Well, it’s official – the S&P 500 Index is down more than 10% from its previous peak, which means it’s in correction territory…and oophf, on Friday, the S&P 500 was down around 4% and is now about 14% off its highs. Other parts of the stock market are down even more.

Yesterday there was even more red on the screen with the S&P 500 shedding around another 1.50% by 3pm.

This tweet from yesterday comes from Tesla (I mean Elon Musk).

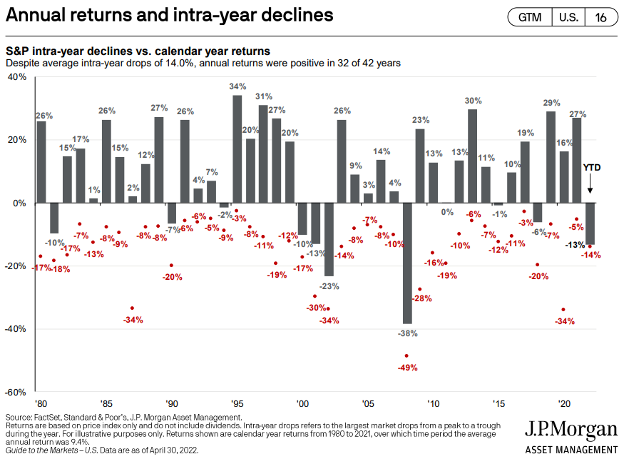

So why is this happening? The snarky answer is, “Because shit like this happens on average once a year.” Even with intra-year declines of 14%, the market has posted positive returns 32 out of the last 42 years…or 76% of the time.

I’ve written about this before because, well, this has happened before. A lot, in fact. Look at it this way… I came into the business in August of 1999. Here’s a table of how much each calendar year has been down for every year I’ve been in the biz…

So of the 24 years (I’m gonna count 1999), ten years (42%) had intra-year declines of greater than the 14% average, 12 (50%) were less than the average, and two years (8%) were exactly 14% drops.

Since we use a drop of 10% to define a “correction”, 16 of my 24 years (67%) have had a 10% or greater loss.

I’m not bragging, I’m just saying that my experience informs me because another way of looking at this is from the percentage of years that had drops AND finished the year in the red: 2000, 2001, 2002, 2008, 2015 (with 2011 at 0% and the 2015 drop at -1%). That’s 5 out of 24 years (20%), and one of those five years was a -1% loss, so you could argue it could also be 16% rather than 20%.

Back to what I AM trying to say. Shit happens, and sometimes there is a reason, and sometimes there’s not, and sometimes there are reasons and they aren’t the reasons you think and sometimes the reasons are exactly what you think. Regardless, those reasons are not predictable and therefore are impossible to anticipate.

Except…are they? Are they impossible to anticipate?

In fact, they are.

You can’t anticipate THE pullback, THE correction, THE bear market, or THE market rout…but you can anticipate A pullback, A correction, A bear market, or A market rout.

If you build your wealth plan to raise and hold the cash you need when the market is at all-time highs, you essentially become financially unbreakable.

BAD LANGUAGE ALERT…but follow me, because while I’m generally loose with the language, I’m purposefully using it here.

First – understand this next part is attributed to John Goodman, who distributed some of the most usable financial advice to come out of Hollywood. The one-minute YouTube clip is here. If you don’t know the scene (or watch it first) you won’t understand the below. So check it…

Now – what does it mean to be financially unbreakable? Well, in my words, it’s the ability to look at a market pullback, glance over at your cash balance, then back to the market and say, “Fuck you.” The market is down 15%, “Fuck you.” The market is down 25%, “Fuck you.”

I can keep going, but you get the point. And crass, yeah I get that too, but hey, I got you to read it…so there’s that.

How much cash is the right amount to be financially unbreakable? You need a plan to be sure, but you can take a SWAG at it by using 12-15 months. Frankly, even 3 or 6 months gives you a degree of “unbreakability.”

I know I’m a broken record on the cash, but I come back to the 24 years and all the stats. The losses become permanent when you need to raise cash inside a window of a downturn. If you can live out of a pot of cash and not sell the securities when they are down, you avoid permanent losses.

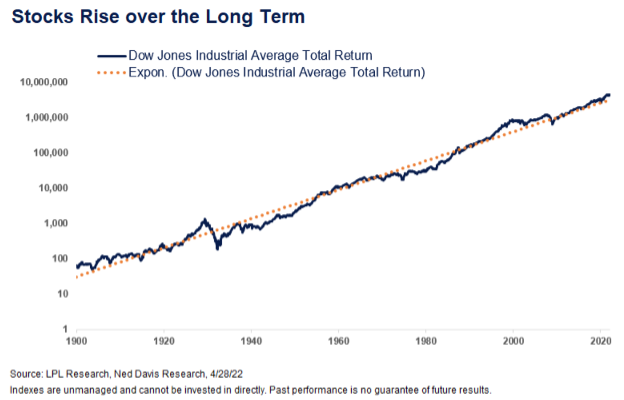

Short-term volatility doesn’t change the fact that time is on your side if you exercise patience and don’t fall victim to your caveman brain’s survival instincts kicking in.

The annualized return over the period of the below chart is 9.5%. If you are financially unbreakable and can endure the short-term pain of these corrections, your returns should look similar.

I know sell-offs are brutal and when I take the stage with “be patient, stick to the plan, don’t panic, hold on, don’t sell, have cash, be unbreakable, etc,” it can come off as cavalier or dismissive. I promise it’s not – the whole Team knows that times like this create anxiety and stir emotions which generate natural and understandable survival instincts.

If you are worried and need to talk, please reach out. We are all here to help.

Also, remember…

Keep looking forward.