There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his many numerous, mysterious ailments. The Doc runs a full battery of tests, and delivers the bad news to the patient:

“Unfortunately, everything is okay…”

And that seems to be the same way many of today’s glass half-empty investors are digesting information about the markets. They are seeking out a catastrophic, weeks left-to-live diagnosis for what – at least so far – has been an ordinary amount of market tumult.

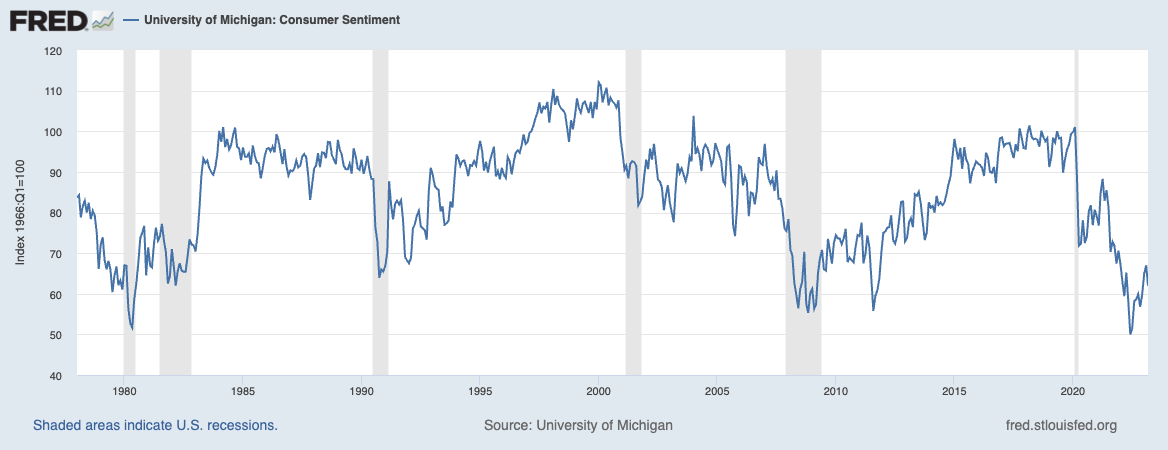

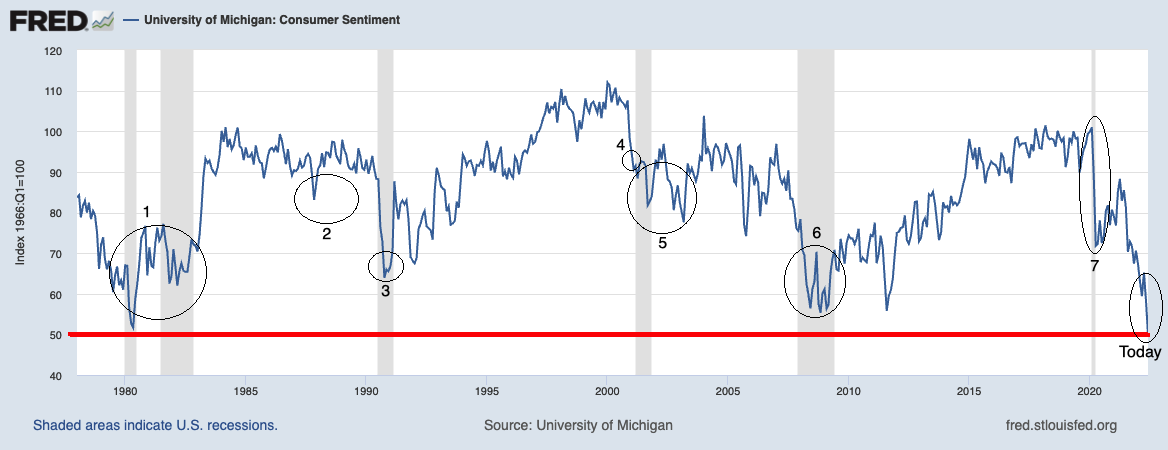

Is it fair to call today’s investors hypochondriacs? Well, given their near-hysterical levels of sentiment – worse than the 1987 crash, the dotcom implosion, 9/11, and the GFC – I do not believe that is an unfair comparison.

Consider:

– Unemployment at 3.4% is at 50-year lows;

– Pandemic induced Inflation seems to have peaked about a year ago;

– Earnings continue to come in at near record levels;

– Trillions in fiscal stimulus are still stimulating the economy;

– Consumer spending near recoird high levels;

– The major money center banks are healthy;

– The FOMC has informed us that they are hitting pause on future rate hikes.

What about the negatives?

– Regional banks continue to lose assets;

– Services inflation remains sticky;

– 2 more small banks blew up over the weekend;

– Concetrated Markets led by a small number of big cap tech names;

– Market participants are expecting a recession;

– Russia’s war in Ukraine continues to drag on;

– Debt ceiling brinksmanship continues to threaten stability;

– Markets are essentially flat over the past 2 years.

Is the glass empty or half full?

Here is a quick mental exercise to allow you to operate without your hindsight bias getting in the way:

At the end of 2022, an all-knowing market deity visits to inform you that almost halfway through the year, 1) Rates will be appreciably higher; 2) Three of the biggest bank failures in U.S. history will occur; 3) The U.S. will be on the verge of defaulting on its debt; 4) Several high-flying stocks will disappoint on earnings and see a substantial decline in price.

Given all that, is your equity stance bullish or bearish on January 1?

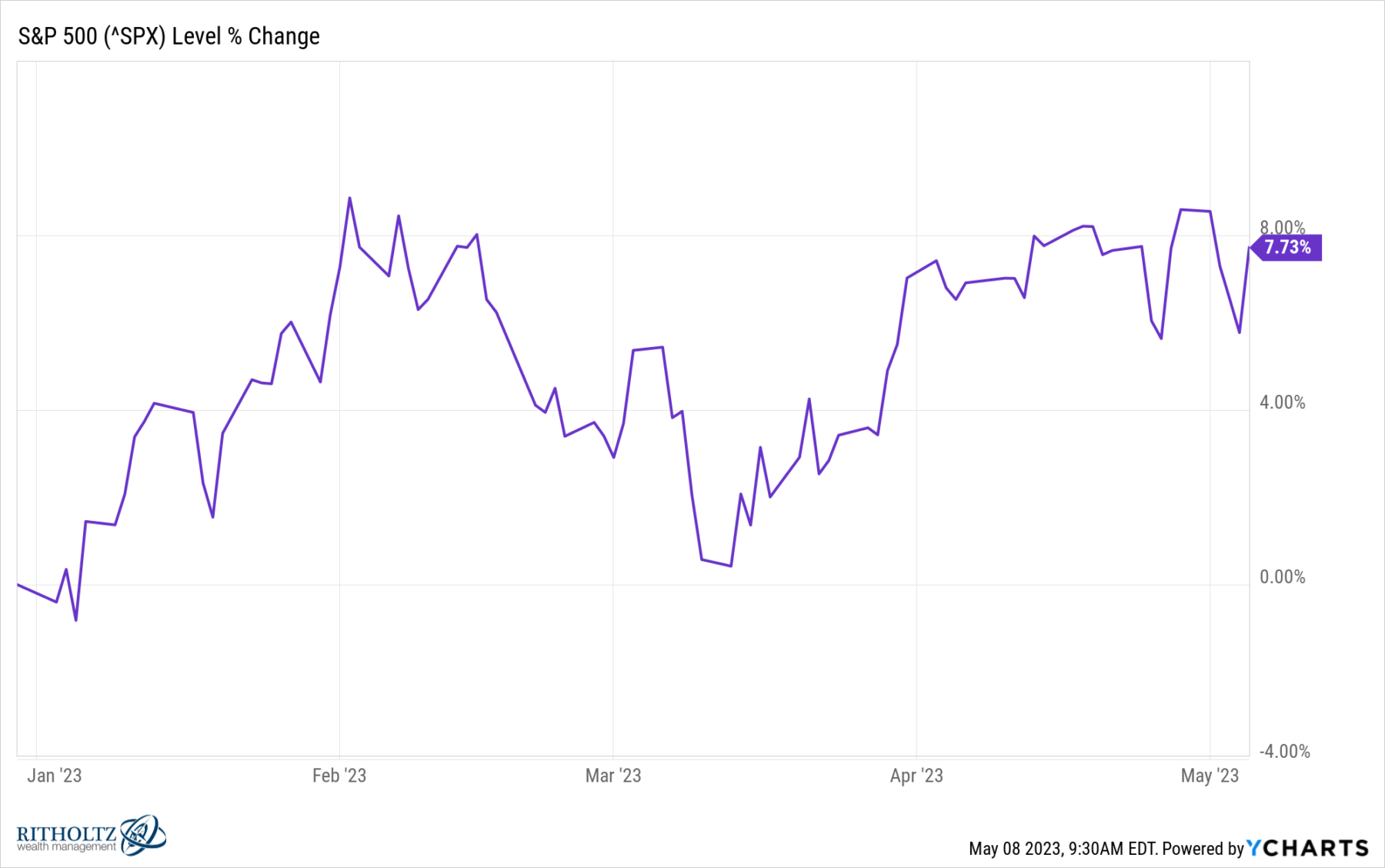

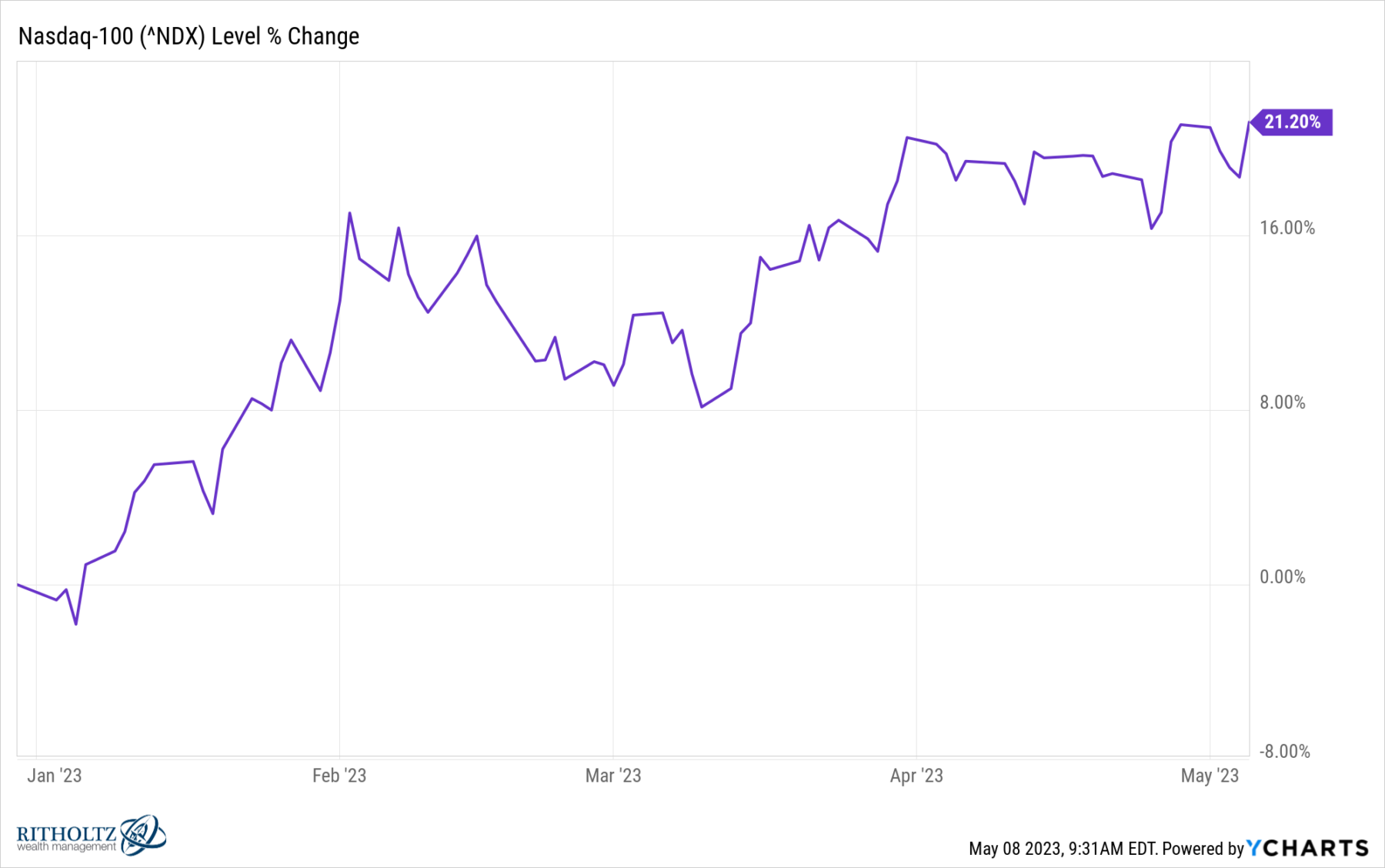

If you say bullish, get the fire extinguisher, because your pants are likely in flames. As of this writing, the S&P 500 is up 7.73% YTD, while the Nasdaq 100 is up 21.2% over the same time period. That is damned good given the parade of horrible laid out above. I don’t ascribe to the Panglossian view that stocks always go up over the long run and therefore you should ignore any and all concerns, including the ones above. As I am fond of pointing out, one day this rally will end, the market cycle will turn and the next really negative era will begin.

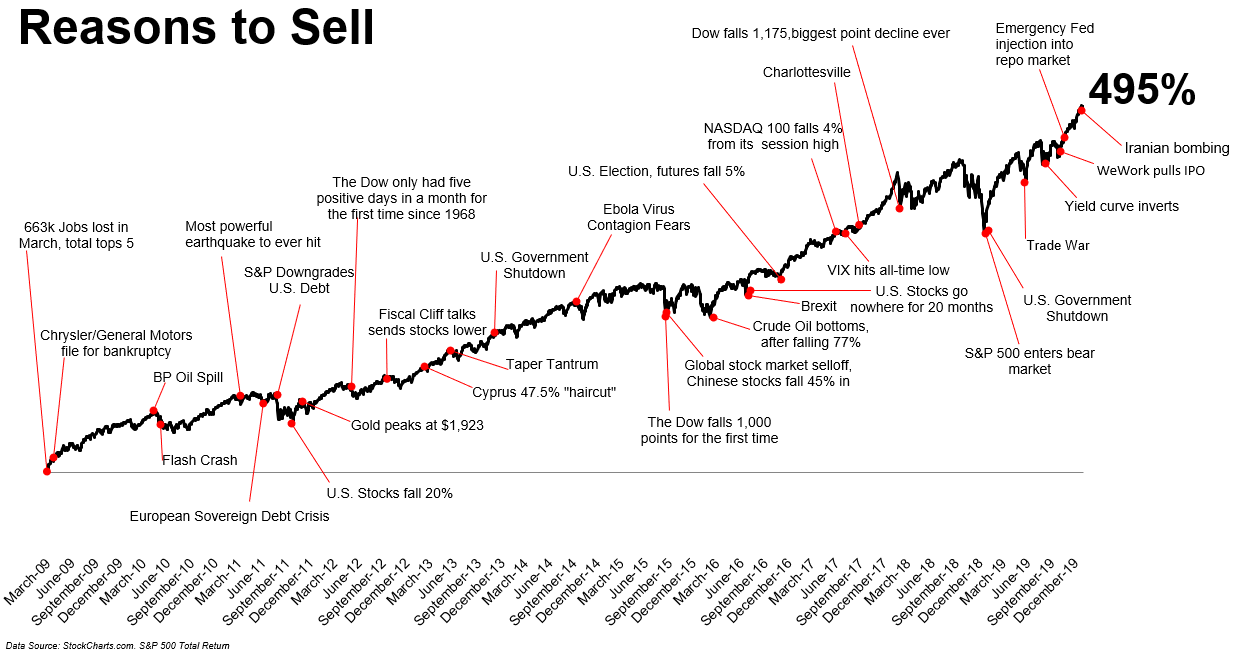

But something is always breaking, and there are always things to worry about, as it seems that there is always some issue on the edge of disaster. Even good news can be problematic: When everything is going great, stability can beget complacency, excess speculation, and eventually, instability.

I suspect it is an unusual combination of modern-era factors — social media, partisanship, and even frustration with the accelerating pace of change– that are what is mostly driving this negative sentiment. Lots of people say they are negative on equities, and yet equities continue to do pretty well despite — or is it because of — all of the bad news.

Perhaps too many investors are focusing on the wrong question: Instead of asking yourself “What is the bad news?” it is more useful to ask “How much of the bad news is already reflected in market prices?”

As we have pointed out over the years, there are always reasons to sell stocks. The problem is that most of the time, those are bad reasons…

Source: Irrelevant Investor

Previously:

One-Sided Markets (September 29, 2021)

Is Partisanship Driving Consumer Sentiment? (August 9, 2022)

Sentiment LOL (May 17, 2022)