When I first started paying off debt, I had NO CLUE what I was doing or how I’d actually reach my big, scary goal of becoming debt free. It felt impossible. I’d spend HOURS stressing and worrying about money to the point where I couldn’t fall asleep at night. A LOT has changed since then! My husband and I successfully paid off over $111,000 of debt WITHOUT making a fortune (we were 2 teachers at the time). IT IS possible to become debt-free, no matter where you are in your debt journey and no matter your income level. All that’s required? A PLAN! And in order to execute your plan, you HAVE to stay organized.

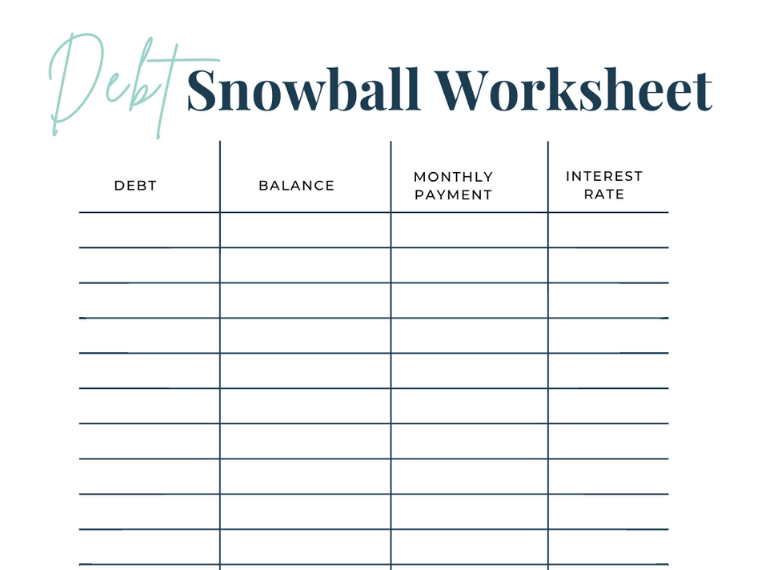

That’s why I’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. If you need help with actually creating a plan that works for you FIRST, then definitely grab my free debt-free roadmap where I’m breaking down the very first steps my husband and I took toward creating a debt payoff plan that actually worked.

When we first made the decision to really work on our debt, we were quickly overwhelmed with how many methods there were for paying off what we owed. So, we set off doing what was most suggested: listing out our debts and interest rates. Since our interest rates were all fairly similar AND I really needed a simple plan to follow that would help me stay motivated along the way, we decided to go with the quick-win strategy: the debt snowball method.

In this scenario, you work with the smallest and easiest debt to pay off FIRST. Our debt took us over four years to get rid of, and we definitely needed some motivation to keep us going. Once you start to see real progress on your smaller debts and eventually pay them off altogether, you become increasingly fueled to conquer the rest.

Let’s get into what exactly the debt snowball method is and how you can implement this in your own debt free strategy!

What Is The Snowball Method?

The debt snowball method is fairly simple, which is why I love it so much! Imagine a small snowball rolling down the hill. While it rolls down the hill, it slowly and slowly gets bigger then starts to pick up even more speed. By the time it reaches the end, you have a much larger snowball than you started off with.

This metaphor is used to describe paying off debt in a specific order. When you pay off one debt, the amount you would use for that minimum payment is added to other larger debt payments. In the end, you’re left with just one large debt payment.

If you’re brand new to the snowball method, be sure to check out my guide on how to pay off debt fast with the debt snowball.

However, the debt snowball isn’t the only useful method for paying off debt out there. Another popular option is the avalanche method. You can see me compare the pros and cons of both the avalanche and snowball debt methods in this post.

Ultimately, it doesn’t matter how you pay off the debt, as long as you get there!

Example Of The Snowball Method

Let’s break it down even further with an example! Let’s pretend that your have four debt balances that you need to pay off:

- Credit card debt 1: $1,500

- Credit card debt 2: $4,000

- Student loan debt: $20,000

- Car loan debt: $15,000

With the snowball method, you always start with the lowest payment first. In this case, it would be credit card debt number 1.

If you have 1,000 a month to pay off debt, you will pay it out as the following:

- Credit card debt 2: minimum payment ($75)

- Student loan debt: minimum payment ($200)

- Car loan debt: minimum payment ($250)

- Credit card debt 1: minimum payment ($50) + all remaining money ($575)

At the end of the first month, your first credit card debt has already been cut down by a third! After three months, the first debt will be paid off completely. Now, you can contribute the money you would have normally spent on the minimum payment for credit card debt 1 to the other credit card.

Over time, your payments get bigger and bigger, just like a snowball!

How To Use The Free Printable Debt Snowball Worksheet

As with anything money-related, it can be difficult to keep track of things. To make sure you’re making all the right payments in all the right places, I recommend using a worksheet. It just makes organization that much simpler and allows you to visually keep track of all your numbers.

The first step in conquering debt always begins with budgeting. It allows you to live within your means and ensure you have the leftover income to actually contribute to your debt. With this leftover income number, you will need to start working on your debt snowball.

Next, you’ll want to write out a list of all your debt and order them from smallest to largest. Don’t consider their minimum payments or interest rates while ordering them.

Write out the minimum payments you will need to make each month for each payment. This way, you know you will at least make the minimum payment for each debt.

Then, for your lowest debt, add in the amount of money remaining from your leftover income number to pay off the debt once you’ve deducted all the minimum payments.

Once you’ve actually made the payments, you’re done! It’s that simple.

The thrill of it all really comes down to watching all the progress you’ve made. As you see the debt numbers slowly go down and get to cross off a whole debt entirely, that’s pure bliss. It can be hard sticking to a debt snowball at times (or any debt, for that matter). But, it’s so worth it in the long run when you ultimately get to claim yourself as debt-free.

Download Your Free Printable Debt Snowball Worksheet

If you’re ready to get started, first of all – congratulations! You’re taking a huge step right now in deciding to get ahead of your debt and finances. But now it’s time to roll up your sleeves and get to work.

First, download and print off this free printable debt snowball worksheet and then sit down and get organized. At first, it may seem daunting, but I promise that you will see a notable change in just a few months. When in debt, it’s important to stay aware of all your payments and finances at all times. Ignoring debt doesn’t mean that it’s not there!

Second, grab my free debt free roadmap that will walk you through the first steps to creating a debt payoff plan that will actually work for you!

AND if you find yourself needing extra inspiration, make sure to follow me on Instagram (@inspiredbudget) where I share daily money tips and financial encouragement!