Business owners often confuse margin and markup. After all, they both deal with sales, help you set prices, and measure productivity. But, there’s a key difference between margin vs. markup—and knowing this difference is how you can set prices that lead to profits.

Unsure about the difference between markup and margin in accounting? We’ve got you covered. In this article, we’ll go over:

- Margin vs. markup

- Markup vs. margin chart

- Why do margins and markups matter?

Margin vs. markup

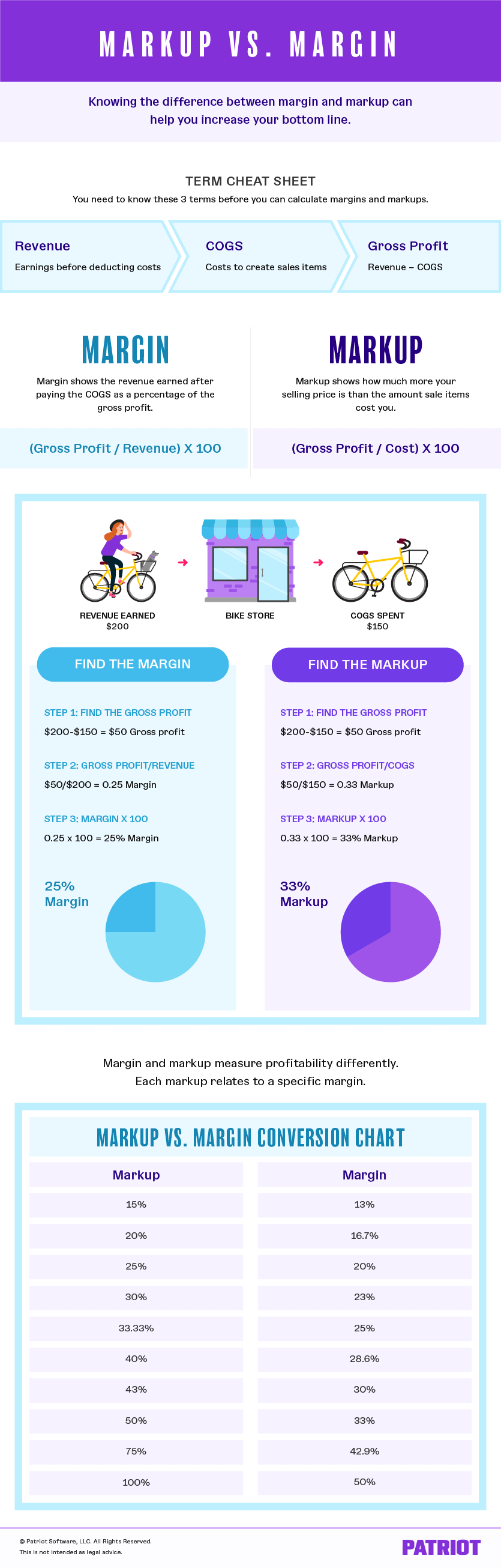

Before we dive into the difference between markup vs. margin, you need to understand the following three terms:

- Revenue: Income you earn by selling your products and services. Revenue is the top line of your P&L (profit and loss) statement and reflects earnings before deductions.

- Cost of goods sold (COGS): Expenses that go into making your products and providing your services. Calculate COGS by adding up materials and direct labor costs.

- Gross profit: Revenue left over after you pay the expenses of making your products and providing your services. Gross profit is revenue minus COGS.

All three of these terms come into play with both margin and markup—just in different ways.

What is margin?

Margin (or gross profit margin) shows the revenue you make after paying COGS. Basically, your margin is the difference between what you earned and how much you spent to earn it.

To calculate margin, start with your gross profit, which is the difference between revenue and COGS. Then, find the percentage of the revenue that is the gross profit. To find this, divide your gross profit by revenue. Multiply the total by 100 and voila—you have your margin percentage.

Let’s put the margin meaning into a formula:

Margin = [(Revenue – COGS) / Revenue] X 100

OR

Margin = (Gross Profit / Revenue) X 100

The margin formula measures how much of every dollar in revenue you keep after paying expenses. The greater the margin, the greater the percentage of revenue you keep when you make a sale.

Margin calculation example

Let’s look at an example. You sell bicycles for $200 each. Each bicycle costs you $150 to make. What’s your margin?

To start, plug the numbers into the margin formula:

Margin = [($200 – $150) / $200] X 100

First, find your gross profit by subtracting your COGS ($150) from your revenue ($200). This gets you $50 ($200 – $150). Then, divide that total ($50) by your revenue ($200) to get 0.25. Multiply 0.25 by 100 to turn it into a percentage (25%).

Margin = 25%

The margin is 25%, meaning you keep 25% of your total revenue. You spend the other 75% of your revenue on producing the bicycle.

What is markup?

Like margins, markups also use revenue and COGS. But, a markup shows how much more your selling price is than the amount the item costs you.

To calculate markup, start with your gross profit (Revenue – COGS). Then, find the percentage of the COGS that is gross profit by dividing your gross profit by COGS—not revenue.

Let’s put the markup meaning into a formula:

Markup = [(Revenue – COGS) / COGS] X 100

OR

Markup = (Gross Profit / COGS) X 100

The markup formula measures how much more you sell your items for than the amount you pay for them. The higher the markup, the more revenue you keep when you make a sale.

Markup calculation example

Let’s go with the bicycle example from above: You sell bicycles for $200 each, and each bike costs $150 to make. What’s your markup?

To start, plug the numbers into the markup formula:

Markup = [($200 – $150) / $150] X 100

First, find your gross profit by subtracting your COGS ($150) from your revenue ($200). This gets you $50 ($200 – $150). Then, divide that total ($50) by your COGS ($150) to get 0.33. Multiply 0.33 by 100 to turn it into a percentage (33%).

Markup = 33%

The markup is 33%, meaning you sell your bicycles for 33% more than the amount you paid to produce them.

Markup vs. margin chart

There may come a time when you know your markup and want to convert it to get your margin—or vice versa. Why? Because you may want to know what an X% markup means for your margin.

The good news is that margins and markups interact in a predictable way. Each markup relates to a specific margin and vice versa. Markups are always higher than their corresponding margins.

Pro Tip: You can use our margin vs. markup chart to find quick conversions for markups and margins.

| Markup | Margin |

|---|---|

| 15% | 13% |

| 20% | 16.7% |

| 25% | 20% |

| 30% | 23% |

| 33.3% | 25% |

| 40% | 28.6% |

| 43% | 30% |

| 50% | 33% |

| 75% | 42.9% |

| 100% | 50% |

So if you mark up products by 25%, you’re going to get a 20% margin (i.e., you keep 20% of your total revenue).

Conversion formulas

But, there may come a time when you mark up products by a number not included in our chart (after all, we couldn’t include every percentage there!). Don’t stress—we’ve got the formulas you need.

Markup to margin conversion

The formula for converting markups to margins is:

Margin = [Markup / (1 + Markup)] X 100

Let’s say you want to know what a markup of 60% means for your margins. You can find this by plugging in 60% (0.60) to the above formula:

Margin = [0.60 / (1 + 0.60)] X 100

Margin = 37.5%

If you mark up your products by 60%, you can enjoy a 37.5% gross profit margin.

Margin to markup conversion

The formula for converting margins to markups is:

Markup = [Margin / (1 – Margin)] X 100

Say you’re deadset on a 35% margin. So, you want to know what your markup should be. You can find this by plugging in 30% (0.30) to the above formula:

Markup = [0.35 / (1 – 0.35)] X 100

Markup = 54%

If you want a margin of 30%, you must set a markup of approximately 54%.

Why do margins and markups matter?

Know the difference between a markup and a margin to set goals. If you know how much profit you want to make, you can set your prices accordingly using the margin vs. markup formulas.

If you don’t know your margins and markups, you might not know how to price a product or service correctly. This could cause you to miss out on revenue. Or, you might be asking for an amount many potential customers are not willing to pay.

Check your margins and markups often to be sure you’re getting the most out of your strategic pricing.

This article has been updated from its original publication date of July 14, 2016.

This is not intended as legal advice; for more information, please click here.