This is important to remember – money is a tool…not a piece of art you hang on the wall and admire. Money is converted and used to service several different needs, but the big ones are current living expenses, material goods, and experiences.

Those needs are what drive investing actions and decisions – and the main activity is the conversion process. Generally, people convert investments into cash, and then the cash is converted into servicing your needs.

Feeling good or taking action is not a legitimate “need” and is therefore unworthy of action and conversion at an inopportune time like now, when the market is down.

You can’t be an investor in an asset class that exchanges risk for return and be happy all the time. You will eventually go through periods where there is pain, and we know from behavioral psychology that losses hurt twice as much as the joy gains bring.

Like now.

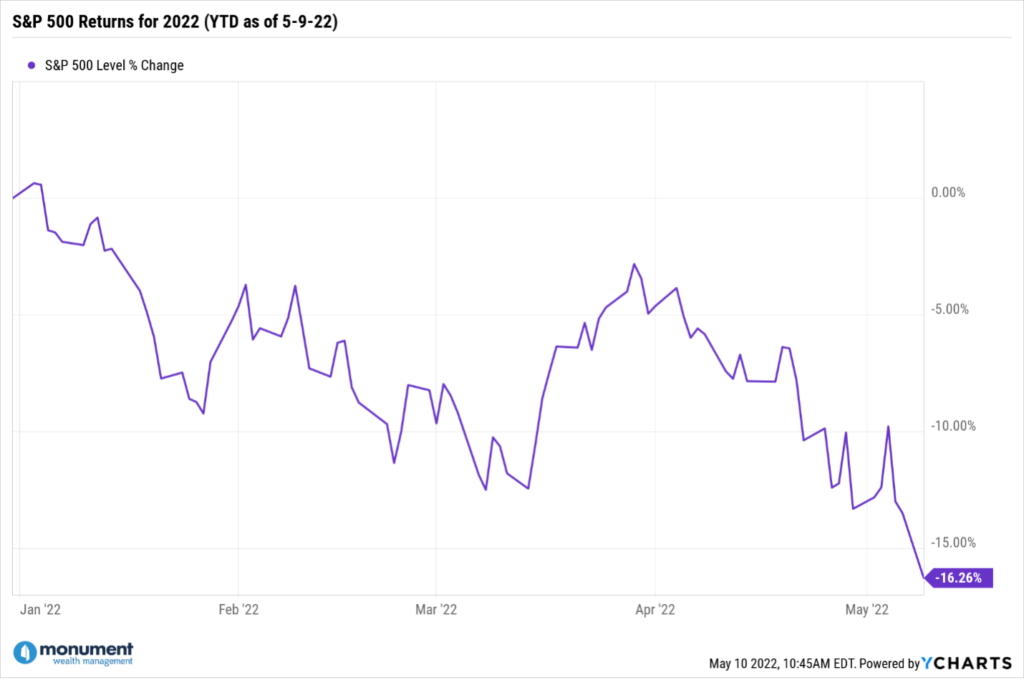

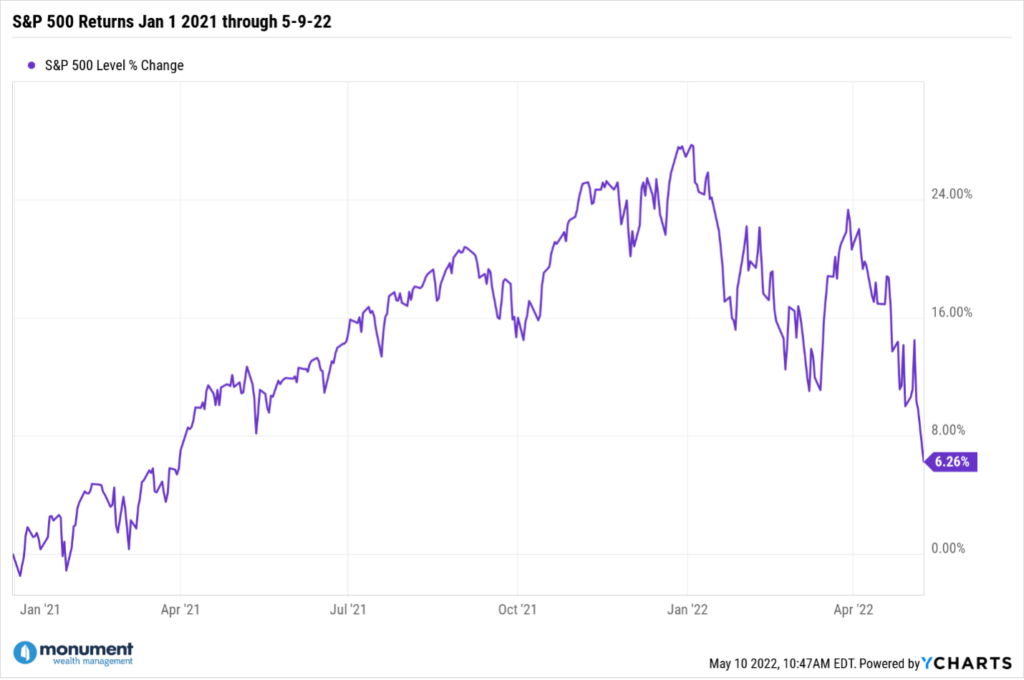

Example: In 2021, the S&P 500 returned 26.89% (see chart below). Reactions were generally, “Yay!”

Now in 2022, the S&P 500 is down around 17%, and reactions are generally, “oh SHIT!”

When taken together, the unemotional reality is this:

But it still sucks, and even though technically we are not in a bear market, with the S&P 500 down almost 17% from its all-time highs, it certainly feels like a bear market. I think the fact that the NASDAQ is now down over 25% from its all-time high back in January and the overallocation of investors to the popular tech names has made it feel even worse than a typical bear market.

With 88 total trading days already in the books for this year, we have seen the second-worst price return on the S&P 500 in history. The only year that had a worse return in the first 88 trading days of the year was 1932, when the market was down approximately 27%.

In 2022, we have 18 days where the S&P 500 dropped over 1%, five days where the S&P 500 dropped over 2%, and three days where the S&P 500 dropped over 3%.

Looking back at April of this year, the S&P 500 fell approximately 8.8%, making it the worst April on record since 1970.

None of that feels good.

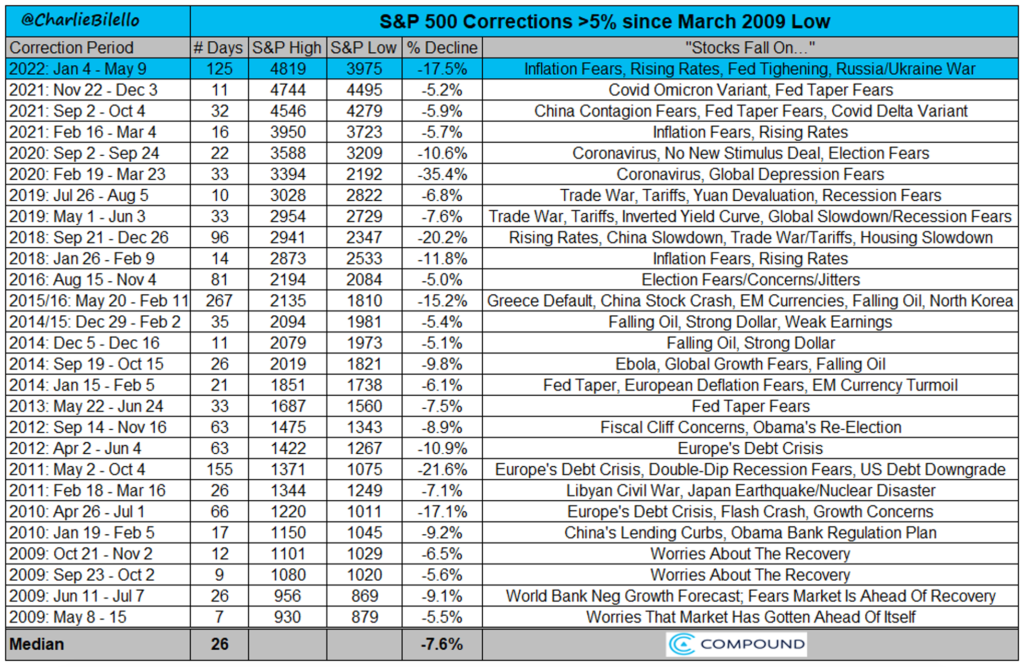

Yesterday I used a statistic from Charlie Bilello (@charliebilello), and today I will use one of his charts showing the periods where the S&P 500 corrected greater than 5% going all the way back to the March 2009 low point. The chart reinforces my point that there is always something.

And there will always be something.

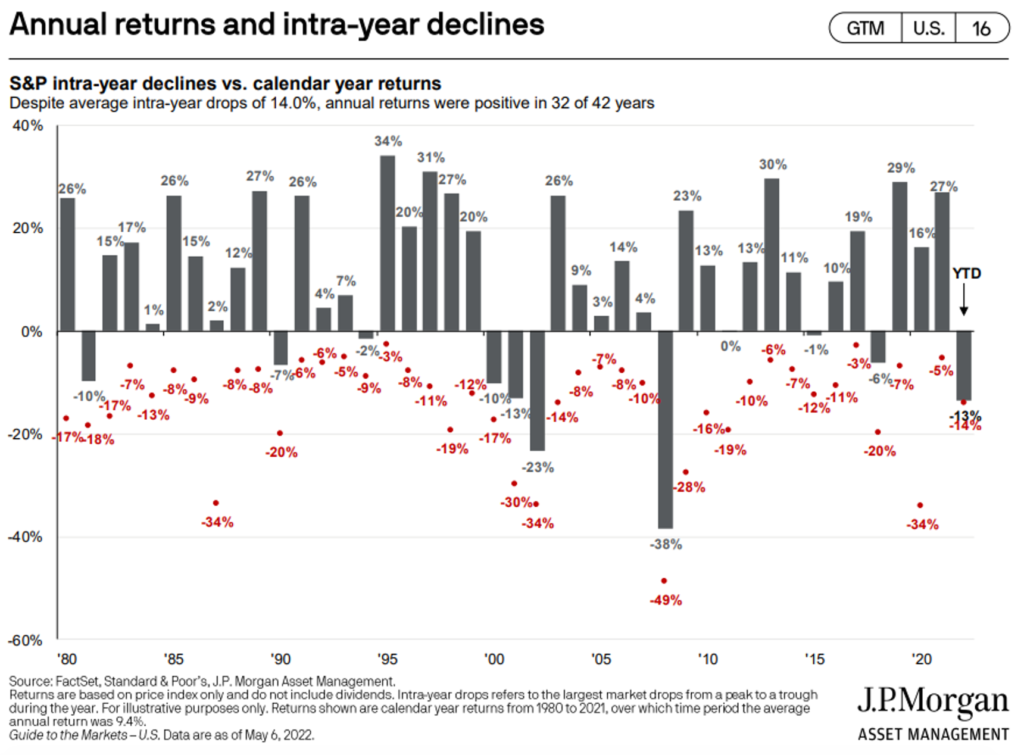

Regular readers of this blog will no doubt recognize the following chart. You can look at it closely, but essentially, it says that shit happens.

Every single year…shit happens.

I come back to the point I opened with – Your portfolio isn’t a piece of art you admire daily, it’s a tool, and you have agency over when and why it gets converted into servicing a need.

Meaning – plan your needs in advance to build and constantly replenish a war chest of cash when markets are up and then dip into it as markets are in a sell-off.

Suppose you are 50 years old with an IRA trading down 17% from the recent high, but you cannot (should not) access it until you are on the downslope to 60. In that case, you really have no NEED to service, and you’d be wise to leave it alone…so long as you had a good portfolio allocation to begin with. If you find that you were inappropriately allocated or too concentrated, then making adjustments is warranted. See yesterday’s blog where I surface a suspicion that many people found themselves over concentrated to a few tech stocks and crypto in April.

Finally, you may think that feeling better or “doing something” is a need, but I disagree with that. That’s your subconscious caveman brain telling you to seek safety. Tamp that down – it’s not a good instinct to follow with investing.

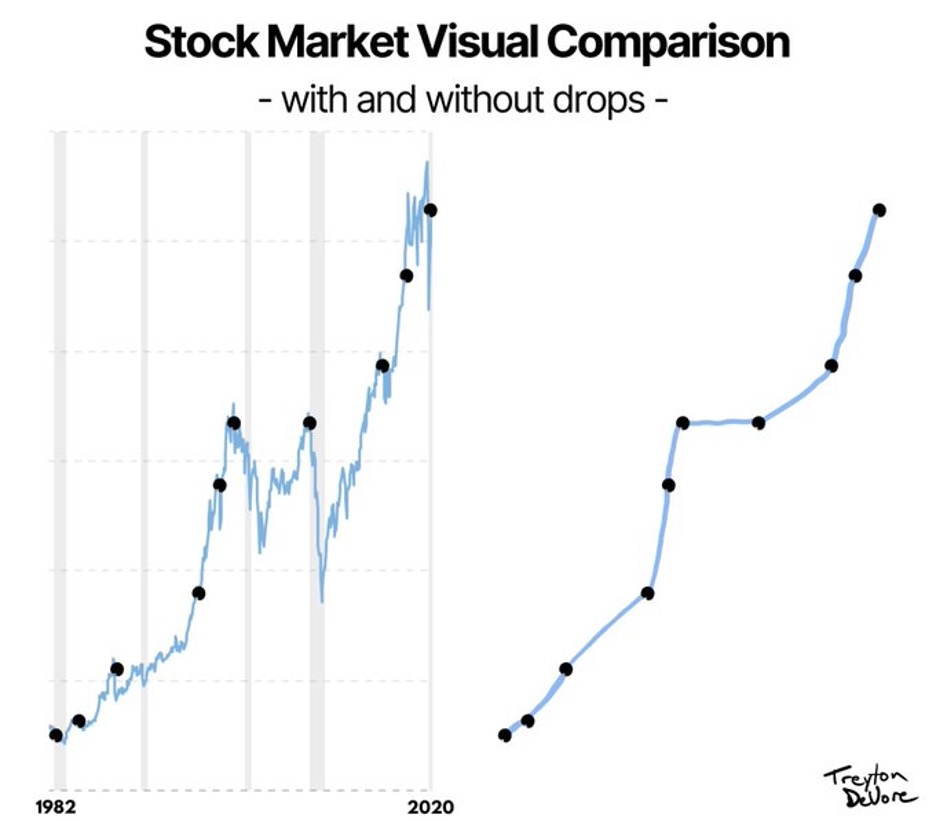

There will always be something going on in the world, and that something will make people say, “But this time it’s different!” but it really never turns out that way. This last graph from @treytonwrites shows why.

Call us if you need to vent or just want to talk about what’s happening. Our answers won’t deviate from what you read here (or have been reading here since like 2008), but we know it feels good to talk and be heard. We are here; just reach out.

Keep looking forward.