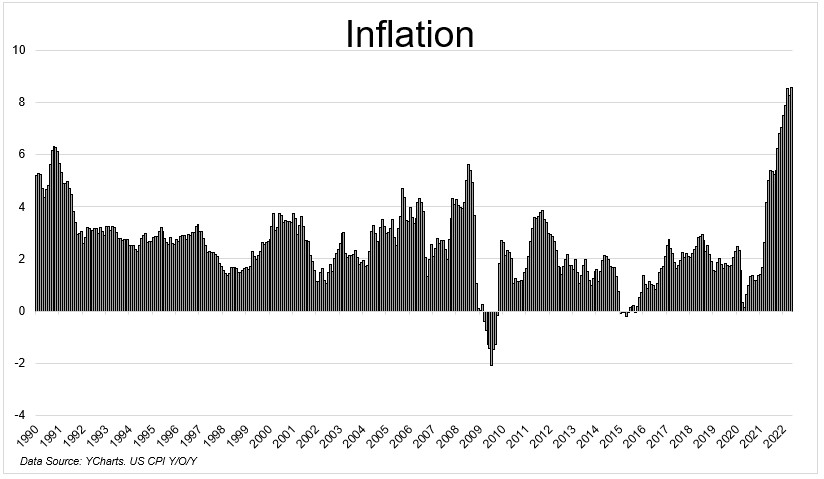

There was some optimism that peak inflation might be behind us. It looks like that was wishful thinking. We just got the numbers for May and everything is coming in hot. At 8.6% y/o/y, price increases are accelerating.

Basically everything is going up. The airfare component skyrocketed 37.8%, by far the highest reading of my lifetime. Fuel oil climbed 106.7% y/o/y and 16.9% m/o/m. Fruits and veggies are up 8%, meat is up 12.3%, chicken is up 17.4%, eggs are up 32%, and milk is up 15.9%. Do you like Apples? They’re up 6.2%. How do you like them Apples?

We haven’t seen price increases slow down the economy just yet. The housing market has cooled off, but the labor market is still super tight and earnings revisions have yet to come down. But sooner or later, and I don’t pretend to be an economist, but sooner or later we’re going to see demand destruction. The biggest question now is how quickly will inflation change consumer spending and how quickly will that cool off inflation.

Josh and I covered inflation and much more on this week’s TCAF with Simon Lack.