My views on inflation continue to evolve: I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s I remained appropriately skeptical about rising prices. The price dynamic during and after the pandemic appeared to be troublesome but my expectations were that inflation would be resolved relatively quickly as supply chains reopened and life returned to normal. “Transitory” turned out to be too optimistic, and I was wrong in my expectations for a faster decline in delta of prices.

I was also wrong about “Greedflation.” That error is the focus of today’s post.

For lack of a better phrase, greedflation occurs when companies take advantage of confusion and price volatility to drive through price increases. These are not due to higher input costs but are the result of specific tactics used to create higher profit margins.

Perhaps this explains in part why corporate profits have held up as well as they have despite higher interest rates and increased wages.

When I put together my list of what was to blame for inflation, corporate profit-seeking was number (13 of 15). Subsequent updates (here, here, and here) have led me to “wonder how much I underestimated greedflation.” That was June; we accumulated more data since. It strongly suggests that the capital side of the ledger has been a more substantial driver of price increases than previously believed.

If I were building that list from scratch today, Greedflation would certainly be in the top 10 and likely in the top 5.

When the Economic Policy Institute analyzed this, they discovered:

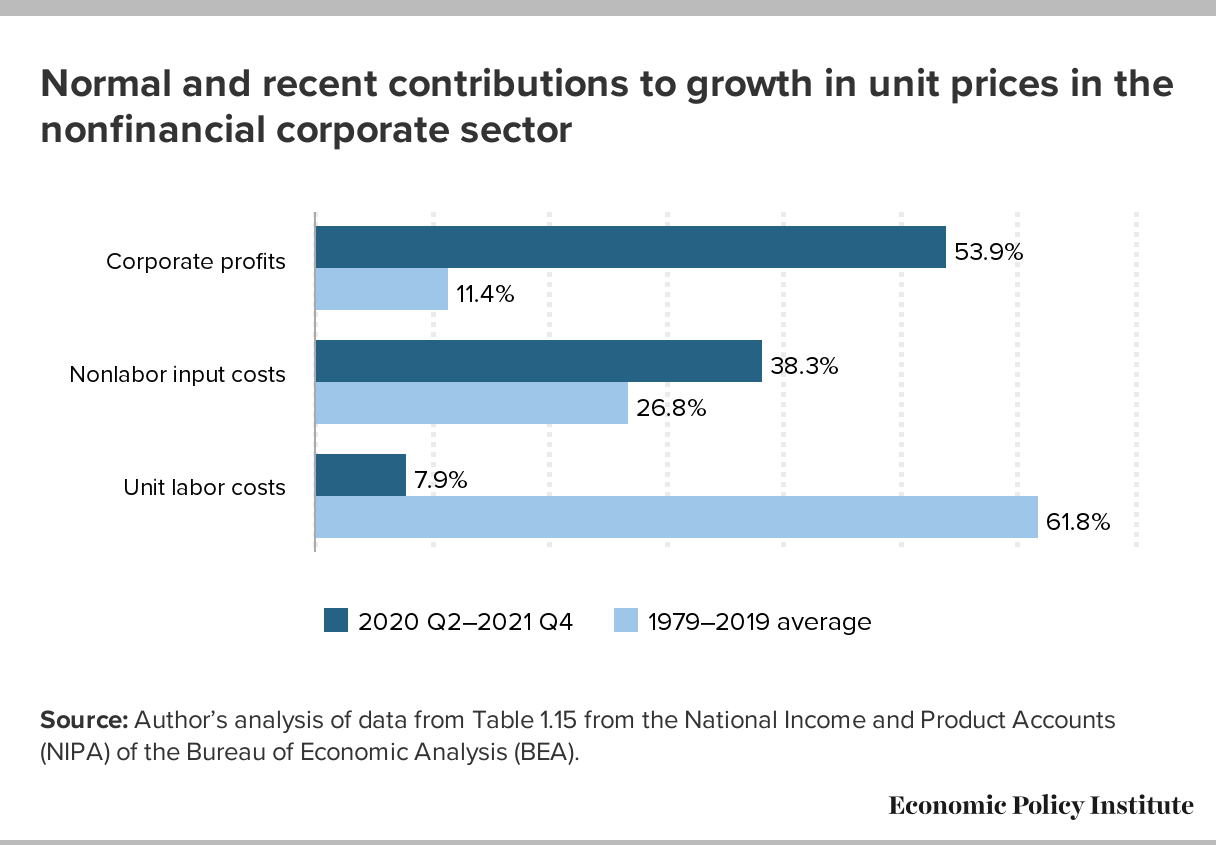

“Since the trough of the COVID-19 recession in the second quarter of 2020, overall prices in the NFC [non-financial corps] sector have risen at an annualized rate of 6.1%—a pronounced acceleration over the 1.8% price growth that characterized the pre-pandemic business cycle of 2007–2019. Strikingly, over half of this increase (53.9%) can be attributed to fatter profit margins, with labor costs contributing less than 8% of this increase.”

Labor and Capital have swapped roles in 2020-era inflation: Over the 4 decades preceding the pandemic (1979 to 2019), profits contributed 11% to price growth while labor costs added more than half – about 60%. Today, profits are responsible for more than half of price increases.

If corporate profit margins are indeed a driver of much of inflation, it raises even greater questions about the current FOMC policy. Generally speaking, high-profit margins are not a sign of an economy that is overheating. Rather, it reflects management behaving opportunistically given the circumstances (that is their job). I have argued prior (here, here, here, and here) that inflation has already peaked, but regardless, it is not the sort of increased prices that are especially susceptible to increased FOMC rates as the cure; Fed Chair Jerome Powell seems to on a path to kill inflation by crushing demand via a Fed-created recession.

But the latest data calls this approach into question. If 1) Corporate profits are indeed the key driver of inflation, and; 2) Federal Reserve policy is unlikely to impact that source of inflation then it raises issues. Further, raising the cost of credit and capital does not incentivize companies to lower their profit margins; it likely has the opposite effect.

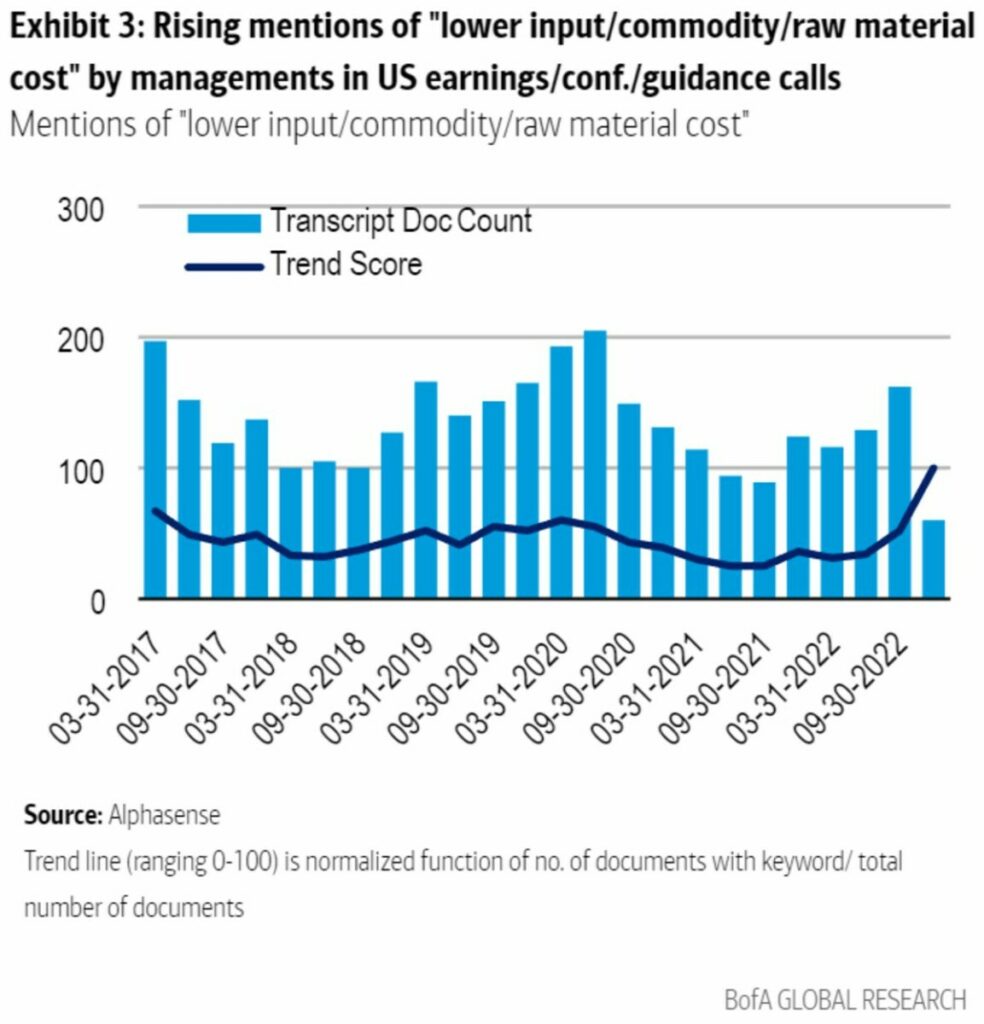

There is some good news: First, we have known for months that commodity and raw materials prices were coming down; as Bloomberg’s John Authers referenced today, we now see evidence of that in quarterly corporate conference calls as well:

And second, as Judd Legum pointed out today, Lael Brainard, the vice chair of the Federal Reserve, acknowledged last month that the “return of retail margins to more normal levels could meaningfully help reduce inflationary pressures in some consumer goods.”

Traditional economic consensus used to be inflation occurred when too many dollars chased too few goods. That was when the world had powerful labor unions, limited globalization, and nascent technological innovations. That world no longer exists.

Unless the Fed figures this out soon, they are going to do real damage to the U.S. economy.

See also:

Corporate profits have contributed disproportionately to inflation. (Economic Policy Institute, April 21, 2022)

Fed should make clear that rising profit margins are spurring inflation (FT, November 2, 2022)

The truth about inflation (Popular Information, November 7, 2022)

Reasons Are Adding Up for Optimism on Inflation (Bloomberg, November 7, 2022)

Restoring Price Stability in an Uncertain Economic Environment (Vice Chair Lael Brainard, Federal Reserve, October 10, 2022)

The Private Equity Guys Trying to Shoplift a Supermarket Chain Before They Sell It (Slate, November 4, 2022)

Previously:

Behind the Curve, Part V (November 3, 2022)

When Your Only Tool is a Hammer (November 1, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Has Inflation Peaked? (May 26, 2022)

Normalization vs Inflation (March 14, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)