Sponsored by

Resilience in a Market Downturn

Dividend growth strategies held up better than the broader market during the recent downturn. They have also performed well in rising markets. The key is quality—dividend growers have demonstrated hallmarks of quality like stable earnings, solid fundamentals, and strong histories of profit and growth.

Quality Drove Results

While the S&P 500® declined more than 19% on a year-to-date basis through June 30, 2022, dividend growth strategies fared far better. And that wasn’t limited to the domestic large-cap stock universe. It applied to mid-cap and small-cap stocks as well.

Outperformance During the Recent Downturn

December 31, 2021 – June 30, 2022

Source: Bloomberg. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

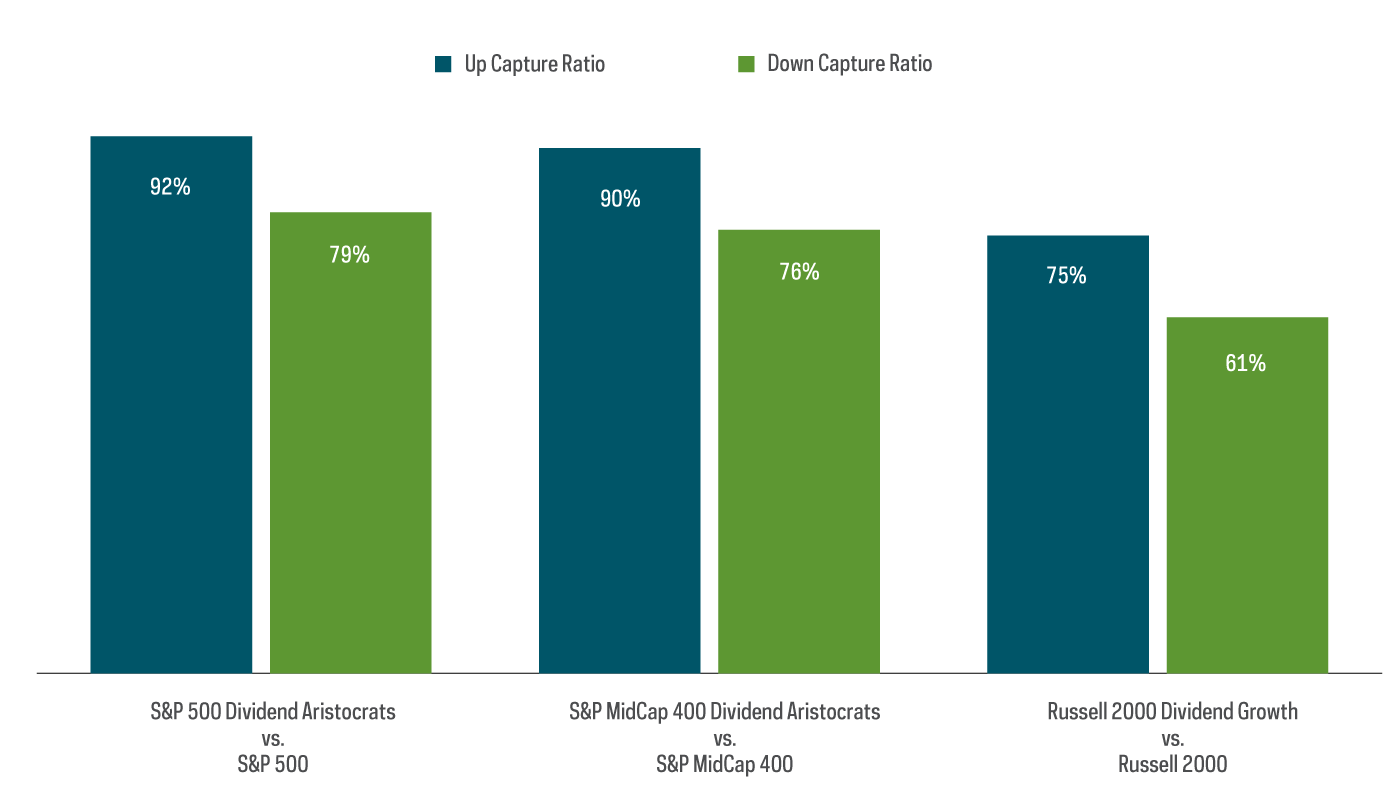

Strong Up/Down Capture Ratios

Index inception – June 30, 2022

Source: Morningstar. S&P 500 Dividend Aristocrats – 5/2/05 – 6/30/22. S&P MidCap 400 Dividend Aristocrats: 1/5/15 – 6/30/22. Russell 2000 Dividend Growth: 11/11/14 – 6/30/22. “Up capture ratio” measures the performance of a fund or index relative to a benchmark when that benchmark has risen. Likewise, “down capture ratio” measures performance during periods when the benchmark has declined. Ratios are calculated by dividing monthly returns for the fund’s index by the monthly returns of the primary index during the stated time period and multiplying that factor by 100.

How Can This Benefit Investors?

The more uncertain the markets, the more investors may want to consider incorporating a dividend growth strategy into their portfolio to help contribute to a more resilient portfolio. ProShares offers the only ETF tracking the S&P 500 Dividend Aristocrats Index, as well as dividend growth ETFs covering various U.S. market caps, technology and international markets.

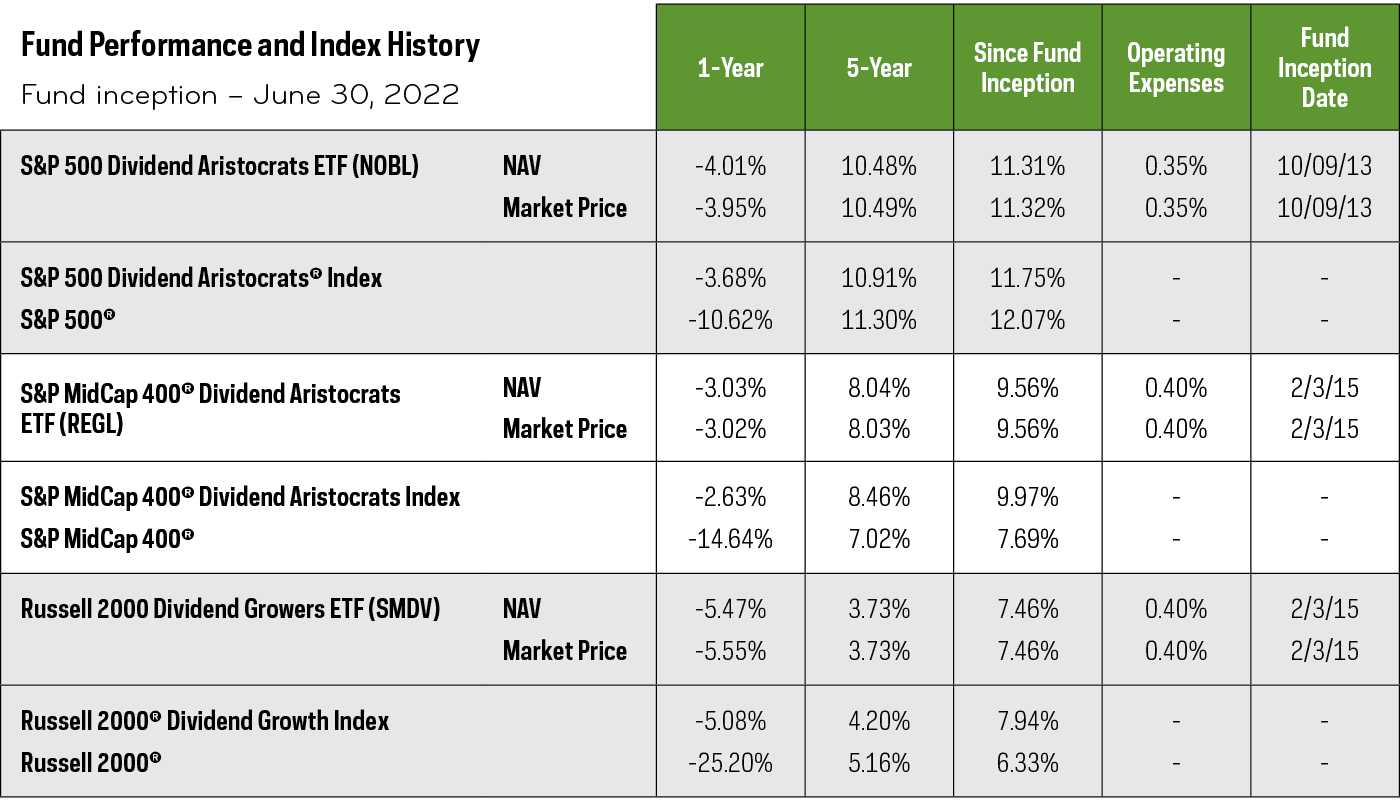

Periods greater than one year are annualized.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. Standardized returns and data current to the most recent month end may be obtained by visiting ProShares.com.

Important Information

This is not intended to be investment advice. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the index at reconstitution.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise; actual results may vary materially.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing. Obtain them from your financial advisor or broker‑dealer representative or visit ProShares.com. ProShares are not suitable for all investors.

Investing involves risk, including the possible loss of principal. These ProShares ETFs are subject to certain risks, including the risk that the funds may not track the performance of the indexes and that the funds’ market prices may fluctuate, which may decrease performance. Please see their summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

Investments in smaller companies typically exhibit higher volatility. Small- and mid-cap companies may have limited product lines or resources, may be dependent upon a particular market niche and may have greater fluctuations in price than the stocks of larger companies. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

The “S&P 500® Dividend Aristocrats® Index” and “S&P MidCap 400® Dividend Aristocrats Index” are products of S&P Dow Jones Indices LLC and its affiliates. “Russell 2000® Dividend Growth Index” and “Russell® ” are trademarks of Russell Investment Group. All have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.