According to the Federal Reserve Board’s April 2023 Senior Loan Officer Opinion Survey (SLOOS)—conducted for bank lending activity over the first quarter of 2023—banks reported that lending standards tightened for most residential real estate (RRE) and commercial real estate (CRE) loan categories. Demand for RRE and CRE loans weakened across all categories over the quarter. No banks expected their lending standards for most loans to ease over the remainder of 2023 and one-third expected more tightening.

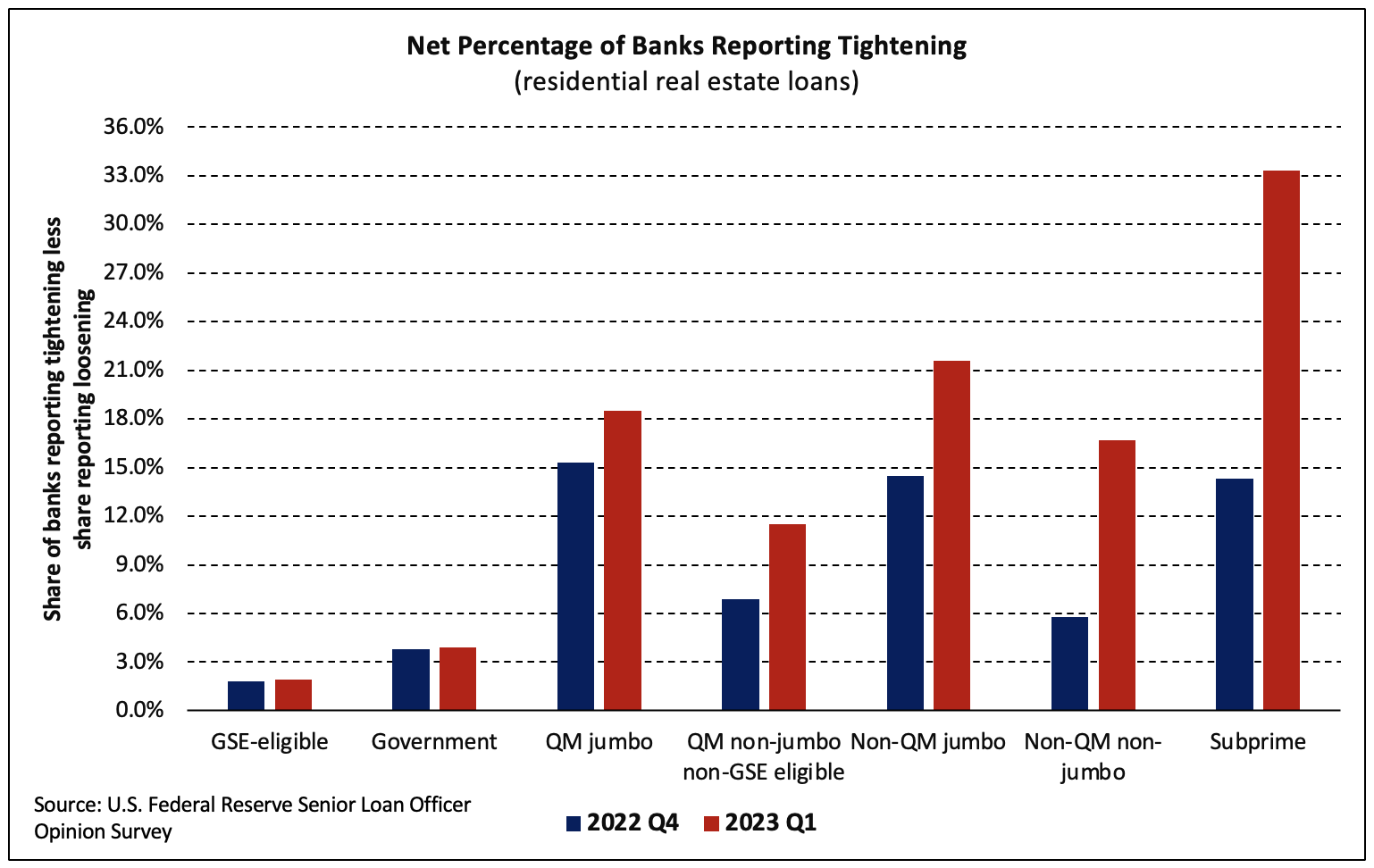

Residential mortgage lending standards tightened the most for subprime loans as the net share of banks reporting tighter standards for these loans climbed from 14.3% to 33.3%. Banks also reported substantial tightening for non-QM non-jumbo, non-QM jumbo, QM jumbo, and QM non-jumbo non-GSE eligible RRE loans. In contrast, GSE-eligible (+0.1 ppt) and government (+0.1 ppt) loans each saw a small increase in the net percent of banks reporting tighter standards in Q1 2023 than Q4 2022.

Demand weakened for all RRE loan categories and home equity lines of credit (HELOCs). The net share of banks reporting weaker demand averaged 50.8% across loan categories. While high, it was a large improvement from the 87.4% average in Q4 2022.

Banks tightened standards for all types of commercial real estate loans, on net, though tightening was more widely reported by mid-sized banks than the largest firms. Banks also reported weaker demand for construction and land development loans, loans secured by multifamily properties, and loans secured by nonfarm nonresidential properties.

Banks reported having tightened all the terms surveyed on all categories of CRE loans over the past year. For multifamily and construction and land development loans, a substantial net share of banks widened the spread on loan rates, lowered the loan-to-value ratio, increased debt service coverage, and decreased maximum loan size.

Related