PFSweb (PFSW, ~$280MM market cap) is reader suggestion to the recent theme of companies that have sold a major business segment leaving the proforma stub business looking cheap, and here again, the company is continuing to pursue strategic alternatives, which will likely lead to a sale of the remaining segment.

PFSweb has an interesting history, they started out as “Priority Fulfillment Services” but changed their name to “PFSweb” (as any e-commerce adjacent company did at the time) and IPO’d in December 1999, popping over 160% on their opening day, as you can imagine, it has been an ugly ride since the IPO. Ostensibly the company helps enable mostly old line retailers with their ecommerce strategy and fulfillment operations. This has historically been done in two business segments, LiveArea is their e-commerce consultancy/advisory business and the PFS business is some combination of a third-party logistics (“3PL”; warehousing, fulfillment, returns) and a business processing outsourcing (“BPO”, call centers, etc) operation.

Somewhat unexpectedly, PFSweb sold their LiveArea business to a subsidiary of the Japanese conglomerate Dentsu International for $250MM in cash (roughly a 20x EBITDA multiple on LiveArea’s 2020 segment EBITDA), the deal is expected to close this quarter and net PFSweb between $185-200MM in proceeds after taxes and fees. Included in the press release is a line regarding the remaining PFS segment:

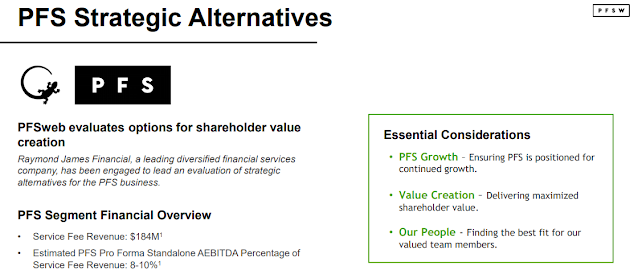

“With the divestiture of LiveArea underway, PFSweb has also engaged Raymond James to lead the exploration of a full range of strategic alternatives for its remaining business segment, PFS, to maximize shareholder value.”

And from the investor presentation:

That all sounds like a sale to me, the remaining PFS business is in the hot 3PL space, I personally have a hard time distinguishing between what is really 3PL and what is just a BPO, how much of it is a commodity business, etc., it has almost become a buzzword like SaaS or cloud in the technology space. But the industry has been a significant covid beneficiary with branded manufacturers and retailers scrambling to become more omnichannel and improve their ecommerce capabilities.

Look no further than the recent XPO Logistics spinoff, GXO Logistics, it was XPO’s 3PL/warehouse outsourcing business that has taken off since the spin (~+35% in a month) and now trades at something like 15x 2021 EBITDA (I spent 5-10 hours on GXO, couldn’t wrap my arms around it). They’re not an apples-to-apples comparison, GXO has something like 100x the warehouse/logistics space that PFS currently operates (about 1.6 million square feet spread across Vegas, Dallas, Memphis, Toronto, the UK and Belgium), but more just to illustrate the opportunity and growth investors are pricing into the industry. This is a pretty fragmented industry, PFS is subscale (bloated SG&A expenses), seems like there would be any number of buyers that could fold it pretty quickly into their operations.

Here’s the current proforma situation (PFSW is late on the 10-Q, noting they want more time to adjust the financials for the sale of LiveArea, so I could be off on this):

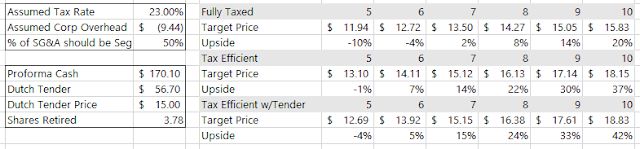

One question I had is how the company is presenting the remaining PFS segment, in the investor slide above they guide to 8-10% “standalone” adjusted EBITDA margins, yet in their quarterly segment reporting PFS did ~$26MM in LTM EBITDA. I asked their outsourced IR, got sort of an unhelpful non-answer, but I’m assuming that standalone includes a portion (but it wouldn’t be all) of their previous corporate overhead that was a bloated $20MM in 2020. So on a segment basis (what a strategic acquirer might be looking at) the proforma PFS is trading for only 4.2x EBITDA. For my back of the envelope valuation, I’ve assumed that some of that corporate overhead (going with a round 50%) really should be distributed to the segments. They’ve hinted at moving some SG&A to the segments on earnings calls and mentioned in a recent 10-Q that an increase in property tax (sounds like an operating expense) bumped SG&A up. The top row of each scenario is the EBITDA multiple assigned to the PFS segment.

As of the 10-K, PFSweb did have $56.5MM of NOLs, but based on the LiveArea sale, hard to know if there is any tax shield remaining for a sale of PFS, I’m backing into about a 23% assumed tax rate on LiveArea and applying it to PFS in the “Fully Taxed” scenario. But of course there are ways to avoid the double taxation and simply sell all of the remaining PSFweb in a cash or stock transaction. We also don’t know what PFSweb plans to do with the LiveArea proceeds other than paydown their debt, similar to LAUR, I tried to map out what a tender offer might look like if they went down that path and used 1/3 of their proforma cash position to repurchase shares. Just a guess and playing around with numbers. But either way, assuming the LiveArea deal closes (make your own determination if that’s a good assumption), then the remaining 3PL business is extremely cheap to acquirer, maybe just sort of moderately cheap as a subscale standalone, but should have downside reasonably protected given the industry tailwinds.

Other miscellaneous thoughts:

- The industrial/logistics REITs are trading for high multiples and experiencing a lot of M&A (i.e. Zell fighting off others for MNR, Blackstone buying WPT), growth in 3PLs is a large part of that (PSFW is guiding to 5-10% topline growth over tough 2020 comps at the PFS segment with expanding EBIDTA margins), this is a different angle at a similar theme (I continue to own and like INDT as well).

- Transcosmos owns 17.5% of PSFW, they’re a Japanese call center/BPO business, they made a strategic investment several years ago, but unclear how much influence they have, just semi noteworthy as PSFW’s largest investor.

- PSFW has a little bit of noise in their financial reporting, they will pass along certain third-party expenses (like last mile delivery) to their clients but book it as revenue with an offsetting expense, so it might screen as lower gross margin than the business is in reality. In addition, they have one client (Ricoh) where they will briefly take ownership of the inventory they’re managing so that causes some fluctuation in working capital.

- PSFW does have options available, I don’t own any but they could be interesting, with LAUR the company already has a significant buyback ongoing with the prospect of a tender offer to support the price and limit the downside, here we don’t know PSFW capital allocation plans outside of debt repayment. Feels pretty similar otherwise.

Disclosure: I own shares of PFSW