What is the Cost of Inflation Index from FY 2001-02 to FY 2022-23? CBDT notified the Cost of Inflation Index FY 2022-23 AY 2023-24 for Capital Gain on 15th June 2022. You may be aware that the base year was changed from the earlier FY 1981-82 to FY 2001-02.

Change in the Base year for Capital Gain Indexation

In Budget 2017, the Government proposed to change the base year to calculate the indexation benefit from 1981 to 2001. Do remember that the change in the base year is across all asset classes but the impact would differ across assets that enjoy indexation benefits on long-term capital gains—real estate, unlisted shares, gold, and bond funds. Up to 31st March 2017, the capital gain was calculated with 1981 as the base year. This means that the purchase price of an asset bought before 1 April 1981 could be calculated on the basis of the fair market value of 1981. However, from 1st Apr 2017, the purchase price will be calculated based on the fair market value of 2001. Accordingly, capital gains on assets acquired before 1 April 2001 will also be calculated using fair market value as of 2001.

What is Cost of Inflation Index (CII)?

It is a measure of inflation that is used for computing Long Term Capital Gains (LTCG) on the sale of capital assets as per IT Section.48.

It is announced for each Financial Year but not based on Assessment Year. Hence, the applicable rate of CII will be for that particular financial year.

To arrive at a capital gain, it is very much important to calculate the LTCG. For this purpose Cost of Inflation Index is a must.

Take an example of how the indexed cost of acquisition will be calculated using Cost of Inflation Index or CII.

The formula is as below.

Indexed Cost of Acquisition=(Cost of Acquisition/Cost of Inflation Index (CII) for the year in which the asset was first held by the assessee OR FY 2001-02, whichever is later)* Cost of the Inflation Index (CII) for the year in which the asset was sold or transferred.

Let us assume that you purchased the property in FY 2005-06 at Rs.50 lakh and sold the same in FY 2017-18 at Rs.1.5 Cr. Now the indexed cost of acquisition will be as per the above formula i.e.

Indexed Cost of Acquisition=(Rs.50 lakh/117)*272=Rs.1,16,23,931. So the Long Term Capital Gain=Selling Price-Indexed Cost of buying property=Rs.33,76,069.

(Note-As per the below Cost of Inflation Index (CII), the CII rate for FY 2017-18 is 272 and for FY 2005-06, it is 117).

However, if you do not consider the indexed cost, then in plain the gain may be said as Rs.1 Cr lakh (Rs.1.5 Cr-Rs.50 Lakh). But in the case of taxation, the LTCG on capital assets will be after adjusting the cost of buying to inflation or the Cost of Inflation Index (CII).

Cost of Inflation Index from FY 2001-02 to FY 2022-23 AY 2023-24 for Capital Gain

Below is the complete list of Cost of Inflation Index FY 2022-23 AY 2023-24 for Capital Gain from the new base year FY 2001-02 to FY 2022-23.

This notification will come into force with effect from 1st day of April 2022 and will accordingly apply to the Assessment Year 2022-24 and subsequent years.

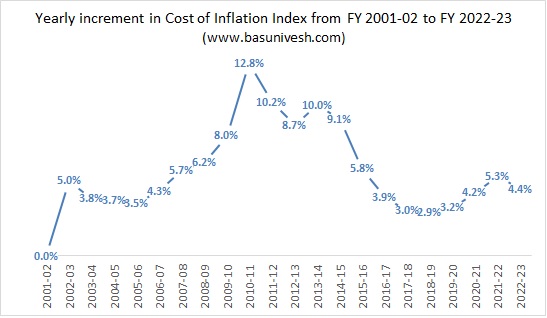

Let us see how year on year it is increasing from FY 2001-02 to FY 2022-23.

You noticed that the CII increased to around 4.41% from the last year.

Hope this information will help you in arriving at your capital gain tax.

Refer to our latest posts –