Many people turn to real estate investing to grow their wealth. When done well, this type of investing may produce attractive returns.

It also holds the possibility of being a regular income source over the long run.

There are several options for investing in real estate. You might purchase residential or commercial properties for investment purposes.

The goal is to rent the property and live off of the supplemental income.

The work involved and the money needed to get involved in traditional real estate investing can be overwhelming for many people.

However there are other options, like crowdfunded real estate, for people wanting to potentially grow wealth through real estate.

Summary

Fundrise is crowdfunded real estate platform where you can invest in real estate for as little as $500. This is open to everybody, not just accredited investors.

Pros

- Low minimum investment

- Low minimal fees

Cons

- Risk for loss in any investment

- Limited liquidity capabilities

What is Fundrise?

Fundrise is one of the more well-known investment firms focusing on what’s commonly called crowdfunded or crowdsourced real estate investing.

Fundrise Overview

A few different real estate crowdfunding companies have entered the investing scene in recent years. Fundrise is one of the more established companies to offer real estate investment options to mainstream investors.

Here’s a summary of the company’s overview, taken from information on the Fundrise web site.

Fundrise has been helping people invest in real estate ventures for around 10 years. Fundrise founder Ben Miller actually started working to create Fundrise.

Miller eventually brought Kenny Shin and Brandon Jenkins on board, and their combined partnership brought the company fully functional.

As experienced investors, the founders realized that many investment options for real estate left the profits in the hands of middlemen like big banks.

Meanwhile, while the investors themselves were short-changed on profits thanks to fees and high loan interest rates.

The team’s motto?

Give everyone the opportunity to invest directly in high quality real estate, without the middlemen.

Fundrise’s management team worked for nearly a year with the Securities and Exchange Commission.

Their efforts to become an approved investment company paid off. Fundrise launched their first online public offering in 2012 and gained 175 investors.

Today, the this real estate investment platform has over 300,000 members and has invested in over $7 billion worth of real estate investments.

How Does Fundrise Work?

It used to be that investing in private real estate assets was limited to those with hundreds of thousands of extra dollars laying around.

If you didn’t have big bucks, you weren’t allowed to play the game.

Fundrise has helped to change that by allowing investors of nearly all bank account sizes to participate in bigger real estate deals.

Overview of the Fundrise features:

- The minimum investment with Fundrise is just $10

- Non-accredited investors without a high net worth can invest

- 0.85% annual asset management fee

- Fundrise offers only commercial real estate investments

Historical Real Estate Performance vs. Traditional Market Performance

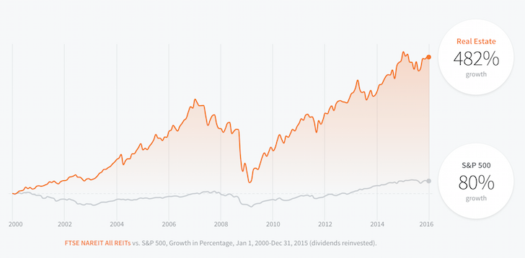

The chart below shows the returns of the real estate market versus the returns of the S&P 500 from the year 2000 to the year 2016.

As you can see, real estate performed far better than the S&P 500 did.

Even without the housing bubble burst and its comeback you can see better performance in the real estate market.

I would imagine the reason for this has to do with two facts.

First, the increase in market crashes over the last twenty years may have made investors feel more secure in owning brick and mortar properties as opposed to pieces of paper that claim ownership in companies.

Second, low mortgage interest rates may have spurred on investors’ eagerness to take advantage of how cheap it is to borrow money for real estate purchases.

The reasons for the solid returns in this type of investing in recent years are anyone’s guess, but the proof is in the numbers.

Real estate investments have been outperforming the market for the last several years – almost two decades now.

Consider All Factors

This shouldn’t be the sole factor you consider as you decide whether or not a real estate crowdfunding platform is for you.

However, historical returns are an important fact to weigh into the equation.

Also, market performance has had its own rally in the last couple of years, with the S&P 500 rising in value by over eight percent in just the first half of 2017 alone.

The point is that all markets have their ups and downs, whether it be the real estate market, the stock market, or the bond market.

Your goal as an investor is to decide how you should diversify your investments between the different markets.

You should do this in a way that makes you feel comfortable as it produces growth in alignment with your risk tolerance level, helping to facilitate a balanced investing strategy.

If real estate crowdfunding platforms and investing is something you are comfortable with, and if you have a good understanding of the risks associated with it as well as the historical profits, including some real estate holdings in your portfolio might be a good way to help you reach your financial goals.

If you end up deciding to explore crowdfunded real estate opportunities, here’s what you need to know about the Fundrise process for new investors.

How to Start Investing with Fundrise

Here’s the process for getting started with investing in crowdfunded real estate through Fundrise.

As a new investor, you would open up an account with Fundrise by visiting the company’s web site. It’s free to open an account with the company.

From there you would share your bank account information. Don’t worry: security is a top priority for Fundrise. The site boasts a 128 bit SSL encryption security system.

Making your minimum $10 deposit to your Fundrise account deems you to be eligible to begin investing.

Fundrise has several plan options to choose from. Portfolios within your plan are based primarily on your stated goals.

Investment Choices

After you opened your account you would choose from one of the five investment plans this real estate investment platform offers.

- Starter ($10 initial investment)

- Basic ($1,000 initial investment)

- Core ($5,000 initial investment)

- Advanced ($10,000 initial investment)

- Premium ($100,000 initial investment)

Each plan invests in portfolios that hold a combination of Fundrise’s eREITs. An eREIT is Fundrise’s version of a REIT. The Starter portfolio is the most accessible option.

What is a REIT?

A REIT is a security that invests in real estate through property or mortgages and often trades on major exchanges like a stock.

Fundrise offers a similar type of product, which they call an eREIT (Electronic Real Estate Investment Trust).

The company defines the product as “a professionally managed, diversified portfolio of commercial real estate assets such as apartments, hotels, shopping centers and office buildings.”

The Fundrise eREITS are non-traded, which means stock market ups and downs can have less of an impact on the performance of Fundrise investment offerings.

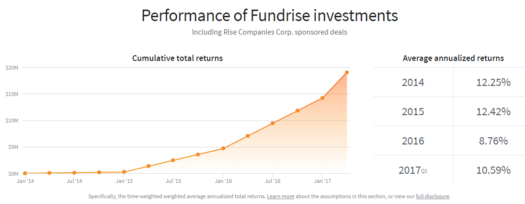

Speaking of performance, here’s a chart directly from the site that can give you an idea of their eREIT returns.

Fundrise investments implement a variety of four strategies for each account type offered.

As stated earlier, the strategy combination is based on the type of account you open and on your goals and is meant to help balance risk and reward accordingly.

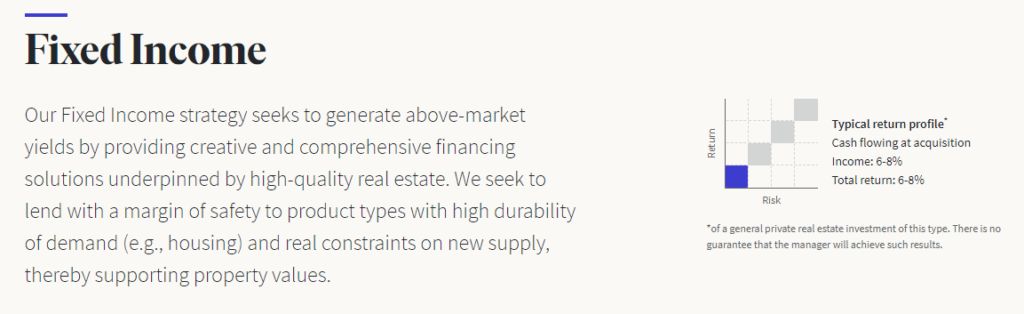

The Fixed Income Strategy

The goal of the fixed income strategy is to produce above-market yields while lending with a healthy safety margin in durable real estate products.

In this portfolio, you’ll primarily find housing and mixed use developments.

This portfolio is a relatively low to moderate risk portfolio that projects returns of 6% to 8% annually and income of 6% to 8% annually

This portfolio purchases properties that are cash flowing at acquisition. This investment strategy is meant for investors looking for a monthly income return.

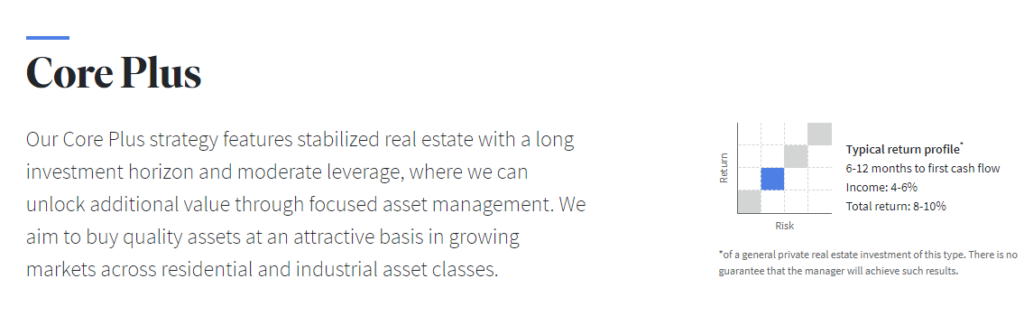

The Core Plus Strategy

Fundrise’s Core Plus Strategy focuses on stabilized properties with a long investment term.

In other words, this portfolio tends to hold funds that are a bit riskier than the Fixed Income Strategy, but that also means more possibility for growth.

This fund expects to produce moderate current income yield.

You can expect annual returns of 6% to 8% and income of 4% to 6% annually. This portfolio’s investments can be expected to cash flow 6 to 12 months from acquisition.

You wouldn’t choose this strategy if you were looking for immediate and regular income return.

Instead, this strategy could help you if you were looking for income returns in the near future.

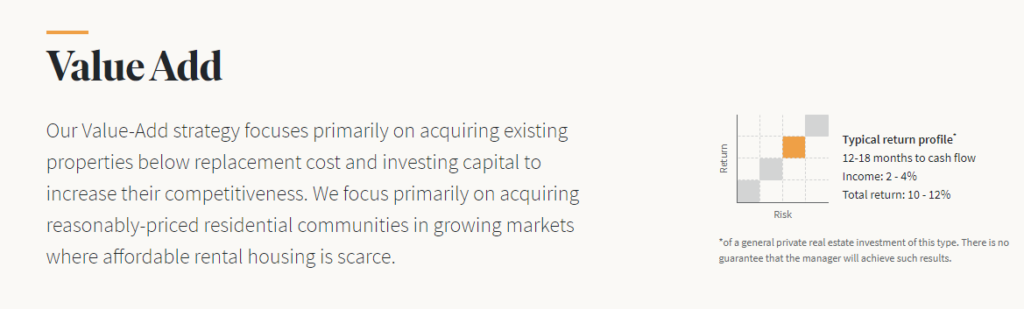

The Value Add Strategy

The company’s Value Add Strategy works to buy properties that are priced below replacement cost.

The goal then is to add capital to increase the property’s overall value. Fundrise works to maximize returns by focusing on purchases in affordable communities.

They look to buy in growing markets where housing is difficult to find.

Properties in this portfolio will generally not cash flow until 12-18 months after purchase.

Once they do start earning income, you can expect a 10% to 12% annual return and a 2% to 4% annual income.

Apartment communities, office buildings and mixed-use communities make up the primary holdings in this portfolio.

If you’re okay with higher risk and the potential of a higher return, along with income-producing assets that cash flow in a year or more, this could be the portfolio for you.

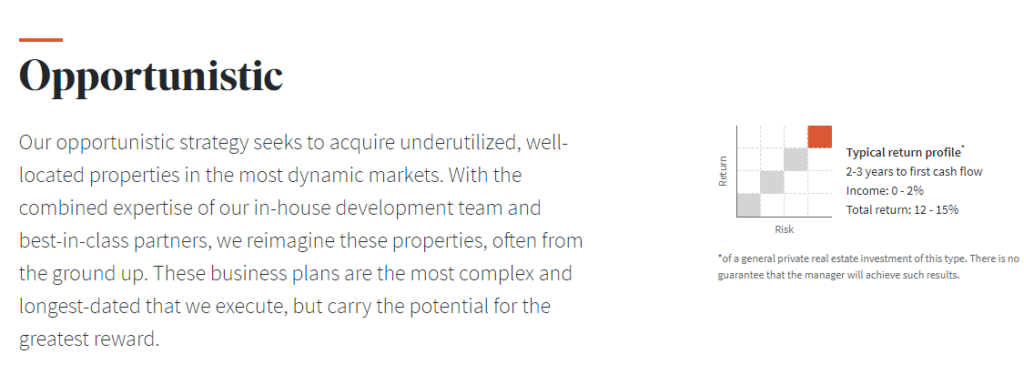

The Opportunistic Strategy

The fourth strategy Fundrise offers is called the Opportunistic Strategy. As you can guess from its name, this is the riskiest of strategies that Fundrise offers.

Properties in this portfolio are underutilized and in attractive markets with a large potential for growth.

You can expect to see returns of 10% to 12% in this portfolio. Income will range from 0% to 2% as returns are reinvested to promote maximum growth.

You’ll start earning supplemental income from this strategy at about the 2-3 year mark. This portfolio is for the investor that is interested in the highest potential returns.

Just keep in mind that great risk of initial loss of investment is involved with this portfolio. It’s slightly less of a balanced investing strategy.

If you have a low risk tolerance level, this is probably not the portfolio you want to have the majority of your money invested in.

That being said, it could be fun to put a minority of your investment capital into this fund and see what happens, especially if you’re age 50 or younger.

Broad Range Investment Choices

Fundrise invests in commercial real estate deals all over the United States, which can possibly lower the risk for default or losses.

Here’s why. Let’s say the commercial real estate market collapses in Atlanta. Fundrise will investors still have a stake in properties in Dallas or other major metropolitan areas in the United States.

Since the eREITs are made up of a variety of properties nationwide, one area’s market collapse won’t necessarily affect another area.

The broad diversification of Fundrise’s portfolio properties means investors have a lower potential risk for loss.

With their “eggs” divided up into many properties within each fund’s basket, risk of loss is potentially reduced. .

One of the reasons for the rising popularity in crowdfunded investing is that it takes away much of the work required to invest in real estate.

It also eliminates many of the other possible problems associated with being a traditional real estate investor.

When you invest in traditional real estate via rental properties or fix and flips, you’re in for some serious potential issues.

How Fundrise Simplifies Real Estate Investing

Investing via the traditional routes definitely has its benefits. Buying and renting homes and apartment buildings can produce a steady monthly income stream.

If you’re looking to increase cash flow or replace traditional job income as you head toward financial independence, a real estate crowdfunding platform can be more attractive than traditional investing opportunities.

The supplemental income you can get from real estate assets obtained via crowdfunding platforms can be easier to get than through traditional real estate investment opportunities.

Doing the fix and flip thing can produce large amounts of cash in a relatively short period of time. Profits can increase if you are handy with home repair and improvement tasks and can do most or all of the work yourself.

However as with any type of investing – including crowdfunding – there are some downsides to the traditional types of real estate projects.

Owning Rental Properties

With owning rental properties, you’re on the hook for finding and managing tenants. You’re also responsible fortaking care of any home repair issues that might come up.

Also, not all tenants are responsible, respectful members of society who will value your property as much as you do.

Some tenants are careless and not concerned about being respectful of the property. Some won’t pay the rent on time – or at all.

Yes, there are safeguards you can put in place to increase your chance of getting a good tenant.

Performing credit checks, references and background checks are all good ways to increase your chance of getting a good tenant.

However, those safeguards all require the time and money of the property owner.

And even if you put all of the safeguards in place, and there’s still no guarantee you won’t end up taking your now former tenant to court for non-payment of rent.

Similarly, you could end up doing a major overhaul on the property due to damage inflicted by tenants.

Of course, you could hire a property management company to do all of the dirty work for you.

However in doing so, you’re looking at giving away a slice of your monthly profit as well.

Fixing and Flipping Properties

Being a Fix and flip real estate investor can have its own set of problems. First, there’s the work involved in finding and then fixing up the property.

Then, as improvements progress, there is the risk of possibly finding more problems than you bargained for.

After the property is fixed (usually costing several thousands of dollars) you’ve got to sell it and pay realtor fees.

Oftentimes a bottom-line profit in the fix and flip world isn’t what an investor hoped it would be.

Also, fix and flips generally require quite a bit of time and effort on the part of the investor.

Large Down Payments Needed

On top of that, most mortgage lenders require that real estate investment deals have at least twenty to thirty percent down payment before they’ll fund the deal.

That can be an astronomical amount of cash for the typical investor.

A small residential home costing $200,000 would require a down payment of $40,000 to $60,000. And that’s not including closing costs and the money needed to perform any repairs or improvements.

This is not to say that traditional real estate projects aren’t for you. Only you can decide whether or not you want to own brick and mortar properties.

However it’s important to know up front the cash needed and the work involved before you become a direct owner of rental properties or fix and flip properties.

Is Fundrise Legit?

Just as there are risks with traditional real estate projects as outlined above, there are also risks with crowdfunded real estate investing.

Next, I’ll outline some of the risks of crowdfunded real estate investing.

That way you can make an informed decision about whether Fundrise or other crowdfunded real estate opportunities might be right for you.

Due Diligence Limitations – Banking on the Expertise of Others

With crowdfunded real estate investing, investors are basically banking on the expertise of others.

Unless you have an in-depth knowledge of commercial real estate investing as a whole, you will be relying on the information you are being given by the crowdfunding company as to the possible profitability of a deal.

Similarly, if you are not familiar with loan risk analysis parameters, you may unknowingly choose an unwise investment to put your money in.

When investing in real estate, whether crowdfunded or otherwise, it’s good to know the answers to the following questions:

- What is an acceptable loan-to-value ratio?

- Should I invest in a property where the owner is only putting five percent down? Or should I look for deals with down payments in the twenty and thirty percent range like the bank does?

- Are the ROI projections for the deal realistic? Is the owner really going to make as much money on the deal as he or she thinks they are?

- What is the need in the area for the type of property the owner is promoting? Is the chance of gaining quality tenants high enough?

There are good and bad sides to the crowdfunding investment platform. The bad side is that you are giving up a large amount of control as you are putting your money into the hands of others in hopes for a profit.

The good side is that reputable crowdfunding companies will commit to doing some serious due diligence on the deals they present to their members before they offer them.

Having an Expert Management Team Helps

Fundrise management staff does work to help minimize risk by only approving deals that have been thoroughly scrutinized.

That being said, it is important that investors understand that this intense examination doesn’t eliminate risk altogether.

Since the leadership team at Fundrise has had personal experience in commercial real estate investing, it means they have more experience than the typical investor at spotting a good deal versus a bad deal when commercial property managers come to them for a loan.

This truth can help to counter possible risks for investors who have little or no personal real estate investing experience.

It helps to have this expertise backing you as you consider whether or not crowdfunded real estate investing may be a smart choice for your personal investment portfolio.

But as with any investment the risk for loss still exists, even on highly analyzed real estate opportunities.

Limited Liquidity

Crowdfunded real estate investments do have limited liquidity capabilities too. In the case of Fundrise, there is a six-month holding period on all investments.

After that six-month period is up, investors have the option to cash out their investment, but that option is only offered once per quarter.

Are you the type of investor that likes to have full liquid access to your investments? If so, crowdfunded real estate investing might not be the right product for you.

Potential Property Owner Failure

With any real estate deal, there is the chance that the owner of the property could end up losing the property or going bankrupt due to unforeseen costs.

This could leave crowdfunding investors holding an empty bag.

The key to avoiding this type of scenarios lies largely in making sure you are dealing with a company that has done due diligence on its investments.

You need to know the company has taken steps to be transparent about its inner workings.

Because Fundrise is a publicly offered investment, it lies under the scrutiny of the Securities Exchange Commission.

This helps you as an investor to be secure from a Bernie Madoff type of a situation.

The company also works to invest in the top commercial real estate markets and with the top real estate companies.

Being choosy about who they loan money to helps to protect investors from potential property owner failure.

However, it’s important to know that risk still does exist with any investment platform, whether in real estate or in the stock market.

Is Fundrise a Good Investment?

So, is investing with Fundrise a smart investment choice? Only you can answer that question.

Even with the crowdfunding option, some investors might be more comfortable building their real estate investment portfolio slower by purchasing properties directly.

Knowing that you have full control over the buildings you own directly might be more appeasing to you than owning pieces of a basket of buildings you’ll likely never see.

However, the upside of owning via crowdfunding is that you don’t have to spend time managing those buildings either.

Whether you choose traditional investing or crowdfunded real estate investing is up to you.

But know that the real estate investment market can be a path to building wealth that may sustain you for years to come.

Customer Reviews

Fundrise is rated a 3.2 out of 5 on Trustpilot. Out of the 318 reviews published on Trustpilot as of this writing, 84% of them are 5-star reviews.

Positive reviewers comment on stellar service and attractive returns they’ve earned.

Negative reviewers comment primarily on low returns, however, may of these reviewers withdrew their investments after only a few months.

Fundrise specifically states it offers a long-term investment strategy.

Fundrise is rated A+ by the Better Business Bureau. The BBB states that Fundrise has 21 closed complaints in the last three years.

Fundrise appears to work hard to respond to and address all BBB complaints.

Alternatives to Fundrise

Let’s review some alternatives to Fundrise.

Groundfloor

Groundfloor is like Fundrise in that it offers real estate investments with a minimum investment of just $10.

However, whereas Fundrise specializes in long-term investments, Groundfloor focuses on short-term investments for both either a non-accredited or an accredited investor.

Groundfloor investments typically have a term of 18 months or less. These investments are short-term, high-yield investments that often earn 10% in a year or less.

You as the investor choose which properties you own shares in and how much you invest in each property.

In a way, Groundfloor helps you create your own REIT instead of investment in already-formed REITs.

Groundfloor does not charge any fees for investors. The company earns its money from borrowers.

Note that Groundfloor practices debt investing instead of pursuing equity investments. Money is earned from borrowers instead of from tenants.

See our full Groundfloor Review for more information.

DiversyFund

DiversyFund has a $500 minimum investment and invests your money primarily in residential rental properties such as apartment complexes.

They currently offers two REITs: The Growth REIT I and the Growth REIT II.

Both REITs purchase apartment complexes of 100 units or more, add value to them with specified renovations, and then works to hold and stabilize the properties.

Typical investment terms with DiversyFund are five years, after which the company sells the value-added, stabilized properties to other investors.

Based on historical earnings, you can expect to earn between 5% and 18% with DiversyFund. However, the company cannot guarantee similar earnings in the future.

As with Fundrise, DiversyFund allows both a non-accredited an accredited investor to join regardless of their net worth.

Fees for DiversyFund vary based on the offering, but you can expect to pay a 2% annual fee on your equity dollars each year.

See individual circular offerings for descriptions on additional fees.

Read our full DiversyFund Review for more information on this investment company.

CrowdStreet

CrowdSteet offers you the flexibility to invest in funds that hold multiple properties or individual properties. Anyone can invest in one of the company’s funds, but only an accredited investor with a high net worth can invest in individual properties.

This platform locks your money into your investment for years at a time, so you’ll need to be ok with not having access to these funds for an extended period of time.

The company also charges an annual asset management fee ranging from .5% to 2.5%. This can reduce your overall profits.

Many investment opportunities on this platform have a high minimum investment. Because of this, So CrowdStreet could be a better choice for people with a lot of money and the time to research their investments.

Note that all investments in real estate via crowdfunding companies such as Fundrise come with a risk of loss of your initial investment. This is important to know as you decide which company you’ll invest with and how much money you’ll invest.

FAQ

Here are some answers to some frequently asked questions about Fundrise.

Fundrise investments are meant to be held for the long-term (i.e. five years or more). However, you can pull your investment funds early, although you should expect to pay a penalty fee to do so.

Yes, you can! However, it’s important to note that the more you have in your Fundrise account, the more investment opportunities you’ll have with the company.

Fundrise offers several types of accounts including individual accounts, joint accounts, Traditional IRAs, Roth IRAs and trusts.

Note that IRA investments are not available with the Starter account plan. You’ll want to consider your investment needs before getting this starter portfolio.

Yes, you can get business accounts with Fundrise including S-corp, C-corp, LLC, Single-person LLC and more.

Summary

Investing can be a well-known path to building wealth. A well-rounded investment portfolio includes a variety of investments.

It might contain some stock market investments, some real estate, and/or ownership interests in individual businesses.

At the end of the day, the goal of an investor is to weather the ups and downs of the different markets and come out ahead.

For short-term investors, the “end of the day” could mean anywhere from one to five years. For long-term investors, it could mean ten to forty years or more.

All investment markets have their highs and lows. It’s not the highs and lows that you necessarily need worry about as an investor.

Instead, it’s whether your investment choice has the stability to weather those fluctuations and come out profitable over the long-term.

Do your research and choose your investment portfolio offerings wisely. Diversification is important. Investment education and management is important as well.

By managing your investments well and staying educated on the latest investment news, you’re creating a foundation that will provide financial security for years to come.