Executive Summary

Financial advisors have had to navigate many challenges in 2022, from an inflationary environment, the likes of which we have not experienced in decades, to weak stock and bond market performance. Here at Kitces.com, we have sought to provide advisors with the insights and education they need to help their clients (and their firms) navigate these uncertain conditions, from blog posts and podcasts on these trending topics to the continued expansion of our Kitces Courses and our popular monthly Office Hours and webinars.

Earlier this year, we introduced our own Investment Adviser Representative (IAR) CE programs that allow those in the growing number of states that have adopted the NASAA Model Rule to meet their 12 hours/year CE requirement. Combined with the continued availability of CE credit for CFP certification, CPA and EA licenses, and various Investment & Wealth Institute (IWI) and American College designations, Kitces Premier Members have a wide variety of opportunities to fulfill their CE requirements.

To keep pace with the current inflationary environment (which also comes with a new CFP Board fee for CE credits and rising staff costs), the Kitces Members Section will be implementing a concomitant $20/year increase in its annual membership fee for Premier Members in 2023, from $149/year to $169/year (the first increase in 3 years!). In addition, Kitces.com will be required to collect a new $36/year “IAR CE Reporting Fee” from advisers who choose to earn IAR CE with Kitces.com to cover the new mandatory reporting costs being imposed on CE providers reporting CE credits completed by IARs.

Notably, as part of the pricing change, we will be making significant investments into the back end of the Kitces platform on behalf of members as well, including hiring a new Senior Director of Platform and Product, who will lead our 2 full-time developers in a significant overhaul of the underlying architecture of the site, to make it faster and easier to navigate in the year(s) to come! We will also be hiring a new Director of Advisor Education, Instructional DesigNerd, and Director of Advisor research soon to support our efforts to provide the best educational content for Advicers. Advisors can also look forward to the release of our newest Kitces Course, “How To Review Insurance Documents To Ensure Clients Understand Their Risk And Address Gaps In Their Coverage” in early 2023, and can take a look at new investments in our AdvisorTech Directory, including the addition of AdvisorTech Satisfaction scores and Integration scores.

In 2023, Kitces Premier Members will also get to experience new formats for our monthly Office Hours sessions, which will include “Software Showcases” to help advisors select between tools in key AdvisorTech categories, as well as “Advisor Makeover” sessions, where industry consultants and I will give advisors real-time feedback on their websites, pricing, firm finances, compensation structures and more!

Ultimately, though, we are still just getting going with the ongoing growth of the Kitces platform as we continue to execute on providing Advicers with relevant content across our 4 strategic pillars: Navigation, Education, Research, and Development (and yes, our organizational strategy really does spell out N-E-R-D!). All in pursuit of our mission: Making Financial Advicers Better, And More Successful. I hope you’ll continue the journey along with us in 2023 and beyond!

Expanding IAR CE Support As 9 More States Adopt In 2023

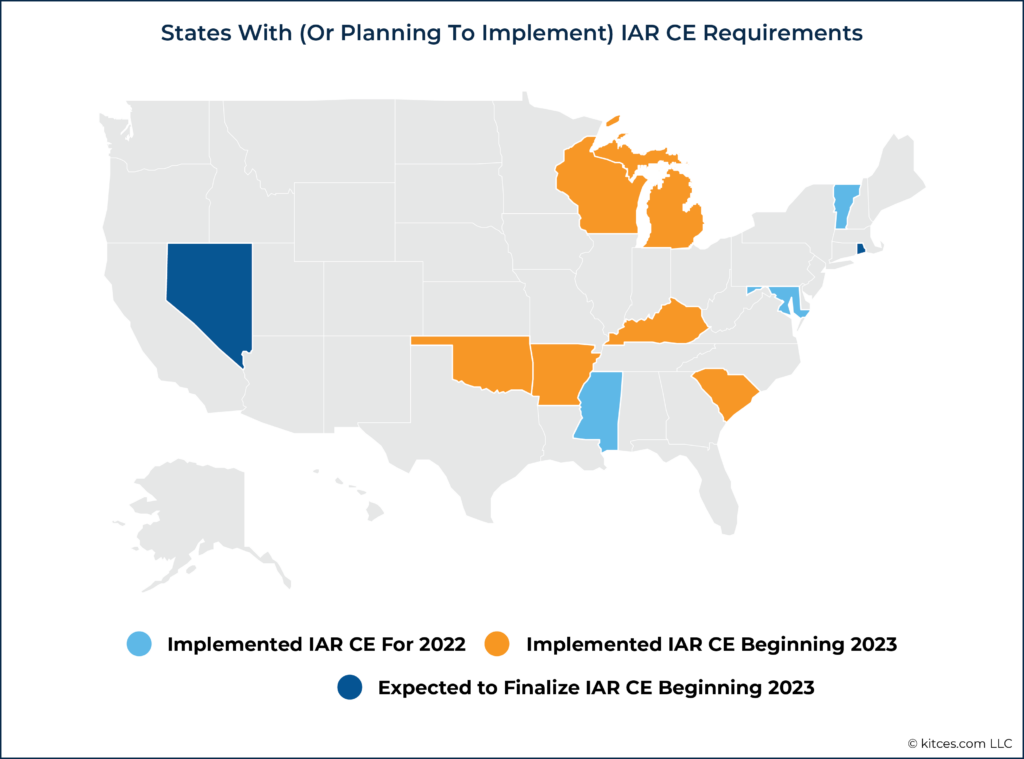

At the beginning of 2022, the first Investment Adviser Representative (IAR) annual CE requirements took effect. As a result of several years of background research and regulators seeking public comment from investment advisers, the Model Rule was promulgated by NASAA in 2020 to require IARs to obtain 12 hours of annual CE (including 6 hours of “Products & Practice” and 6 hours of “Ethics & Professional Responsibility”) and was initially implemented in 2022 in 3 states – Maryland, Mississippi, and Vermont. But now, as more state legislatures pass their own version of the requirement, another 7 states are ‘coming online’ with an IAR CE obligation in 2023, including Arkansas, Kentucky, Michigan, Oklahoma, South Carolina, Washington DC, and Wisconsin (and 2 more are expected to have their new laws passed in time for 2023: Nevada and Rhode Island).

To address this newfound need for an additional type of CE – on top of the CE obligations that those with professional designations already face – earlier in 2022, Kitces.com rolled out its own IAR CE programs to meet the full 12 hours/year obligation for investment adviser representatives in the affected states as a part of our Members Section CE offering.

In addition to CE credit for CFP certification, CPA and EA licenses, and various Investments & Wealth Institute (IWI) and American College designations, Kitces Members can now earn more than enough IAR CE credits for all CE-eligible Nerd’s Eye View blog content and recorded webinars. And we will be exploring some additional IAR CE formats in 2023 as well (stay tuned for more updates!).

The Kitces Members Section now covers the annual 12-hour IAR CE requirement, in addition to CFP, CPA, EA, and various other advisor designations!

We’ve also recently announced a partnership with SmartRIA, where, for a small additional fee to SmartRIA for the service, RIAs can gain access to the Kitces Members Section through the SmartRIA platform and track whether all their IARs have fulfilled their CE obligations (as it applies to IARs as long as they are registered in a state with the new CE requirements because they have more than the de minimis number of clients there, even if the advisor’s home state does not have the requirement). And an upcoming integration enhancement will automatically track in SmartRIA all the IAR CE that the firm’s advisers have already earned via Kitces.com!

Notably, though, part of the new IAR CE obligation is a new mandatory “IAR CE reporting fee” of $3 per CE credit hour (or $36/year to report all 12 hours of CE), which must be collected by CE providers and then remitted to FINRA (the manager of the IAR CE reporting database) when the IAR CE is reported. (Advisers are not eligible for self-reporting their IAR CE; unfortunately, it must be reported by a CE provider, with the attendant $3/hour reporting fee.) As a result, in 2023, Kitces.com will be required to implement and collect a new $36/year “IAR CE Reporting Fee” for any advisers who choose to earn IAR CE with Kitces.com to cover the new mandatory reporting costs being imposed on IARs.

In 2023, Kitces.com will collect and remit to regulators the new $36/year IAR CE reporting fee on behalf of investment advisers who are required to fulfill the new CE obligation.

Members Section Platform And Pricing Updates

In addition to NASAA implementing a new per-CE-hour reporting fee to fulfill the IAR CE obligation, so too did the CFP Board earlier this year announce a new CFP CE reporting fee (also to take effect in 2023) of $1.25 per CE-hour, which amounts to nearly $20/year of reporting fees for each CFP certification to report their average-of-15-hour/year CE obligation. Which, alas, across the tens of thousands of hours of CFP CE that is reported via Kitces.com every year, adds up very quickly.

As a result (along with rising staff costs in the current inflationary environment), in 2023, the Kitces Members Section will be implementing a concomitant $20/year increase in its annual membership fee for Premier Members, from $149/year to $169/year. This is the first pricing increase that the Kitces Members Section has implemented in 3 years (since 2020) and will apply to all new members who purchase (and existing members who renew) in 2023, including both individual members and Groups (from which the Group can then receive its multi-advisor Group discounts).

In 2023, the annual Kitces Premier Membership fee will be adjusted from $149/year to $169/year to account for rising CE costs.

Notably, pricing for our Courses and Summits is not changing and will remain at $397 per program (reduced to $297 for Members), with the additional cost of IAR CE reporting to remain optional for IARs to choose only if needed (as the IAR CE requirement will only apply in 12 out of 50 states in 2023).

As part of our pricing change in 2023, though, we will also be making significant investments into the back end of the Kitces platform on behalf of members as well. With rapid growth to more than 13,000 members in just the past few years, our membership and CE tracking and reporting systems (and the login and navigation flows they support) have made the Members Section significantly slower to navigate and load pages. Consequently, we have recently begun a hiring process for a new Senior Director of Platform and Product, who will lead our 2 full-time developers in a significant overhaul of the underlying architecture of the site, to make it faster and easier to navigate in the year(s) to come!

New Kitces Insurance Course, Ongoing 2023 Summits, And AdvisorTech Directory Improvements

In 2022, we launched our latest Estate Planning Course, “How to Spot Issues for Discussion When Reviewing Estate Documents”, to complement our (recently updated) Tax Course on “How To Find Planning Opportunities When Reviewing A Client’s Tax Return”, as we delve deeper into training for advisors on how to really maximize their opportunities and generate ideas for potential recommendations when going through the data-gathering process with clients. Which is part of our longer-term effort with Kitces Courses to build programs that help financial advicers actually learn how to be advicers and engage with and deliver meaningful financial advice to clients.

Kitces Courses, at $397 each (or $297 for Members), are a great way to use unused Education budget before the end of the year!

To complement our existing Courses on data gathering, in early 2023, we’ll be launching our next course, “How To Review Insurance Documents To Ensure Clients Understand Their Risk And Address Gaps In Their Coverage”, which will focus on how to delve into the fine print in life, disability, and long-term care insurance policies (and other supporting insurance documents that clients provide during data-gathering). Stay tuned in the coming weeks for our early Beta release, with a full launch to follow shortly thereafter (once we gather initial feedback to make sure we’re hitting the mark with the most relevant content for you!).

In the meantime, you’ll continue to see our popular Summits again in 2023! Our Financial Planning Value Summit just closed last week with more than 1,000 participants (you can still purchase the full recording here!) that delved deep into annual service calendars, client engagement standards, and more, and we’ll be gearing up soon for our Marketing Summit to run on April 27th, 2023. Super-early bird registration is now open (Today only! Early bird registration coming soon).

A recording of the recent Financial Planning Value Summit is still available, covering annual service calendars, client engagement standards, and new client task managers!

We’re also continuing to invest into our AdvisorTech Directory, which recently rolled out with new AdvisorTech Satisfaction scores (from our biennial Kitces Research on Advisor Technology study) and Integration scores (from Craig Iskowitz of Ezra Group).

In 2023, we’ll be running the next version of our Kitces AdvisorTech Research study to get the latest details on what advisors are using (and what they like and don’t like!)… which means a mid-2023 update to the Satisfaction Scores we include in the AdvisorTech Directory, new usage (popularity) scores from advisors, and more.

In 2023, the next Kitces AdvisorTech Research Study will provide Assessment Score updates for the AdvisorTech Directory on the technology advisors like and use the most!

We’re excited to see growing use of the AdvisorTech Directory and have lots more ideas of what else we can do from here in the years to come!

New Software Showcases And Advisor Makeovers In Office Hours

In the coming year, we’re also looking to experiment with some new formats for our third-Friday-of-the-month Office Hours sessions. Over the past several years, Office Hours have been an open forum to discuss specific practice management topics, where Members can hear the answers to their business and career questions from me and other outside industry consultants we invite. But in 2023, we’ll be alternating our Office Hours sessions between a new “Software Showcase” program and a series of “Advisor Makeover” sessions.

Software Showcases will highlight 3-4 popular software vendors in a particular category, side by side, for 15-20 minutes each, so that if advisors are looking to select a new software platform, they can get a quick and easy comparison of the major players and their key features, making it easier to narrow down the choices to the final 1-2 that they may want to vet further. We’ll be starting with a bevy of 4 leading financial planning software programs and will aim to cover other popular categories later this year, including CRM systems, Portfolio Management systems, Investment Analytics, and more.

In the new Advisor Makeover sessions, we’re extending a popular series that we’ve done at the beginning of each of the past 2 years, where Taylor Schulte and I have conducted ‘live makeovers’ of advisor websites, giving them real-time consulting feedback on their websites (as long as they’re willing to share the experience with other advisors in attendance, so everyone can hear the feedback and see how the tips are applied!). In the coming year, we’re aiming to do Advisor Makeovers not only on advisor websites (and other marketing materials), but also on how advisors price and present their services, on the firm’s finances (a review of the advisor’s Profit & Loss statement), on compensation structures for advisors and non-advisory employees, and more.

In 2023, Office Hours will feature Software Showcases that provide easy comparisons of the key vendors in major software categories, and Advisor Makeovers where you can see fellow advisors get real-time consulting advice on the challenges they’re trying to solve (that may provide helpful guidance for your circumstances, too!).

We’re very excited about the new formats… and stay tuned for more announcements of particular Advisor Makeover sessions (especially for advisors who want to be a guest and get some ‘free consulting’ from me and our guest consultants) in 2023!

Expanding The Kitces Team Of Nerds And New Career Opportunities

The ongoing growth of ‘Financial Advicers’ who deliver (and really get paid for) financial planning has driven a significant increase in demand for more education, resources, and guidance on how to improve at the craft of advice delivery, which in turn has led to significant growth in the Kitces team over the past several years, which now numbers more than 20 people who work behind the scenes to make it all happen.

And it’s been the growth of this team that has allowed us to expand our content, with more navigational resources like our AdvisorTech directory, more webinars and Office Hours, and the launch of Kitces Courses and our Marketing and Value Summits, as well as a host of behind-the-scenes platform improvements such as the ability to Save Articles and Suggest Topics that you’d like us to ‘Nerd Out On’ for you, in addition to our recent rollout of IAR CE.

All in pursuit of our mission: “Making Financial Advicers Better, and More Successful”.

But we’re not done yet! In the coming year, we’ll be hiring several new positions to support the continued growth of our Team of Nerds! A few of the open (or soon-to-be-open) positions include:

- Director of Advisor Education (open now!) to lead, grow, and scale our Education team as we continue to ramp up our Courses, Summits, webinars, and other CE offerings for the Advicer community

- Instructional DesigNerd (coming soon!) on our Education team to turn our Advicer curriculum into actual Course material in our LMS (for those who have expertise in instructional design tools like Articulate or Captivate!)

- Director of Advisor Research (coming soon!) to lead our expanding research work on Advicers across our 4 major studies (AdvisorTech, Pricing & Productivity, Marketing, and Well-Being).

If you or anyone you know might be interested, they can apply directly via our Career Opportunities page (particularly for the Director of Advisor Education role that is open now, if you or someone you know has a strong passion for adult education and wants to Nerd out with us!). Or sign up for the Kitces Careers mailing list here to stay apprised of future openings on the team!

All of which is ultimately in pursuit of our mission at Kitces.com – To Make Financial Advicers Better, and More Successful – through our focus on providing Navigational resources, Educational insights, Research on Advicers, and supporting the Development of Advicer skills. (Yes, our organizational strategy really does spell out N-E-R-D!)

I hope you’ll continue the journey along with us! And if you think there’s anything else we should be working on that we’ve missed, please share your thoughts in the comments below!