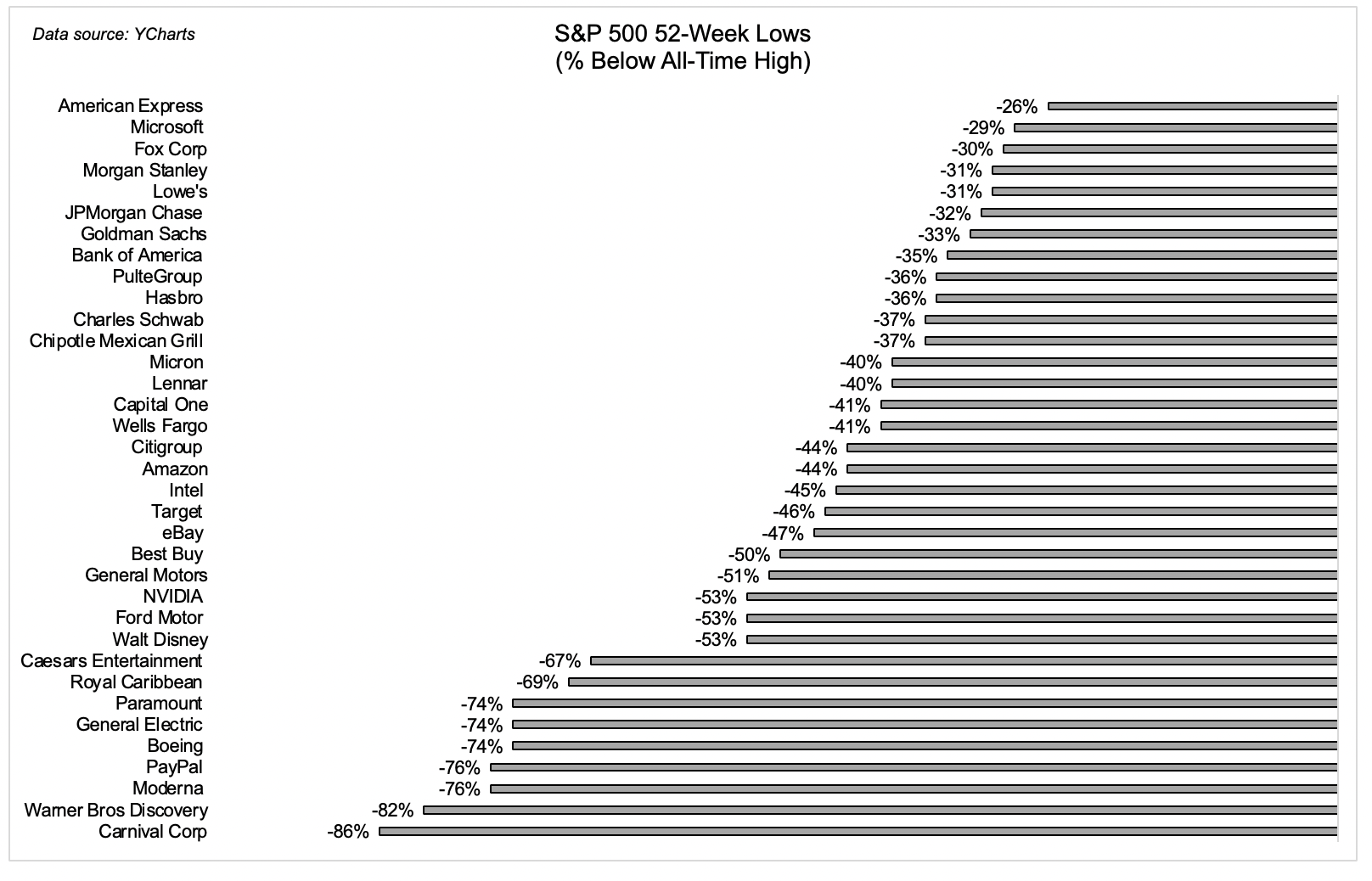

175 stocks in the S&P 500 closed at a 52-week low yesterday. Unsurprisingly, not a single one closed at a 52-week high.

I was looking through the list and a few things stood out.

Financials dominate this list. From the big banks like JPM and Goldman to the credit card companies like Capital One and American Express, they’re all down between 30 and 45%. Home builders are in a similar pain point. Then a little lower on the pain spectrum are retailers like Amazon, Target, eBay, and Best Buy. They’re all down between 45 and 50%. Then you’ve got media which is really struggling. Disney is down 53%, Paramount -74%, and Warner Bros/Discovery is down more than 80%. Netflix, not shown because it didn’t close at a 52-week low, is 75% below its highs.

It’s going to be interesting to keep an eye on how different areas of the economy perform over the next couple of months. Assuming the economy slows down, which seems likely at this point, how will companies like Netflix perform? We’ve never seen how sensitive a lot of these subscription services are to an overall economic slowdown. We’ve definitely never seen how inflation might impact people’s spending habits when it comes to these businesses. Aswath Damodaran was talking about this with Patrick O’Shaughnessy:

The big challenge for us, the money we spend now is on things we didn’t have 40 or 50 years ago. We don’t know how discretionary or non-discretionary your Netflix subscription is. We’re going to find out very quickly, right? So, this is going to be the real test. So much of our market cap comes from companies that provide products and services that weren’t around 30 or 40 years ago. We’re going to find out how inflation plays out on those decisions. Are you far less likely to upgrade your iPhone if the prices are going up 15 or 20% a year than if they’re going up 5% a year? We’re going to find those things out if inflation is here to stay.

Josh and I are going to cover this and everything else that’s going on in these markets on tonight’s What Are Your Thoughts?