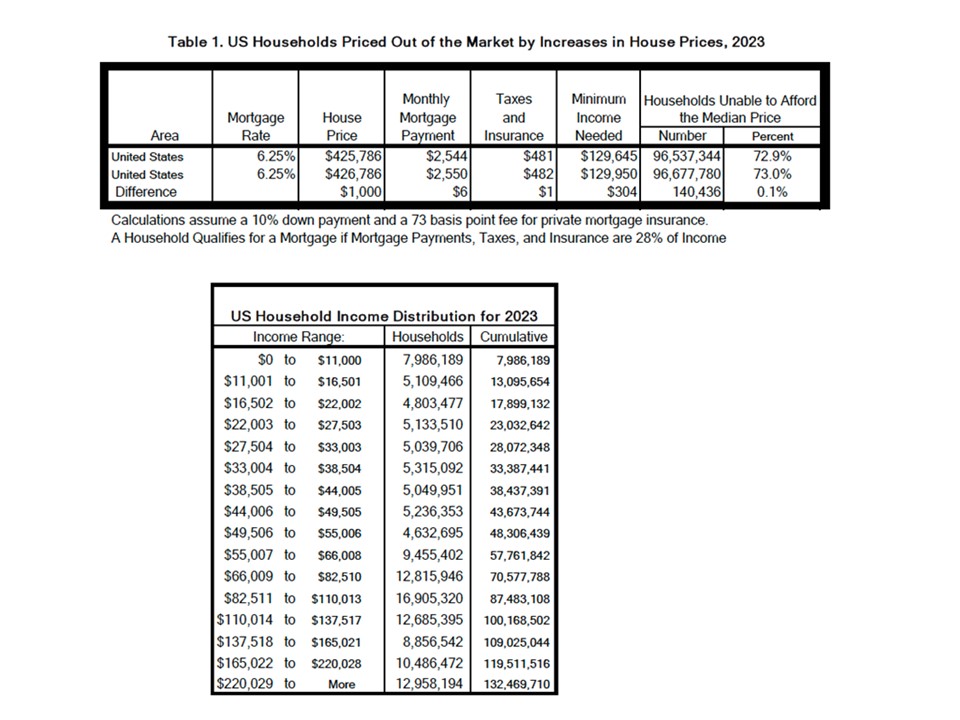

NAHB recently released its 2023 priced out estimates, showing how higher prices and interest rates affect housing affordability. The new estimates show that 96.5 million households are already not able to afford a median priced new home in 2023 due to the fact that their incomes are insufficient to qualify for the required mortgage under standard underwriting criteria. If the median new home price goes up by $1,000, an additional 140,436 households would be priced out of the market. These 140,436 households would qualify for the mortgage before the price increase, but not afterward.

The underwriting criterion used to determine affordability is that the sum of mortgage payments, property taxes, homeowners and private mortgage insurance premiums (PITI) during the first year is no more than 28 percent of the household’s income. Key assumptions include a 10% down payment, a 30-year fixed rate mortgage at an interest rate of 3.5%, and an annual premium starting at 73 basis points for private mortgage insurance.

As usual, NAHB’s latest update includes priced out estimates for all states and metropolitan areas. The priced out numbers vary with both the sizes of the local population and the affordability of its new homes. Among all the states, Florida registered the largest number of households priced out of the market by a $1,000 increase in the median-priced home in the state (9,573), followed by Texas (9,151), and California (7,243), largely because these three states are the top three populous states.

The metropolitan area (or metro division) with the largest priced out effect, in terms of absolute numbers, is Houston-The Woodlands-Sugar Land, TX, where 3,054 households will be disqualified for a new median-priced home if price goes up by $1,000. The Atlanta-Sandy Springs-Alpharetta, GA metro area registers the second largest number of priced-out households (2,626), followed by Chicago-Naperville-Evanston, IL metro division (2,467) and New York-Jersey City-White Plains, NY-NJ metro division (2,065).

These differing impacts of adding $1,000 to a new home price are largely due to different sizes of metro population and the affordability of new homes in each area. The largest priced-out effect is in the Houston, TX metro area, where 2.1 million households are unable to afford the median-priced new home initially, and a $1,000 increase prices out an additional 3,054. The large impact in the NY-NJ metro division is because their contains the largest population size among all metro areas.

More details, including priced out estimates for every state and over 300 metropolitan areas, and a description of the underlying methodology, are available in the full study.

Related