Hope your road is a long one.

May there be many summer mornings when,

with what pleasure, what joy,

you enter harbors you’re seeing for the first time;

may you stop at Phoenician trading stations

to buy fine things,

mother of pearl and coral, amber and ebony,

sensual perfume of every kind—

as many sensual perfumes as you can;

and may you visit many Egyptian cities

to learn and go on learning from their scholars.

Keep Ithaka always in your mind.

Arriving there is what you’re destined for.

But don’t hurry the journey at all.

Better if it lasts for years,

so you’re old by the time you reach the island,

wealthy with all you’ve gained on the way,

not expecting Ithaka to make you rich.

(C.P. Cavafy, “Ithaka,” 1894, 1910 … maybe a little 1911)

I’ve been traveling a lot recently. My mind often travels, through books and arguments and streams of data; more recently, my body has gone on the road as well. I’d like to share a little of what those travels have meant, to me as a person as an investor.

Journeys of the body

I finally went to Mumbai to meet my parents after two years of pandemic-related travel disruption. The weather was still mild in late March, early April and we were lucky to travel for a few days to the holy city of Rishikesh, in northern India. The journey allowed me to fulfill a life-long desire to take a dip in the holy Ganga river. In mid-April, we went to Provence for the kids’ spring break. Finally, in mid-May, I went to Chicago to attend the Morningstar Investor Conference where I finally met in person Charles Boccadoro, David Snowball, and some very thoughtful fund managers.

Traveling is very important to me because I crave to hear first person stories of what’s going on in our world. Our planet represents billions of experiences and while it’s convenient to look for an easy narrative in the news, travel offers purely divine lessons for the curious minded. When I travel, I try and listen carefully. Whether it is the gentle flow of the Ganga or the wildly different perspectives of strangers, there is so much to learn and so many old delusions that need to get destroyed.

Journeys of the body

Hearing the flow of the waters of the Ganga near Rishikesh

At Devprayag, where two rivers, the Bhagarathi and Alaknanda merge with the underground Saraswati River, to form the Holy Ganga.

At the Pont Du Gard where a two millennium-old aqueduct crosses the river Gardon.

And in Chicago, with Charles

Journeys of the mind

I am also listening to lots of professional investors and fund managers. By watching their videos, podcasts, and reading their letters to shareholders, we get to view the market through their lenses. There is a saying on Wall Street: Nobody ever made money talking. Listen carefully. What better time than the financial turmoil of 2022 to listen carefully. Genuine internal progress is made through reading, listening, observing, and then analyzing and thinking. Finally, we must adapt the knowledge to what works for each one of us individually.

Unexpected market environments bring portfolio losses for almost everyone. We know that to be the price for being in liquid capital market assets. But for that price, we also get a silver lining. Among some benefits of a market selloff are forced humility, healthier valuations, tax loss harvesting, and a good starting point for the lightly invested folks. One more benefit is to learn from a variety of professional fund managers to see how they played this game so far and what they think is next on the horizon. It is also an opportunity to calibrate what we thought would happen to our portfolio versus what actually happened to the portfolio.

Process

I use three (paid) services to track a growing list of active fund managers: MFO Premium, Y Charts and Portfolio Visualizer. I’ve set up templates with all the funds (and some stocks) I follow. I sort the funds by year-to-date returns and pick 4 categories of funds: best absolute returns, worst returns, top benchmark outperformers, and some self-selected funds where I might have met the managers or heard about their investing prowess. I include the bottom performers because when times are tough, fund managers open up with greater willingness than usual to share their thoughts and processes.

It’s easy to be carried away and be judgmental. I find that exercise not helpful. I have invested long enough to know it’s really difficult to do it well, to be consistent, and to perform in the public eye. I try to learn when I can from those who are on the front lines of the battlefield, and if there is nothing to learn, we can move on to the next fund.

Nature of Fund Manager/CEO Letters

The qualitative part of most fund manager letters are configured in three parts: the manager’s perspective of the macro environment, portfolio construction that’s hurt or helped, and individual security analysis that the manager feels confident in sharing.

I usually focus just on the macro-outlook and portfolio construction. I avoid reading too much about individual securities because a good stock or credit analyst can pretty much convince me of anything they want to convince me of. We know the fund managers know how to analyze securities; we want to know how well they were able to use that knowledge to make money.

The first time I read a letter from a fund manager, I want to match the fund’s performance to portfolio construction. If I think the manager is good at setting up a framework and laying out a portfolio that lives by that framework, I then go back into the archives and read from 6 months, 12 months, and 24 months ago. How was the portfolio constructed at those points compared to the fund manager’s thought process? I like to know if the fund manager investment picks worked well when they called the market well. And I want to know what happened to the fund when they didn’t call the market well. I don’t believe anyone can see the future; but good investors can pick investments where the odds are in their favor, regardless of the future.

When I read a letter where the fund is struggling, I want to see if the fund manager is reducing risk or adding to positions. What are they rooting for? Are they pragmatic? If not, is it because the incentives are not set up right? For example, is a growth manager always going to tout growth stocks no matter what the season. Is that stubborn touting helpful to me as an investor? Are there growth managers who raised cash when valuations got excessive? Do they have a habit of making such wise decisions or was this one off?

Finally, many fund managers have fantastic websites with lots of information. On the opposite end, some managers have very dry websites. I think it’s very important for fund managers to communicate with current and prospective investors. Fund managers should write for themselves (and then post it online so others can benefit). Even if we investors don’t learn anything, you will become a better fund manager by writing out your thoughts and trying to present them more clearly to us.

Berkshire Hathaway’s annual shareholder letter is a great starting point for acquiring wisdom on investing and the markets. With the Annual meeting televised since the last few years, I found myself glued to CNBC watching Buffett and Munger tackle questions for a great part of the morning and afternoon on the 1st of May. He talks a lot about companies self-selecting shareholders and has done a particularly good job in laying out his framework. I think this kind of framework showcasing is very important for active fund managers to attract the right kind of fund shareholders, and I hope more managers will be involved in this process. Without the lack of thoughtful reading from the manager’s desk, the end investor can only rely on performance chasing, which is the worst way to accumulate assets and investors.

Here are some other handpicked comments and charts from a smattering of MFO Profiled funds I have started following. The Total Returns for each fund are as of May 24th, 2022.

The Outperformers

Invenomic Fund: (BIVIX, formerly Balter Invenomic) +49.73% YTD (commentary as of mid-May). The fund is closed to most new investors.

Our short portfolio drove performance for the fund again in April. Year-to-date through April, our short portfolio has contributed approximately 36.6% to our returns on a gross basis…. Given the sharp selloff in risk assets, our net exposure has drifted higher from the end of April to mid-May. One of the main reasons for the increase in net exposure is our shorts getting smaller as they fall toward our price targets. We are also adding new longs to the portfolio as stocks drop and hit our buy targets…. We are finding opportunities to buy attractive assets at fantastic valuations, while continuing to short, overvalued companies likely to disappoint investors, in our opinion. We expect the volatility in the market to remain elevated for the foreseeable future.

Aegis Value Fund (AVALX) +13.29% YTD (Commentary for H2 2021)

Conventional investors, intoxicated on recent returns, have been ignoring increasingly precarious financial conditions… While pundits laud these mostly mega-cap technology investments as the new safe havens, given the nose-bleedingly high valuations to which these stocks have ascended, we suspect that owning these stocks has become a massively overcrowded trade… At the Aegis Value Fund, we have worked to hitch our own wagon to equities that we believe are among the most undervalued in the market today.

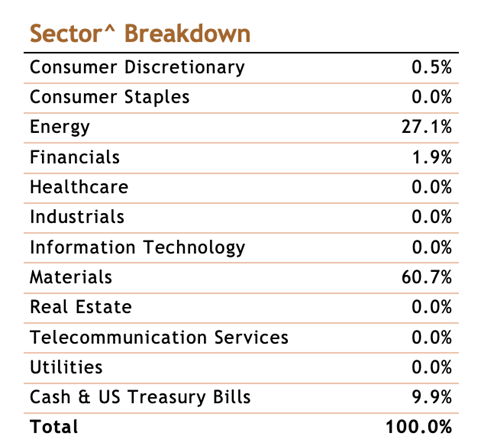

(Table as of March 31, 2022)

[Ed. Note: Look at the contributions to Energy and Materials coming into the year for the fund! Genius or too risky?]

AXS Market Neutral Fund (COGMX, formerly Cognios Market Neutral): +5.63% (commentary as of March 2022)

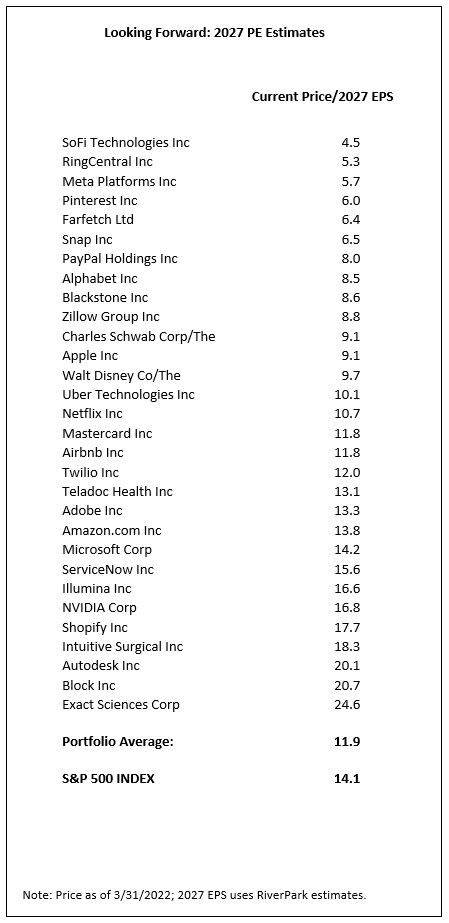

Our conclusion is that while the stock market as a whole is expensive, there is increasingly a group of extremely expensive stocks and an oasis of very reasonably priced stocks, providing an opportunity for both long-only, value-oriented investors and those investors interested in the arbitrage opportunity between these cheap and expensive stocks in a long-short/market-neutral fashion.

RiverPark Short Term High Yield (RPHIX) +0.24%

The Fed is using higher interest rates and quantitative tightening to quell inflation. Whether they will be successful, we have no opinion….

For a manager who says we have no opinion I find it fascinating how this bond fund is UP this year given the brutal selloff in the entire fixed income universe. The Q1 2022 letter is full of details explaining investment process, portfolio construction, the SPAC redemption strategy, and the macro environment.

Funds where the going is tough right now

Riverpark Long Short Opportunity (RLSIX) -50.38% (Q1 2022 Commentary)

Although many of these companies were “COVID Winners” that helped propel strong results for the Fund in 2H20 (and remain amongst the most exciting growth businesses we own), investors have aggressively rotated away from these (and many other) high growth names in a “risk off” reaction to the current macro and geopolitical landscape.

Rather than follow the market’s so-called “de-risking” strategy, we “leaned in”… Given the impressive fundamentals throughout the long portfolio, our current long book now represents the highest revenue and earnings growth portfolio that we have owned since the fund’s inception in 2009.

Artisan Small Cap Investor (ARTSX) -34.99%

But market rotations away from growth can make this a “self-correcting problem,” leaving us with a more attractively valued portfolio (which we believe we have been able to upgrade during the rotation) that has performed well over full market cycles. We perhaps don’t say this frequently enough—it is our clients’ trust and patience that have allowed us to maintain this long-term perspective during periods of underperformance.

Seafarer Overseas Growth and Income (SIGIX) -8.24% (outperforming EM benchmark indices)

David Snowball introduced me to Andrew Foster at the Morningstar Investor Conference, and I had the opportunity to ask him many questions on EM investing. I walked away wanting to read a lot more of his writing because he said, “Our research pieces seem to be inconclusive and not prone to one word Buy or Sell recommendations.” Mr. Foster’s anti-twitter philosophy of investing clicked with me. Later, upon doing research I noticed that Seafarer had beaten the benchmarks handily because it had managed to avoid Chinese internet stocks and Russian stocks. It took me a while to go through the various articles and come across this gem of a theory the fund manager labels Control Party Analysis.

In my work, I utilize an analytical technique that I call “control party analysis” to determine which person or entity controls a company. Experience has taught me that it is problematic to assume that a large shareholder, founder, or executive board is in control of a company, regardless of public perception. Instead, I prefer to create a hypothesis as to the identity of the control party, and then use the company’s historical transaction record (i.e., financial statements, and major corporate actions and decisions) as evidence to test the hypothesis….

These facts, when taken together, suggest the government enjoys material sway over the sector. Further, the facts suggest that the government exercises control not only via ad-hoc restrictions and censorship, but also over cash flows and capital allocation. Given the government’s past record of intervention in the banking sector, this gives me pause. At best, I know that despite the public image of the Chinese internet sector, it is not made up of growth-seeking companies piloted by visionaries. At worst, I wonder whether the future of the sector will fall short of the potential that investors currently ascribe to it, and whether such inflated valuations will persist. (Commentary from Q2 2017)

The challenge for investors and fund managers

Some active fund managers are working hard to differentiate themselves from index hugging. Investors looking for alpha may be tempted to eschew indices and instead look for a growth fund here, a value fund there, or an international small cap fund somewhere. This product hunting is a mistake. When investors go product hunting, they get married into innovation, ESG, crypto, etc. Instead, spend time focusing on the manager.

When you read letters, read about how the managers thinks. If you like the way they think based on their current commentary and performance, go back into the archives, and read more.

Maybe after reading hundreds of letters, we might be lucky to find a few good managers. We hope they will be smarter than us, more tenacious, lucky in investing, skilled in their craft, and determined to invest in the markets despite the tough love markets dish to all who come to it.

There are many rivers in India but only one considered to be the holy Ganga. All rivers are important, and we need every one of them, but it takes a special kind of river to help get us to where we want to be.