Some employers pay their employees with company stock as part of their total compensation package. This way, employees become owners and potentially feel a greater sense of duty towards the firm.

If you don’t own any of your company’s stock, you might be less inclined to come in early or leave late. Without company stock, maybe you’ll walk by the piece of trash in the hallway instead of picking it up. Instead of going the extra mile, you may do just enough not to get fired!

Since I began working after college in 1999, I’ve always received company stock as part of my total compensation. Today, my wife and I own 100% of Financial Samurai.

Company ownership does feel good. However, not all company stock is created equal.

Why You Should Regularly Sell Your Company Stock

Although it feels great to own part of the company you work for, you should still regularly sell some of your company’s stock whenever you can. Here are the four main reasons why.

1) Diversification. You’re already highly leveraged to your company.

For most people, their career is their #1 money maker. The better your company does, the better you will likely do, and vice versa. To then accumulate company stock means more concentration risk.

When your company is doing well, you’re thrilled to own as much company stock as possible. However, things never go well forever. As a minority investor, the vast majority of decisions are outside your control.

If your stock begins to do poorly because of bad senior management decisions, you may experience a double whammy of a decline in your company’s stock price and a job loss. Therefore, selling your company stock to diversify your exposure makes sense.

The longer you work at your company, the more company stock you will receive. As a result, it’s wise to regularly sell some or all of your vested shares each year. Even after selling, you’ll still own shares since you can rarely sell your entire holding at once.

In 1965, the average tenure of companies on the S&P 500 was 33 years. By 1990, it was 20 years. It’s forecast to shrink to 14 years by 2026. Why is the tenure of companies on the S&P 500 striking? The reasons are due to competition, M&A, innovation, and failure.

Your company’s share price will inevitably go through a downturn. When it does, you will be glad to have diversified.

2) To build passive investment income.

Besides diversifying your net worth, you should sell company stock to generate more passive income. There’s a good chance your company’s stock does not pay a dividend. For example, the majority of tech growth companies do not pay dividends.

Therefore, the only way to capitalize on your company’s share price is to sell. Once you’ve sold your shares, it’s worth reinvesting the proceeds into assets that will generate passive income. These assets include dividend-paying stocks, REITs, bonds, and private real estate.

If your company does not pay dividends, it is likely a higher beta company that is highly dependent on future cash flows. The more dependent a company is on future cash flows, the riskier it is because the future is so unpredictable.

One of the keys to getting rich and staying rich is to turn funny money into real assets. And I consider companies that don’t pay dividends a type of funny money. One day its share price could be flying high. Another day it could crash down to earth due to an endless number of exogenous and endogenous variables.

The more passive investment income you can generate, the more freedom you will have.

3) To pay for things today to improve the quality of your life.

Holding any company stock means investing for the future. However, we also need to live for today. By regularly selling company stock, you can use the proceeds to pay for vacations, buy a safe car, purchase a nice home, take care of your parents, and pay for school tuition.

There’s no point in saving and investing your money if you’re never going to spend it. Even if your company’s stock price continues to appreciate in value after selling it, you will still be able to enjoy the experiences and the things you’ve purchased with the proceeds.

4) To pay for taxes.

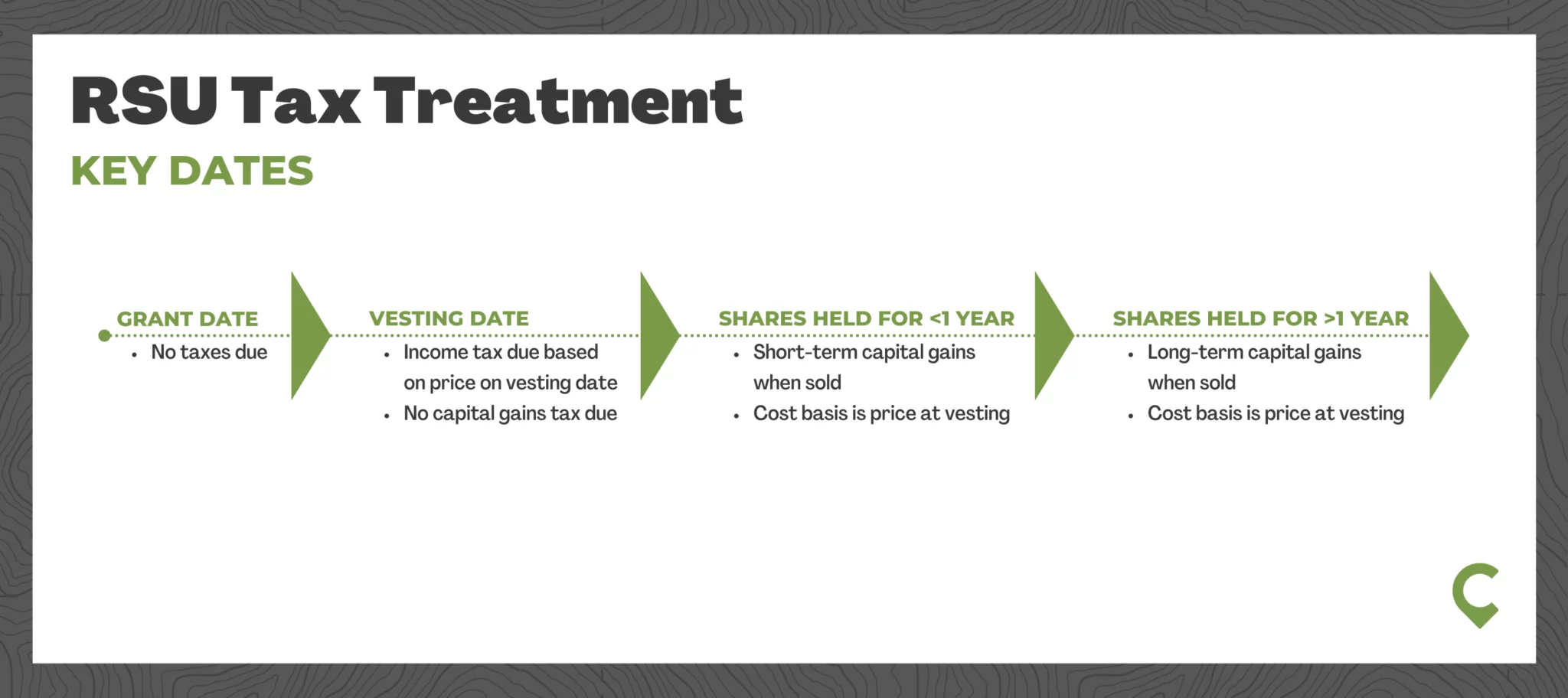

With Restricted Stock Units (RSUs), you are taxed when the shares are delivered, which is almost always at vesting. Your taxable income is the market value of the shares at vesting.

RSUs compensation is taxed at your ordinary-income tax rate. Think of them as a cash bonus that’s linked to the price of your company’s stock.

If you hold the shares for a year or longer after vesting, any gain (or loss) is taxed as long-term capital gains (shares held less than one year from vesting are taxed at short-term capital gains tax rates).

If the value of your company stock plummets before you sell, then you may face a highly unfavorable tax situation.

Example Why Selling Some Company Stock Is Important

Let’s say 1,000 RSUs vest at $100/share and you are in the 35% marginal federal income tax bracket. You have to pay $35,000 in marginal federal income taxes on the $100,000 in proceeds.

However, if you decide to hold onto your shares after vesting, and the share price declines to $35/share, you’re losing. Not only do you still owe $35,000 in marginal federal income taxes, but now you only have $35,000 left in stock! In other words, because you didn’t sell your RSUs on the vesting date, you are left with nothing.

Sure, you have a $65,000 loss that can be used to offset a $65,000 gain immediately that year. However, it may be hard to come up with a $65,000 gain in such an environment.

Selling some company stock as they vest is good tax liability management. Plenty of people got burned during the 2000 dotcom bomb and 2022 bear market by not selling stock after vesting.

Glad I Sold My Company Stock Every Year

From 2001 to 2012, I worked at Credit Suisse. Each year, I sold my vested shares to diversify into real estate. After experiencing the 2000 dot-com bubble, I was determined to buy more real assets. I sold shares valued between $20 – $70/share during this 11-year period.

In 2012, I negotiated a severance package that let me keep my three years of deferred Credit Suisse stock. I proceeded to sell stock every year they vested between a price range of $25 – $30 from 2013 – 2015.

It didn’t feel great selling Credit Suisse stock every year at a 10% – 30% lower share price. However, I wanted to sell because I was bearish on the equities business.

Part of the reason why I left in 2012 was that technology was hollowing out our business. Algorithmic trading and the internet meant commissions and fees were headed to zero. If I was bullish on the equities business, I would have stayed for six more years until age 40.

R.I.P. Old Employer

On Monday, March 20, 2023, Credit Suisse’s share price dropped to an all-time low of 0.98 a share after getting acquired by archrival UBS.

I feel sad because Credit Suisse didn’t need or accept bailout equity financing during the global financial crisis, but UBS did to the tune of $69 billion. Funny how fortunes turn.

CS made too many mistakes after I departed in 2012. One of its most egregious blunders was losing $5.5 billion due to its exposure to Archegos Capital. Archegos Capital was over-leveraged, and Credit Suisse was left holding the bag as one of Archegos’ prime brokers.

Be careful which firm you plan to dedicate your life to. If you pick the wrong horse, you may have wasted a lot of time, especially if you didn’t sell company stock to pay for a better life.

What If My Company Stock Continued To Go Up?

It’s easy to be glad to have sold company stock if your company’s share price ends up imploding. However, what if your company has lots of positive momentum? You feel strongly your company’s stock price will continue to rise over time. Should you still sell your stock each year?

I think the answer is still “yes,” but perhaps not 100% of what you are able to sell each year. Remember, usually, only a portion of your shares is edible to be sold each year due to a normal three-to-four-year vesting period.

No matter how bullish you are on your company, random exogenous variables happen all the time that can deliver huge setbacks. Recent variables include the pandemic, lockdowns, government law changes surrounding evictions and student loans, bank runs, wars, and an overly aggressive Fed.

In 2022, companies such as Meta gave up five years worth of stock gains. In 2023, Silicon Valley Bank gave up 40 years of stock gains as it went into government receivership. Stock prices can correct in a hurry.

Sure, you could get lucky being an early employee at companies like Apple and Google. If you never sold shares for at least ten years, you would be rich beyond your wildest dreams. But the odds of joining a superstar company early and lasting for ten-plus years are small.

Don’t forget, your reinvested proceeds can also do well.

The One Thing To Buy With Company Stock Proceeds

If you are bullish on your company, my best recommendation is to sell enough company stock to pay for things that provide you with incredible value today. Buying a nice house to enjoy life and raise a family if you have kids is a prime example.

I doubt you will ever regret selling company stock to buy a house you love. The memories you create in the house are priceless. Positive memories tend to appreciate in value over time. Everything else, such as entertainment and food, can be payable through your salary.

Besides, the better your company does, the more you will get paid overall. Therefore, even if you sell some company stock that continues to appreciate, your salary will continue to go up and the rest of your unvested shares will continue to appreciate as well.

Carefully Analyze Your Company And Industry Each Year

If you are receiving company stock each year, then be realistic about your company and the industry’s prospects. After a while, it’s easy to get so drunk on your company’s Kool-Aid that you are no longer aware of the circling sharks.

Living in San Francisco, it was relatively easy to see banking was a lagging industry that would continue to lag compared to the technology industry. As a result, I sold company stock every year, left after thirteen years total, and leveraged technology to start Financial Samurai.

I tried to get a job at Airbnb in 2012, but couldn’t. So I just incorporated my own business and bought other tech companies instead.

When the government forced so many businesses to shut down in 2020, I became more bullish on owning an online business that couldn’t be shut down. High-margin, cash-cow businesses that don’t require employees are great!

New Challenges Ahead

However, today, the sharks are circling with the growth of artificial intelligence and short-form content from the likes of TikTok. Therefore, maybe it’s a good idea to sell some of my company’s stock and diversify.

The reality is, I’m unmotivated to sell off a piece of Financial Samurai because I don’t need the money. Further, my net worth is already highly diversified.

Inviting minority partners just means extra work and headaches. One of the main attractions of running a lifestyle business is not having to manage anybody! Besides, I can always leverage AI and create more short-form content as well.

Company stock is just a variable component of your total compensation. Treat the risk asset like any other risk asset and do your due diligence accordingly.

Reader Questions and Suggestions

Do you regularly sell company stock? When were the times you regretted selling some company stock and why? What are the main things you buy with company stock proceeds?

With mortgage rates coming way down after the regional bank runs, I’m more bullish on real estate. Take a look at Fundrise, my favorite private real estate platform that invests primarily in the Sunbelt, where valuations are lower and net rental yields are higher. Treasury bonds are no longer as attractive.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.