*Disclaimer: Please note that is this a $18MM market cap that is closely held and illiquid*

HMG/Courtland Properties (HMG) is a tiny REIT that recently announced intentions to hold a vote early next year to approve a plan of dissolution and liquidate. HMG was founded in 1974 by Maurice Wiener, he is 80 and is still the CEO of the company (technically this is an externally managed REIT, but there is no incentive fee), he controls 56% of the shares through various entities leaving little doubt the liquidation proposal will be adopted.

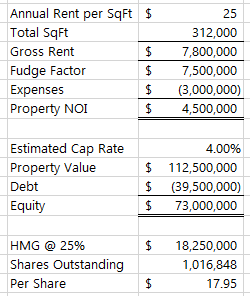

The company’s assets are a bit of mess (this liquidation will probably take several years), but the largest asset is a 25% equity ownership in a newly constructed Class A multi-family apartment building (“Murano at Three Oaks“) in Fort Myers, FL. Construction began in 2019, the building was completed in March and is already 97% leased as of the recently released 9/30 10-Q. With inflation running hot and migration to the sun belt, cap rates on multi-family assets like this one are being quoted below 4%. This is a hidden play on the craziness in multi-family M&A.

Disclosure on the property is limited. But checking the building’s listing on apartments.com, it appears the going rate for their units is around $25 annually per square foot, there are 318 units and 312,000 square feet of rentable space. Let’s round down a bit for some vacancy to $7.5MM top line revenue, again back of the envelope, let’s use 40% of gross rent goes to some combination of property management, operating expenses and taxes (I spot checked a few multi-family REITs for this, could be off!), that gets you an NOI of $4.5MM on the property.

The rest of the REIT sort of looks like someone’s personal portfolio/family office, in this case the CEO’s:

- The external advisor’s “Executive Offices” at 1870 South Bayshore Dr in Coconut Grove, FL. This appears to be a single-family home (unclear if the CEO uses it as his primary residence) that has a Zestimate of $2.5MM, it has a tax assessment of $1.5MM and a book value of $590k (it was purchased in the 90s). There’s no debt on the property, let’s call it $2MM net to HMG or roughly another $2/share in value.

- 28% interest in a 260 River Street in Montpelier, VT, carrying value of $870k. Tricky to tell what this really is but they had some environmental abatement issues that are seemingly behind them, a new tenant took possession of the property in March.

- About $4MM in net cash (after subtracting out ~$800k of current liabilities)

- $2.8MM of marketable securities, much of which is equities and preferred stock in undisclosed large cap REITs

Then it gets a little strange (if it hasn’t already), there’s $4.85MM (as of 9/30) in carrying value in 46 individual private investments, it appears like most of these are real estate related (including some multi-family which could have embedded gains) but also includes non-real estate related stuff like technology and there’s an energy investment hidden in here somewhere too. Below is the breakout from the last 10-K, the carrying values have moved around a bit but gives you a sense of the asset classes.

These investments are carried the lower of cost or fair value, there could be some diamonds in the rough, a few excerpts from recent monetization events:

“During the nine months ended September 30, 2021, we received cash distributions from other investments of approximately $1.03 million. This included distributions of approximately $584,000 from our investment in a multi-family residential property located in Orlando, Florida which was sold during this quarter. We recognized a gain of $315,000 from this investment.”

And this one:

In August 2021, one of our other investments in a private bank located in Palm Beach, Florida merged with a publicly traded bank, and we exchanged our original shares for shares in the publicly traded bank. Accordingly, we have reclassified this investment as marketable securities, and as of September 30, 2021 this investment with historical cost basis of $35,000 has an unrealized gain of approximately $128,000.

But also this one:

The other OTTI adjustment in 2020 was for $175,000 for an investment in a $2 billion global fund which invests in oil exploration and production which we committed $500,000 (plus recallable distributions) in September 2015. To date we have funded $658,000 and have received $206,000 in distributions from this investment. The write down was based on net asset value reported by the sponsor and takes into consideration the current disruptions in the oil markets because of the economic fall out of the pandemic.

Even stranger there are some ~$1.5MM in loans they’ve made, apparently mostly all to the same person.

On the minus side of the ledger, there’s about a $1MM in annual expenses between the management fee and G&A, we should probably capitalize that for at least 4 years given it’s going to take time to unwind all the mess here and I get approximately ~$30/share in value and it trades for about ~$17.25/share today.

The key with any liquidation is the timing of the cash flows. Here it could be a reasonably attractive IRR since the largest asset just stabilized and it would make sense to either sell or refinance cash out of it in the near term. Once most of your basis is out of the stock, it’s easier to be patient on later monetization events.

Disclosure: I own shares of HMG