The onset of the COVID-19 pandemic brought substantial financial uncertainty for many Americans. In response, executive and legislative actions in March and April 2020 provided unprecedented debt relief by temporarily lowering interest rates on Direct federal student loans to 0 percent and automatically placing these loans into administrative forbearance. As a result, nearly 37 million borrowers have not been required to make payments on their student loans since March 2020, resulting in an estimated $195 billion worth of waived payments through April 2022. However, 10 million borrowers with private loans or Family Federal Education Loan (FFEL) loans owned by commercial banks were not granted the same relief and continued to make payments during the pandemic. Data show that Direct federal borrowers slowed their paydown, with very few making voluntary payments on their loans. FFEL borrowers, who were not covered by the automatic forbearance, struggled with their debt payments during this time. The difficulties faced by these borrowers in managing their student loans and other debts suggest that Direct borrowers will face rising delinquencies once forbearance ends and payments resume.

Data and Definitions

In this analysis, we use data from the New York Fed Consumer Credit Panel, an anonymized, nationally representative 5 percent sample of credit reports from Equifax. Although we do not directly observe the owner of a loan, we use the administrative forbearance event to sort loans into one of three mutually exclusive categories. The first includes Direct loans disbursed by the federal government and some legacy loans disbursed under the FFEL program and now owned by the federal government. The second and third categories include remaining loans that were not covered by the interest waiver or automatic forbearance: FFEL loans still owned by commercial banks and private loans which were either originated by private entities or were federal loans refinanced into the private market. The table below details these loans, denoted Direct, FFEL, and private loans, on the eve of the pandemic.

Direct loan borrowers have lower credit scores, higher balances, and hold over 85 percent of outstanding balances

| Direct | FFEL | Private | |

|---|---|---|---|

| Total debt outstanding | $1.3 trillion | $133 billion | $95 billion |

| Delinquent but not defaulted rate (in percent) | 5.3 | 5.4 | 5.0 |

| Median balance per borrower | $18,773 | $10,143 | $14,087 |

| Median age | 33 | 41 | 39 |

| Median credit score | 654 | 687 | 713 |

Notes: All values are as of February 2020. Direct loans also include loans disbursed through the Family Federal Education Loan (FFEL) program but subsequently sold to the federal government. FFEL loans only include FFEL loans still owned by commercial banks.

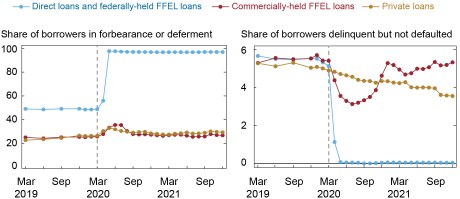

Student Loan Forbearance and Delinquency during the Pandemic

The chart below shows the share of borrowers in either deferment or forbearance (left) and the share of borrowers with a student loan at least ninety days delinquent but not in default (right) since the first quarter of 2019. Our calculation of the delinquency rate differs from the typical calculation in the New York Fed’s Quarterly Report on Household Debt and Credit because we focus on borrowers instead of balances and we exclude defaulted loans. Prior to the pandemic, the share of borrowers in forbearance remained stable across all three student loan types with FFEL loans and private loans at around 26 percent and Direct loans at roughly double the rate largely due to the higher share of borrowers in in-school deferment. After the onset of the pandemic, forbearance rose across all loan types with Direct loans rising to almost 100 percent due to administrative forbearance. Consequently, all previously delinquent but not defaulted loans were marked current, driving this rate to zero during the pandemic. Meanwhile, student loan borrowers with either private or FFEL loans needed to request voluntary forbearance from their loan servicer. The rate of forbearance for private loans increased from 26 percent in February 2020 to 33 percent in May 2020 before steadily declining. The forbearance rate for FFEL borrowers increased from 26 percent in February 2020 to a peak of 36 percent in June 2020 before falling to levels on par with private loans.

Forbearance brought Direct borrowers current throughout the pandemic, but struggling FFEL borrowers only got a brief reprieve

Note: FFEL is Family Federal Education Loan.

Like Direct loans, many previously delinquent FFEL loans were marked current during forbearance driving the delinquency rate from 5.4 percent just before the pandemic to a low of 3.1 percent in July 2020. Since voluntary forbearance for FFEL loans typically lasted only a few months, delinquency began to increase again late in 2020 before another round of stimulus payments at the beginning of 2021 drove another small decline. From March 2021, delinquency for FFEL borrowers continued to rise, returning to pre-pandemic levels by the end of 2021. By contrast, private loan borrowers weathered the pandemic remarkably well with delinquency rates declining throughout the pandemic to a low of 3.6 percent at the end of 2021.

The Evolution of Student Loan Balances during the Pandemic

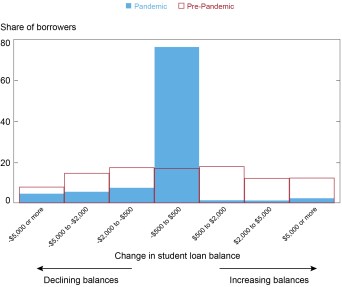

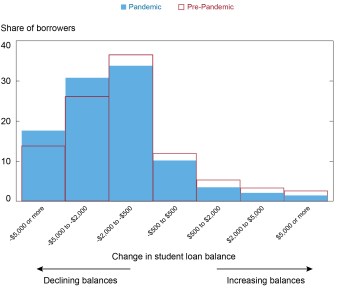

To better understand the evolution of borrowers’ loan balances during the pandemic, we compare changes in balances during the pandemic (between April 2020 and December 2021 – blue bars) to changes in balances prior to the pandemic (between June 2018 and February 2020 – red bars). We include only those student loan borrowers who took out their last loan prior to October 2017 to focus on those who are no longer initiating new loans.

Prior to the pandemic, Direct loan borrowers were nearly split between those making progress on their loans (40 percent) and those with increasing balances (43 percent). While increasing balances are typical for the small subset of delinquent borrowers, this is more commonly because of the availability of Income-Drive Repayment (IDR) plans, where borrowers pay a share of their disposable income as a monthly payment, which is often too small to cover accruing interest. IDR borrowers in negative amortization can have increasing balances despite making on-time payments, and this has become more common in recent years. However, the share of borrowers with increasing balances dropped to nearly zero during the pandemic due to administrative forbearance and the temporary 0 percent interest rate. Of the borrowers who had increasing balances prior to the pandemic, 83 percent had no change in their balance during the pandemic forbearance while 9 percent made some progress. Meanwhile, Direct loan borrowers with declining balances pre-pandemic were more likely to have declining balances during the pandemic with 34 percent continuing to reduce balances on their loans and 66 percent not reducing them.

Most Direct borrowers made no payments during the pandemic forbearance

Notes: The pre-pandemic period denotes the change in student loan balances between June 2018 and February 2020. The pandemic period denotes the change in student loan balances between April 2020 and December 2021.

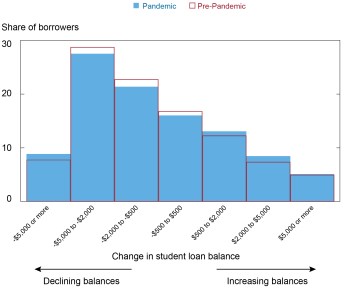

The next chart details the evolution of balances for borrowers with FFEL loans, which did not receive automatic forbearance. Prior to the pandemic, a higher share of these borrowers had declining balances (59 percent) than Direct loan borrowers (40 percent). Since the last FFEL loans were distributed in 2010, FFEL borrowers are, on average, older, have higher credit scores, and have less generous IDR plans than Direct borrowers, factors leading them to have growing balances less frequently. During the pandemic, the majority of FFEL borrowers did not change their paydown habits. However, at least some FFEL borrowers were able to accelerate the rate of paydown, resulting in an increase of one percentage point for those paying down most aggressively. Meanwhile, the share of FFEL borrowers with increasing balances grew by 2 percentage points. The growth in increasing balances was in part due to the increase in elective forbearance for FFEL borrowers since interest was still accruing, but a small percentage of them struggled, missing payments when they had previously been making them.

Some FFEL borrowers struggled with payments during the pandemic while others accelerated paydown

Notes: The pre-pandemic period denotes the change in student loan balances between June 2018 and February 2020. The pandemic period denotes the change in student loan balances between April 2020 and December 2021.

The last chart below shows how borrowers with private loans changed their paydown patterns during the pandemic. These borrowers were more likely to increase their rate of paydown during the pandemic. Compared to the previous twenty months, private loan borrowers were less likely to have increasing balances, make no progress, or make small progress on their loans and were more likely to make larger balance reductions than in the previous year. The share of private loan borrowers paying down at least $2,000 increased by 9 percentage points, from 40 percent to 49 percent. This acceleration in paydown by private student loan borrowers and some FFEL borrowers was likely aided by several rounds of stimulus payments, which we showed in a previous post drove large reductions in credit card debt during the first year of the pandemic, however we do not find a similar stimulus-fueled paydown for Direct borrowers.

Private student loan borrowers accelerated paydown during the pandemic

Notes: The pre-pandemic period denotes the change in student loan balances between June 2018 and February 2020. The pandemic period denotes the change in student loan balances between April 2020 and December 2021.

Lessons from FFEL Borrowers

We believe that the experience of the FFEL borrowers exiting forbearance in late 2020 foreshadows future repayment difficulties for Direct borrowers once required payments resume. Borrowers with bank-held FFEL loans, who did not receive automatic forbearance, were more likely to struggle with payments during the pandemic. Some FFEL borrowers were able to avoid delinquency through forbearance, but delinquency rates increased shortly after the forbearance period ended. Further, delinquency among previously forborne FFEL borrowers was not limited to their student loans. We find that these borrowers experienced 33 percent higher delinquency on their non-student, non-mortgage debt after exiting forbearance than the Direct borrowers who remained in forbearance. Although borrowers will likely face a healthier economy going forward, Direct loan holders have higher debt balances, lower credit scores, and were making less progress on repayment than FFEL borrowers prior to the pandemic. As such, we believe that Direct borrowers are likely to experience a meaningful rise in delinquencies, both for student loans and for other debt, once forbearance ends.

Policymakers have considered several proposals to soften the end of the forbearance program that has helped to smooth cashflow for most student borrowers during the pandemic recession. These proposals range from temporarily not reporting missed payments to credit bureaus to outright cancellation of federal student loans. Suspending the reporting of delinquencies will certainly prevent payment difficulties from appearing on a borrower’s credit report and allow borrowers to better ease into repayment, but these repayment issues will still exist under the surface. These concerns have motivated a debate on student loan cancellation which will be the topic of an upcoming post.

Jacob Goss is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is an economist in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.