old).

Option A offered IRR of 6.17% p.a. and 6.33% for policy tenures of 5 and 10 years respectively. Taxable. The returns won’t change with entry age.

Option B offered IRR of 4.82% p.a. and 5.35% for policy tenures of 5 and 10 years respectively. Tax-free. For a 35-year-old, IRRs improve to 5.40% (5-year policy term) and 5.59% p.a.

An FD (or any pure investment product) offers the same return irrespective of age.

You must also see that Option A offers better returns than Option B

While this is evident from the illustrations, why does this happen?

Again, the cost of life insurance.

Since the Option A covers you for 1.25XSingle Premium, your investment incurs lower cost for life insurance.

Option B is at least 10X Single Premium. Higher insurance cost. Lower returns.

Hence, everything else being the same, Option A will offer better returns than Option B.

But maturity benefit from Option A is taxable. Exempt for Option B

Why?

Because the Sum Assured in Option A is only 1.25 to 1.77 times single premium.

As per income tax laws, the maturity proceeds from insurance plans are exempt from tax only if the Sum Assured (Life cover) is at least 10 times the annual premium.

For tax exempt returns, Sum Assured >= 10 times Annual (or Single premium).

Option A does not meet the condition. Only Option B does.

Option A: Higher but taxable returns. You will pay tax only on the returns (not on the principal). To be taxed at your marginal rate.

Option B: Lower but tax-free returns.

If you are planning to invest, check the post-tax returns.

We usually associate life insurance products with tax-free returns. If you are considering ABSL Fixed Maturity plan as an alternative to a bank fixed deposit because of tax-free returns, you will be disappointed with option A.

Premature exit is costly

Traditional plans (and non-participating plans are no different) have rigid exit requirements. While this plan allows you to surrender the plan after your investment, you will get a very small amount back.

For instance, in case of surrender, you will get the higher of the following two back.

- Guaranteed Surrender Value (GSV) = GSV factor X Single Premium Paid. The GSV factor matrix is not provided in the policy document or brochure. Guess I will have to buy the plan to figure this out.

- Special surrender value (SSV) = The maturity proceeds discounted at 30-year G-sec rate + 2%. The 30-year G-sec yield as on August 8, 2022, is 7.7% p.a. The maturity value will be discounted at 9.7% p.a. Now, this can be calculated.

For a 45-year-old, Option B returned 16.83 lacs after 10 years on investment of Rs 10.18 lacs (includes 18K GST).

If you surrender a few days later, you will get 16.83 lacs/ (1+9.77%) ^10 = Rs. 6.62 lacs back. You had invested 10.18 lacs.

With a bank fixed deposit, you will not have such a problem. Only a minor interest penalty.

What should you do?

ABSLI Fixed maturity gives the look-and-feel of a bank fixed deposit product.

Guaranteed returns (unless you think ABSLI can default).

Not very long maturity.

And I must say that the plan has a very simple structure. I have reviewed many non-participating plans earlier. While you can figure out what you will get with those plans too, those plans tend to have very complicated calculations. Just look at LIC Dhan Sanchay (Plan 865) that I reviewed recently. ABSLI Fixed Maturity plan is quite crisp. Maturity value is a simple percentage of your single premium. Just like a bank FD.

However, the product does not impress on the returns front. Option A has higher but taxable returns. Option B has tax-free but lower returns. Neither variant is good enough.

Moreover, the returns depend on your entry age, resulting in lower returns for older investors. Premature exit is expensive.

Suggest you give this product a pass.

If you find merit in this product, do consider the tax implications of Option A and Option B before choosing between the two. It is easy to ignore that returns from Option A will be taxable.