Climate change could affect banks and the financial systems they anchor through various channels: increasingly extreme weather is one (Financial Stability Board, Basel Committee on Bank Supervision). In our recent staff report, we size up this channel by studying how U.S. banks, large and small, fared against disasters past. We find even the most destructive disasters had insignificant or small effects on bank stability and small and positive effects on bank income. We conjecture that recovery lending after disasters helps stabilize larger banks while smaller, local banks’ knowledge of “unmarked” (flood) hazards may help them navigate disaster risk. Federal disaster aid seems not to act as a bank stabilizer.

Bank Disaster Exposure

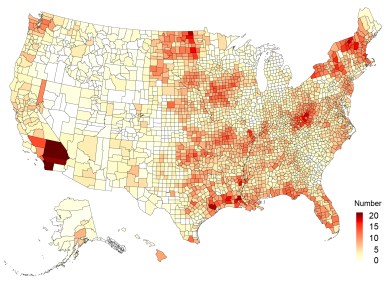

We studied the effects of all FEMA weather disasters between 1995 to 2018. FEMA disasters are “official” disasters, declared by the President at the request of governors. If granted (some aren’t) the declaration releases federal financial aid to covered affected areas. The map below shows where, and how often, disasters strike. Most counties were hit by at least one while counties in southern California, the Midwest, and along coasts experienced fifteen or more over the last quarter century.

Number of FEMA Weather Disasters by County: 1995 – 2018

We measure banks’ exposure to disaster by their relative share of branches in a county times the amount of property damages wrought by a disaster (using SHELDUS damage estimates). We pay special attention to “extreme disasters”—those in the 90th percentile of damages. To illustrate, consider a bank with half of its branches located in a county, which branches represent one tenth of all bank branches located there. If an extreme disaster destroys $100 million in property in the county, the bank‘s exposure is $5 million ($100 million x 0.5 x 0.10). We also look specially at banks with all their branches in just one county; these hyper-local banks in the “eye” of the storm may be more vulnerable (given exposure) than multi-county banks that can draw on liquidity from branches elsewhere. In short, we looked at how the most severe disasters affected the most vulnerable banks.

Disasters Impact Estimates

Using regression models, we estimated the impact of extreme disaster exposure on standard stability measures including loan loss rates, default risk, and profits. Banks don’t cause the weather, so the correlations are plausibly causal.

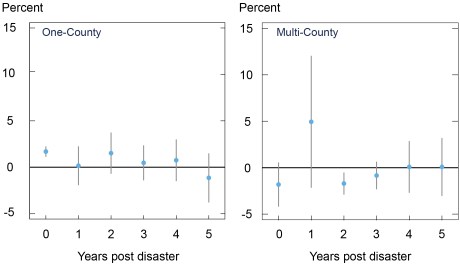

The estimates for loan loss rates are shown below. If the 95 percent confidence band through the estimate includes zero, we say that the estimated effect is not statistically significant. We see on the left that loss rates at single-county banks rise about 2 percent above average in the year of the disaster but return to average thereafter. Loss rates at multi-county banks never increase significantly. Their losses spike in year one but the estimate is imprecise, ranging from -3 percent to 12 percent. In any case, their losses quickly return to average. Overall, these loan loss impacts seem modest and temporary.

Loan Loss Rates after Extreme Weather Disasters,

by Bank Footprint

Notes: Plotted is the estimated change in loan loss (charge-off) rates given a standard deviation increase in extreme disaster exposure. The change is expressed as a percentage of the average loss rate. “Extreme disasters” are those in 90th percentile (by damages) of all FEMA disasters. The bands through the estimates are 95 percent confidence bands. The estimates use annual U.S. bank data over 1995-2018. One-county banks have all their branches located in a single county.

We also find modest effects on default risk, or rather, distance-to-default (Z score). We see in the top panel below that default risk at multi-county banks is unaffected by extreme disasters. The picture for single-county banks is less benign, as we expected. They edged about one percent closer to default after extreme disasters, and the effect persists over the medium run. While concerning to the bank and supervisors, the impact doesn’t seem destabilizing. The average bank moved over 10 percent closer to default during the 2008 banking crisis (several times more for banks most affected by the crisis).

Moreover, disasters are not necessarily bad for banks; extreme disasters tend to improve banks’ bottom line, as the lower panels show. The increases in profits are small, to be sure, but the picture does not suggest eroded profits over the medium term.

Default Risk and Profits after Extreme Weather Disasters,

by Bank Footprint

Notes: Shown are the estimated change distance-to-default (top) and bank profits (bottom) given a standard deviation increase in extreme disaster exposure. The changes are expressed as a percentage of the average loss rate. “Extreme disasters” are those in 90th percentile (by damages) of all FEMA disasters. The bands through the estimates are 95 percent confidence bands. The estimates use annual U.S. bank data over 1995-2018. One-county banks have all their branches located in a single county.

Mitigated Disasters?

We considered three factors that might explain banks’ resilience, starting with FEMA disaster aid. Although FEMA aid goes primarily to households, it could buttress banks indirectly. To investigate, we compared counties that received aid to neighboring counties that didn’t—disparities that can reflect political friction (Gasper 2015). We find that banks in the former (that is, aided) counties didn’t fare significantly better, given damages, suggesting FEMA aid is not the main, bank stabilizer.

A second possible stabilizer is simply the fact that weather disasters increase the demand for loans. Households and business alike may need credit to rebuild and repair following a destructive event (the Bank of America burnished its reputation with generous “handshake” loans after the devastating San Francisco earthquake and fire in 1906). Banks’ earnings on new loans can offset losses on prior loans and even, as we found, strengthen their bottom lines somewhat. We confirm (following others) that lending by multi-county banks increase after disasters. If increased loan demand stabilizes banks against disasters, it might explain why FEMA aid seems not to—as that aid may be a substitute for loans.

“Local knowledge” is a third possible stabilizer we consider. Small, locally based banks are known to have closer relationships with borrowers than more remote, larger banks (Rajan and Petersen). Accordingly, we conjecture that local banks may also be better informed about flood hazard where they operate. Using digitized versions of FEMA’s historic flood maps, we find that one-county banks avoid mortgage lending in zones where floods are more common than flood maps would predict. Knowing the lay of the land may help them manage flood risks.

Final Considerations

The modest disaster effects we find for U.S. banks seem consistent with the ECBs climate stress tests conducted last year as well as studies discussed in our paper. Caution is advised, even so. First, we looked backward; if the disasters looming are orders of magnitude worse than extreme disasters past, stability concerns remain. Second, we ignored (for lack of data) the stabilizing benefits of property insurance. In a world without insurance, weather disasters would surely be worse for banks. Of course, prudently supervised banks can be expected to avoid lending against uninsurable assets. Third, as we noted at the beginning, climate change might affect bank stability through other channels.

Kristian Blickle is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donald Morgan is an assistant vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Kristian Blickle and Donald Morgan, “Climate Change and Financial Stability: The Weather Channel,” Federal Reserve Bank of New York Liberty Street Economics, April 4, 2022. https://libertystreeteconomics.newyorkfed.org/2022/04/climate-change-and-financial-stability-the-weather-channel/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).