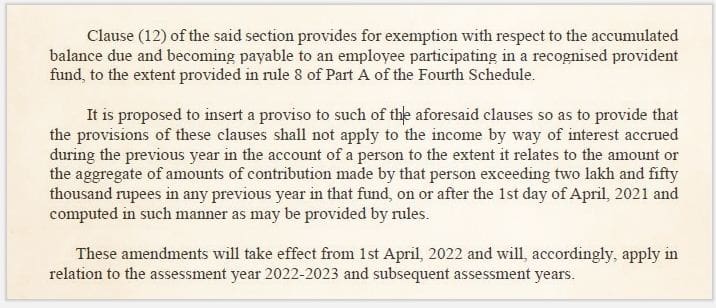

We are all aware that Budget 2021 (The Finance Bill 2021) has introduced one of the key amendments to the EPF Act. As per this amendment, from 1st April 2021 onwards, the interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable.

Until FY 2020-21, the interest income earned on contributions to EPF made by the employee was completely TAX-FREE.

Related Article : For more details, you may kindly go through this article @ Interest on EPF Contributions above Rs 2.5 lakh is Taxable | Budget 2021

In addition to the above amendment, the central govt has decided to implement the below important changes to the EPF act.

New EPF Rules 2021 | Latest Amendments

Below are the new EPF rules that EPF members need to be aware of;

- EPFO Aadhar Verification mandatory w.e.f. 1st June, 2021. (The last date to seed the Aadhaar number with UAN is extended from June 1, 2021, to September 1, 2021, for all EPFO beneficiaries.)

- EPFO hikes death insurance under EDLI scheme to Rs 7 lakh.

- EPFO allows its subscribers to avail the second COVID-19 advance (partial EPF withdrawal)

Let’s now go through these new EPF rules 2021 in detail….

EPFO Aadhar Verification mandatory w.e.f. 1st June, 2021

- The EPFO has instructed all the Employers (Company) that from June 1, if PF account is not linked to Aadhaar or UAN is not Aadhaar verified, then their ECRs (Electronic Challan cum Return) will not be filed. The last date to seed the Aadhaar number with UAN is extended from June 1, 2021, to September 1, 2021, for all EPFO beneficiaries

- This means, though employees can see their own PF account contribution, they will not be able to get the employer’s share.

- Also, if the accounts of PF account holders are not linked with Aadhaar, then they will not be able to use the services of EPFO.

So, hurry up, link your UAN to Aadhaar and get it verified.

EPFO hikes death insurance under EDLI scheme to Rs 7 lakh

In an another major amendment to the EPF act, the central govt has hiked the insurance claim amount under the EDLI scheme to Rs 7 lakh.

In a gazette notification, the Employees’ Provident Fund Organisation (EPFO) said the minimum death insurance has been increased to Rs 2.5 lakh and the maximum to Rs 7 lakh, from the earlier limits of Rs 2 lakh and Rs 6 lakh, respectively.

While the lower limit of Rs 2.5 lakh is coming with retrospective effect (w.e.f. 15th Feb, 2020), the upper limit has a prospective effect.

The Employees’ Deposit Linked Insurance Scheme (EDLI) is an insurance cover provided by the Employees’ Provident Fund Organization (EPFO). A nominee or legal heir of an active member of EPFO gets a lump sum payment of up to Rs 6 Lakhs (now Rs 7 lakh) in case of death of the member during the service period (active EPF member).

Related Article : How to make EPF Death Claim by Nominee of a Subscriber? | EPF/EPS/EDLI Scheme Benefits

EPF advance (partial withdrawal claim) to combat Covid-19

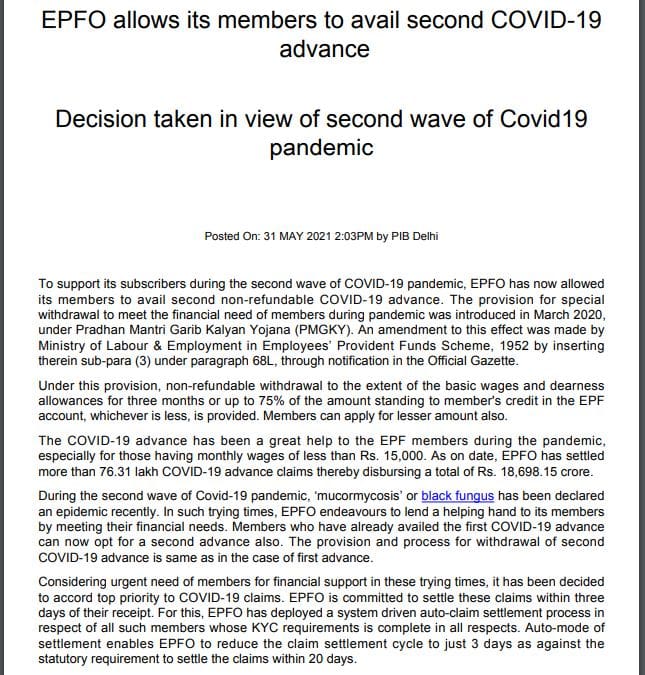

EPFO allows all its members to avail second covid-19 advance (partial withdrawal).

Earlier last year (2020), the EPFO had allowed its members to withdraw COVID-19 advance to meet exigencies due to the pandemic. To support its subscribers during the second wave of COVID-19 pandemic, the EPFO has now allowed its members to avail second non-refundable COVID-19 advance.

The members are allowed to withdraw three months basic wages (basic pay + dearness allowance) or up to 75% of amount standing to their credit in their provident fund account, whichever is less.

The EPFO has settled more than 76.31 lakh COVID-19 advance claims thereby disbursing a total of Rs 18,698.15 crore as on date. If you have already availed the first COVID-19 advance, you can now opt for a second advance also.

Continue reading :

- Important & Comprehensive list of Budget 2021-22 Amendments related to Personal Finance | W.e.f AY 2022-23

- Provident Funds – Types & Tax Implications

- EPF Partial Withdrawals / Advances : Details, Rules & Guidelines

- Why should you Withdraw Old EPF Account Balance? | In-operative EPF A/c Timeline

- How to check if my Employer is depositing EPF amount with EPFO / Trust?

(Post first published on : 31-May-2021)