#2 scares me a bit as it sounds like what ADES did, but PFSW already distributed most of their cash to shareholders in a special dividend last year, they don’t have a huge cash balance burning a hole in their pocket.

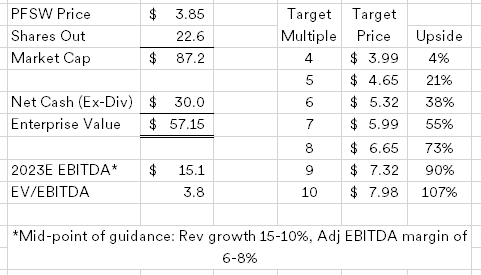

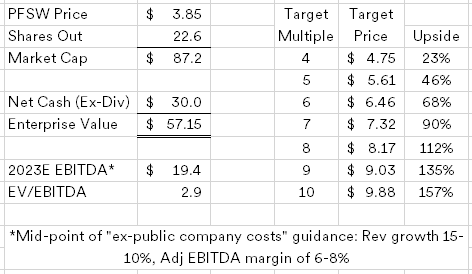

Providing 3PL services to the retail industry, you’d expect PFSW to be in the midst of a covid hangover similar to UPS/FDX or Amazon, but the company has continued to grow on top of their covid gains and are similarly guiding to 5-10% revenue growth and 6-8% standalone EBITDA margin in 2023 (on their recent conference call, 2023 is off to an “very strong start” and later a “phenomenal start”). They also provide their estimate of public company costs of 2% of revenue that could be eliminated by either a strategic acquirer or if the company was taken private. Following the 2021 asset sale and special dividend, PFSW has a clean balance sheet with $30MM in net cash.

The above is using the standalone EBITDA guidance (full corporate overhead), if we use the ex-public company cost guidance it naturally looks even cheaper.

A popular 3PL is GXO, a recent spin of XPO Logistics, GXO is a much larger, more scaled and diversified business, but it trades at 13x 2023 EBITDA guidance levels, well above PFSW that is under 4x EBITDA.

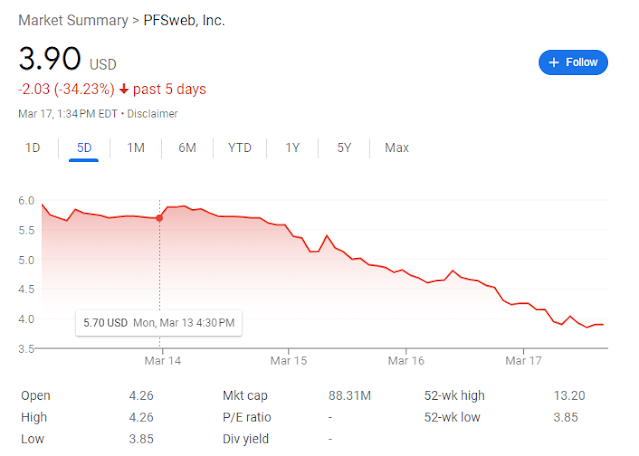

PFSW reported earnings on the 14th, its down about 30% since then despite no negative news coming out of the earnings report or the conference call. My guess is either someone is getting liquidated, this is a relatively illiquid stock, or the revenue guidance is getting picked up by data aggregators as a significant decrease. PFSW had a quirky contract where their GAAP revenue was distorted higher, but that ran off last year, their GAAP revenue will now match their previously reported “service fee revenue”.

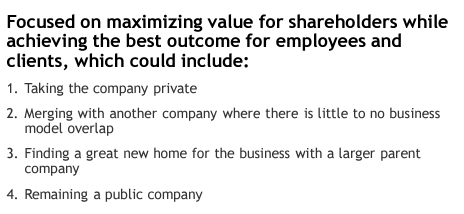

The sale process has dragged on longer than anticipated, they wanted to dress up the company for sale and by the time the makeover was done, the markets have changed just a bit. There should buyers for this business, dozens of private 3PL providers would make strategic sense and plenty of middle market PE shops that could also be interested.

Disclosure: I own shares of PFSW and calls