Do you know where is your EPF money invested? After the recent Government approval for an 8.1% interest rate on EPF for FY 2021-22, many felt anguish as 8.1% is the lowest rate in the last 40 years. Hence, many think that it is their right to get the highest interest rate on their EPF account forever and hence Government must declare forever the highest rate. Because they are HONEST taxpayers in India.

However, they are unable to understand how the EPFO will generate income from the EPF corpus (which is a combination of employer and employee contributions). I know that it hurts as the way the rates are going down. However, think as if you are the fund manager of EPF. Is it possible for you to generate a CONSTANT TAX-FREE HIGH-INTEREST rate forever? The reason for declaring the interest rate on annual basis is to analyze the profit generated from the invested amount and arrive at a decent rate of return.

However, few salaried are so anguish that their money from EPF is utilized to fund the expenses of government employees and politicians. We can’t change their mindset nor wish to argue with them. However, it shows their mentality that they are unable to understand how EPFO generates the income from the corpus. They are unable to understand that 8.1% is still better than other available debt products.

Let us not go for a debate on this. Because in the end, interest declaration is neither in my hand nor in the employer’s or employee’s hands. Rather, this post is to give you an insight into where your EPF money will be invested.

Where is your EPF money invested?

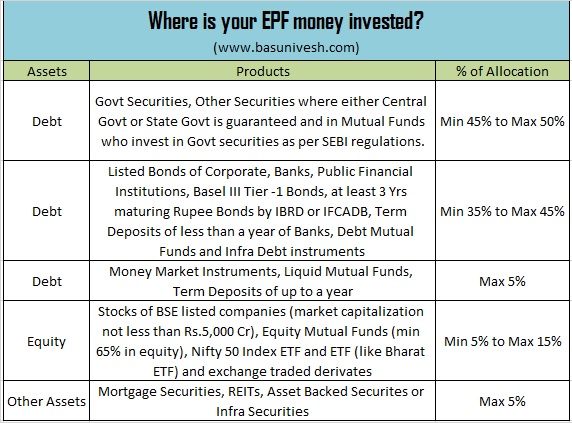

After a lot of searches, I found information about EPF investment patterns and thought to share the same with you all. I am not sure whether it is the latest one. However, I think this is the right information.

Your EPF money is invested in various assets as below.

You noticed that except for term deposits, the rest of all products are market-linked (whether they are equity or debt). Hence, the returns on investment will vary based on so many factors. However, the government still declares that decent fixed returns for EPF subscribers mean the best. I am not here to defend the government. However, my point is that our money is invested in market-linked instruments. But, we are yearly getting decent tax-free returns from EPF means far better than the other available debt instruments.

The above allocation is shared based on the information available. Hence, if any one of you found a piece of different information, then let me know. However, as far as the above asset allocation is concerned, I think this is the current status.

Refer few of my earlier posts related to EPF –