Thank you for reading, hope you’re having a good holiday season and thanks to those who have reached out with ideas, commented on write-ups, told me I’m stupid, or corrected me over the years, I genuinely appreciate it. Again, I don’t manage outside capital, the blog portfolio is my personal taxable account and is managed as such, my results aren’t comparable to any professional’s performance and I simply use the S&P 500 as a reference point, not a real benchmark. I have a good stable day job, I don’t live off of this portfolio (never pulled money from it, although I will likely have to withdraw funds early next year to pay taxes), so my risk tolerance is going to be naturally higher than others.

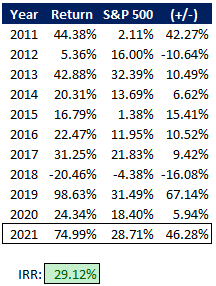

With that preamble out of the way, my account returned 74.99% in 2021 versus 28.71% for the S&P 500, and an IRR since inception of 29.12%.

Some of my biggest dollar weighted winners were BRG calls, LAUR (mostly also via calls that have since expired), and then holdover ideas written up in previous years like FRG, DBRG, and MMAC. My biggest dollar weighted losers were LYLT (caught that falling knife post spin a little too quick), APVO and CMCT.

Surprised myself on how much I wrote/posted this year, maybe not exactly a good sign as its lead to a lot of turnover, possibly overdiversification, but I just found so many interesting special situations (or at least I thought so at the time) and continue to do so. It can’t be this easy in the future, there’s a lot of speculative activity in markets, some could (rightfully) accuse me of that as well. Great results never really feel “real” until the next downturn, but I’ll keep my strategy going and continue to push forward.

Thoughts on Current Holdings

I wrote these intermittently over the last two weeks, if some of the share prices/valuations are stale, I apologize but they should be directionally right, mostly just in random order in just quick elevator pitch style:

- BBX Capital (BBXIA) continues to look too cheap despite surly management, proforma for the recent private market purchase of Angelo Gordon’s shares (slightly disappointing since they might have been keeping management honest here), I have the book value somewhere around $21/share and it trades for $10/share. For that price, even after all the buybacks, you get ~$6.50 in cash plus another ~$4.80 in the receivable from BVH which should be money good, that more than covers the market price without all the Florida real estate and other businesses. They recently put out a new investor presentation that shined light on the Florida real estate that’s worth looking at, but again, market cap is covered by cash and securities here.

- Accel Entertainment (ACEL) is the best part of regional casinos, the slot machines without the worst part, all the capex and lease payments. Their acquisition of Century Gaming unfortunately didn’t close this year, to me it sounded like a management misstep or unfamiliarity with cross state border acquisitions. But ACEL announced a big buyback ($200MM on a $1.2B market cap), it trades at roughly 8x EBITDA proforma for the acquisition, wage inflation should put more discretionary dollars in their client’s pockets, a few more states are talking about legalizing VGTs, the shares seem pretty cheap to me.

- Howard Hughes Corporation (HHC) is my perennial value trap, but the pitfall of their diversified real estate model is also a benefit, the company is attempting to reposition the narrative back to a land developer for home builders and building sunbelt apartments. They recently purchased a massive plot of land west of Phoenix that apparently has a 50 year development life and will add potentially logistics/warehouse and single family rentals (they’re also building these in their Bridgeland MPC) to their product mix. In disposition news, this week the Wall Street Journal is reporting that they’ve sold 110 N Wacker in Chicago for more than $1B (HHC has JV partners here, the property has debt, but that exceeded my expectations for a covid office sale). They’re still too heavy on office for my liking (about 50% of NOI) but have essentially stopped new development in that sector in favor of covid beneficiaries.

- PhenixFin (PFX) is frustrating to me, this company shouldn’t exist, activists won control of the company last year (then called Medley Capital or MCC) and internalized the BDC. Since then, they’ve mostly let their legacy investments roll off and invested the proceeds into mREITs. My original thesis was me speculating that this would be sold to another BDC, that hasn’t happened, in their recent FY22 results press release PFX announced the formation of an “asset-based lending business engaged in the gem and jewelry industry” and highlighted $490MM in net capital loss carryforwards for the first time that I can remember. Neither is a sign that they’re selling unfortunately, but I might be, this is no longer a strong conviction holding but not expensive at ~70% of book value (essentially unlevered, small net debt position).

- NexPoint Diversified Real Estate Trust (NXDT) is unfortunately still in the process of converting from a closed end fund to a REIT, the process has dragged on a bit longer than expected, but the backdrop for NXDT’s assets continues to improve in the meantime and NAV continues to march slightly higher (~$23, trades for roughly 60% of NAV). The thesis remains mostly the same, this will starting reporting as a REIT, be eligible for index inclusion (including broad indices, BDCs and CEFs are generally excluded from market indices since they’re considered funds), and start attracting a REIT investor base and multiple. On the negative side, this is another manager with a poor reputation, and potentially has some governance issues with NXDT owning other NexPoint affiliates and some fee double dipping. NXDT continues to be one of my favorite ideas.

- Jackson Financial (JXN) has gone up in a straight line since its spin from Prudential PLC in September. Jackson is the largest variable annuity provider in the U.S., it should have strong demographic tailwinds as baby boomers retire and rollover their 401(k)s, but the financials are a total black box and these annuity companies usually trade extremely cheap for that reason. One way to get a valuation re-rating is via share repurchases and cash dividends, JXN was trading at just 28% of book value at the time of my write-up, since then they’ve bought back approximately $185MM in stock and announced a $0.50/share quarterly dividend (~5% yield). I’m not a strong enough at accounting to figure out JXN’s financials, the stock is up 55% since the spin (might be some more near term upside via index buying, this was a foreign-to-US spin), I’m not in a rush to sell it but I’m not a long term holder either.

- Orion Office REIT (ONL) is a shaky low conviction hold for me, the setup of being a merger-spin out of a heavily retail owned stock and the resulting forced selling tempted me enough to start a position. A dividend initiation should help recruit a little wider investor base in the near future, but my current thought is I’m unlikely to own this for the long term as I’m still personally bearish about return to office. There are countless examples, but near me, Allstate recently sold their suburban headquarters campus to investors who plan on turning it into logistics/warehouses — when old line type companies are making drastic switches away from large corporate campuses, makes me worried for the sector, especially with an average lease term under 3.5 years.

- Sonida Senior Living (SNDA) is a recent buy after they completed an out of court restructuring transaction, this is a bit of a jockey bet in that I like the Conversant Capital team and what they’ve done thus far at INDT, here they control the company and have started to implement their new business plan with the acquisition of two Indianapolis area senior housing properties. Senior housing has a lot of operating leverage, if occupancy levels recover to normalized levels and the demographic wave finally materializes, Sonida could do very well over the next 3-4 years.

- My other senior housing play is the preferred stock of Regional Health Properties (RHE-A), which briefly attempted a similar out of court restructuring by proposing to exchange the preferred stock for common. The largest preferred shareholder comically shot it down. This company is a bit of a mess, they recently had the State of Alabama pull the license of one of their biggest tenants a couple weeks ago, looks like RHE might be taking over the management of another one of their facilities here shortly. That temporary measure appears to becoming more permanent in their other managed facilities. The company is in a tough spot, it is not bankrupt but the capital structure doesn’t work and there’s no easy way to fix it since the worthless common stock need to approve of an exchange.

- Unfortunately, as soon as I hit publish on my Altisource Asset Management (AAMC) write-up, the shares were delisted from the NYSE (no direct reason given) and have yet to trade since. I’m a bit surprised/disappointed that the company hasn’t made any public announcements regarding an attempt to regain NYSE (or other listing) eligibility. One can only hope (pray?) that they’re working behind the scenes on an acquisition and settlement with Luxor that would get the shares trading again.

- HMG/Courtland Properties Inc (HMG) is a nano cap liquidation where their largest asset is a newly developed Class A multi-family property in Fort Myers, FL. The company recently released a proxy statement to approve the plan of liquidation and quoted a $20-$30/share liquidation value, the shares still trade in the middle of that range, but I think the value is closer to $30 (although I probably wouldn’t recommend initiating a position here, the liquidation may take a long time).

- The only previously undisclosed holding I have are some recklessly speculative near term call options in Nam Tai Property (NTP). Nam Tai has a long history, it pivoted from an electronics manufacturer to a property developer when Shenzhen experienced exploding growth. IsZo Capital won their year long legal fight against prior management, they’ve put out a number of $40/share in intrinsic value, the stock trades at $11/share after prior management experienced a margin call and DB foreclosed on their shares. IsZo by contrast has been adding to their stake. There’s a lot of risk here, China real estate is obviously shaky, excuse my gambling, again its a personal account, don’t recommend this for others.

- Bluerock Residential Growth REIT (BRG) entered into a transaction with Blackstone to buy their multi-family properties and lending book for $24.25 per share, plus BRG is going to spinoff a single family rental REIT, “Bluerock Homes Trust”, where BRG got a third party valuation firm to put a $5.60 NAV per share on it. BRG is currently trading for $26.36, the deal with Blackstone is almost certain to close, thus the market is applying a pretty steep discount on the single family REIT. It will revert to being an externally managed by Bluerock (BRG started as externally managed, later pseudo-internalized), who prior to this transaction didn’t have a great reputation, but obviously this was a great result for shareholders and merger arb types might want to look at the spin (expected Q2 close).

- I wrote up the mess of a situation at Transcontinental Realty (TCI) and parent American Realty (ARL) earlier this week. I had one big mistake, I thought the $134MM of notes receivable were just mortgage loans consolidated from Income Opportunity Realty (IOR), that’s not the case, so the fair value of TCI is ~$15 higher than the $60/share I threw out there. IOR is maybe the strangest little micro cap I’ve looked at, almost all of the assets of the company are a loan to Pillar, IOR’s external advisor, not sure how that’s okay legally and might be why it is being challenged in a shareholder lawsuit. IOR is probably worth a closer look (won’t take you long).

- There’s not much to update on PFSweb (PFSW) which I wrote up in August, but only because the company hasn’t filed its Q2 or Q3 financials due to “additional time and work needed to meet the SEC reporting and accounting requirements for its LiveArea divestiture.” That’s not confidence inspiring, but this is like some of my other “informal liquidations” where they’ve sold one business unit, the other is for sale, the situation is fairly de-risked with a large cash position. I continue to hold awaiting news but my conviction has lessened.

- Another informal liquidation, Laureate Education (LAUR), has mostly worked out to plan, the sale of Walden University closed and they’ve since paid out $7.59/share in special dividends. They’ve also collapsed the dual share structure. It is now a purer play on Mexico and Peru, my best guess is this is not the end state and we’ll see a final sale of the remaining assets once covid subsides and/or the political climate in Latin America improves. Most of my exposure rolled off earlier in December when my calls expired, now just hanging onto a smallish position to see how the rest plays out.

- Rounding out the informal liquidations, not much has changed at Advanced Emissions Solutions (ADES) since my write-up, the did report Q3 earnings and have an adjusted ~$5/share in net cash against a $6.50 stock price. They state that strategic alternatives are continuing for the remaining activated carbon business, hopefully that means a sale and not some transaction involving ADES using the cash for an acquisition.

- Now to a formal liquidation, Luby’s (LUB) has exceeded my expectations, shareholders received a $2.00 initial distribution on 11/1, which was most of my cost basis. The most recent estimate of liquidation proceeds is $3.00/share, shares trade slightly below that estimate, others have suggested there’s a fair amount of juice left (this author thinks a base case of $3.30, which sounds reasonable), I’m willing to just let it play out as the company has indicated it should be mostly wrapped up by mid-2022.

- I own two tiny natural gas trusts, with ECA Marcellus Trust I (ECTM) I got lucky and now have received over half my basis out of the partnership this year in distributions, it wasn’t my original thesis of a liquidation, but I’m content for now letting it runoff via distributions much the same way as a liquidation. With SandRidge Mississippian Trust I (SDTTU) the assets have all been sold back to SandRidge (SD) but there is a shareholder lawsuit holding up the final distribution of proceeds to unitholders. The trust has since delisted and stopped filing with the SEC, so its fallen into that dark stage and trades erratically at irrational prices while we await final resolution.

- I found the Golar LNG (GLNG) pitch on Andrew Walker’s podcast interesting, but probably not for me, but did make me think about my own holding that I’ve honestly sort of forgot about in Technip Energies (THNPY). Technip Energies is the E&C for many of the largest LNG projects around the world, and should benefit from many of the same LNG as a transition fuel themes. There are two remaining catalysts post spin, first parent FTI does still own ~12% of TE and plans to sell (removes the overhang once they do), and second, Technip Energies will be initiating a dividend next year (that was the plan all along) which could open it up to a wider shareholder base and semi-similar to JXN, cold hard cash might relieve some concerns around the complicated accounting.

- Logan Ridge Finance Corporation (LRFC) is similar to PFX in that it is a BDC that doesn’t pay a dividend (I believe they’re the only two credit BDCs that don’t pay dividends). BDCs aren’t included in indices and if it doesn’t pay a dividend, it is hard to attract regular yield-focused retail investors, so its limited to a small subset of investors willing to play in these ponds. LRFC was recently taken over by BC Partners, they’re in the process of repositioning the portfolio to generate yield and restore the dividend, that’ll likely happen in the first half of 2022 and I expect the discount to NAV to decrease (trades for 58% of NAV today).

- Atlas Financial (AFHBL for the bonds) is a covid recovery play on taxis, limos and ride sharing drivers returning to work and a business change from a risk taking insurance provider to more of an asset-lite agency model. I originally didn’t like the RSA plan for the bonds, but the alternative plans don’t seem to have gone anywhere, so I’m happy to change my mind and support the RSA here even though it bifurcated the creditor group. The key line in the Q3 earnings release was “Our current in-force business is approximately 6% of what we underwrote as a carrier in 2018, and given current trends we feel there is considerable room to recapture business over time”. Even if they get only a portion of that business back, should make the bonds money good over time.

- During the worst of covid, I bought some LEAPs on Marathon Petroleum (MPC) as a proxy for Par Pacific (PARR) since long dated options weren’t available on the later. Those MPC calls expire next month and I’ll take profits, with PARR I’ve reduced my position throughout the year and might sell the rest early next year, I’ve owned it for 6-7 years and it has gone nowhere, they haven’t touched the NOLs, just a difficult business that I probably don’t understand as well as I should.

- I’ve held Liberty Broadband (LBRDK) through a few iterations, bought in prior to the General Communications deal with the old LVNTA as a merger arb, owned it through its time as GLIBA, I’ll continue to hold. Maybe this is the year CHTR cleans up their ownership structure and takes out Liberty Broadband?

- INDUS Realty Trust (INDT) will similarly just be in my tuck it away and forget about it pile for now, it is a logistics/warehouse REIT that has recruited much of the old Gramercy Property Trust (GPT) team, with the former CFO, Jon Clark, taking over at year end to round out things out. The tailwinds are pretty clear, and with a relatively small asset base and experienced team, they can be “sharp shooters” as they describe it, pick and choose smaller deals the likes of Blackstone can’t be bothered with to assemble a portfolio.

- Some of my bigger positions now are just semi-jockey plays in industries I semi-understand (start out as special situations but then “tripped into” a good management team), Green Brick Partners (GRBK) continues to grow like a weed, CEO Jim Brickman manages the business like a private company, he’s not afraid to switch strategies, lately that means heavily investing in land in 2020 and building a lot of homes on speculation in 2021 to take advantage of rising prices. With DigitalBridge (DBRG), there’s continued M&A in the digital infrastructure space and its seems like CEO Marc Ganzi can raise unlimited amounts of money at this point, so I’m content to just to go along for the ride. Franchise Group (FRG) has grown into my largest position, it is hard to believe that CEO Brian Kahn has created so much value in a short period of time, especially after his gaff with Rent-A-Center (RCII) when he forgot to send in an extension notice triggering the termination of that deal. I’m content to just sit on these three for the longer term and defer the taxes.

Closed Positions since 6/30

- I briefly owned Loyalty Ventures (LYLT) for a month or so following the spinoff from ADS and got sliced up trying to catch the falling knife, it ended up being my biggest single performance detractor for the year. But it is too early to tell if I completely misjudged the business quality but the stock was punished early, sold off from nearly $50 in the when issued market until below $30. The CEO has been buying shares, I’ll revisit it at some point.

- I also only briefly owned Franklin BSP Realty (FBRT) following their reverse merger with Capstead Mortgage Corp (CMO), my math was wrong and the upside was too small in the first place. FBRT is probably an interesting buy for some income investors, the management team has a good reputation and has managed the REIT well privately, but for me it was too small of a position and I moved on.

- Condor Hospitality Trust (CDOR) worked out well but I probably could have traded around it better. After only selling their assets to Blackstone, there was a trading day or two there where some uncertainty existed around the true net asset value per share. And then this week it traded at near the liquidating dividend, I sold a couple weeks ago, but those that bought this week might end up with a free look at whatever is remaining once the corporate shell wraps up.

- CorePoint Lodging (CPLG) didn’t work out very well, I made a mistake and missed the IRS payment that had to come off the top as well as that the new buyer would want to rid themselves of the Wyndham (WH) management agreement. I’m sort of glad this will be private again as I’ve had it wrong now multiple times.

- LGL Group (LGL) got caught up in the “high redemption, low float SPAC” trend that lasted a few weeks. LGL was invested in the SPAC sponsor of DFNS, DFNS had options available on it and when 90+% of the SPAC’s shareholders redeemed for trust value, the newly public IronNet (IRNT) became a meme stock due to limited float and options/gamma squeeze possibilities. I sold my warrants I held into that madness for a gain. The company is doing a spinoff of their operating business in Q1, I plan to revisit early next year and might re-take a position.

- Communications Systems Inc (JCS) also seemed to get caught up in some strange day trading dynamics on the day it announced their initial pre-merger $3.50 dividend that well known to anyone following the company. But the stock spiked from $6.79 the day before to over $9 the next day and got as high as $10 the week after that. I didn’t top tick it or anything, but did take advantage of that bit of luck and sold my shares. The company still hasn’t complete its merger with Pineapple Energy, having recently moved their outside merger date to 3/31/22. The shares trade pretty cheaply today if things go to plan (but thus far they haven’t), I plan to revisit it again early in 2022.

- Retail Value (RVI) I sold shortly after the large liquidating dividend as I didn’t feel like I had a good grasp on the remaining value of the stub. There’s been some good discussion in the comments section that has continued, which I always appreciate and I might revisit this one as well as the liquidation is near its end.

- The MMA Capital Holdings (MMAC) deal closed as anticipated.

Performance Attribution

No money was added or withdrawn during the year (but I will likely need to withdraw funds in 2022 for taxes). My leverage is particularly high at the moment, not a market call, more a result of trying to delay some gains into the new year for tax planning purposes. On average, I was probably 115-120% long in 2021.

Disclosure: Table above is my taxable account/blog portfolio, I don’t manage outside money, and this is only a portion of my overall assets (I also have a stable job, not living off this money). As a result, the use of margin debt, options, concentration doesn’t fully represent my risk tolerance.