Jump to winners | Jump to methodology

More brokerages growing, working faster

Sponsored by: Australia’s fastest-growing mortgage brokerages are important because they reflect how the industry is constantly moving forward.

Australia’s fastest-growing mortgage brokerages are important because they reflect how the industry is constantly moving forward.

Australian Broker’s Fast Brokerages 2022 report recognises the best of those that stand out for their growth in combined revenue and settlement volume.

Some have even used the recent tough times to their advantage.

“We understand our customers’ needs are always changing”

Andrew Soo, GM Capital Solutions

“Australia’s economic climate and the impacts of the pandemic have certainly propelled many brokerages forward in a manner unlike any in history,” says Peter White, managing director of the FBAA.

A strong entrepreneurial base, tech advances and the growth of the broker channel all underpin their success.

“We understand our customers’ needs are always changing,” says Andrew Soo, director at GM Capital Solutions, one of the winners.

“Mortgage broking is only getting tougher, and it’s important to stick with your clients to see things through during the most difficult times.”

Start-ups

More than a dozen of the 52 brokerages on the 2022 list were set up during the pandemic, a testament to entrepreneurial spirit and Australia’s relatively strong economic conditions.

One such example is Marquee Group, based in North Melbourne and launched in July 2020.

“Despite commencing the business during the COVID-19 pandemic, we have successfully facilitated over 300 loans and achieved sustained year-on-year growth with absolutely no marketing,” says director Jonathan De Sensi.

According to research by IBISWorld, there was a 9.2% increase in the number of brokerages nationwide to 11,387 since 2021. In addition, MFAA figures show that the average value of loans settled per broker for the six months to March 2022 was the highest observed to date at $9.5m. Several fast-growing brokerages have specialised in particular areas of the market to accelerate their businesses.

Protego Finance started in mid-2020 with a primary focus on working with first-time buyers building new homes in the northern suburbs of Adelaide.

“Over our two-year journey we have had so far, we have grown from having a single land agent as a referral partner to now having connections with four major land sales companies and 10 building consultants constantly referring clients to us,” says director Ben Gregory.

Mortgage Domayne, another 2022 Fast Brokerage winner, has ambitions to become the leading construction brokerage Australia-wide. This fiscal year, it aims to achieve $800m in settlements with just 16 brokers.

“We identified a gap in the market to have an internal conveyancing arm specialising in the land settlement process,” explains director Mark Polatkesen.

“External conveyancers don’t always understand this specialised process, and after experiencing inconsistencies in the services businesses were offering, we created our own in-house team. This decision has paid off, generating about 40 new files a month.”

He adds, “Our major projects and innovations for the balance of FY22 include building savings plan automation as well as automated communication with our client.”

“We’ve seen huge growth in the last two years, mostly through organic referrals from clients that we have helped”

Alissa Childs, Two Birds One Loan

More share, more product lines

According to the MFAA’s Industry Intelligence Service 14th Edition report, mortgage brokers’ share of the market was a record 69.5% of all residential home loans facilitated in the October 2021 to March 2022 quarter.

“We’ve seen huge growth in the last two years, mostly through organic referrals from clients that we have helped,” says co-founder Alissa Childs of Fast Brokerage Two Birds One Loan.

Childs opened the boutique brokerage in 2018 with Eloise Dooley and recently took on two new staff members to assist with managing the volume.

“We have not done anything too differently; we are just finding that by providing exceptional customer service, we have a huge following of supporters who continue to sing our praises, which generates a significant volume of new enquiries,” adds Childs.

As residential lending peaked and then started to drop in mid-2022 along with an easing of house prices, there has been an ongoing move among broker businesses towards diversifying product lines away from a sole reliance on residential to offering a more diversified, holistic suite of financial products and services.

“We’re seeing many brokers achieve great results when diversification is part of their overall growth strategy, and we expect this to continue in 2023,” says John Mohnacheff, group sales manager at non-bank Liberty.

This is reflected in how Fast Brokerages are structuring their businesses.

Sydney-based Atelier Wealth, for example, plans to add commercial and asset finance as part of its future offering.

“We’re building capabilities and upskilling ourselves to slowly move into this space,” says co-owner Aaron Christie-David.

“As we mature from being ‘mortgage brokers’ to offering more finance options, we are excited to see how this builds more engagement with our clients.”

Investing in people has also underpinned growth.

“Our growth reflects our investment in building our team.”

“As we mature from being ‘mortgage brokers’ to offering more finance options, we are excited to see how [adding commercial and asset finance lines] builds more engagement with our clients”

Aaron Christie-David, Atelier Wealth

Tech to the rescue

There is certainly no respite with an ever-shifting regulatory environment and the advent of best interest duty reforms.

Luckily for brokers, online tools to cope with processing paperwork remotely are helping.

“The move to be more paperless with e-signatures, e-verification/digital ID, bank statements and platforms like Quickli is enhancing our proposition,” says Christie-David.

“Clients have a more seamless digital experience, and it also reduces the need for manual checks.”

According to Equifax’s 2022 Mortgage Broker Industry Pulse Check, the three biggest broker time wasters are slow lead generation, lengthy application lodgements, verifying an applicant’s employment income information and assessing for fraud.

For brokers who haven’t yet embraced tech, there is a significant time and revenue drain.

“Technology is the driver of the future to expedite settlements, and I think I see lots of brokers in the marketplace sort of halfway there but not all the way there. Sometimes it’s a hybrid of an aggregator’s automated system,” explains White. “I think the way they communicate through technology needs to be more personalised.”

One Fast Brokerage following this lead is Oxygen Home Loans with its automatic referral system that helps customers find a finance broker. Oxygen Home Loans built a full interface into the McGrath Real Estate CRM solution in 2021, involving a free SMS web app. Customers were having to proactively ask real estate agents for broker introductions, which did not work well due to the focus of the agent being on selling the property rather than arranging finance.

“[The system] provides valuable listing and property management leads as well as customer insights to real estate agents, in addition to mortgage opportunities to Oxygen Home Loans,” says managing director Ben Taylor.

Plans to diversify lines, the adoption of tools to increase productivity, and a renewed focus on customers’ changing needs show the mortgage broking industry is maturing.

“I feel we’re evolving from glorifying settlement volume to building professional brokerages,” says Christie-David.

From the Sponsor

Liberty is proud to sponsor Australian Broker’s Fast Brokerages 2022 special report.

Brokers have been at the heart of Liberty’s success from day one. As a fast-growing, pioneering non-bank founded in 1997 to help more people get financial help, brokers have always been integral to our product delivery to customers. We understand the needs of brokers and the work that goes into building a business. That’s why our products are customised to suit the needs of more customers, to help brokers diversify and build their businesses.

On behalf of Liberty, I congratulate the free-thinking fast brokerages recognised in this report, which reflects headcount and revenue growth over the 2021/22 financial year.

The past 12 months have been particularly challenging for the broking industry, and to hear the tales of brokerages that have not only survived, but thrived, during this period shines a light on the future of the mortgage landscape.

We are proud to offer innovative solutions at competitive prices to provide brokers and customers with greater choice. Over the past 25 years, our free-thinking approach to loan solutions has seen more than 700,000 customers get financial assistance across a wide range of home, car, personal and business loans, as well as SMSF lending and insurance products.

We will continue to support and champion the broker channel as they assist more customers in securing the financing they need to realise their dreams.

John Mohnacheff

John Mohnacheff

Group Manager – Sales,

Liberty

- 10X Home Lending

- Absolut Financial

- Aqua Financial Services

- Astute Norwood

- Atelier Wealth

- Ausun Finance

- Blackbird Mortgage Solutions

- Blue Crane Capital

- Build Invest Grow

- Capital for Castles

- Chatham House Financial

- CoastFin

- Dealer Finance Group

- eChoice Finance

- Entourage Finance

- Evan Phaedonos

- Everlend

- Finspo

- GM Capital Solutions

- Go Mortgage

- Innovative Home Loans

- JT Home Loans

- Lend Perspective

- Lendary

- Loan Market – Abbas Khorakiwala and Priyank Dubey

- Loan Market – Deven Patel

- Loan Market – Hannah Chen

- Loan Market – Lana Moy and Greg Wunder

- Loan Market – Toby Edmunds & Associates

- Loan Market Direct

- Loan Market Double Bay

- Loan Market Horizon

- Loan Market Newcastle CBD

- Loan Market Norwood

- Loans Australia

- Marquee Group

- Masters Broker Group

- MoneyQuest Balwyn

- Mortgage Advice Bureau Sydney

- Mortgage Domayne

- My Mortgage Freedom

- Oxygen Home Loans

- Property Before Prada

- Protego Finance

- Reliance Smart Finance

- Savvy Finance Group

- Seed Finance

- Significant Financial Solutions

- Soren Financial

- Stamford Capital Australia

- Two Birds One Loan

- Wealthful

Fast Starters 2022

- 10X Home Lending

- Capital for Castles

- Everlend

- Finspo

- Go Mortgage

- Lendary

- Loan Market – Abbas Khorakiwala and Priyank Dubey

- Loan Market – Hannah Chen

- Loan Market – Lana Moy and Greg Wunder

- Loan Market Direct

- Loan Market Horizon

- Marquee Group

- Mortgage Advice Bureau Sydney

- Protego Finance

- Reliance Smart Finance

- Soren Financial

Australian Broker invited submissions for its second annual Fast Brokerages awards on 25 July 2022 as the publication sought to recognise Australia’s fastest-growing mortgage brokerages.

The research team asked brokerages to list their revenue totals and settlement volumes for the 2020/21 and 2021/22 financial years, in addition to other growth milestones they wanted to highlight. They then evaluated the nominations received to determine which brokerages experienced standout growth.

The 2022 Fast Brokerages awards are given to brokerages that achieved more than 30% growth in combined revenue and settlement volume.

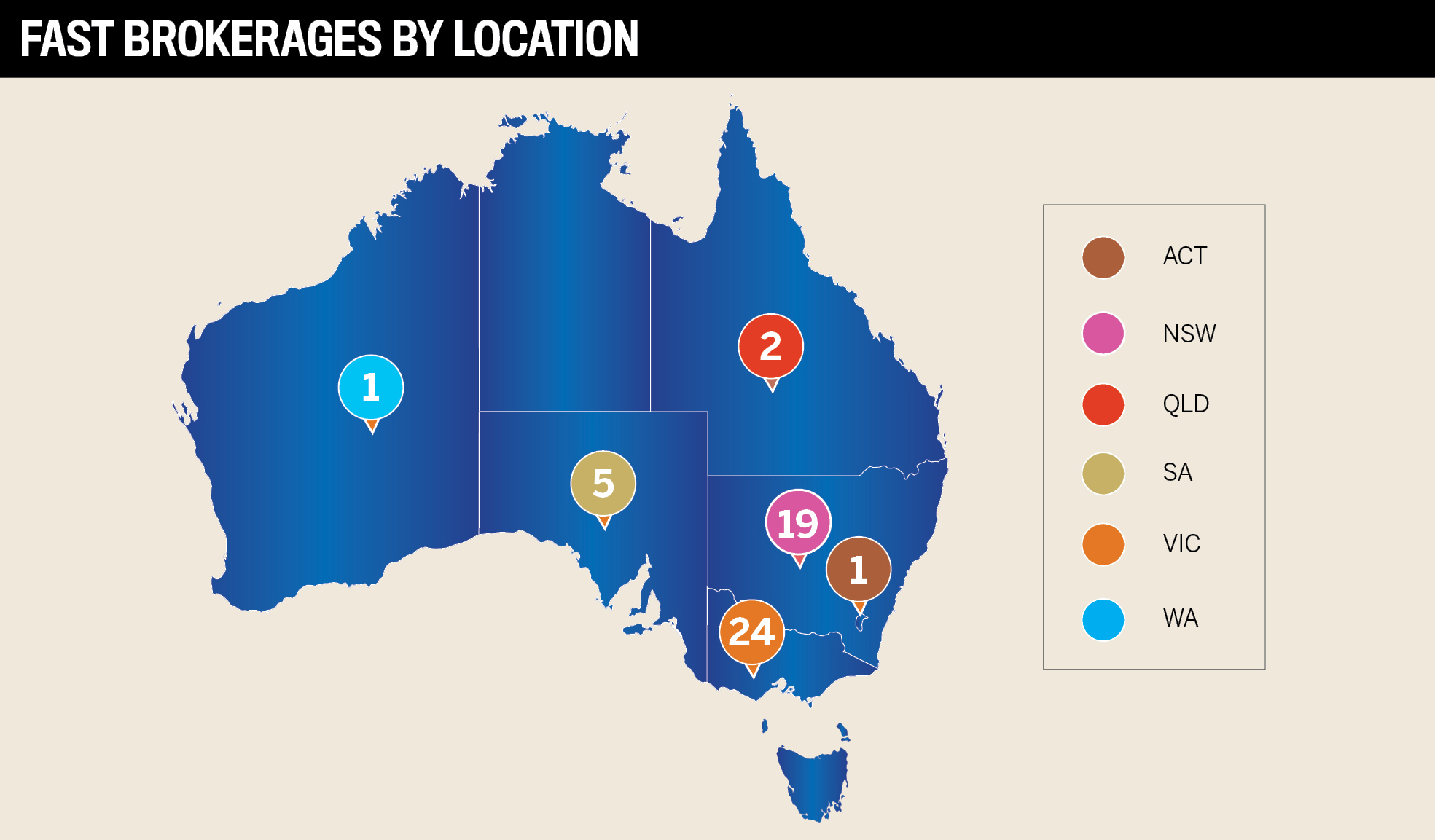

A total of 52 brokerages made the final list of Fast Brokerages this year. Australian Broker also highlights 16 brokerages as Fast Starters that have been in business for three years or less, making their mark on the mortgage landscape. These brokerages confirmed their resilience and cemented their strong positions in the Australian mortgage industry.

This special report is proudly sponsored by Liberty.