And on we go after a short break with another fresh 15 Norwegian stocks, selected by the Google Sheets random generator. This time, I have identified six companies that go onto the preliminary watch list. Let’s go:

106. Instabank

Instabank is a 50 mn EUR market cap “fully digital bank that offers loan products, savings and insurance to consumers in Norway, Sweden and Finland.” The company was IPOed in 2022 and surprisingly trades slightly above its IPO price, a clear exception for the 2020/2021 IPO vintage.

Equally surprising is the fact that a relatively young “digital bank” makes a profit. They seem to lend to more “high yielding” customers but overall, they show decent growth and the stock looks cheap at 8x trailing earnings and ~6,5x 2023 earnings.

Although I am not a big fan of Nordic banks, I think this one is worth to potentially “watch”.

107. GNP Energy

GNP Energy is a 19 mn EUR market cap Energy company that has lost more than 50% since its IPO in 2020. I also found very little tangible information on this one. “Pass”.

108. Wilh. Wilhelmsen

Wilh. Wilhelmsen is a 1 bn EUR market cap “global maritime industrial group offering ocean transportation and integrated logistics services for car and ro-ro cargo. It also occupies a leading position in the global maritime service industry, delivering services to some 200 shipyards and 20 000 vessels annually.”.

Looking at the long term chart, it seems that there is significant cyclicality in Wilhelmsen’s business:

The shares currently trade at a historical high and on avery low P/E multiple. The P&L is not easy to read as the majority of net income comes from non-consolidated JVs. My gut feeling tells me that entering at the top of the cycle might not be a smart idea, however they seem to be very active in supporting the offshore wind industry. Therefore I’ll put them on “watch”.

109. Austevoll Seafood

Austevoll is a 1,6 bn EUR fish farmer, which compared to the other fish players so far, is a very established player. Looking at the long term chart we see a relatively good value creation, but quite some volatility:

The stock looks quite cheap at 8x 2023 earnings, but they employ quite some leverage. I think they were also hit by the suprse Norwegian Special tax for Salmon fsih farmers. Overall, this could be one of the fish farms where one could learn something, therefore they go on the preliminary “watch” list.

110. Tysnes Sparebank

Tysnes is a 20 mn EUR local savings bank, which, not surprisingly is located in Tysnes near Bergen. The stock looks cheap, but regional savings banks are not my specialty, therefore I’ll “pass”.

111. Salmar

Salmar, with 5,5 bn EUR market cap seems to be one of the “larger fish” among the Norwegian fish farms. The long term share chart looks impressive, despite the obvious hit from the special tax:

However, the valuation at 17,5x 2023 earnings seems to reflect this already to a certain extent. Interestingly, Salmar holds a 71% interest in another listed Norwegian company called Froy which seems to be a specialist in servicing fish farms. According to the Q4 report, they seem to contemplate selling Froy

Overall, Salmar is also a company which could be interesting to “watch” as their track record seems to be really god.

112. Froy

As a one time excepion, I follow up with Froy, a 475 mn market cap stock in which Salmar holds a 72% stake. Froy was IPOed in 2021 and its share price went on a pretty wild ride:

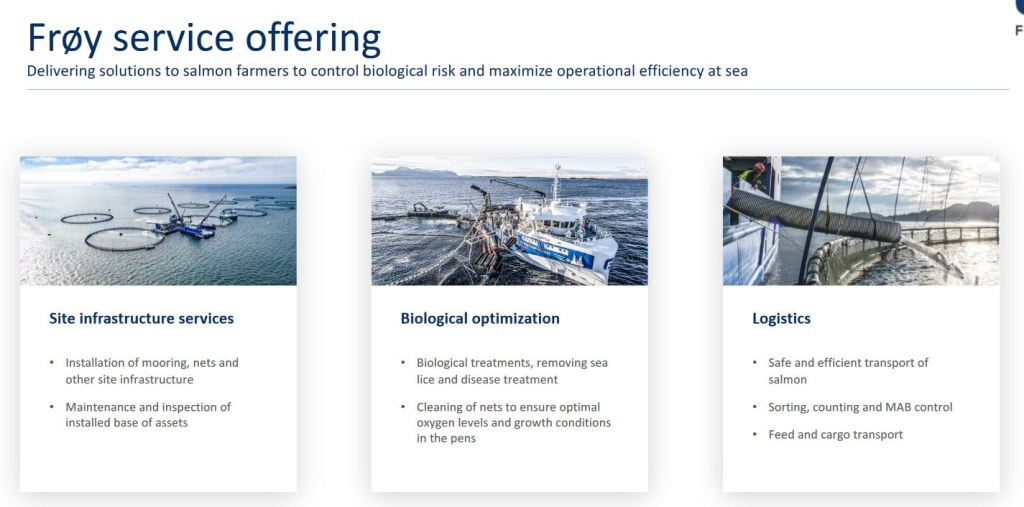

According to their initial investor presentation, Froy seems to be a very important service provider to the fish farming industry, providing all kind of essential services with a focus on Norway:

I guess that their focus on Norway led to the significant loss in the share price follwoing the surpise tax on Norwegian Slamon farming last years.

As mentioned in the Salmar write-up, Salmar seems to be considering “strategic options” for Froy whatever that means. In any case, I find Froy interesting, despite the fact that it is not cheap at 18,5x 2022 earnings. “Watch”.

113. Okea

Okea is a 250 mn EUR market cap company that owns minority interest in several Norwegian off shore oil fields.

They seem to specialize on mature oil fields and try to extend the life of these fields.

The company was IPOed in 2020 and the share price has been fluctuation widly between 10 andf 70 NOKs:

As many oil stocks, the stock looks ridicuolosly cheap at around 2,4x trailing P/E and a big juicy dividend. However there seems to be clearly a strong leverage to oil prices which are now declining for some months. Somehow I still find them interesting bexause of their foucs on Norway, therefore they go on “watch”.

114. Techstep

Techstep is a 37 mn EUR market cap company that seems to hav had its best time in the early 2000s, although the current business model seems to have impmented only in 2016. The company seems to offer some mobile services, but only achieved to have a positive operating result in 2 out of the last 6 years. “Pass”.

115. Sparebanken 1 Helgeland

This is a 324 mn EUR market cap regional savings bank that looks quite profitable- The stock has performed quite welll since the GFC and is not too expensive (P/E ~10,5). However. local banks are out of scope for me, “pass”.

116. Agilyx

Agilyx is a 228 mn EUR market cap company that is active in chemical plastics recycling. As a 2020 IPO, the stock trades around the IPO price, which can be considered a succes for this vintage.

As one can expect from a young cleantech company, they are loss making, although they do have sales, currently a run rate of 15-20 mn EUR. However gross margins are negative for the time being and they are burning cash.

The main shareholder is a fund called “Saphron Hill Ventures” and as many such companies they have an impressive list of strategic partners (Exxon etc.). They seem to operate a JV with Exxon in the US called Cyclix, that recycles plasticand another project seems to be in construction in Japan

Plastic recycling is an interesting topic, however a negativ gross margin really turns me off, therefore I’ll “pass”.

117. Aurskog Sparebanken

Aurskog is a small, 89 mn EUR market cap local savings banklocated in Aurskog near Oslo with no specific aspects at a first glance. “Pass”.

118. SATS

SATS is a 110 mn EUR market cap fitness chain that is active across Scandinavia. The company IPOed in 2020 and lost around -75% since then, indicating that not all is great.

The main reason might be that since their IPO, they have not been able to genrate a profit. The company has significant debt, although they managed to lower the debt burden over the past 3 years.

Because of loan covenants, the company is not allowed to distribute dividends and Q4 2022 was not great, most likely due to electricty and heating costs.

At an EV/EBITDA of ~5,5 this might be interesting for turnaround specialists, but for me the risk is much too high, therfore I’ll “pass”.

119. Nykode Therapeutic

Nykode is 570 mn EUR market cap “clinical-stage biopharmaceutical company, dedicated to the discovery and development of vaccines and novel immunotherapies for the treatment cancer and infectious diseases. Nykode’s modular platform technology specifically targets antigens to Antigen Presenting Cells.” Nykode was only profitable in its IPO year 2020 and has been making losses in 2021 and 2022.

As far as I understand, they are using a different technology to MRNA, but they have some interesting cooperations and Cash should last for a couple of years. However, Biotech is far out of my circle of competence, therefore I’ll “pass”.

120. Wallenius Wilhelmson

By coincidence, this 3 bn EUR market cap company has been selected in the same part of the series as Wilhelm Wilhemsen. And indeed, the companies are related as Wallenius Wilhelmsen seems to be a JV between Wallenius and Wilhelmsen, specialising in owning and operating ships that transport cars.

As other shipping companies, the stock did quite well, doing ~11x since the bottom in MArch/April 2020. The stock looks really cheap at a P/E < 5, but buying cyclical stocks at the margin peak is rarely a good entry point. As I have Wilhelm Wilhelmson already on watch, I’ll “pass” here.