Disclaimer: This is not investment advice. PLEASE DO YOU OWN RESEARCH !!!

Some days ago, I made the case for a significant increase in demand for insulation in Europe for the next several years. In this post, I want to dig a little bit deeper into the main listed players and which I find more interesting. In general, even only for the German speaking region there are many companies that offer insulation, among them very large, diversified groups such as BASF, Dow Chemical and St. Gobain.

However, the following listed companies are those who do the majority of sales in insulation to my knowledge:

Kingspan, Irleand/UK

Rockwool, Denmark

Recticel, Belgium

Steico, Germany

Sto SE, Germany

Sto, Rockwool and Recticel are already in my portfolio with relatively small weights.

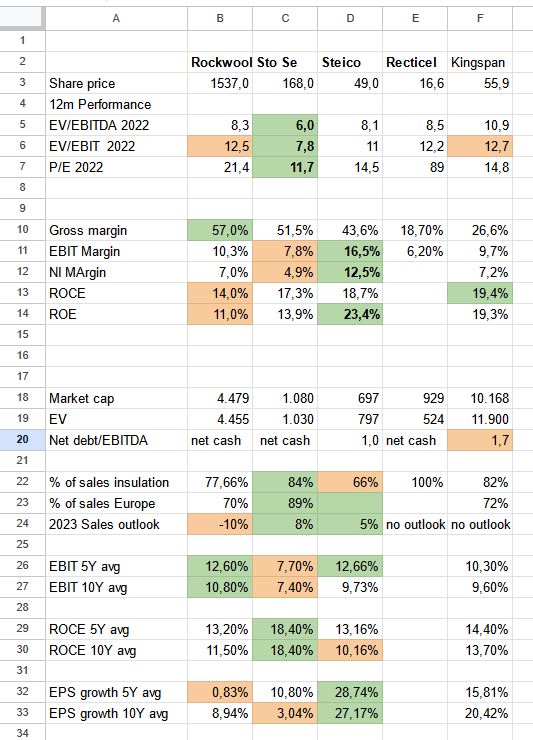

Before jumping into the companies, I have compiled a table with a few KPIs that i find interesting. One quick coment upfront: As Recticel is undergoing a signifcant transformation, their numbers are curently not comparable.

Maybe one reminder: These companies are all relatively capital intensive manufacturing companies. These are not SaaS companies or “Razor and blade” businesses. In addition, the overall cycle in the construction industry seems to indicate a recession in 2023 and potentially beyond.

However, even commoditiy companies can do very well if the starting valuation is low enough and demand is higher than capacity for a longer period of time. And trying to time a cycle in a cyclical industry is not easy.

- Kingspan

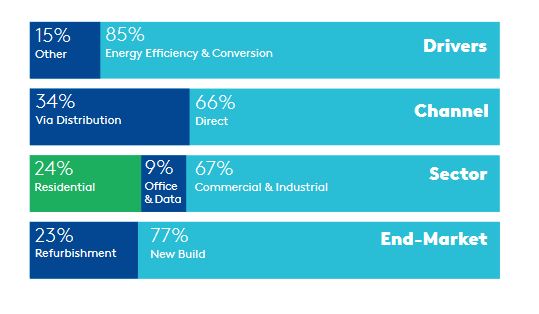

Kingspan is clearly the “Big Kahuna” among the European insulation specialists. It has the largest market cap, the highest ROCE and the best growth rates over 5 and 10 years. The main reason why I think it might not be the best choice for why I am looking for is this graph from their annual report:

Kingspan Has 76% commercial exposure and 77% exposure to new build. As my thesis mostly centers around refurbishment of residential dwellings, Kingspan does not give me the exposure I am looking for. Overall, I do think that Kingspan is a very good company and has a really cool logo, but for me it is a “pass”.

2. Rockwool

Rockwool is the second largest player in this space. Interestingly, Rockwool has the highest Gross margin, but the lowest returns on investment and capital. It looks like, that melting rock is quite capital intensive. What I like about Rockwool is that they seem to be well managed and have “best in class” investor communication.

On the other hand, they are quite pesimistic for 2023 and expect -10% sales compared to 2022.

Interestingly, the stock trades at a premium which I don’t consider as fully justified, especially as the “non insulation” segement is more porfitable than insulation and might get hit harder from a decline in new construction.

As a consequence, I decided to actually sell the ~1% stake in Rockwool as it looks a lot less attractive on several dimensions than its competitors.

3. Recticel

Recticel, the Belgian player is an interesting combination of Special Situation and future Insulation pure play. Recticel used to be a diversified group, doing foam matraces, car supllier and insulation. The last step of this refocusing was supposed to be the sale of the engineered foam business for 685 mn UER in cash to US Group Carpenter.

The transaction was supposed to close in 2022, but then delayed to 2023. A few days ago, Recticel mentioned that Carpernter wants to “renegotiate” the deal. They tried to “hide” it in the Q1 trading update:

With regard to the main transaction, Carpenter has recently requested a substantial price adjustment to the purchase price, invoking the current overall trading evolution. Recticel is considering all its options in this regard.

The share price got hammered by -25% (or -250 mn market cap) by this announcement as we can see in the chart:

Recticel is clearly interesting as a special situation, but for now, for just getting exposure to European insulation, it might not be the best candidate. I therefore decided to also sell my Recticel shares but will keep them on close “watch”.

4. Sto Se

Now we come to the first German competor, Sto SE. Sto is a family owned company that shows decent returns on capital but relatively low margins. On the plus side, the company is very reasonably valued, has significant exposure to European (and German insulation) and had “ok” growth in the last 5 years. In addtion, profitability is in line with long term averages.

Interestingly, other than Rockwool, Sto is quite confident to be able to grow “mid single digits” in 2023 This is especially remarkable as traditionally, they are known to be quite conservative. I haven’t seen numbers from Sto directly, but it seems to be that around 70% of Sto’s business is linked to renovation which could explain their optimism.

What I find interesting is the fact that they have set themselves a pretty clear target for 2025:

“The Sto Group is aiming for a turnover of EUR 2.1 billion and a return on sales of 10% in relation to EBT by 2025.”

This 210 mn EBT target in 2025 compares to 128 mn EUR in 2022 or an increase of around +70%. Considering that Sto, at least in my observation, guides rather conervatively, this is quite astonishing but maybe not unrealistic.

Just when I was writing this post, Sto has released Q1 numbers for 2023. Overall, they were weaker than 2022, but this can be attributed to the really bad weather in Q1 and Sto upheld its 2023 outlook.

Looking at the numbers, what is remarkable that Sto has the lowest margins of all the competitors. Why is that ? To my unerstanding the main reason is that Sto, which sells “Facade insulation systems” only partially manufactures its own insulation panels, but also sources panels from other manufacturers. I found a few articles that Sto started to produce own panels only in 2008 or 2010. Interestingly, this allows Sto to offer all different varieties of insulations panels to customers, although the majority (60% or so) is polystyrol based.

Another interesting aspect is that Sto seems to have their own distribution network and only partially sell via distributors. This is clearly more challenging in the beginning, but once it is in place, an own distribution system is often an advantage.

In a nutshell, Sto for me offers a really compelling risk/return profile: It has ample exposure to the most interesting segment, it has an already attractive valuation and taking into account their targets, Sto looks like a reallying compelling opportunity to me. Therefore it justifies an an increase to a 4% position at current prices in my opinion.

5. Steico

Now to the second German player, Steico. Steico is a player that specializes in wood based products. Based on 2022 numbers, Steico looks impressive: they have the highest margins and the best returns on capital. In addition, EPS growth over 5 and 10 years has been phenominal, even better than Kingspan.

However, looking at historic numbers, especially the last 2 years stand out as being much more profitable than in the past. In addition, Steico has more exposure to general construction than for instance Sto, with Insulation only at around 2/3 of sales, and even within insulation, new builts play a role.

Looking at the share prcie it is also quite obvious that Steico had real problems following the financial crisis before it finally took off like a rocket in 2020/21:

On the other hand, Steico managed to achieve all of that growth organically by building plants and selling more stuff which, in the phase of high investments, leads almost automatically to lower returns on capital. So one could reasonably assume that maybe the long term returns on capital are somewhere between the growth phase and the 2020-2022 boom phase.

Steico targets 650 mn of sales in 2026, which would be a 9% CAGR.

So overall, Steico is clearly less an insulation play than for instance Sto, but on the other hand it is also clear that it’s wood based products are clearly gaining market share.

I therefore decided to allocate 2% of the portfolio into Steico at current price. I admit, that there might be some home bias at work, as Steico’s HQ is only ~25 kilometers away from where I live.

Update: Just before pushing the “Send” button on this post, a rumour surfaced that the founder intends to sell his majority stake in Steico. This comes after a big decline and just before the planned release of the Q1 numbers. I have to say that this made me very nervous and decided to not invest under these circumstances.

Summary:

At the end of the day, the insulation basket is now reduced to Sto with a 4% stake. Recticel is on watch as well as Steico, which dropped out due to this last minute rumour.