Originally written for Livewire

I have to admit to a touch of schadenfreude watching the demise of Silicon Valley Bank (SVB) on Twitter this week. All of those Silicon Valley free-marketeers screaming at the government to rescue them? Caps lock permanently on and all.

Silicon Valley Bank $SIVB reports earnings tomorrow

Investors have rightfully been fixated on $SIVB‘s large exposure to the stressed venture world, with the stock down a lot.

However, dig just a little deeper, and you will find a much bigger set of problems at $SIVB… 1/10

— Raging Capital Ventures (@RagingVentures) January 18, 2023

They are right, though.

Moral hazard is a serious problem in the modern economy. Bailouts and rescues are becoming ubiquitous. Not only does that create a system of heads private investors win, tails the taxpayer loses, it derails creative destruction. Dumb ideas need to fail. Poorly deployed capital needs to be redeployed to businesses and managers that have the good ideas.

That’s how you get productivity growth in the economy. The fact that we don’t let anyone go bust these days has been a significant contributor to productivity growth declining relentlessly for the past 20 years.

For all that, no bank depositor should ever lose their money in a developed-world economy. It’s absurd to think every single small and medium sized business should be running around analysing bank balance sheets to determine the credit worthiness of their deposits. If you deposit your money in a regulated, licenced, developed-world bank, you have every right to expect that your money will be there as and when you need it.

Regulated and capitalised

Before we get onto the solutions, it is worth noting that plenty of investors ARE losing money here. SVB was listed on the stock exchange. Its $11bn of equity has been wiped out (the market capitalisation was $43bn at the peak). Unsecured lenders to the bank are in for a haircut too. And the taxpayer is unlikely to lose much, if anything. There are far worse examples of moral hazard if you want to find them.

But it was an abject regulatory failure. Take a moment to read this Tweet thread from Bill Martin (@RagingVentures on Twitter), a hedge fund manager. In 10 tweets, using nothing but the latest publicly available balance sheet, Martin highlighted the most fundamental liquidity mismatch you could conjure up. How can a regulated bank invest almost all its at-call deposits in assets with a duration greater than ten years? How can a regulator let them do that? The simplest, most basic liquidity rules should stop a regulated bank from taking such a stupid risk.

Monetary manipulation the root of many problems

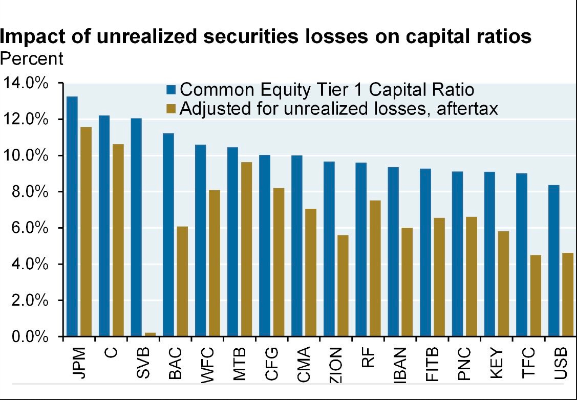

My best guess is that this won’t be a widespread issue in the banking sector. Not many bank treasurers are that stupid. For most banks, including the larger regionals in the US, valuing their assets at current interest rates will not significantly impact their capital position. As you can see in the chart below, for SVB, revaluing its balance sheet to market values wiped out all its Tier 1 capital.

Impact of unrealized securities losses on capital ratios. Source:JPMAM

It is emblematic, though, of the stupidity that can happen when interest rates are manipulated to zero. From commercial property to unlisted infrastructure assets to Australia’s housing market, trying to rescue an economy through ultra-low rates has consequences that are now becoming obvious to everyone.

Monetary policy is a very blunt, often ineffective tool with wide-ranging unintended repercussions. Yet it has become the primary tool relied upon in times of crisis, despite fiscal policy (government spending) being a far more effective method of targeted stimulation.

Central Bank governors should not be on the homepage of the Daily Mail. The role that positive real interest rates play in efficient capital allocation should be given more weight. And encouraging people to overextend themselves at artificially low rates can cause financial crises.

The collapse of a US regional bank might be a relatively containable issue. It won’t be the last disaster caused by the monetary madness of the past few years. If inflation risks start to recede and the economy starts to weaken, I hope these lessons aren’t forgotten.