The freefincal robo advisory tool is now available on Google Sheets. You can use it to plan from start to finish for retirement (early, normal, before and after), non-recurring financial goals (child education) and recurring financial goals (holidays, appliances etc.).

The tool would help anyone from ages 18 to 80 plan their retirement with a detailed cash flow summary, six other non-recurring financial goals, and four other recurring financial goals.

More than 1000 investors and financial advisors are using the tool. The tool was recently featured in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

All inputs are fully customisable. It can be used for commercial use as well. Users will get all future updates as well.

Presentation: The tool is available

- as an Excel file with macros. It will work on Mac Excel and Windows Excel.

- on Google Sheets with scripts (a replacement for Excel macros)

This is a screenshot of the Google Sheets editions. The screenshots and video guides below for the Excel edition also apply to the Google Sheets Edition.

There are nine Sheets with the following steps. A detailed video guide is available.

Video Guide

Click to play

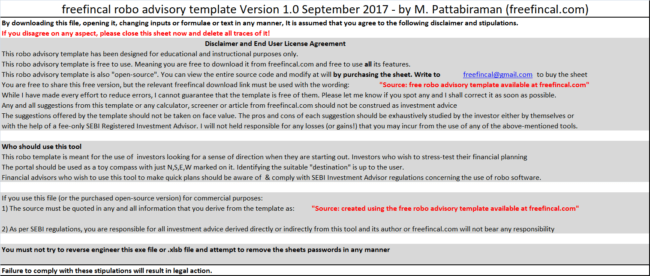

Robo Advisory Software: Read me First

This is the end-user license agreement. The user will have to agree to this upon first use.

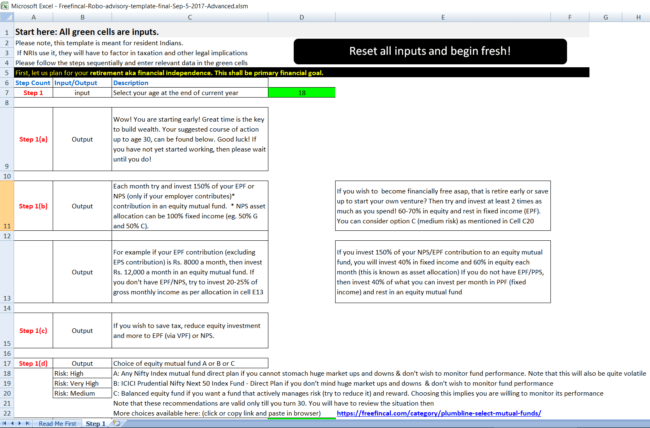

Step 1: Age of the user

A simple solution is provided for ages 18 to 25 without further input. Older users will be asked if they are married or not and directed to the next sheet.

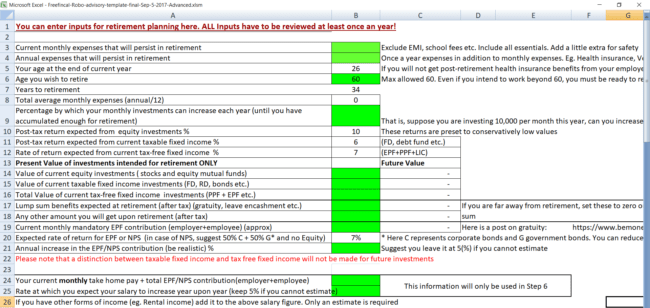

Step 2 Retirement Inputs

You can enter details relevant to creating your retirement plan here

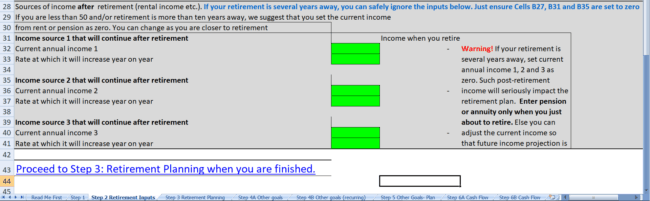

You can include up to three post-retirement income streams

You can include up to three post-retirement income streams

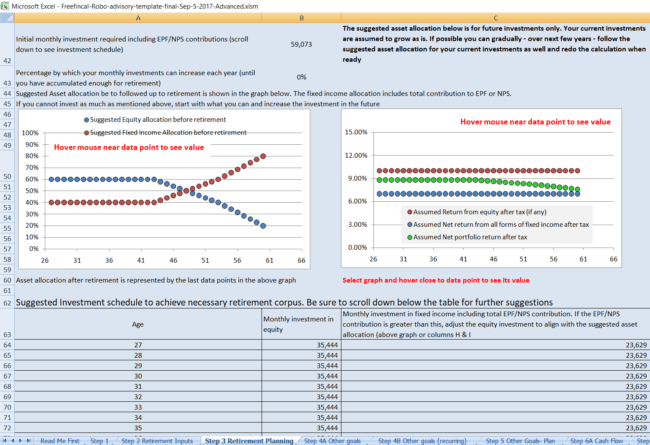

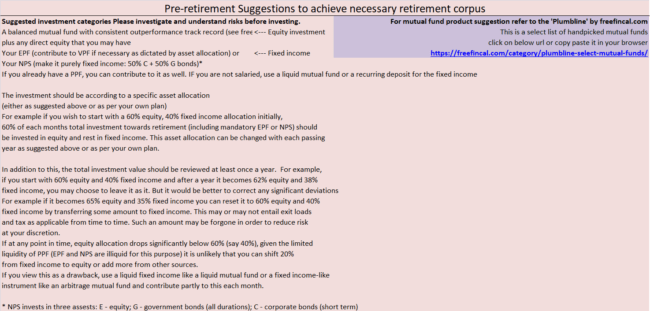

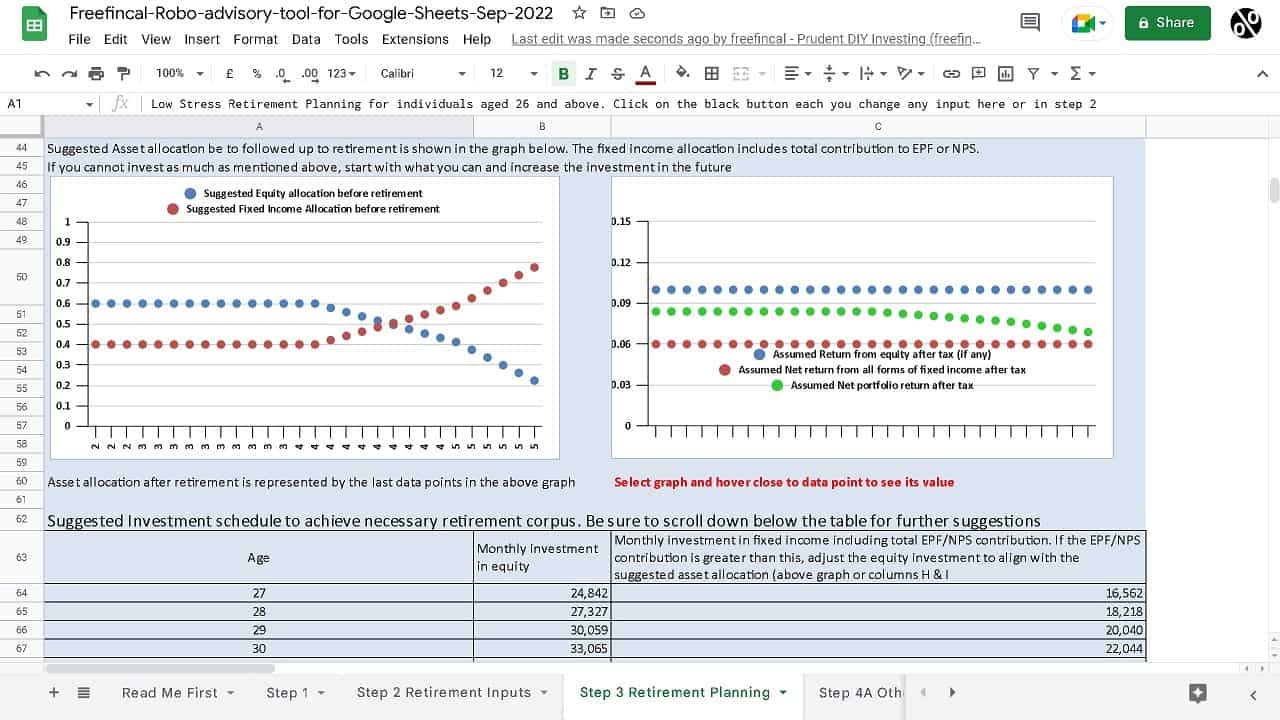

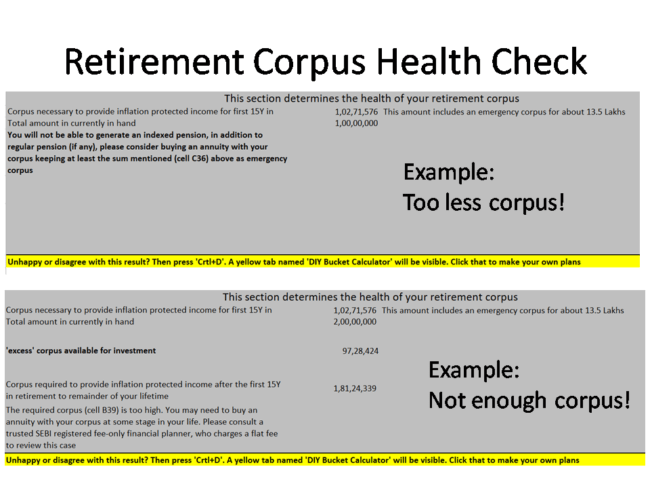

Step 3 Retirement Planning

This sheet tells you the investment strategy to be adopted before retirement (and up to retirement) with clear asset allocation break-up and investment portfolio management suggestions.

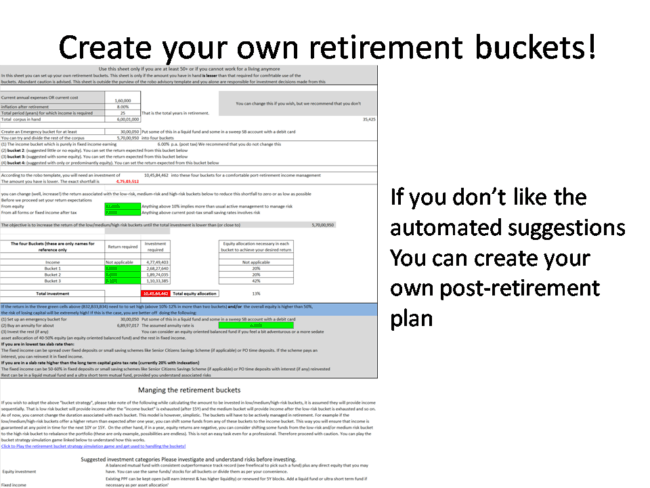

If you are retired, you can obtain an opinion about the health of your retirement corpus.

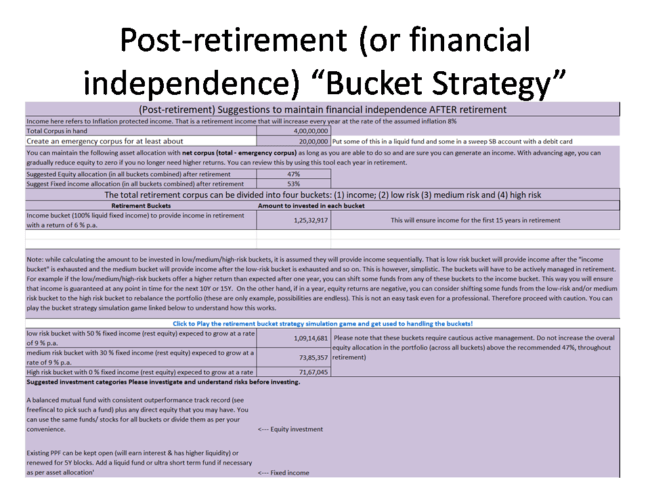

and a detailed retirement bucket investment strategy in case the corpus is good enough.

and a detailed retirement bucket investment strategy in case the corpus is good enough.

You can play this simulation game to understand how the bucket strategy works: The Retirement Bucket Strategy Simulator

You can play this simulation game to understand how the bucket strategy works: The Retirement Bucket Strategy Simulator

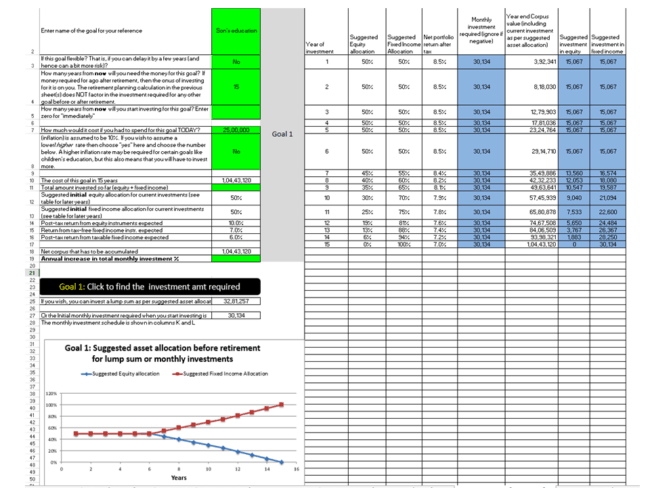

Step Four A: Non-recurring Goals

You can get a complete investment strategy for one-time goals like your children’s education, a business etc.

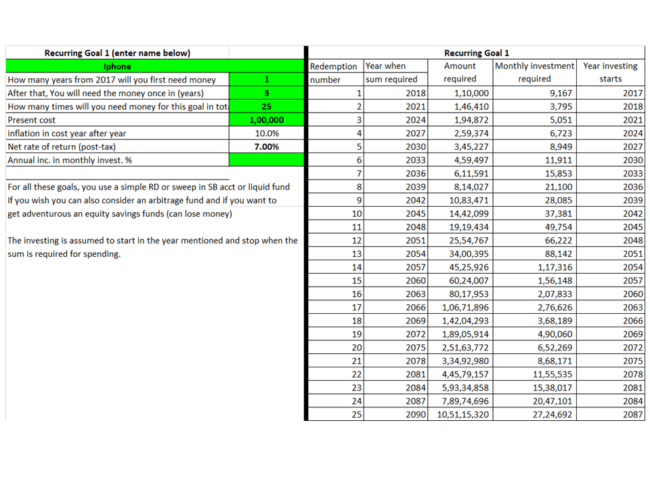

Step Four B: Recurring Goals

You can also plan for recurring goals like a holiday every other year, or a new car or iPhone every few years.

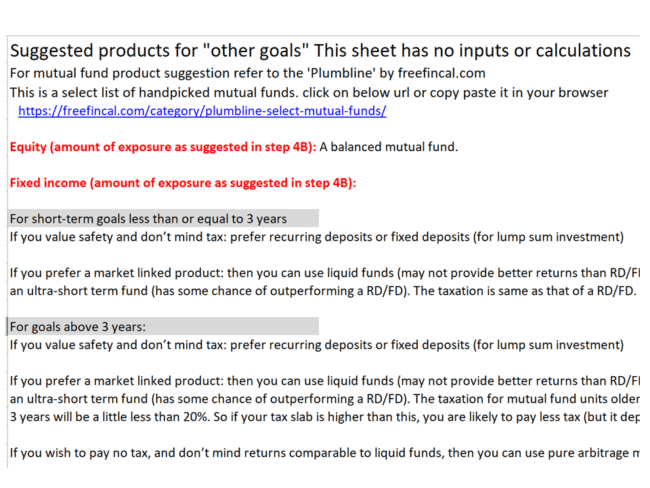

Step 5: Suggested Product Categories + “PlumbLine”

Investment suggestions for financial goals are listed here. In addition, PlumbLine offers a set of mutual funds to invest.

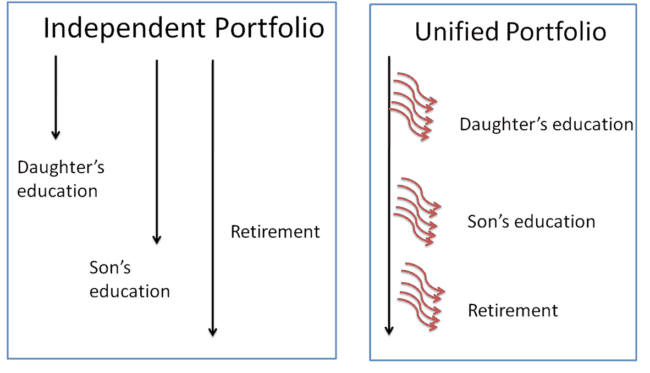

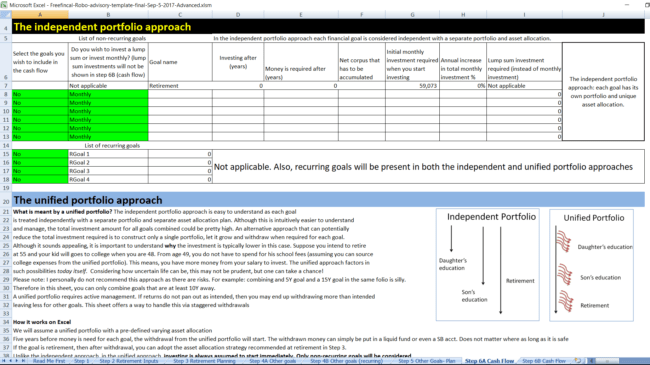

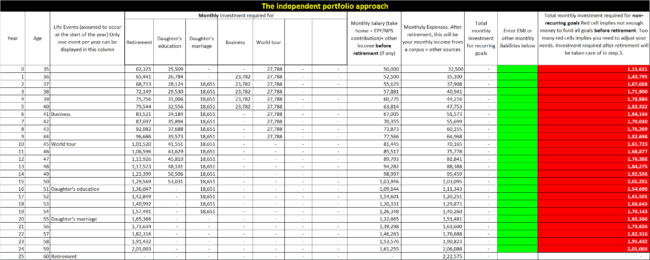

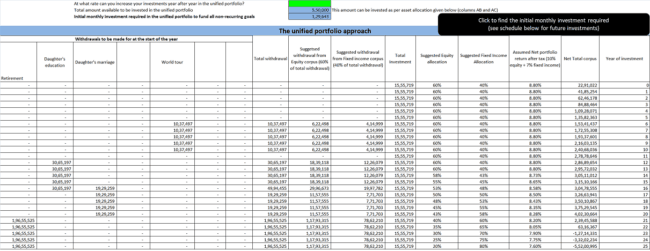

Step 6A: Independent portfolio vs Unified portfolio

The cash flow for two different portfolio models is available. You can see the video for more details.

This is a screenshot of step 6A.

Step 6B: Cash Flow

Independent portfolio

Unified portfolio

Video Guide

How to use the Robo Advisory Tool to check if you are ready to retire

Get the Robo Advisory Tool

All inputs are fully customisable. It can be used for commercial purposes as well. As of May 2022, 1000+ investors and financial advisors are using the tool. Users will get all future updates as well.

Google Sheets Edition (with scripts): Get the robo tool by paying Rs. 5160 (Google Sheets edition; Instant Download. No refunds allowed). One-time purchase.

Excel Edition (with macros): It will work on Mac Excel and Windows Excel.

Get the robo tool by paying Rs. 5160 (Excel edition; Instant Download. No refunds allowed). For support, write to freefincal [AT] Gmail [DOT] com. Please download the file and open it via Excel. One-time purchase.

Outside India? Then use this Paypal link to pay USD 80 (Kindly write to freefincal [AT] Gmail [DOT] com after you pay).

Beta Testing Team: The robo tool was tested and enhanced by a team of friends and readers for over a month: Anirban Ghosh, Anish Mohan, Dashrath Memane, Guru Rudagi, Lokesh Shah, Mahesh Bangadkar, Muthu Krishnan V, Niranjan Kaushik, Prajal Sutaria, @Prashanth_Krish (Twitter handle follow him!!), Srinivasan SR, Sajo C Mathew, Prof. Shriram R, Srinivasan Sundararajan, Sumit Nisal, Vignesh Baskar, Balaji Swaminathan, Amarnath Reddy. I am indebted to their time, effort, consideration and dedication. Without their help, this release would not be possible.

Do share this article with your friends using the buttons below.