Your business is efficient and error-free all the time. Well, maybe it’s 90% of the time. Actually, maybe 85% of the time. OK, maybe it’s time to investigate with an accounting KPI (key performance indicator).

With knowledge comes power—as soon as you know where improvements are needed, you can create a plan for future success. This is where key performance indicators come into play.

Read on for tips for creating useable KPIs and see KPI examples for accounts payable and accounts receivable.

What is an accounting KPI?

Key performance indicators help measure success across multiple areas of your business. It can also help you chart the effectiveness of your team and departments. Create an accounting KPI by:

- Knowing where and how you can improve

- Measuring data over time to track your progress

- Working to improve those data points for your future

We know that you want your business to get better and better. Being able to put your finger on exactly what is working and what needs improving is key to your team’s success. This is where key performance indicators will help you out.

What makes effective accounting KPI?

No matter how efficient your business is, it’s never a bad time to start using accounting KPI to chart and navigate future improvements. There isn’t one perfect KPI or set of KPIs that will immediately solve all of your problems.

Because all realms of your business can be tracked, measured, and improved, the number of KPIs can become unmanageable in no time. Not all KPIs are created equal. In fact, you may find that some don’t help at all.

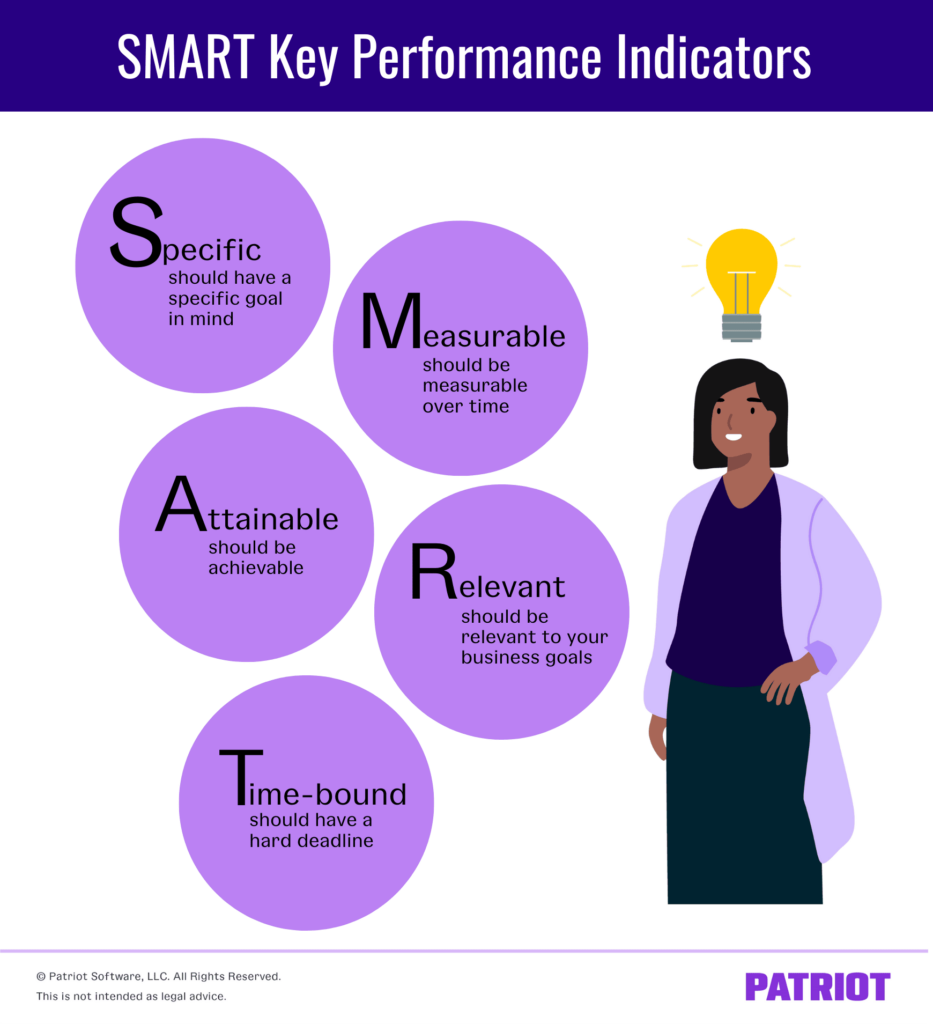

A good practice is to use KPIs that follow the SMART principle. Your KPIs should be:

- Specific: KPIs should help direct you toward a specific goal or action

- Measurable: You should be able to quantify your progress

- Attainable: Your KPIs should be achievable, otherwise they mean nothing

- Relevant: KPIs should be relevant to the success of your team, department, and business

- Time-bound: KPIs without a deadline may never create change. Hard deadlines make goals more achievable

Key performance indicators are part of a long, fine-tuning process of keeping your business healthy. If you find yourself coming back to the drawing board, or realizing what you thought was important was wrong, don’t sweat it. The point here is to think about your company’s future.

Ask yourself:

- What do I want my team, department, or business to achieve?

- What is stopping us from making that a reality?

- And, how can we turn obstacles into opportunities?

KPIs for accounting

Here’s a list of what we think are the top five accounting KPIs for your accounts payable and accounts receivable processes. Use these KPIs to help you start improving the effectiveness of your accounting processes.

KPIs for accounts payable

Accounts payable (AP) is the money you owe vendors. When you receive goods from a vendor and pay later, they extend credit to you, which increases your accounts payable. An accounts payable account will help keep track of your AP.

KPIs for accounts payable can help you keep track of where you fall short in paying back vendors. Here’s our top five KPIs for accounts payable:

- Cost per invoice shows the average cost of processing a single invoice. If the cost per invoice is high, there are probably inefficiencies. If you process invoices by hand, think about the processing time, rate of errors, and the number of invoices processed per year—all of these things can drive up the cost per invoice.

- Invoice exception rate describes the percentage of invoice exceptions that require manual interventions. Invoice exceptions occur when there’s a difference between what’s on the invoice and on the associated order, contract, or receipt. In fact, 20% of all invoices require some type of intervention—which means more time and money to track down and fix the problem.

When compared to a straight-through invoice (one that is processed without any intervention) invoice exceptions are costly in both time and money. Creating a KPI for the rate of straight-through invoices could also be helpful. The higher the percentage, the lower your costs.

- Invoice process time describes the average amount of time needed to completely process an invoice from receipt to payment. The quicker, the better. Consider signing up for accounting software to streamline your invoicing process.

- Payment error rate shows the number of errors you made when making payments. The usual suspects are duplicate payments, incorrect account numbers, and payment amounts, but these aren’t the only problems you have to watch out for. If your payment error rate is high, there’s probably a problem in your process or team.

- Invoices processed per year per full-time employee (FTE) helps you understand just how efficient the people (or person) who process your APs are. If the number of processed invoices is low per full-time employee, you may want to consider new training or a closer look at procedures.

KPIs for accounts receivable

Accounts receivable (AR) is the money owed to your business. When you provide a product to a customer and they pay at a later date, you extend credit to them, which increases your accounts receivable. Your accounts receivable help you keep track of what is still owed to you.

KPIs for accounts receivable can help make your accounts receivable more efficient by reducing delinquent accounts and improving collections. Here’s our top five KPIs for accounts receivable:

- Days sales outstanding (DSO) is an average of the number of days it takes to collect receivables from a sale. A low number shows that receivables are quickly being converted to cash and cash flow is strong. A high number shows that your customers are purchasing on credit and waiting to make their payments.

- Average days delinquent (ADD) keeps track of just how long a payment is overdue. ADD works by looking at the due date of a receivable and when that receivable is paid. When the number of days is low, things look good. But as the number of days grows, you may want to try a few things: Touch base with your customers more frequently, make sure that expectations for payments are clear, and protect your payment rights when legally able.

- Collection effectiveness index (CEI) tracks just how efficient you are at getting ahold of overdue payments within a specific time period. You can find your CEI by calculating the percentage of collected payments against receivables available for collection.

- Percentage of high-risk accounts can help keep you safe from rising amounts of bad debt. Goldilocks may be a good role model for this balancing act—not too much risk, not too little. Just the right amount.

- Operational cost per collection keeps track of how much it costs to collect a single payment. Depending on the cost, you can figure out just how efficient your AR process is. If the cost per collection is high, think about ways to reduce the price—new training or even automation may be an option.

This is not intended as legal advice; for more information, please click here.