As inflation is something that we haven’t seen for a few decades, I am still trying to get my head around this trying to understand how this could influence investments going forward. In this posts I just wanted to touch three areas: Inflation linked bonds, pension liabilities and highly indebted countries.

- Inflation linkers

When looking for assets that gain or at least compensate for inflation, one should not forget Inflation linked bonds. Per construction, they compensate at least fully for the officially measured inflation.

In addition, Inflation linked bonds function also as an instrument to observe “implied” inflation rates, I.e. the market price of an inflation linked bond contains the investor’s expectation for future inflation rate.

The German agency for debt has a good page (in German) that explains how these securities work. One thing to mention is that most bonds are linked to Eurozone inflation, not German inflation.

Looking at the detail page of the 2033 linker we can see that this bond carries a 0,10% coupon and trades at a yield of -1,73%. Comparing this with the 2032 fixed rate bond (there is no 2033 fixed rate Bund) that yields around 1%, we can estimate that the difference between the two yields (1-1,73%)= 2,73% is the market’s current estimate for the inflation in the Eurozone for the next 10 years or so. (Remark: in reality, this is more complex, see for instance here, but for this exercise it is good enough).

Interestingly, the 10 year US “breakeven inflation” rate is at around the same level. There is plenty of literature, especially for the US that overall, these implied breakeven inflation rates are actually quite decent predictors of actual future inflation (before any external shocks), at least since 2003. The caveat here is clearly that there were no inflation linked bonds in the last period where inflation went up a lot (1970s, 1980s), so how this will play out in the current environment is open.

Looking at two 30 year Bonds we can also see that compared to the nominal bonds, the linkers performed much better:

2014, 30 year nominal:

vs. 2015 Linker 30 years:

So what’s the message here ? If someone believes that we will have very high (or even hyperinflation) for some years to come, buying linkers would be an absolute no-brainer. Professional investors could even leverage this by shorting nominal Bunds. I think this is the easiest way to “bet” on inflation expectations.

2. Pension liabilities

In the past weeks I have been reading a couple of times that higher interest rates are a big positive for companies that have large pension deficits.

Indeed, the liabilities as such will be lower if discounted with a higher interest rates. However there are other factors which need to be taken into account:

- If interest rates increase, the liability goes down but also the assets will get hit. The sensitivities published by companies normally relate only to the liability side, not to the asset side.

- Many pension plans are indexed either to salaries, pensions or inflation. That means if inflation goes up, future payments will increase. Some companies report sensitivities towards inflation, some not.

So let’s look how this looks like for Lufthansa, which is often called the “flying pension plan”:

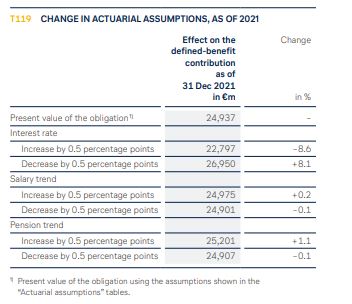

These are the assumptions that Lufthansa takes for their ~20 bn gross liability:

And these are the sensitivities to changes in the assumptions:

So at first sight, the interest rate sensitivity dominates everything else. But again: The interest rate sensitivity only relates to the liability side and doesn’t cover the effects on the asset side.

In addition, looking at the assumed pension increase (+1% p.a.) and what we see currently how the trend is in Germany with pension increase between 5-6% for 2022, it is not difficult to calculate a significant impact if the pension trend would need to be adjusted. An increase by only 2% p.a. would eat up half of the interest benefit, and an increase of 4% p.a,, would fully eat up the interest rate effect.

To be honest, it is not clear to me if Lufthansa will be forced to increase pensions by a certain amount, but my message is as follows: In the current environment, with inflation increasing much faster than interest rates, it is not clear that the overall effect is positive for pension liabilities especially due to inflation and the development of asset prices.

3. Highly indebted countries (esp. Italy, Spain)

Another argument that I heard is that the ECB is not raising interest rates because this would bankrupt especially Spain and Italy in a very short time. And yes, Italian Govies are trading at a pretty wide spread against bunds these days.

However what very few people seem to understand is, that the current scenario with deeply negative real interest rates is basically the best thing that can happen to highly indebted countries. Why ?

First, the revenue of the government in many areas will more or less automatically increase by the inflation rate (VAT) or even faster (taxes on Gasoline). Second, Governments don’t have to refinance their debt every year at current interest rates. Italy for instance has an average maturity of around 7,6 years of outstanding debt, so therefore they have to refinance “only” around 15% of their debt per year.

So for countries like Italy, most KPIs like debt in % of GDP or Interest expense in % of Government revenue will become better automatically even if interest rates increase by one, two or even three percent as GDP increases faster.

In my opinion, the ECB is much more concerned about the overall economic situation and the real estate sector thatn Italian or Spanish Government finances.

All other things equal, high inflation (and negative real interest rates) will benefit anyone who is highly indebted and whose income is rising at least as quickly as inflation and I do think that countries like Italy are actually benefiting significantly from the current situation at the expense of those who have high nominal savings and whose income is not rising with inflation (German savers for instance).