ALJ Regional Holdings (ALJJ) is likely a familiar name to many readers (and thanks to those that pointed it out to me), it was an NOL shell that Jess Ravish (former Drexel, Jefferies and TCW executive) used as a holding company to buy and sell several various unrelated businesses over the last 10-15 years to soak up the tax assets. The vast majority of the NOLs expire in 2022. It has functioned as Ravich’s mini-PE fund, he owns ~47% of the stock (management owns 56% as a group). As of 9/30/21, ALJ had two operating businesses: 1) Faneuil, a business processing outsource provider and; 2) Phoenix Color, a specialty book printer that manufactures education materials, heavily illustrated books, etc.

Likely due to the upcoming NOL expiration, ALJ has made two significant asset sales in the last two months:

- On 12/21/21, ALJ sold a large piece of the Faneuil business to TTEC Holdings (publicly traded as TTEC) for $140MM cash ($15MM of which will be escrowed) and a $25MM-earn out. The remaining pieces of Faneuil are expected to generate normalized revenue of $80-$90MM. The sale is expected to close in Q1, and TTEC gets a 3-year option to buy the remaining business. The transaction is structured as an asset sale, so ALJ will receive all the economics of the business performance up until the closing date.

- On 2/4/22, ALJ sold the entire Phoenix Color business to Lakeside Book Company (subsidiary of LSC Communications, the disaster spin from RRD) for $135MM cash. The sale is expected to close in Q2.

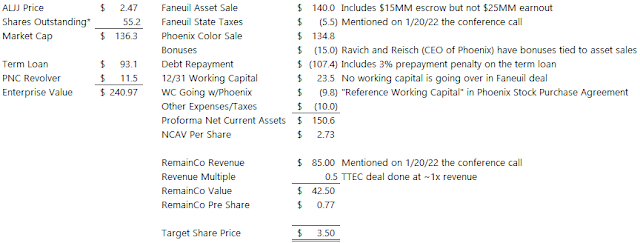

Following the closing of both of these transactions, I estimate ALJ will have roughly $150MM in net current asset value plus the remaining business at Faneuil, versus a current market cap (including the conversion of converts and warrants) of $136MM:

The main reason the stock is cheap is Jess Ravich, the market doesn’t trust him, one good example is he participated in a financing round during covid and got convertible debt at a $0.54 conversion price that PIKed for a year (further diluting minority shareholders) before it was amended. Another is he’s also been facing legal trouble over the last few years regarding his time at TCW. Now that the NOLs are burned off and/or expiring, maybe he no longer wants to deal with public shareholders and uses the cash proceeds to take out the minority shareholders. There is precedent, he did a large cash tender back in 2012 following the sale of a business, the Alpha Vulture blog covered it well back then.

Disclosure: I own shares of ALJJ