Why does inflation matter?

If inflation is expected to average 5% a year over the next 10 years, our $100 would be worth just $55. Our banks and fixed deposit rates are not paying us enough interest to even keep up with inflation, which means the value of our cash just gets eroded over time.

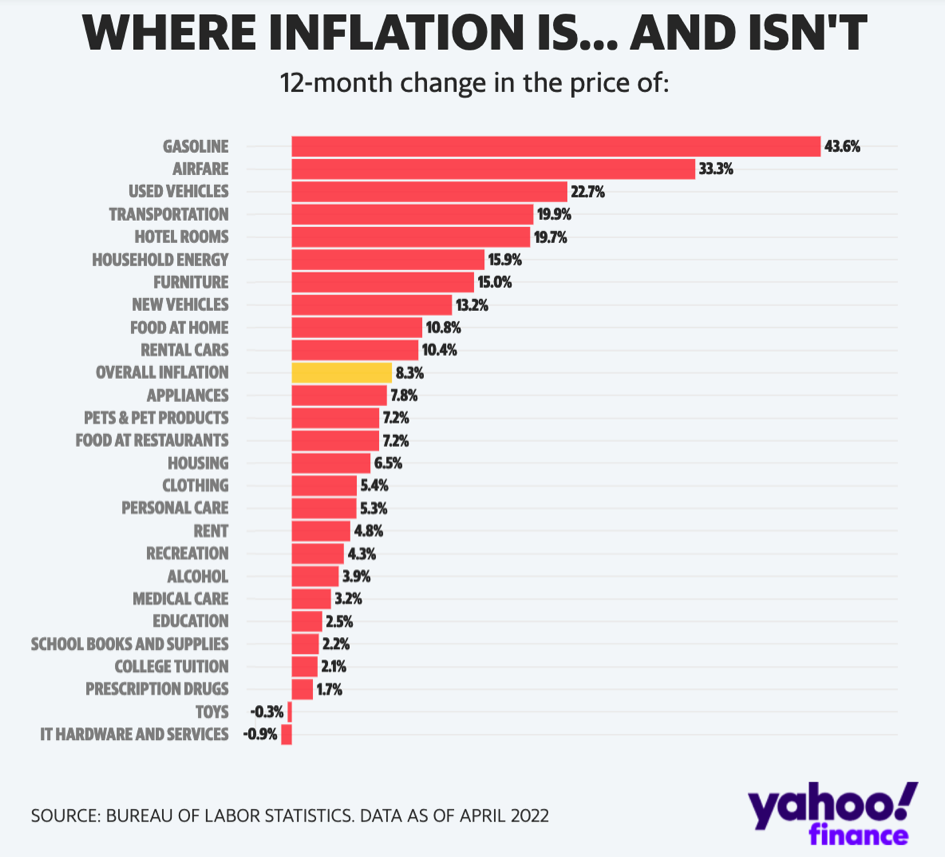

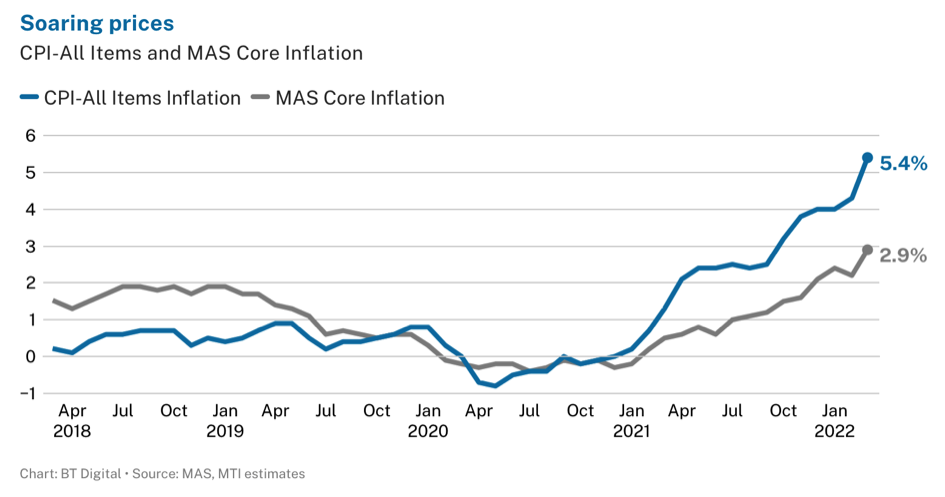

Even if you haven’t been tracking, you may have realized that your monthly household expenses have been increasing over the last few months. From higher electricity bills to more expensive groceries, most consumers have not been spared from the effects of inflation. And for those whose incomes are unable to keep up, we now face a very real risk of having less purchasing power (both now and in the near future) as the prices of goods and services continue rising.

Inflation erodes the value of cash

By now, you should already know that staying in cash alone will be the worst move to make in the next few years – especially with inflation not going away anytime soon.

A good way to hedge against inflation would be to increase our earnings. If you’re a salaried employee, you’d want to start thinking about how you can ask for a raise, or even switch jobs if you get a better offer elsewhere. If you’re a business owner, you’d need to think of how to maintain or increase your profit margins – especially as your suppliers raise their prices and drive your operating costs higher.

But if increasing your earnings is not possible (or extremely difficult at this point), then another way to hedge against inflation would be to invest your cash for higher returns instead.

How to invest to beat inflation

After all, many businesses offset higher inflationary costs by raising their prices and passing them on to customers. This in turn increases their revenue and earnings, which tends to drive higher stock prices over time, thus benefiting both the company and its investors.

Traditionally, growth stocks tend to do poorly in inflationary environments. This is because rising interest rates leads to a higher discount rate being applied to a stock’s future earnings, thus reducing valuation multiples. As future earnings become less valuable and current earnings become more important, investors shift their focus back to value stocks instead (often valued on current earnings). In particular, value stocks in the consumer staples space (like food or energy) often tend to do well during inflation because the demand for necessities are inelastic, which gives these companies higher pricing power to increase their prices.

But just because inflation is high now does not mean it will last forever. If you are trying to manage your portfolio for what may be a very short period of time, you could potentially end up doing more harm to your returns instead.

What’s more, there is no straightforward relationship between inflation and stocks. Rather, history has shown that investing in stocks can help outpace inflation in the long term. Over the last 3 decades, the S&P 500 had an average annualized return of 8.1% even after adjusting for inflation.

Annual inflation-adjusted returns of S&P 500 Index vs. inflation, 1992–2021

Investors with a longer time horizon therefore do not have to worry too much about the impact of inflation on their portfolio.

Simply sticking to a diversified asset allocation strategy will serve you well.

How should I invest?

With stock prices taking a beating in recent months, this may be a good time to start looking for undervalued bargains. And if you own (or intend to own) any growth stocks, watch their debt levels and ensure that they have pricing power to support returns. Aside from reviewing the annual reports and quarterly earnings calls, you may also want to spend some time watching their competitors to confirm that they’re still ahead of the league.

But if conducting detailed stock analysis isn’t your cup of tea, an easier way could be to invest in ETFs (exchange traded funds) instead. These track a basket of stocks and allow you to ride on broader market indexes, industry exposure or even thematic plays.

Another way could be to use funds, which allows you to outsource and invest into a range of companies managed by professional fund houses instead. An easy way to do so would be via moomoo’s Money Plus, which offers various funds by Blackrock, Lion Global or Franklin Templeton without any subscription fees.

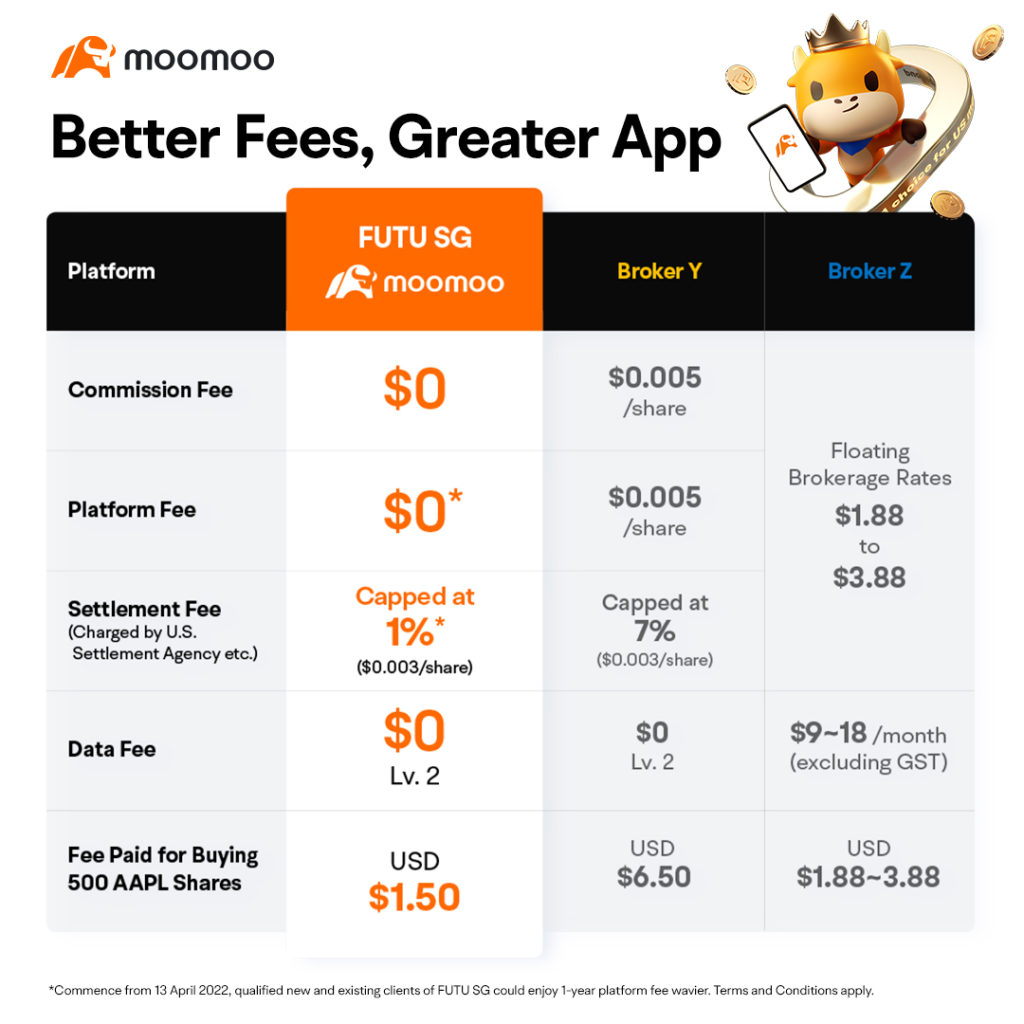

Use a low-cost brokerage like Futu SG (moomoo) so that you pay less

Trading fees can quickly add up if you’re not careful, so be sure to use a low-cost brokerage like moomoo so that you pay minimal transaction fees each time you buy or sell any shares.

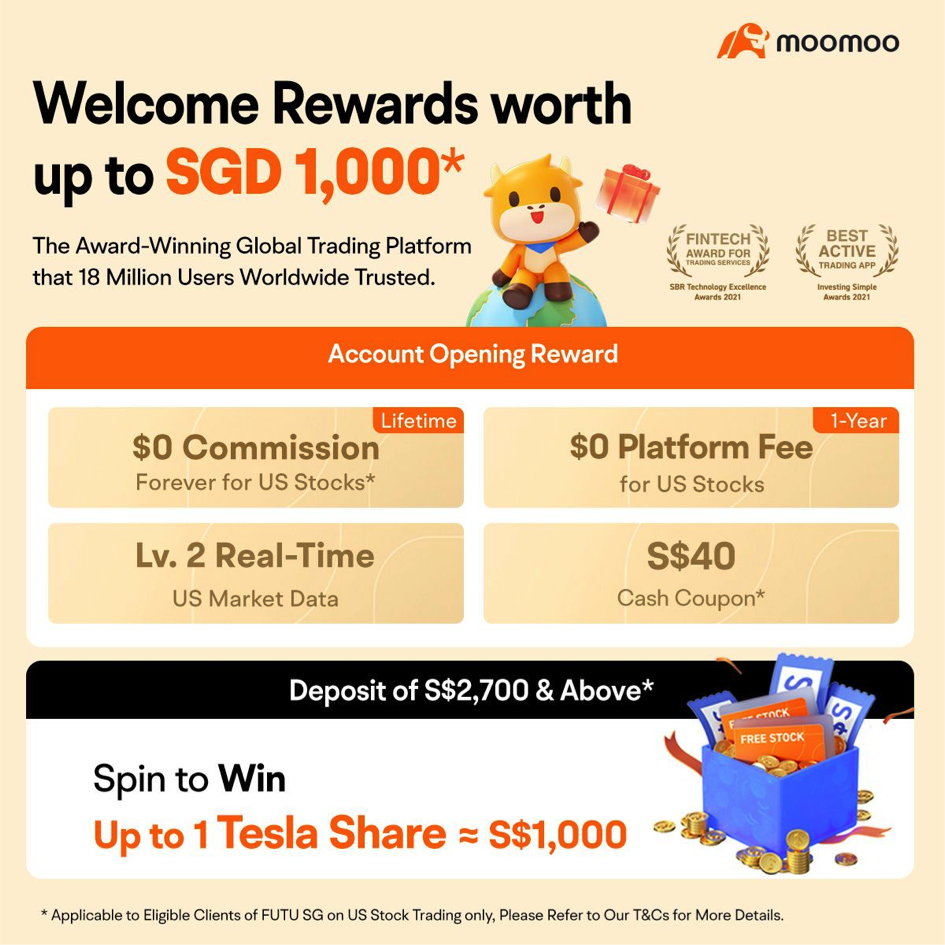

Consider moomoo, which is the first digital brokerage in Singapore to offer a $0 platform fee, $0 data fee, and lifetime $0* commission for US stocks.

On moomoo, you can freely buy and sell your shares as you do dollar-cost averaging to lower your overall cost per share in the long run. All these for a low fee, since no commissions* are charged on US stock trading.

What’s more, one great thing I like is that while US Level 2 market data is often not provided free by most brokerages, you can actually get it on moomoo for free, which can help give you the market depth and pattern of transactions so you can better adjust your prices instead.

Sponsored Message With $0* commission fees on US stocks forever, enjoy trading and investing with just one powerful app – moomoo. Get access to advanced app features today including charting, stock screeners, AI monitors, heatmaps and more…with NO data fees!

Open an account here and deposit S$2,700 or more (S$1,000 for students) to get a welcome bundle of:

- Lifetime commission-free* trades on US stocks

- 1 free share (worth up to S$1,000)*

- S$40 cashback

*Terms and conditions apply. The moomoo app is an award-winning trading platform offered by Moomoo Inc., a subsidiary of Futu Holdings Limited (NASDAQ:FUTU) and backed by Tencent. Futu SG is regulated by the Monetary Authority of Singapore and has received approvals-in-principle for all SGX memberships. Disclosure: This post is brought to you in conjunction with Futu SG. All opinions are that of my own, based on my trading experience with moomoo. Please feel free to click on my affiliate links if you’ll like to sign up for an account! This advertisement has not been reviewed by the Monetary Authority of Singapore.