Not eligible or interested in setting up direct deposit with Chime? No problem. Here are three other ways to move money into Chime.

1. Make an instant transfer7

This option is available the first time you add money to your Chime Checking Account. All you have to do is link an external bank account, and add your debit card number, then you’ll be able to add at least $200–instantly.

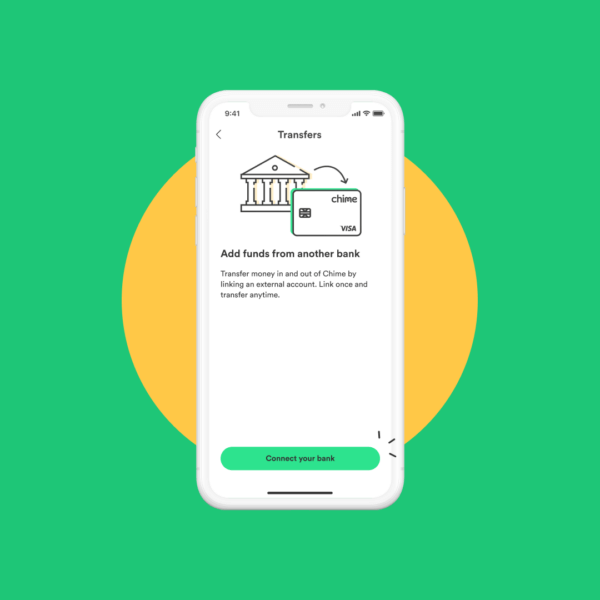

2. Transfer from a major bank

This option works if your account is at one of the following banks: Bank of America, Capital One 360, Charles Schwab, Chase, Citi, Fidelity, Navy Federal, PNC Bank, SunTrust, TD Bank, USAA, US Bank, or Wells Fargo.

Here’s how:

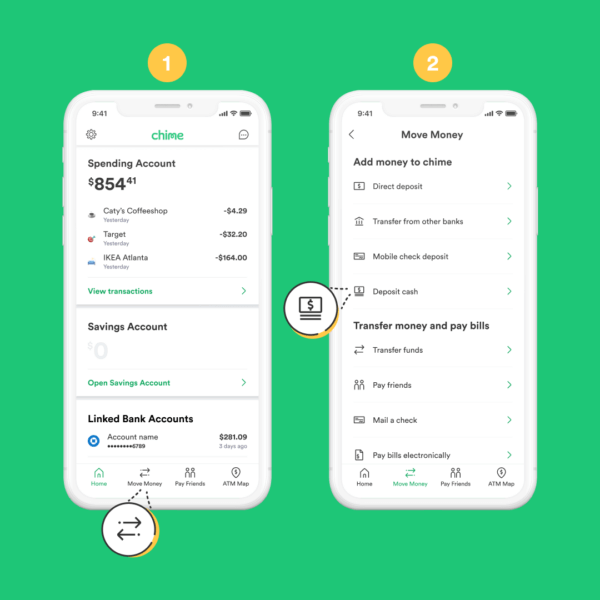

- Log into the Chime app and click “Move Money” —> “Transfers.”

- Enter the username and password for your other bank (don’t worry; it’s encrypted!).

- Transfer your money: up to $10,000 per day and $25,000 per month for most members. You’ll have access to the funds within five business days.

3. Transfer from another account

If you’re using a bank that’s not listed above, or you want to transfer a larger amount of money, worry not. You can also move money from your old bank.

Here’s how:

- Log into your old bank’s website or app.

- Look for a menu item that says something along the lines of “transfer funds” or “add external account.”

- When prompted, add your Chime Checking Account number and bank routing number (which you’ll find under Settings within the Chime app).

While the transfer time will depend on your old bank’s policies, you’ll usually see the money in your Chime Checking Account within a few business days.

4. Deposit cash⁸

Depositing cash into your Chime Checking Account is quick and easy. We’ve teamed up with WalgreensⓇ to bring you free cash deposits at any of 8,500+ locations. That’s more walk-in locations than you’d have using any bank in the US.

Cash deposits can also be made at more than 75,000 other retailer locations, including Walmart, CVS, and 7-Eleven stores.

Here’s how to deposit cash:

- Log into the Chime app and click “Move Money” → Deposit Cash

- The map will direct you to the nearest walk-in retail location.

- Hand your cash and Chime Visa® Debit Card to the cashier. You can deposit up to 3 per day $1,000.00 per load; $1,000.00 per day; $10,000.00 per calendar month (subject to any retailer imposed limits).

Wondering about wire transfers? While we don’t allow those yet, we hope to add them in the near future.