The pandemic precipitated a surge in contactless payments as most commerce shifted online and significantly accelerated the move to digital in the retail payments industry. More than 75% of Americans use some form of digital payment, with more than 50% of U.S. consumers shifting purchases online from brick-and-mortar stores since the onset of COVID-19, according to a recent McKinsey report.

The gap between what customers want and what financial institutions can offer with their legacy platforms is continuously widening. Customers — influenced by experiences they have at tech companies like Uber, Amazon and Google, as well as newer fintechs — are expecting their banks to replicate the same level of digital-first, personalized and “in-the-moment” experiences.

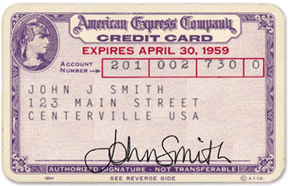

With regard to those omnipresent pieces of plastic — credit cards — what cardholders carry in their wallets today differs very little from the credit cards that were first created in the 1950s.

A card today looks and works fundamentally the same as it did 50 years ago at a time when almost everything else about our world has changed. What should be the next step in the evolution of these card experiences?

How can FIs address this gap?

We have identified five key themes which banks need to cater to deliver future-proof experiences across retail payments and cards:

- Now, not later;

- User-managed controls over customer servicing;

- Dynamic vs static security;

- Hyper-personalize for customer segments of ONE; and

- Present when and where needed.

Let’s dig into each of these in detail.

1. Now, not later

Today’s customers are used to experiences and offerings delivered in real time, which is no different in the case of retail payments and credit cards. Forty-four percent of people surveyed in the Deloitte Consumer Payments Survey 2021 strongly indicated that instant issuance would improve their payment experience. Similar to issuance, issuers need to make the payment process frictionless. This includes offering customers the option to push their cards to their preferred digital card wallets and merchants.

Financial institutions are not and were never limited by their imagination or their strong desire for offering immediate solutions to their customers. They have, however, been undermined for years by legacy technology platforms which hark back to the dawn of the internet era and were never designed for the immediacy of today’s customer expectations.

2. User-managed controls over customer servicing

As fraud rates continue to increase, customers want to be in control. More than 60% of Gen Y and Gen Z customers say that they are likely to use card controls. Over the last several years, issuers have addressed this expectation by offering controls such as ability to block transaction types and freeze cards — but these have become table stakes. Customers now expect even greater control and transparency over their cards and payment methods, including geolocation limits, individualized spending limits, time-of-day based controls, merchant category blocks as well as specific merchant-related limits.

Customers want the ability to control their cards as well as the ability to do it from their mobile devices. They no longer want to wait in call center queues to get their cards blocked/unblocked or set transaction limits. The value proposition speaks for itself. McKinsey found that the cost to serve customers (with 100 being a market average) is less than 40 for fintechs (which rely solely on digital support channels), around 55 for top-performing banks (which have well-defined digital support channels), and 100 for the average performing bank (with average or underdeveloped digital support channels).

3. Dynamic vs. static security

The current security features of a card are static and prone to fraud. All security features for a credit card today are static in nature, including the PIN (four to six digits long), a fixed card number, and a CVV code (three digits long) — all these features have a lower level of security than a typical customer’s Netflix account.

A sophisticated fraudster can easily overcome these security features and cardholders are understandably concerned: 77% of them highlight security as one of the most important things they look for when choosing how they’d want to pay in the future.

Issuers have an opportunity to get ahead of this trend and offer dynamic CVV, PIN and expiration dates that change every 30 seconds, making it difficult for anyone to access the data if their information is breached. Another innovation is to instantly issue unique and secure virtual cards that can be issued instantly for single uses to prevent the card number from getting exposed. And these are just the starting point — in aggregate, these features can help to fundamentally negate fraud.

4. Personalize for a segment of ONE

Customers are demanding greater personalization. According to EY, 81% of Gen Z customers think that more personalized service can help deepen their relationship with their issuer4. As a result, issuers need to consider how they can expand their ability to offer personalization across many variables, including form factor, merchant category, transaction amounts, demographics, location and more — offering unique experiences for each customer.

One such example is digital art. Issuers could offer customers the ability to customize their digital cards through digital art and micro-animations — adding additional layers of digital experience. Similarly, reward programs and fees can be curated to the needs and persona of a specific customer and create value propositions that are truly bespoke and delightful.

5. Present where and when needed

In times past, people went in search of water to lakes and rivers. That very water now flows into our homes when and where we need it. Banking, too, is undergoing similar transformation — while customers previously went to branches and physical locations to pay and to transact, they now want to be able to make payments, convert purchases to loans, receive offers — in contextually and temporally relevant ways.

The most sophisticated FIs recognize this and have invested in building not just their own digital channels but also work with distribution partners, i.e. fintechs, co-brands and providers that can distribute their card products as banking becomes more embedded. This allows them both to drive greater customer acquisition and also creates delight as customers experience a credit card or other financial product (e.g. a BNPL loan) in the context of a purchase, or a visit to a store, or at a time when they are actively engaged with a partner’s brand.

Where to next?

If banks can offer and build on these experiences, they can not only address the evolving customer expectations but also future proof their business against emerging digital competitors.

However, with the legacy platforms that financial institutions rely on today, achieving that is near impossible and makes it cumbersome to rapidly grapple with shifting market realities.

Addressing the next-gen needs of customers requires a next-gen platform. Card-processing platforms like Zeta are built ground-up with cloud-native, API-first and digital-first capabilities, and come pre-configured with rich customer experiences and the ability to hyper-personalize offerings, thus empowering issuers to truly shape a better future for their customers.

Bhavin Turakhia is co-founder and CEO of Zeta, a banking tech unicorn and prover of next-gen credit card processing.