Bally’s Corporation (BALY) is the old Twin River Worldwide Holdings (old ticker, TRWH) that began with two casinos in Rhode Island, then really starting in 2019 through an aggressive series of complicated acquisitions created a sprawling omni-channel gaming company that appears well positioned to benefit from the long term growth in iCasino and online sports betting. The architect of this transformation is Soo Kim of Standard General, he is the Chairman of the Board and his investment firm owns more than 20% of the shares. On 1/25/22, Standard General submitted a non-binding offer to buy Bally’s for $38 per share (shares trade for $35-$36).

The offer appears very opportunistic as the economy is reopening, the pieces of Bally’s serial acquisitions are starting to come together but before their true earnings power are fully apparent, all while the market has sold off gaming stocks. Likely Kim is simply highlighting the shares are cheap, he’s best positioned to understand the value of the company, and nothing further comes to fruition on the management buyout front. However, now that the acquisition strategy is maturing and the need for a public currency might not be as important, he could actually want to take it private and negotiate a higher price with the board. But at current prices, I agree shares are cheap and would be happy to own the stock absent a deal.

Here’s a slide from their investor presentation showing the pace of acquisitions, almost all of the regional casinos were acquired in 2019-2020, many the result of forced divestures when larger gaming peers consolidated. This allowed Bally’s to pick properties up on the cheap and build a nationwide footprint in which to standup a mobile gaming presence. I generally prefer the regional casinos to destination ones as they’re more stable and proved that throughout covid. Bally’s Corp bought the “Bally’s” brand name from Caesars (CZR), they’re in the process of rebranding all of their regional casinos to the Bally’s brand, the old CZR’s owned Bally’s in Las Vegas (the original MGM Grand) is being rebranded to a Horseshoe property (and Bally’s Corp is buying the Tropicana Las Vegas from GLPI).

The two non-physical casinos deals really worth calling out are:

- On 11/19/20, Bally’s entered into an agreement with Sinclair Broadcast Group (SGPI) to rebrand their regional sports networks (the 21 they acquired from FOXA in the DIS deal) from Fox to Bally’s, in exchange Sinclair got stock and warrants in Bally’s, Bally’s also must commit a certain percentage of marketing spend on Sinclair’s networks. The cord cutting trend is well known, RSN valuations are down (Sinclair’s RSN’s debt trade at distressed levels), sports is generally the reason cited for cord cutting because their content is so expensive. But from Bally’s angle, this deal puts their brand right in the face of the most engaged sports fans, even if RSNs are losing subscribers, they’re unlikely to be losing the ones that Bally’s is targeting. While Caesars, MGM or Draft Kings are spending big on the NFL at the national level, Bally’s has instead targeted the more engaged local fan, one that might have a more frequent/year-round betting cadence than just the NFL season.

- On 4/13/21, Bally’s announced a combination with Gamesys Group (GYS in London) for cash and stock, the deal closed on 10/1/21. Gamesys is a UK based online gaming company (casino strategy versus sports betting, mostly UK and Asian markets) that does both bingo and iCasino games, the idea is to pair the successful Gamesys iCasino offering (where legal in the U.S.) with the Bally’s sports betting/Sinclair offering to create an integrated experience. Generally you need a physical presence in a state to get an online license, so in order for Gamesys to fully access the U.S. market they needed to partner with someone like Bally’s who thanks to their acquisition spree, have a presence in most of the desirable gaming jurisdictions. To fund the rollout of iCasino and online sports betting in the U.S., both the existing Gamesys international business and the U.S. regional casino business are highly cash generative. Bally’s expects to spend 20% of FCF for the next several years on the rollout, but they’re taking a more measured pace than other competitors when it comes to promotions, etc.

Interestingly, the CEO of Gamesys became the CEO of Bally’s, signaling an emphasis on bringing the successful Gamesys model to the United States. Also, the management of Gamesys elected to take stock in the merger instead of cash, at current prices that appears to be a mistake as the value of those shares is roughly half what the cash offer was a few months ago, but shows their confidence in being able to replicate their success here.

Below are all the contingent equity securities that have been issued in conjunction with various acquisitions over the last two years (note the Gamesys acquisition shares are in the share count today, the others generally aren’t in reported numbers):

Here are their Q3 2021 numbers annualized (Bally’s hasn’t reported Q4 numbers yet or provided 2022 guidance):

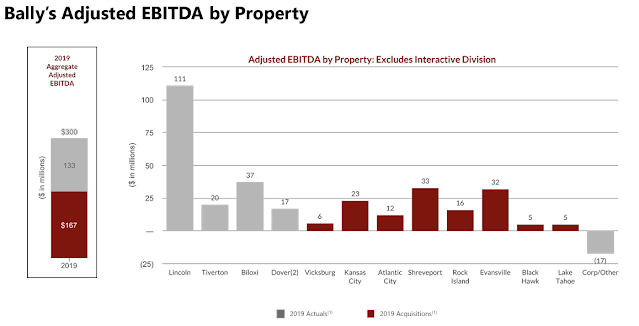

And to show possibly more normalized numbers, here are what the Bally’s regional casinos did in 2019:

If we back out the corporate expense on the above for an apples to apples with the Q3 numbers, we get $317MM versus the $359MM (post rent) done in Q3, for simplicity, let’s just say normalized is somewhere in between there, an average would be $343MM. Add Gamesys (pretty consistent grower over time) and subtract the corporate expense gets us $633 of EBITDA against a $5.9B EV (using 68 million shares, $3.445B of debt excluding capitalized leases) for an 9.4x EBITDA multiple (or a 14% levered FCF yield using management’s estimate) that gives no value to the mobile app opportunity in the U.S. (currently loss making). Again, there are a lot of moving parts, I could be wrong, please double check, but I think that’s a pretty reasonable price to pay for a company that is potentially in play and/or at an inflection point in their business model.

Disclosure: I own shares of BALY